House Plan Slams Harvard And Yale With Higher Endowment Taxes

Table of Contents

Keywords: Harvard endowment tax, Yale endowment tax, university endowment tax, higher education funding, endowment tax reform, tax on university endowments, wealth tax, proposed legislation, taxation of endowments.

A groundbreaking new house plan is shaking up the higher education landscape by proposing a substantial increase in taxes levied against the colossal endowments held by prestigious universities such as Harvard and Yale. This controversial proposal, aiming to address wealth inequality and generate substantial revenue for public services, has ignited a fierce debate. This article delves into the specifics of the plan, its potential consequences, and the ongoing discussion surrounding its merits and drawbacks.

The Proposed House Plan: Key Details and Implications

Tax Rate Increases and Calculation Methods

The proposed house plan suggests a significant increase in the tax rate applied to university endowments. Instead of the current (hypothetical) rate of, say, 1%, the plan proposes a tiered system, potentially reaching as high as 5% for endowments exceeding a certain threshold (e.g., $10 billion). The calculation method would likely be based on the total market value of the endowment at the end of the fiscal year, not just investment returns.

- Example: If Harvard's endowment, currently valued at approximately $50 billion, faces a 5% tax, the university could face a tax burden of $2.5 billion. For Yale, with a similar sized endowment, the tax burden would be comparable.

- Exemptions: The proposed legislation may include exemptions for endowments specifically earmarked for financial aid or specific research initiatives. The specifics of these exemptions are yet to be fully determined and are a crucial part of the ongoing debate.

Projected Revenue and Allocation

The projected revenue generated from this endowment tax is substantial. Based on the current endowment values of Harvard and Yale alone, and assuming a 5% tax rate, the potential revenue could reach billions of dollars annually.

- Harvard & Yale Revenue: As illustrated above, a 5% tax could generate $5 billion annually from these two institutions alone.

- Public Funding Impact: This revenue injection would significantly bolster public funding for various crucial sectors. Proposed allocations include increased funding for public K-12 education, improved infrastructure development, and expansion of affordable healthcare initiatives. The exact allocation would depend on legislative priorities and further debate.

Arguments For and Against the Proposed Endowment Tax

Supporters' Arguments

Proponents of the endowment tax argue that it is a necessary step towards addressing systemic wealth inequality. They contend that these massive endowments represent accumulated wealth that could be better utilized to benefit society as a whole.

- Ethical Arguments: Supporters emphasize the ethical responsibility of wealthy institutions to contribute to the common good, particularly in addressing pressing societal needs.

- Proponent Statements: Statements from supporting lawmakers emphasize the need for "fair taxation" and ensuring that institutions with vast resources contribute proportionally to public welfare.

Opponents' Arguments

Opponents of the tax raise concerns about potential negative consequences for universities. They argue that such a significant tax burden could severely restrict university operations and compromise their ability to provide financial aid and conduct vital research.

- Negative Consequences: Critics point to the potential for reduced funding for scholarships, research grants, and faculty salaries. This could affect student access to higher education and hinder scientific advancements.

- University Officials' Concerns: Statements from university presidents and administrators express fears that the tax would compromise their long-term financial stability and ability to fulfill their educational mission.

Potential Long-Term Effects on Higher Education

Impact on University Spending and Financial Aid

The proposed endowment tax could dramatically alter university spending priorities. Universities might be forced to implement significant budget cuts, potentially affecting research initiatives, faculty hiring, and financial aid programs.

- Budget Cut Scenarios: Universities might reduce departmental budgets, delay construction projects, and limit faculty recruitment.

- Accessibility Concerns: Reduced financial aid could significantly reduce the accessibility of higher education for low- and middle-income students.

Changes in University Investment Strategies

In response to the new tax, universities may alter their investment strategies to minimize their tax burden. This could lead to a shift toward lower-risk investments, potentially impacting the overall growth of their endowments.

- Diversification Strategies: Universities may diversify their portfolios to reduce exposure to certain asset classes subject to higher taxation.

- Impact on Endowment Growth: Changes in investment strategies could affect long-term endowment growth and ultimately impact the university's ability to fund its operations and financial aid initiatives.

Conclusion

The proposed house plan to increase taxes on university endowments, particularly those held by institutions like Harvard and Yale, represents a significant shift in the landscape of higher education funding. The plan promises substantial revenue for public services while raising concerns about its potential impact on university operations, research, and financial aid. The debate surrounding this proposal highlights the complex interplay between wealth inequality, public funding, and the role of universities in society. Further research into the tax on university endowments is essential, as is informed discussion on endowment tax reform. Contact your elected officials to voice your opinion on the university endowment tax and help shape the future of higher education funding.

Featured Posts

-

Aces Preseason Game Undrafted Rookie Deja Kellys Dramatic Game Winner

May 13, 2025

Aces Preseason Game Undrafted Rookie Deja Kellys Dramatic Game Winner

May 13, 2025 -

Ademola Lookman Liverpool Face Chelsea Competition In Transfer Pursuit

May 13, 2025

Ademola Lookman Liverpool Face Chelsea Competition In Transfer Pursuit

May 13, 2025 -

Oregon Ducks Womens Basketball Overtime Victory Against Vanderbilt

May 13, 2025

Oregon Ducks Womens Basketball Overtime Victory Against Vanderbilt

May 13, 2025 -

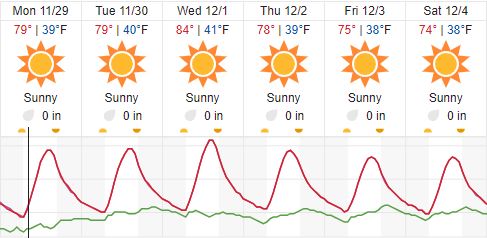

Extreme Heat Warning Paso Robles Faces Scorching Temperatures

May 13, 2025

Extreme Heat Warning Paso Robles Faces Scorching Temperatures

May 13, 2025 -

O Megalos Kataklysmos Tis Mesogeioy Mia Anatheorisi Ton Istorikon Dedomenon

May 13, 2025

O Megalos Kataklysmos Tis Mesogeioy Mia Anatheorisi Ton Istorikon Dedomenon

May 13, 2025

Latest Posts

-

Premier League Agent Meets With Liverpool And Arsenal

May 14, 2025

Premier League Agent Meets With Liverpool And Arsenal

May 14, 2025 -

Dean Huijsen Transfer Update Bournemouth Interest And Real Madrids Plans

May 14, 2025

Dean Huijsen Transfer Update Bournemouth Interest And Real Madrids Plans

May 14, 2025 -

Arsenal And The Premier League Star The Ornstein Report

May 14, 2025

Arsenal And The Premier League Star The Ornstein Report

May 14, 2025 -

Bournemouth Target Huijsen Will Real Madrid Sanction The Sale

May 14, 2025

Bournemouth Target Huijsen Will Real Madrid Sanction The Sale

May 14, 2025 -

Premier League Star A Target For Arsenal Ornstein Reveals

May 14, 2025

Premier League Star A Target For Arsenal Ornstein Reveals

May 14, 2025