Home Sales At Crisis Levels: Analysis Of A Weak Real Estate Market

Table of Contents

Economic Factors Contributing to the Crisis

Several intertwined economic forces are contributing to the current crisis in home sales.

Rising Interest Rates

The Federal Reserve's aggressive interest rate hikes have dramatically impacted the housing market. The increase in the federal funds rate directly translates to higher mortgage rates, making homeownership significantly less affordable. For example, a 2% increase in interest rates can add hundreds of dollars to a monthly mortgage payment, effectively reducing the purchasing power of many potential buyers.

- Impact on monthly payments: Higher interest rates lead to substantially increased monthly mortgage payments, pricing many buyers out of the market.

- Reduced purchasing power: With higher borrowing costs, buyers can afford smaller loans and therefore less expensive homes.

- Increased borrowing costs: The overall cost of financing a home increases, impacting affordability and buyer demand.

Inflation and Economic Uncertainty

Soaring inflation and growing economic uncertainty are further dampening buyer enthusiasm. High inflation erodes purchasing power, leaving less disposable income for large purchases like homes. Concerns about job security and a potential recession are also making consumers hesitant to commit to significant financial obligations.

- Impact on disposable income: Inflation reduces the amount of money available for discretionary spending, including home purchases.

- Fear of job losses: Economic uncertainty breeds anxiety, leading many to postpone major purchases like buying a home.

- Decreased consumer spending: Overall consumer confidence is down, impacting spending across various sectors, including real estate.

Reduced Inventory

Currently, many markets are experiencing a significant shortage of available homes. This reduced inventory, coupled with decreased buyer demand due to higher interest rates and inflation, is creating a challenging environment for both buyers and sellers. The scarcity of homes drives prices upwards, making affordability even more challenging.

- Analysis of supply and demand: The imbalance between low supply and reduced demand is exacerbating price fluctuations.

- Impact on pricing: Limited inventory keeps prices elevated, despite the decrease in buyer activity.

- Effects on buyer/seller negotiations: Sellers have less leverage in this environment, but finding a suitable property remains difficult for buyers.

Market Trends Indicating a Weak Real Estate Market

Several key market trends confirm the weakness in the current real estate market.

Decreasing Home Prices

In many areas, we are seeing a decline in average home prices, signaling a shift in market dynamics. While price decreases vary regionally, the trend is clear in several major markets, indicating a softening of the market. [Insert chart or graph visualizing price trends].

- Regional variations: Price decreases are not uniform across all regions; some areas are more impacted than others.

- Price reductions: More sellers are resorting to price reductions to attract buyers in this competitive landscape.

- Impact on property values: Decreasing prices can impact the overall perceived value of homes, impacting future sales.

Increased Days on Market

Properties are staying on the market significantly longer than in previous years, a clear indicator of reduced buyer activity. This prolonged time on the market reflects the challenges sellers face in finding buyers willing to pay their asking price in the current environment.

- Average days on market: Data shows a considerable increase in the average time it takes to sell a home.

- Comparison to previous years: A clear comparison to previous years highlights the significant shift in market velocity.

- Regional differences: The increase in days on market varies across different geographical regions.

Shifts in Buyer Behavior

Buyer behavior is also evolving in response to the weak market. Buyers are becoming more price-sensitive, conducting more thorough due diligence, and taking more time to make purchase decisions.

- Increased negotiation power for buyers: Buyers have more leverage to negotiate lower prices and better terms.

- Demand for specific amenities: Buyers are often more focused on properties offering specific features that match their needs and budget.

- Changes in location preferences: Buyers may be reconsidering their location preferences due to pricing and market conditions.

Strategies for Navigating a Weak Real Estate Market

Despite the challenges, both buyers and sellers can employ effective strategies to succeed in this challenging environment.

For Buyers

Buyers can leverage the current market conditions to their advantage.

- Negotiation tactics: Use the increased inventory and reduced buyer demand to negotiate lower prices and better terms.

- Mortgage rate comparison strategies: Shop around for the best mortgage rates and explore alternative financing options.

- Alternative financing options: Consider options like adjustable-rate mortgages or creative financing to improve affordability.

- Focusing on undervalued properties: Look for properties priced below market value to secure a better deal.

For Sellers

Sellers need to adapt their strategies to attract buyers in a slower market.

- Pricing strategies: Price your property competitively to attract buyers, possibly considering a slight discount below market value.

- Home staging tips: Present your home in its best light to maximize buyer appeal.

- Marketing strategies: Utilize effective marketing techniques to reach a wider audience.

- Exploring alternative sales methods: Consider lease-options or other creative sales strategies to increase your chances of a successful sale.

Conclusion: Understanding and Adapting to Home Sales at Crisis Levels

The current crisis in home sales is a result of a complex interplay of rising interest rates, inflation, economic uncertainty, and shifting market trends. However, by understanding these factors and employing the appropriate strategies, both buyers and sellers can navigate this challenging housing market successfully. Don't let the weak real estate market overwhelm you. Learn more about effective negotiation tactics and market analysis to navigate this challenging environment with confidence. [Link to relevant resource, e.g., a real estate guide or consultation service].

Featured Posts

-

Nuevo Venue Virtual De Ticketmaster Elige Tu Asiento Perfecto

May 30, 2025

Nuevo Venue Virtual De Ticketmaster Elige Tu Asiento Perfecto

May 30, 2025 -

Chinas Impact On Bmw And Porsche Sales Market Trends And Future Outlook

May 30, 2025

Chinas Impact On Bmw And Porsche Sales Market Trends And Future Outlook

May 30, 2025 -

Alcarazs Monte Carlo Masters Win Overcoming Musettis Injury

May 30, 2025

Alcarazs Monte Carlo Masters Win Overcoming Musettis Injury

May 30, 2025 -

The Shifting Sands How Trumps Tariffs Reshaped Indias Solar Exports To Southeast Asia

May 30, 2025

The Shifting Sands How Trumps Tariffs Reshaped Indias Solar Exports To Southeast Asia

May 30, 2025 -

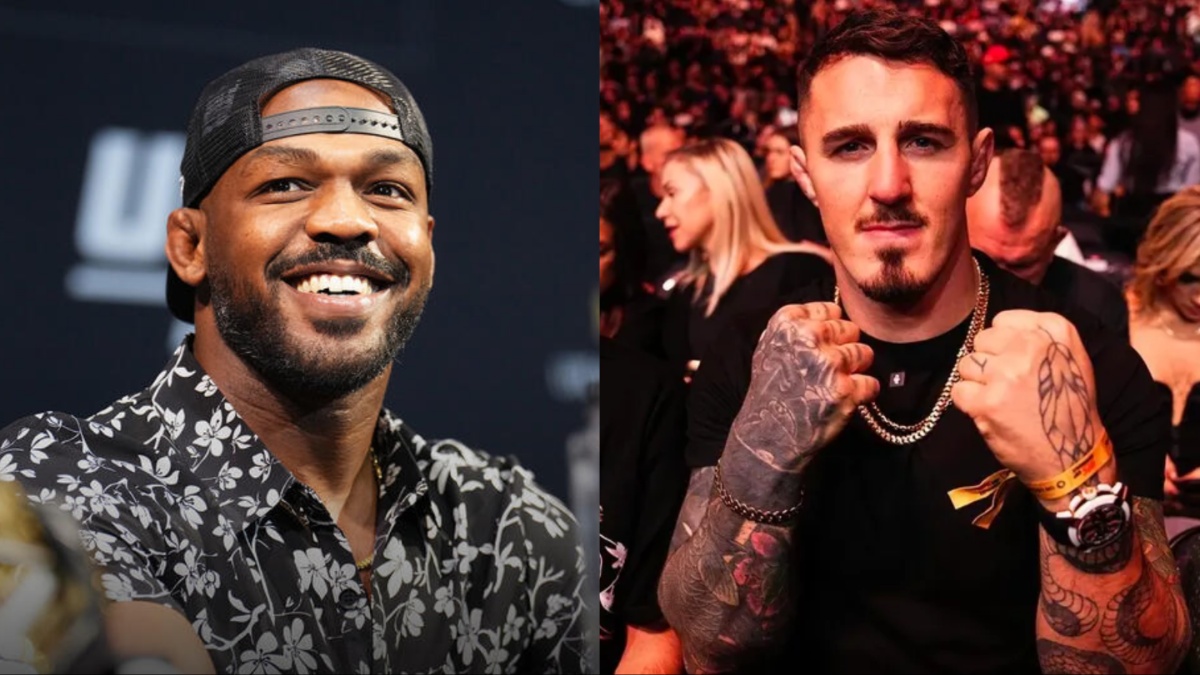

Dana White Update Fuels Claims Of Jon Jones Mental Warfare Against Tom Aspinall

May 30, 2025

Dana White Update Fuels Claims Of Jon Jones Mental Warfare Against Tom Aspinall

May 30, 2025

Latest Posts

-

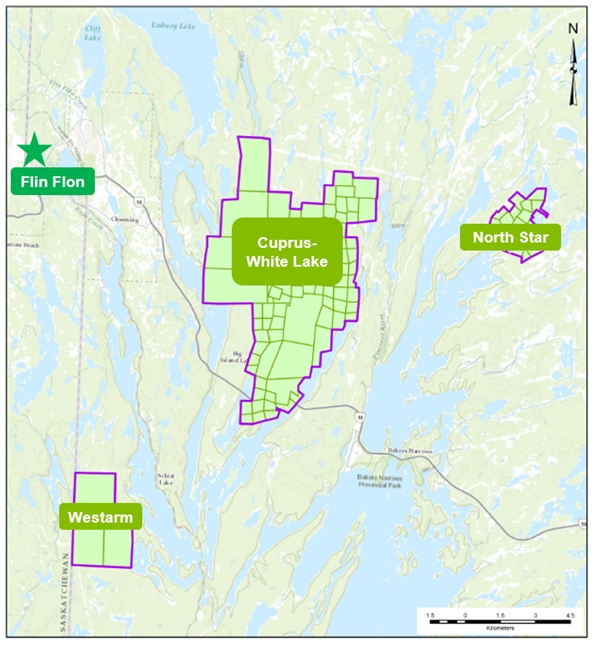

Flin Flon Wildfires Force Hudbay Minerals Staff Evacuation

May 31, 2025

Flin Flon Wildfires Force Hudbay Minerals Staff Evacuation

May 31, 2025 -

Hudbay Minerals Staff Evacuated Amidst Flin Flon Wildfires

May 31, 2025

Hudbay Minerals Staff Evacuated Amidst Flin Flon Wildfires

May 31, 2025 -

Emergency Declared Devastating Wildfires Consume Homes In Eastern Newfoundland

May 31, 2025

Emergency Declared Devastating Wildfires Consume Homes In Eastern Newfoundland

May 31, 2025 -

Urgent Air Quality Warning Minnesota And The Canadian Wildfires

May 31, 2025

Urgent Air Quality Warning Minnesota And The Canadian Wildfires

May 31, 2025 -

Hotter Temperatures Increase Saskatchewan Wildfire Threat

May 31, 2025

Hotter Temperatures Increase Saskatchewan Wildfire Threat

May 31, 2025