How China's Reduced Rates And Easier Bank Lending Affect Businesses

Table of Contents

Increased Access to Capital for Chinese Businesses

The most immediate impact of China's reduced rates and easier bank lending is increased access to capital for businesses of all sizes.

Lower Borrowing Costs and Their Impact

Reduced interest rates directly translate to lower borrowing costs for businesses. This means companies can secure loans at significantly reduced interest expense compared to previous years. This benefit is particularly pronounced for smaller businesses, such as Small and Medium-sized Enterprises (SMEs), who often rely heavily on bank financing for their operations.

- Reduced interest expense: Frees up capital for other investments, improving profitability margins.

- Increased profitability: Lower financing costs directly translate to higher profit margins, allowing for reinvestment and growth.

- Potential for expansion: Easier and cheaper access to credit allows businesses to expand their operations, hire more employees, and develop new products or services. This is especially beneficial for companies looking to expand their market reach both domestically and internationally.

Easing Lending Restrictions and Their Benefits

Beyond simply lowering interest rates, the government has also eased lending restrictions, making it easier for businesses to secure loans, even those previously deemed high-risk. This is particularly beneficial for certain sectors.

- Increased loan approvals: Companies that previously struggled to obtain financing due to stricter regulations now have a higher chance of approval.

- Faster access to funds: Streamlined loan application processes lead to quicker access to much-needed capital.

- Improved cash flow: Easier access to credit allows businesses to better manage their cash flow, smoothing out seasonal fluctuations and reducing financial stress. This is particularly significant for export-oriented businesses facing fluctuating global demand.

Stimulating Economic Growth and Investment

The combined effect of lower borrowing costs and easier lending is a significant boost to economic growth and investment in China.

Boosting Investment and Expansion

Cheaper credit fuels business investment in various areas: new projects, upgrading equipment, and expanding operations. This injection of capital stimulates economic activity across various sectors.

- New job opportunities: Increased investment leads to job creation, boosting employment rates and overall economic prosperity.

- Increased production capacity: Businesses can invest in expanding their production facilities, leading to increased output and improved competitiveness.

- Potential for innovation: Access to capital encourages investment in research and development, fostering innovation and technological advancement.

Impact on Infrastructure Development

Easier lending plays a crucial role in financing large-scale infrastructure projects, from high-speed rail to renewable energy initiatives.

- Improved infrastructure: Investing in infrastructure creates a more efficient and robust economic foundation, boosting long-term growth.

- Enhanced logistics: Improved infrastructure enhances logistics networks, reducing transportation costs and improving efficiency.

- Increased connectivity: Better infrastructure boosts connectivity, improving communication and facilitating business activities across regions.

Potential Risks and Challenges

While China's reduced rates and easier bank lending offer significant benefits, it's crucial to acknowledge potential risks and challenges.

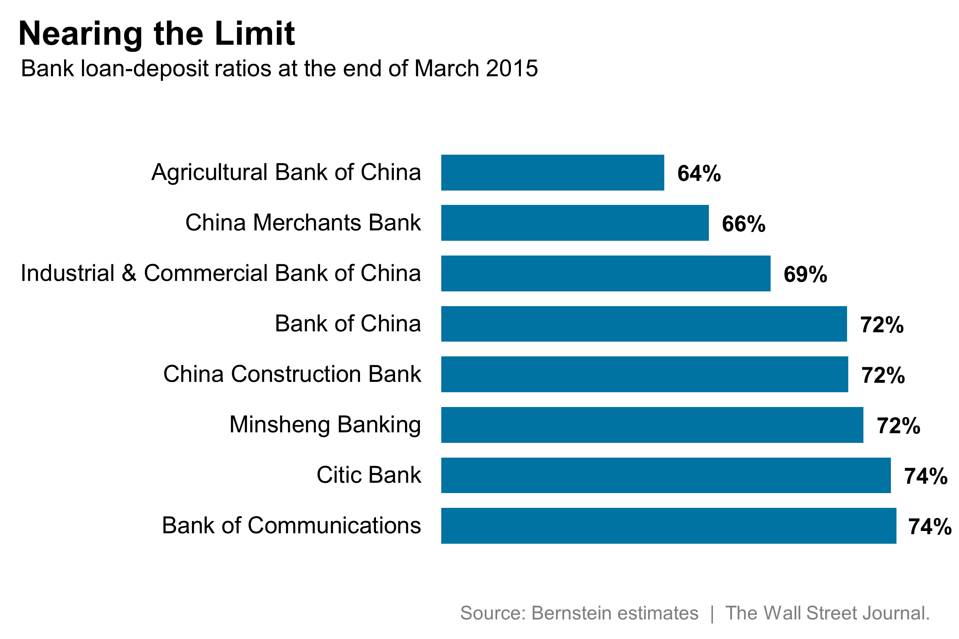

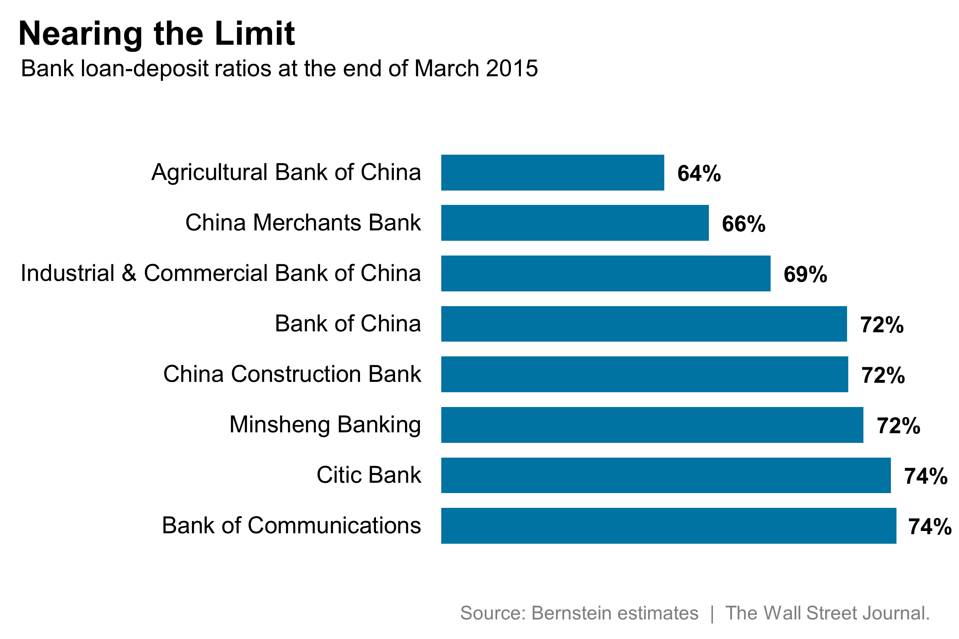

Increased Debt Levels and Financial Risk

Increased borrowing, while stimulating economic activity, also increases overall debt levels for businesses. This carries financial risks.

- Increased financial burden: Higher debt levels can put a significant strain on businesses' finances, particularly if economic conditions deteriorate.

- Risk of insolvency: Businesses with high levels of debt are more vulnerable to insolvency if they experience financial difficulties.

- Potential for financial instability: A rapid increase in debt can potentially destabilize the entire financial system if not managed carefully.

Moral Hazard and Lending Practices

Easing lending restrictions also increases the risk of moral hazard and irresponsible lending practices.

- Need for robust regulatory frameworks: Strong regulatory oversight is crucial to ensure responsible lending practices and prevent asset bubbles.

- Responsible lending practices: Both banks and businesses need to adopt responsible lending and borrowing practices to mitigate risks.

- Sustainable growth: The goal should be sustainable economic growth, not growth fueled by excessive borrowing and unsustainable debt levels.

Conclusion: Understanding the Long-Term Effects of China's Reduced Rates and Easier Bank Lending on Businesses

China's reduced rates and easier bank lending policies have had a significant and multifaceted impact on businesses. While increased access to capital, stimulated investment, and boosted economic growth are undeniable benefits, the potential risks of increased debt levels and irresponsible lending practices must be carefully considered. To thrive in this dynamic environment, businesses must carefully analyze China's reduced rates and easier bank lending policies and adapt their strategies accordingly. Further research into China's reduced interest rates, their impact on Chinese businesses, and China's bank lending policies is crucial for navigating the complexities of the Chinese economic landscape.

Featured Posts

-

Oklahoma Citys Tough Road Ahead Facing The Memphis Grizzlies

May 08, 2025

Oklahoma Citys Tough Road Ahead Facing The Memphis Grizzlies

May 08, 2025 -

Arsenali Nen Hetim Te Uefa S Pas Ndeshjes Me Psg Ne Shkelje E Rregullave

May 08, 2025

Arsenali Nen Hetim Te Uefa S Pas Ndeshjes Me Psg Ne Shkelje E Rregullave

May 08, 2025 -

Is Jayson Tatum Playing Tonight Full Celtics Injury Report For Nets Game

May 08, 2025

Is Jayson Tatum Playing Tonight Full Celtics Injury Report For Nets Game

May 08, 2025 -

Rogues Unexpected Rise To Power In The X Men

May 08, 2025

Rogues Unexpected Rise To Power In The X Men

May 08, 2025 -

Increased Ethereum Network Activity What Does It Mean For Investors

May 08, 2025

Increased Ethereum Network Activity What Does It Mean For Investors

May 08, 2025