House GOP Tax Bill Encounters Resistance Over Medicaid, Clean Energy Provisions

Table of Contents

Medicaid Cuts Spark Outcry

The House GOP tax bill proposes significant reductions in Medicaid funding, a move that has drawn sharp criticism from healthcare advocates and Democratic lawmakers alike. The keywords associated with this section are Medicaid funding, healthcare access, healthcare reform, vulnerable populations, and budget cuts.

-

Deepening Healthcare Inequalities: The bill's proposed cuts threaten to leave millions of Americans without access to vital healthcare services. This disproportionately impacts low-income individuals, families, children, and the elderly, exacerbating existing healthcare inequalities. The reduction in funding could lead to increased wait times, limited access to specialists, and reduced quality of care.

-

Strain on Healthcare Providers: The reduced Medicaid funding will place a significant strain on hospitals and healthcare providers, particularly in underserved communities. Many hospitals rely heavily on Medicaid reimbursements, and significant cuts could lead to service reductions, staff layoffs, and even hospital closures. This would severely impact access to care for vulnerable populations who rely on these facilities.

-

Potential Legal Challenges: The legality of such drastic Medicaid cuts is likely to face significant legal challenges. Advocacy groups and individual states are expected to contest the bill in court, arguing that the cuts violate the constitutional rights of citizens to access essential healthcare services. The outcome of these legal battles could significantly impact the final implementation of the bill.

-

Regional Impacts: The impact of these cuts will vary across the country, with states having higher Medicaid enrollment facing the most severe consequences. For example, states with large populations of low-income individuals and those with a higher prevalence of chronic diseases will be particularly vulnerable to the negative impacts of these proposed funding reductions.

Clean Energy Provisions Under Fire

The proposed House GOP tax bill also targets clean energy initiatives, a move that has sparked outrage among environmental groups and climate change activists. Keywords relevant to this section include clean energy tax credits, renewable energy, climate change, environmental regulations, and fossil fuels.

-

Eliminating Incentives for Renewable Energy: The bill proposes the elimination or significant reduction of tax credits and incentives for renewable energy sources, such as solar and wind power. This will likely stifle investment in these sectors, hindering the transition to a cleaner energy future.

-

Exacerbating Climate Change: By reducing investment in renewable energy, the bill effectively undermines efforts to combat climate change. The continued reliance on fossil fuels will lead to increased greenhouse gas emissions and further accelerate the effects of global warming.

-

Job Losses in the Clean Energy Sector: The reduced investment in renewable energy will result in significant job losses in the burgeoning clean energy sector. This will have a negative impact on economic growth and create further hardship for workers in this rapidly growing industry.

-

Long-Term Economic Consequences: The long-term economic consequences of reduced investment in clean energy are potentially severe. Failure to invest in renewable energy technologies could leave the United States at a competitive disadvantage in the global green economy, hindering future economic growth and innovation.

Broader Political Implications and Resistance

The resistance to the House GOP tax bill extends far beyond the specific concerns about Medicaid and clean energy cuts. The bill's overall impact is sparking significant political opposition and highlighting deep divides within the political landscape. Relevant keywords for this section include bipartisan opposition, political gridlock, legislative process, public opinion, and lobbying efforts.

-

Bipartisan Opposition: The bill faces significant opposition from both Democrats and a faction of Republicans, reflecting deep divisions within the party and the broader political spectrum. This bipartisan resistance suggests the bill's passage in its current form is far from certain.

-

Lobbying and Advocacy: Intense lobbying efforts are underway from various groups with vested interests. Healthcare providers, environmental organizations, and advocacy groups are mobilizing to influence lawmakers and shape the legislative process.

-

Public Opinion: Public opinion polls reveal significant opposition to the proposed cuts to Medicaid and clean energy programs. This public discontent could further hinder the bill's progress and impact upcoming elections.

-

Impact on Upcoming Elections: The highly contentious nature of the bill is likely to play a significant role in upcoming elections. The political fallout from the proposed cuts could significantly impact the electoral prospects of both Republican and Democratic candidates.

Conclusion

The House GOP tax bill's proposed cuts to Medicaid and clean energy provisions are facing significant and widespread resistance, raising serious concerns about healthcare access and environmental protection. This controversy reveals deep political divisions and underscores the potential for significant negative consequences. Understanding the complexities of this House GOP tax bill and its potential impact is crucial. Stay informed about the legislative process and engage in the debate to ensure your voice is heard on this critical issue affecting the future of healthcare and the environment. Further research into the specifics of the House GOP tax bill is strongly encouraged.

Featured Posts

-

Osama Bin Laden Capture New Netflix Series Details Critical Phone Call

May 18, 2025

Osama Bin Laden Capture New Netflix Series Details Critical Phone Call

May 18, 2025 -

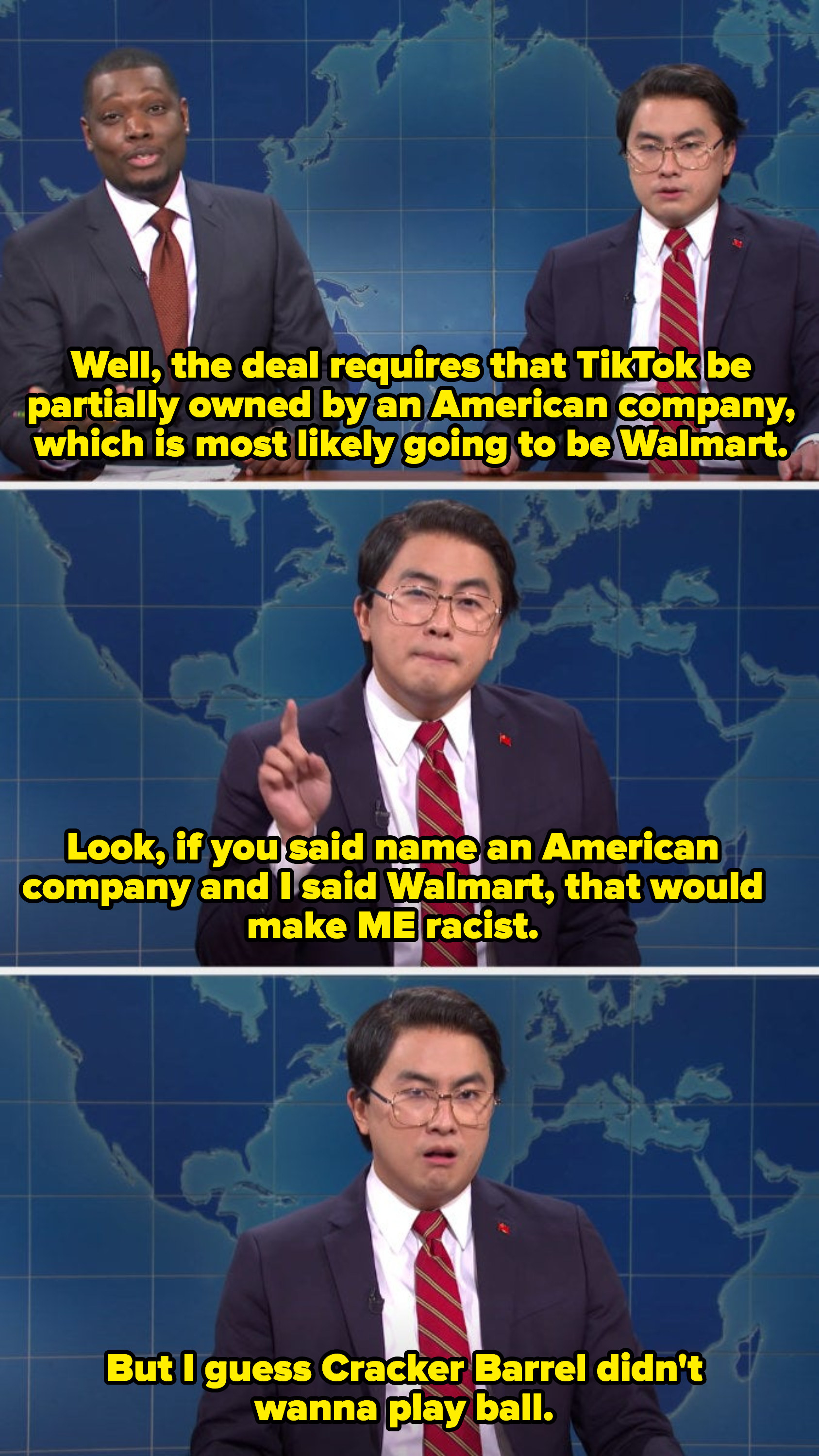

Bowen Yang And The Fight Against Harmful Conversion Therapy Practices

May 18, 2025

Bowen Yang And The Fight Against Harmful Conversion Therapy Practices

May 18, 2025 -

Maneskins Jimmy Kimmel Live Appearance Damiano Davids Stellar Performance

May 18, 2025

Maneskins Jimmy Kimmel Live Appearance Damiano Davids Stellar Performance

May 18, 2025 -

Is Your Home Renovation Stressing You Out Consider A House Therapist

May 18, 2025

Is Your Home Renovation Stressing You Out Consider A House Therapist

May 18, 2025 -

Majority Of Dutch Oppose Eu Retaliation Against Trump Tariffs

May 18, 2025

Majority Of Dutch Oppose Eu Retaliation Against Trump Tariffs

May 18, 2025

Latest Posts

-

Bowen Yang Wants Out A Public Appeal To Lorne Michaels Regarding Snls Jd Vance

May 18, 2025

Bowen Yang Wants Out A Public Appeal To Lorne Michaels Regarding Snls Jd Vance

May 18, 2025 -

Bowen Yang Asks Lorne Michaels To Replace Him As Jd Vance On Snl

May 18, 2025

Bowen Yang Asks Lorne Michaels To Replace Him As Jd Vance On Snl

May 18, 2025 -

Bowen Yangs Plea Replacing Himself As Jd Vance On Snl

May 18, 2025

Bowen Yangs Plea Replacing Himself As Jd Vance On Snl

May 18, 2025 -

Lady Gaga Weighs In On Bowen Yangs Alejandro Ink

May 18, 2025

Lady Gaga Weighs In On Bowen Yangs Alejandro Ink

May 18, 2025 -

Bowen Yangs Hilarious Reaction To Snls White Lotus Parody With Aimee Lou Wood

May 18, 2025

Bowen Yangs Hilarious Reaction To Snls White Lotus Parody With Aimee Lou Wood

May 18, 2025