House Tax Bill Passes: Impact On Stock Market And Bond Yields Today

Table of Contents

Initial Market Reactions to the House Tax Bill

The passage of the House Tax Bill triggered immediate volatility across financial markets. Understanding these initial reactions is key to predicting future trends.

Stock Market Volatility

Major indices experienced significant fluctuations following the bill's passage. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all saw pronounced movements, reflecting investor sentiment and uncertainty.

- Percentage Changes: The Dow saw a 1.5% initial drop, while the S&P 500 fell by 1.2%, and the Nasdaq experienced a 1.8% decrease in the immediate aftermath. These figures, however, are subject to change as the market digests the implications of the bill.

- Trading Volume: Trading volume increased significantly across all major exchanges, indicating heightened investor activity and uncertainty. High volume often accompanies periods of significant market movement.

- Unusual Trading Patterns: Certain sectors experienced more pronounced volatility than others. For example, the technology sector initially saw a sharper decline than the more traditional sectors, likely due to specific provisions within the bill.

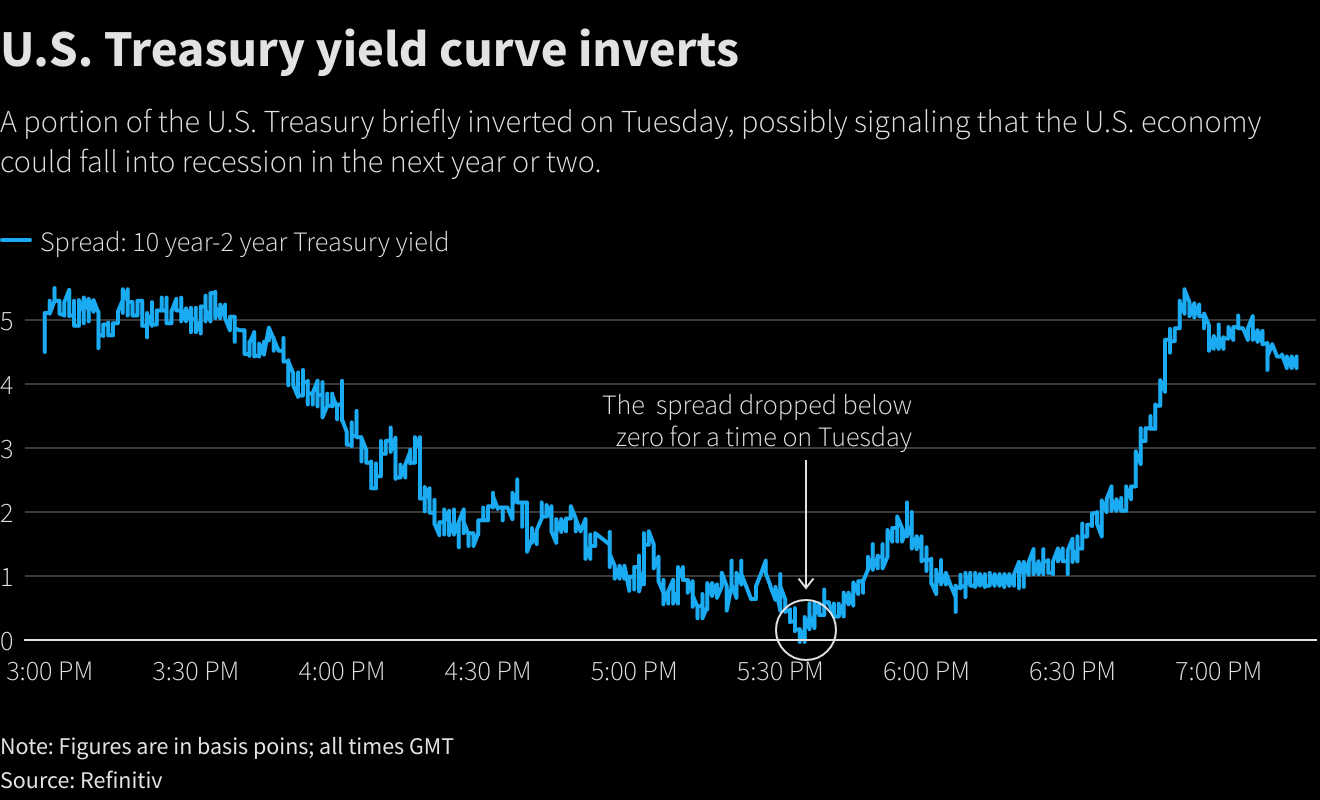

Impact on Bond Yields

The bill's passage also influenced Treasury yields and corporate bond yields. These movements reflect investor sentiment and expectations about future inflation and economic growth.

- Inverse Relationship: Remember, bond prices and yields have an inverse relationship. As bond prices fall, yields rise, and vice versa. The initial market response to the House Tax Bill saw a slight increase in yields across the board.

- Yield Curve Shifts: The yield curve, which plots the yields of government bonds with different maturities, may flatten or steepen depending on investor expectations about future interest rates. Close monitoring of yield curve shifts is crucial for assessing the long-term economic implications.

- Flight-to-Safety: While not immediately apparent, a “flight-to-safety” effect might emerge if investors perceive increased economic uncertainty. This could lead to higher demand for government bonds, pushing their prices up and yields down.

Sector-Specific Analysis of the House Tax Bill's Impact

The House Tax Bill's impact varies significantly across different sectors. Understanding these sector-specific effects allows for a more nuanced assessment of the bill's overall influence.

Technology Sector

The technology sector, often heavily reliant on R&D and capital expenditures, is particularly sensitive to tax policy changes.

- R&D Tax Credits: Changes to R&D tax credits could significantly influence the profitability and investment strategies of tech companies. A reduction in credits might curb innovation and slow down growth.

- Capital Expenditures: The bill's provisions could affect capital expenditure plans. Changes in corporate tax rates directly influence a company's decision-making regarding investments in new equipment, software, and infrastructure.

- Specific Tech Giants: Companies with significant international operations or high R&D spending may be disproportionately affected by specific clauses in the new legislation.

Financial Sector

Banks, insurance companies, and other financial institutions will also experience varying impacts from the new tax law.

- Corporate Tax Rates: Changes to corporate tax rates will directly affect the profitability of financial institutions. A lower corporate tax rate could boost earnings, potentially leading to increased lending and investment.

- Regulations and Compliance Costs: The bill might indirectly influence the financial sector through changes to regulations and compliance costs. Increased regulatory burdens could offset some of the benefits of lower tax rates.

- Lending and Investment Activities: The overall impact on lending and investment activities will depend on multiple factors, including investor confidence and economic forecasts.

Energy Sector

The energy sector is particularly susceptible to changes in tax incentives for both renewable and fossil fuel sources.

- Drilling and Exploration Tax Breaks: Changes to tax breaks for oil and gas exploration will significantly impact fossil fuel companies’ profitability and exploration activities.

- Renewable Energy Investment: Incentives for renewable energy technologies will directly influence investment in solar, wind, and other sustainable energy sources.

- Energy Prices: The net effect on energy prices will depend on the interplay between supply and demand, influenced by both tax policy and global market dynamics.

Long-Term Implications and Economic Forecasting

The long-term effects of the House Tax Bill are subject to ongoing debate and analysis. However, some key areas are worthy of consideration.

Economic Growth Projections

Experts offer varying projections regarding the bill’s impact on key economic indicators.

- GDP Growth Forecasts: Economists have presented conflicting forecasts, with some predicting modest growth increases and others foreseeing a neutral or even negative impact on GDP.

- Inflationary Pressures: Depending on the specific provisions of the bill, inflationary pressures could result from increased consumer spending or business investment.

- Impact on Job Creation: The bill's impact on job creation is similarly uncertain, with potential gains in some sectors offset by potential losses in others.

Investor Strategies in Response to the House Tax Bill

Investors should adapt their portfolios based on their risk tolerance and investment goals.

- Stock Allocation Strategies: Investors might consider adjusting their stock allocations based on the projected performance of different sectors under the new tax regime.

- Bond Portfolio Risk Management: Given the potential for increased interest rates, investors should reassess the risk profile of their bond portfolios.

- Diversification: Diversification remains a key strategy for mitigating risk and ensuring a resilient investment portfolio.

Conclusion

The passage of the House Tax Bill has introduced significant uncertainty and volatility in the stock market and bond yields. Understanding its immediate and long-term effects on different sectors is crucial for investors to make informed decisions. By analyzing the bill's provisions and their impact on various economic indicators, investors can adjust their portfolios to navigate this evolving environment. Stay informed about the ongoing developments surrounding this significant House Tax Bill and its continued impact on stock market performance and bond yields. Continue monitoring news and analysis to make the best investment choices. Learn more about how the House Tax Bill will affect your investments and take control of your financial future.

Featured Posts

-

Honeywells Potential Acquisition Of Johnson Mattheys Catalyst Unit A Deep Dive

May 23, 2025

Honeywells Potential Acquisition Of Johnson Mattheys Catalyst Unit A Deep Dive

May 23, 2025 -

Dylan Dreyer And Brian Fichera Their Relationship Story

May 23, 2025

Dylan Dreyer And Brian Fichera Their Relationship Story

May 23, 2025 -

2025 Umd Graduation The Unexpected Kermit The Frog Appearance

May 23, 2025

2025 Umd Graduation The Unexpected Kermit The Frog Appearance

May 23, 2025 -

Ocean City Rehoboth And Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 23, 2025

Ocean City Rehoboth And Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 23, 2025 -

Bangladeshs Rain Hit Win Najmul Hossain Shantos Match Winning Performance

May 23, 2025

Bangladeshs Rain Hit Win Najmul Hossain Shantos Match Winning Performance

May 23, 2025

Latest Posts

-

Joe Jonas Addresses Public Dispute Involving A Married Couple

May 23, 2025

Joe Jonas Addresses Public Dispute Involving A Married Couple

May 23, 2025 -

Joe Jonass Mature Reaction To A Couples Argument

May 23, 2025

Joe Jonass Mature Reaction To A Couples Argument

May 23, 2025 -

Couples Fight Over Joe Jonas His Classy Response

May 23, 2025

Couples Fight Over Joe Jonas His Classy Response

May 23, 2025 -

Joe Jonas Stuns Fort Worth Stockyards With Pop Up Concert

May 23, 2025

Joe Jonas Stuns Fort Worth Stockyards With Pop Up Concert

May 23, 2025 -

Fort Worth Stockyards Joe Jonas Impromptu Concert Delights Fans

May 23, 2025

Fort Worth Stockyards Joe Jonas Impromptu Concert Delights Fans

May 23, 2025