Housing Corporations Face €3 Billion Loss Due To Proposed Rent Freeze

Table of Contents

The €3 Billion Loss: A Detailed Breakdown

The projected €3 billion loss for housing corporations isn't just a number; it represents a severe blow to their operational capacity and future plans. This significant financial shortfall will have a devastating impact on several key areas.

Impact on Investment and Maintenance

The rent freeze will severely restrict the ability of housing corporations to invest in much-needed repairs, renovations, and new builds. The reduced income directly translates to limitations in vital maintenance and modernization projects. This means:

- Deferred maintenance: Essential repairs, such as roof replacements, plumbing fixes, and electrical upgrades, will likely be postponed, leading to safety hazards and further deterioration of the existing housing stock. This could result in increased costs down the line, as smaller issues escalate into larger, more expensive problems.

- Halted renovations: Planned renovations to improve energy efficiency and accessibility will be delayed or canceled altogether. This will not only impact the comfort and well-being of tenants but also contribute to higher energy bills and a less sustainable housing sector.

- Fewer new constructions: The financial strain will severely limit the ability of housing corporations to build new affordable housing units, exacerbating the already acute housing shortage in the Netherlands. This directly contradicts the intention of the rent freeze to improve the availability of affordable housing.

Effect on Affordable Housing Initiatives

Ironically, the rent freeze may significantly undermine efforts to provide affordable housing. The reduced investment capacity directly impacts the development of social housing projects. This will lead to:

- Reduced construction of social housing: Fewer new social housing units will be built, leaving vulnerable populations with limited options for affordable rental accommodation.

- Deterioration of existing affordable housing: The lack of maintenance and renovations will lead to a decline in the quality of existing affordable housing, impacting the living conditions of vulnerable tenants.

- Long-term negative consequences: The short-term benefits of lower rents will be far outweighed by the long-term negative consequences of a poorly maintained and insufficient housing stock.

The Wider Implications for the Rental Market

The consequences of the proposed rent freeze extend far beyond housing corporations, significantly impacting the broader rental market and its stakeholders.

Impact on Property Investment

The decreased profitability of rental properties will act as a significant deterrent to future investment in the sector. This means:

- Reduced investment in new properties: Investors will be less inclined to invest in new rental properties if the return on investment is drastically reduced by a rent freeze.

- Decline in property quality: Without new investment, the overall quality of rental properties will likely stagnate or even decline, creating a vicious cycle of substandard housing.

- Potential for increased rents in the long run: Paradoxically, the decreased supply caused by reduced investment might ultimately lead to higher rental prices in the long term, directly contradicting the original aim of the rent freeze.

Consequences for Tenants

While ostensibly designed to protect tenants, the rent freeze may have unintended negative consequences for those it aims to help.

- Poorer quality housing: Reduced investment in maintenance and renovations will lead to poorer quality housing with increased risks and discomfort.

- Increased waiting times for social housing: A reduction in the number of new social housing units will exacerbate waiting lists, leaving more people struggling to find affordable housing.

- Lack of innovation and modernization: The rental sector may experience a standstill in terms of modernization and improvements in energy efficiency and sustainability.

Alternative Solutions to the Affordable Housing Crisis

A blanket rent freeze is not the only, nor necessarily the best, solution to the affordable housing crisis. Several alternative approaches deserve consideration:

Targeted Subsidies

Government subsidies directly to low-income renters could provide targeted support without the widespread negative consequences of a rent freeze. This allows for a more efficient use of public funds, focusing aid on those who need it most.

Increased Construction of Social Housing

Increased government funding for the construction of affordable housing units addresses the root of the problem – the shortage of available housing. This proactive approach ensures the availability of affordable options without crippling the existing rental market.

Regulatory Reforms

Exploring rent control mechanisms that allow for controlled rent increases based on factors like inflation and maintenance costs could achieve a balance between tenant protection and the financial stability of housing corporations. This approach avoids the drastic measure of a complete freeze.

Conclusion

The proposed rent freeze, while intending to address affordability concerns, carries significant risks for housing corporations and the rental market as a whole. A €3 billion loss for housing corporations will severely hamper investment and maintenance, potentially undermining the long-term goal of providing affordable housing. The financial strain on housing corporations threatens the quality and availability of rental properties, ultimately impacting both landlords and tenants. Finding a sustainable solution to the affordable housing crisis requires careful consideration and a balanced approach. Explore alternatives to a blanket rent freeze that can effectively address affordability without crippling the housing sector. Let’s work together to find effective solutions beyond the detrimental effects of a potential €3 billion loss due to the proposed rent freeze. We need a sustainable and responsible approach to tackle the affordable housing crisis – let’s find a better way.

Featured Posts

-

Nadals Emotional Roland Garros Goodbye Sabalenkas Triumphant Victory

May 28, 2025

Nadals Emotional Roland Garros Goodbye Sabalenkas Triumphant Victory

May 28, 2025 -

Winning Euro Millions Ticket Urgent Appeal After Irish Shop Sale

May 28, 2025

Winning Euro Millions Ticket Urgent Appeal After Irish Shop Sale

May 28, 2025 -

Hailee Steinfeld My Life In 20 Questions

May 28, 2025

Hailee Steinfeld My Life In 20 Questions

May 28, 2025 -

From Scatological Data To Engaging Audio An Ai Approach To Podcast Creation

May 28, 2025

From Scatological Data To Engaging Audio An Ai Approach To Podcast Creation

May 28, 2025 -

Man Utd Star Criticised For Clumsy Error

May 28, 2025

Man Utd Star Criticised For Clumsy Error

May 28, 2025

Latest Posts

-

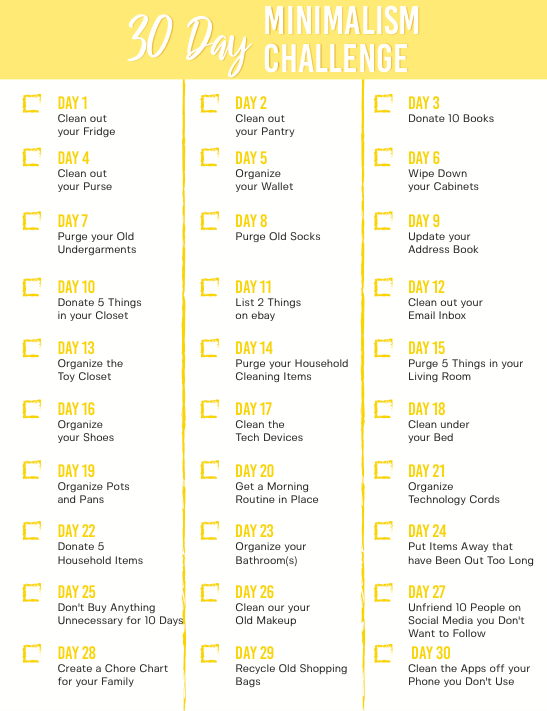

30 Day Minimalist Challenge Transform Your Home And Life

May 31, 2025

30 Day Minimalist Challenge Transform Your Home And Life

May 31, 2025 -

Houstons Unexpected Public Health Issue Rats And Drug Addiction

May 31, 2025

Houstons Unexpected Public Health Issue Rats And Drug Addiction

May 31, 2025 -

The Six Golden Rules Of Office Lunch Etiquette

May 31, 2025

The Six Golden Rules Of Office Lunch Etiquette

May 31, 2025 -

Samsung Galaxy Tablet Undercuts Apple I Pad 101 Bargain

May 31, 2025

Samsung Galaxy Tablet Undercuts Apple I Pad 101 Bargain

May 31, 2025 -

Minimalism In 30 Days Achieving A Simpler Lifestyle

May 31, 2025

Minimalism In 30 Days Achieving A Simpler Lifestyle

May 31, 2025