HMRC's New Voice Recognition System: Faster Call Handling

Table of Contents

How the HMRC Voice Recognition System Works

The HMRC voice recognition system leverages cutting-edge technology to revolutionize how taxpayers interact with the agency. At its core, the system uses sophisticated natural language processing (NLP) and speech-to-text conversion to understand and interpret callers' queries. This advanced technology allows for accurate transcription of spoken language, even accounting for regional accents and variations in speech patterns.

The process is remarkably simple: a taxpayer calls the HMRC helpline and speaks their query clearly. The system then analyzes the speech using its powerful algorithms, identifying key words and phrases to determine the nature of the inquiry. Based on this analysis, the call is automatically routed to the appropriate department or agent specializing in that specific area. This intelligent routing system eliminates the need for navigating lengthy automated menus, significantly reducing call handling time.

- Improved accuracy through continuous machine learning: The system constantly learns and improves its accuracy through machine learning, adapting to new vocabulary, phrasing, and even regional dialects.

- Multi-lingual support: The system offers support in multiple languages, including English, Welsh, and potentially others, making it more accessible to a wider range of taxpayers. Further languages may be added in future phases.

- Integration with existing HMRC systems for seamless data access: The voice recognition system is seamlessly integrated with existing HMRC databases, allowing agents to access relevant taxpayer information quickly and efficiently, facilitating faster resolution of queries.

Benefits of the HMRC Voice Recognition System for Taxpayers

The HMRC voice recognition system offers numerous benefits for taxpayers, primarily focusing on speed, efficiency, and accessibility. One of the most significant advantages is the dramatic reduction in wait times. While precise figures are yet to be released, early trials suggest a potential decrease of up to 50% in average call queue times. This translates to less time spent on hold and more time focusing on other priorities.

- Reduced wait times: Say goodbye to endless hold music! The system aims to significantly reduce your time spent waiting for an agent.

- Increased efficiency: The streamlined process ensures faster resolution of simple queries, freeing up agents to handle more complex issues more effectively.

- Improved accuracy: By minimizing the potential for miscommunication inherent in traditional phone systems, the system helps ensure accuracy in information exchange.

- 24/7 access (potentially): Future implementations may include 24/7 availability for certain services, offering increased flexibility for taxpayers.

- Faster resolution of simple queries: Many routine queries can be answered directly by the system, eliminating the need for an agent interaction altogether.

- Improved accessibility for individuals with disabilities: The system can improve accessibility for individuals with disabilities who may find navigating traditional phone menus challenging.

Benefits of the HMRC Voice Recognition System for HMRC

The new voice recognition system provides substantial advantages for HMRC, improving efficiency and reducing operational costs. Automation of routine tasks leads to significant cost savings, while improved agent productivity allows for better resource allocation. The system also gathers valuable data, providing insights into common taxpayer queries and areas for service improvement.

- Cost savings: Automation reduces the need for extensive call center staffing, resulting in significant cost reductions over time.

- Improved agent productivity: Agents can handle a higher volume of calls and focus on more complex issues requiring specialized expertise.

- Better data analysis: The system collects valuable data on taxpayer inquiries, offering insights for improving services and identifying areas requiring further attention.

- Reduced staffing costs: Automation will contribute to a more efficient workforce, optimizing the deployment of HMRC personnel.

- Better resource allocation: Resources can be redirected from routine tasks to more strategic initiatives.

- Improved call center management: The system provides enhanced management tools for monitoring call volume, agent performance, and overall system efficiency.

Addressing Concerns and Challenges

While the HMRC voice recognition system offers many advantages, potential challenges must be addressed. Accuracy issues, especially with complex or nuanced queries, are a key consideration. Data privacy and security are also paramount.

HMRC is actively mitigating these concerns through rigorous testing, continuous system improvements, and robust data security measures. Human intervention remains available for complex or unusual inquiries.

- Data security protocols: Stringent data security protocols are in place to protect the confidentiality of taxpayer information.

- Continuous monitoring and improvement of system accuracy: HMRC is committed to ongoing monitoring and refinement of the system's accuracy through machine learning and feedback mechanisms.

- Human intervention for complex queries: The system is designed to seamlessly transfer calls to human agents when necessary, ensuring that all taxpayer queries are adequately addressed.

Conclusion

The HMRC voice recognition system represents a significant leap forward in taxpayer service. By automating call handling, this innovative technology promises to drastically reduce wait times, increase efficiency, and improve the overall experience for both taxpayers and HMRC staff. The system's benefits extend from faster query resolution to cost savings and improved data analysis. While challenges remain, HMRC's commitment to continuous improvement suggests a bright future for this technology.

Call to Action: Stay informed about the rollout of HMRC's new voice recognition system and how it can help you manage your tax affairs more efficiently. Learn more about the HMRC Voice Recognition System and how it's transforming taxpayer services.

Featured Posts

-

Ieadt Ihyae Ajatha Krysty Dwr Aldhkae Alastnaey Fy Ealm Aladb

May 20, 2025

Ieadt Ihyae Ajatha Krysty Dwr Aldhkae Alastnaey Fy Ealm Aladb

May 20, 2025 -

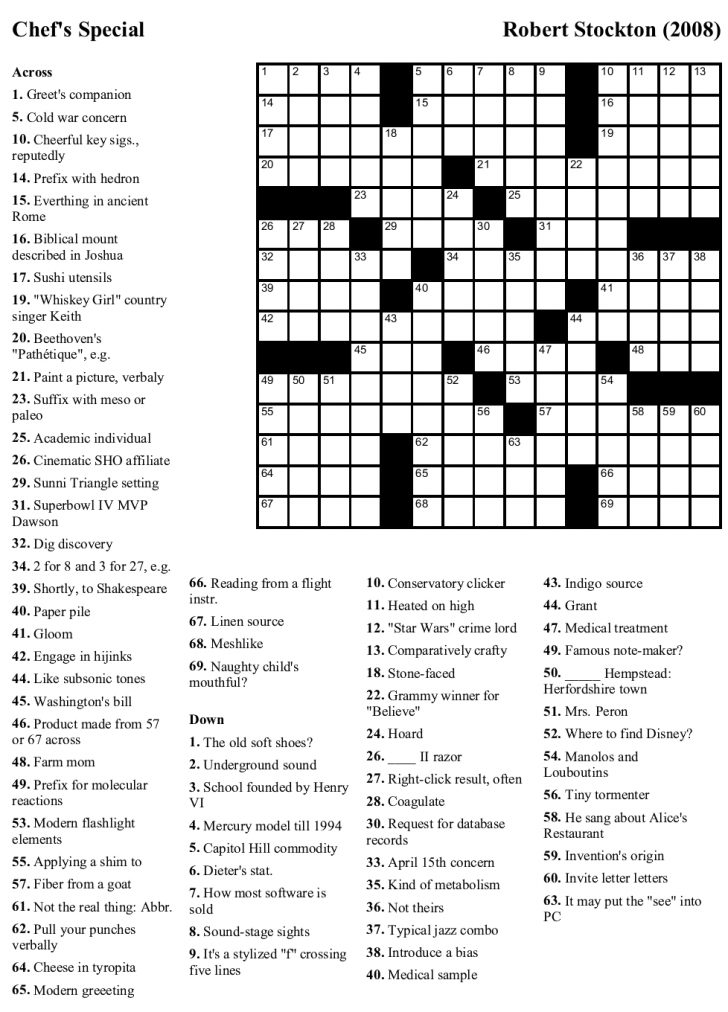

Nyt Mini Crossword Answers For March 15 Complete Solutions

May 20, 2025

Nyt Mini Crossword Answers For March 15 Complete Solutions

May 20, 2025 -

El Viaje De Schumacher De Mallorca A Suiza En Helicoptero

May 20, 2025

El Viaje De Schumacher De Mallorca A Suiza En Helicoptero

May 20, 2025 -

Agatha Christies Towards Zero Episode 1 A Murder Free Mystery

May 20, 2025

Agatha Christies Towards Zero Episode 1 A Murder Free Mystery

May 20, 2025 -

Ia Et Ecriture Une Agatha Christie Virtuelle Revolution Ou Imitation

May 20, 2025

Ia Et Ecriture Une Agatha Christie Virtuelle Revolution Ou Imitation

May 20, 2025

Latest Posts

-

Abidjan Descentes De La Brigade De Controle Rapide Bcr Dans Les Marches

May 20, 2025

Abidjan Descentes De La Brigade De Controle Rapide Bcr Dans Les Marches

May 20, 2025 -

Bcr En Cote D Ivoire Controles Inopines Dans Les Marches Abidjanais

May 20, 2025

Bcr En Cote D Ivoire Controles Inopines Dans Les Marches Abidjanais

May 20, 2025 -

Abidjan Guide Pratique De L Adressage Des Batiments

May 20, 2025

Abidjan Guide Pratique De L Adressage Des Batiments

May 20, 2025 -

Cote D Ivoire La Bcr Effectue Des Descentes Inopinees Dans Les Marches D Abidjan

May 20, 2025

Cote D Ivoire La Bcr Effectue Des Descentes Inopinees Dans Les Marches D Abidjan

May 20, 2025 -

Cote D Ivoire Comprendre Le Nouveau Systeme D Adressage A Abidjan

May 20, 2025

Cote D Ivoire Comprendre Le Nouveau Systeme D Adressage A Abidjan

May 20, 2025