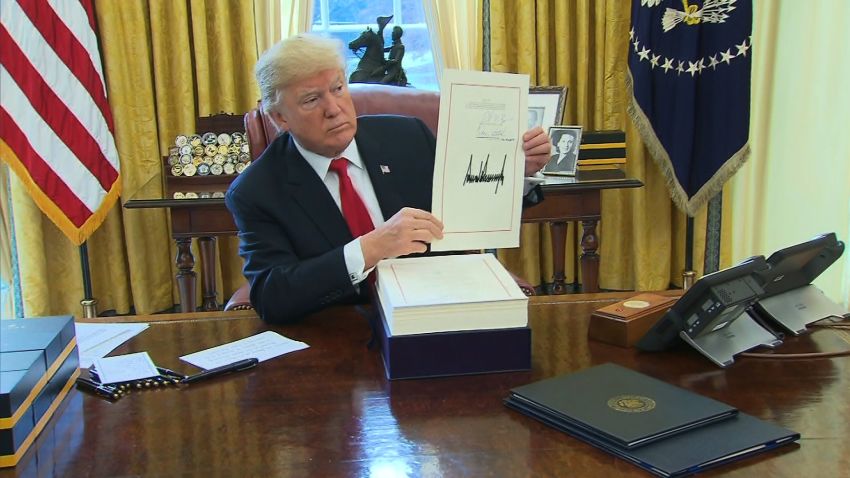

House Passes Trump Tax Bill: Key Changes And Implications

Table of Contents

Individual Income Tax Changes Under the Trump Tax Bill

The Trump Tax Bill significantly altered the individual income tax system, impacting taxpayers across various income levels. Understanding these changes is crucial for navigating your tax obligations.

Tax Bracket Adjustments

The Trump Tax Bill adjusted the individual income tax brackets, resulting in changes to the tax rates for different income levels. The highest tax bracket was reduced from 39.6% to 37%, while other brackets also saw adjustments. These changes impacted tax liability differently depending on income.

- High-income earners: Experienced a lower overall tax burden due to the reduction in the top tax bracket.

- Middle-class families: Saw a mixed impact, with some benefiting from increased standard deductions while others experienced minimal changes or even slight increases in tax liability.

- Low-income individuals: Generally benefited from a simplified tax system and expanded standard deductions, although the impact varied based on individual circumstances.

For example, a high-income earner previously paying taxes at the 39.6% rate now pays at 37%, resulting in a noticeable tax savings. Conversely, a middle-class family may have seen a smaller impact due to changes in deductions offsetting the bracket changes.

Standard Deduction and Itemized Deductions

The Trump Tax Bill significantly increased the standard deduction amounts for both single and married filers. This simplification aimed to benefit more taxpayers by reducing the number of individuals who itemized. However, changes were also made to itemized deductions.

- Standard Deduction: The standard deduction was nearly doubled, making it more advantageous for many taxpayers to use the standard deduction rather than itemize.

- Itemized Deductions: Several itemized deductions were affected, most notably the state and local tax (SALT) deduction, which was capped at $10,000 per household. This cap had a disproportionate impact on high-tax states. Other deductions, such as mortgage interest and charitable contributions, remained, but their effectiveness for some taxpayers was diminished by the increased standard deduction.

Taxpayers who previously itemized, particularly those in high-tax states, often experienced an increased tax burden due to the SALT cap, despite the increased standard deduction. Those who previously used the standard deduction, however, generally benefitted from the higher amount.

Child Tax Credit Modifications

The Trump Tax Bill also modified the Child Tax Credit (CTC), expanding its benefits for many families.

- Increased Credit Amount: The maximum CTC amount was increased, providing greater tax relief for families with children.

- Expanded Eligibility: The changes also expanded the eligibility for the CTC, allowing more families to claim the credit.

- Refundable Portion: A portion of the CTC became refundable, meaning that even if the credit exceeded a family's tax liability, they could receive a refund.

The modifications to the CTC provided significant tax benefits to families with children, particularly those with lower incomes. However, some restrictions and requirements still applied.

Corporate Tax Rate Reductions and Their Consequences

The Trump Tax Bill dramatically lowered the corporate tax rate, aiming to stimulate economic growth.

Lower Corporate Tax Rates

The corporate tax rate was reduced from 35% to 21%, a significant decrease intended to boost corporate profitability and encourage investment.

- Increased Profitability: This lower rate increased after-tax profits for corporations, theoretically providing more capital for investments.

- Economic Stimulation: Proponents argued that the lower rate would lead to increased job creation, higher wages, and greater economic growth. However, critics argued that these benefits wouldn't be as substantial as claimed and that the reduction would disproportionately benefit large corporations.

- Stock Market Impact: The reduction significantly impacted corporate stock prices, which saw an initial surge following the bill's passage.

The actual economic impact of this reduction is complex and debated, requiring further long-term analysis.

Impact on Business Investment and Job Growth

The lower corporate tax rate was expected to influence business investment and job growth in several ways.

- Increased Investment: Companies could reinvest their increased after-tax profits into research and development, expansion, and new equipment.

- Increased Hiring: Companies might also use these savings to expand their workforce, increasing employment opportunities.

- Potential Downsides: Critics warned about the potential for increased income inequality, as the benefits might not be evenly distributed among workers and may disproportionately enrich shareholders.

Long-Term Economic Implications of the Trump Tax Bill

The Trump Tax Bill’s long-term effects on the US economy remain a subject of ongoing debate and analysis.

National Debt Increase

The significant tax cuts implemented by the bill are projected to increase the national debt considerably.

- Increased Deficit: The reduction in tax revenue without corresponding spending cuts would inevitably lead to a larger budget deficit.

- Future Consequences: A larger national debt could lead to higher interest rates, reduced government spending in other areas, and increased economic vulnerability.

- Differing Projections: Different economic models and forecasting agencies offer varying projections on the extent of the debt increase, reflecting the complexity of the economic impacts.

Impact on Budget Deficit

The Trump Tax Bill's impact on the federal budget deficit is directly linked to the national debt.

- Reduced Revenue: The tax cuts resulted in substantial reductions in federal revenue.

- Government Spending: The bill’s impact on government spending varied across different areas.

- Long-Term Outlook: The long-term outlook on the budget deficit is uncertain and depends on various economic factors and future policy decisions. The debate over the bill's overall effectiveness continues.

Conclusion

The Trump Tax Bill represents a significant overhaul of the US tax system, with profound implications for individuals and businesses. While the lower corporate tax rate aimed to stimulate economic growth, the changes to individual deductions and tax brackets have generated considerable debate regarding their overall impact and fairness. Understanding the intricacies of the Trump Tax Bill is crucial for making informed financial decisions. We encourage you to consult with a tax professional to fully assess how these changes affect your specific circumstances. For further insights into the Trump tax bill implications, continue your research and stay informed about upcoming developments and their long-term effects on the US economy.

Featured Posts

-

Fratii Tate Baie De Multime La Bucuresti Dupa Eliberare

May 23, 2025

Fratii Tate Baie De Multime La Bucuresti Dupa Eliberare

May 23, 2025 -

Alix Earles Rise To Fame From Social Media Star To Dancing With The Stars Influencer

May 23, 2025

Alix Earles Rise To Fame From Social Media Star To Dancing With The Stars Influencer

May 23, 2025 -

Freddie Flintoffs Crash A Disney Documentary Unveiled

May 23, 2025

Freddie Flintoffs Crash A Disney Documentary Unveiled

May 23, 2025 -

Cannes Black Market The High Price Of Pure Auteur Fuel Tickets

May 23, 2025

Cannes Black Market The High Price Of Pure Auteur Fuel Tickets

May 23, 2025 -

Accenture Announces 50 000 Promotions Following Delay

May 23, 2025

Accenture Announces 50 000 Promotions Following Delay

May 23, 2025

Latest Posts

-

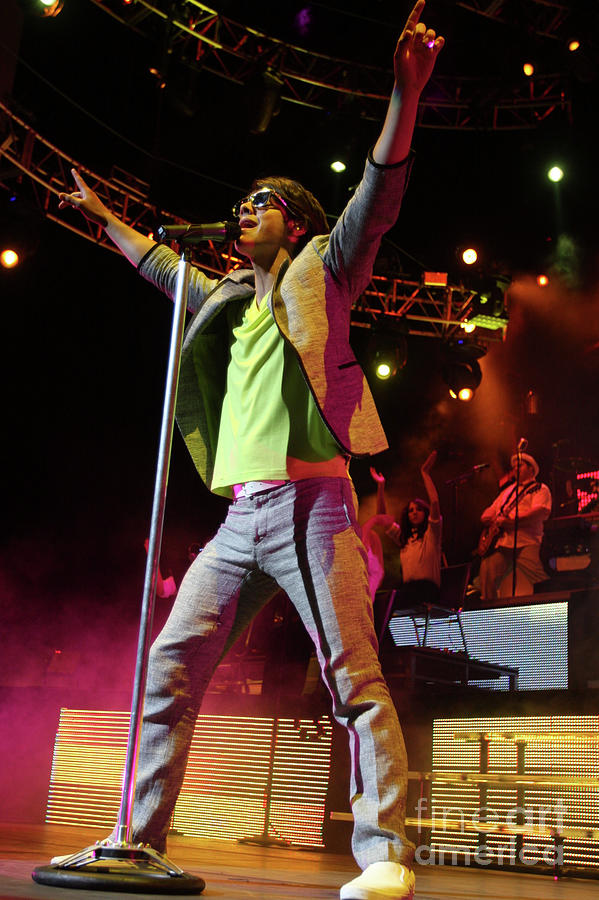

Joe Jonas Stuns Fort Worth Stockyards With Pop Up Concert

May 23, 2025

Joe Jonas Stuns Fort Worth Stockyards With Pop Up Concert

May 23, 2025 -

Fort Worth Stockyards Joe Jonas Impromptu Concert Delights Fans

May 23, 2025

Fort Worth Stockyards Joe Jonas Impromptu Concert Delights Fans

May 23, 2025 -

The Last Rodeo Neal Mc Donoughs Impact On The Film

May 23, 2025

The Last Rodeo Neal Mc Donoughs Impact On The Film

May 23, 2025 -

Usa Film Festival Brings Free Films And Stars To Dallas

May 23, 2025

Usa Film Festival Brings Free Films And Stars To Dallas

May 23, 2025 -

Dallas To Host Usa Film Festival With Free Movie Screenings And Celebrities

May 23, 2025

Dallas To Host Usa Film Festival With Free Movie Screenings And Celebrities

May 23, 2025