How Lack Of Funds Impacts Your Goals & What You Can Do

Table of Contents

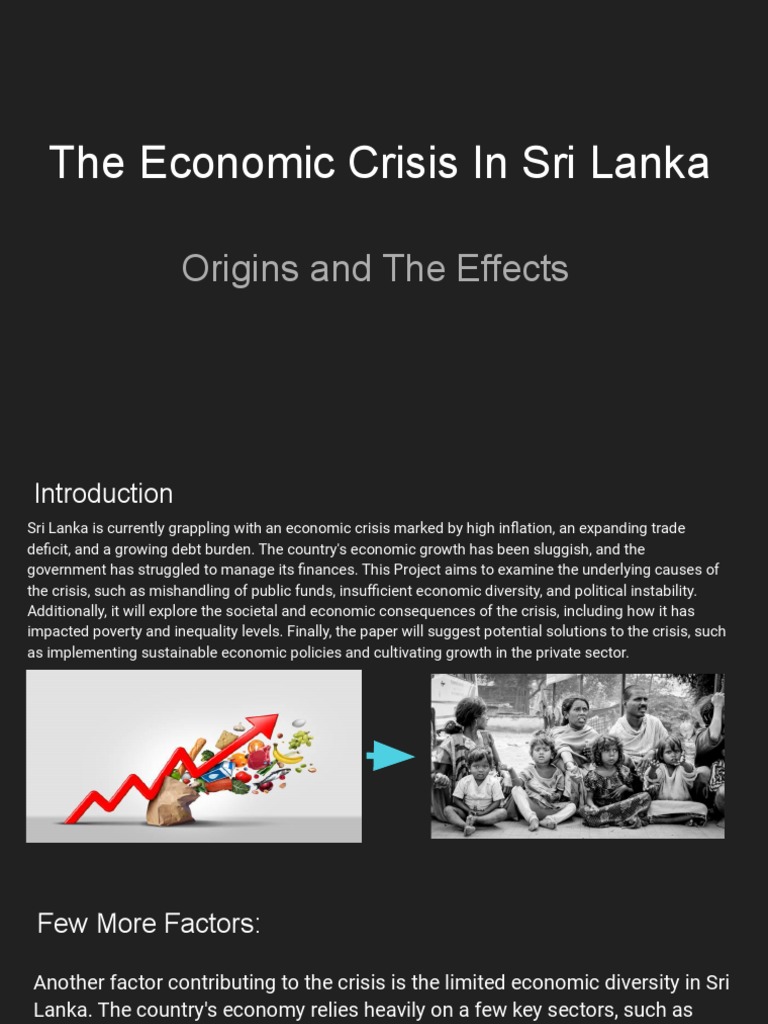

The Devastating Effects of Insufficient Funding on Goal Achievement

Insufficient funds don't just mean delaying gratification; they can have a profound impact on your overall well-being and progress. The stress and anxiety associated with financial insecurity can significantly hinder your ability to achieve your ambitions.

Financial Stress and Mental Wellbeing

Lack of funds is strongly linked to increased stress, anxiety, and depression. The constant worry about money can significantly impact your mental health and ability to focus on your goals. This financial strain can manifest in various ways:

- Difficulty concentrating on tasks: Financial worries can distract you, making it hard to focus on work, studies, or other important tasks.

- Increased irritability and frustration: The pressure of financial instability can lead to increased tension and conflict in personal relationships.

- Sleep disturbances: Worrying about money can disrupt sleep patterns, leading to exhaustion and reduced productivity.

- Strained relationships: Financial stress can put a significant strain on personal relationships, causing arguments and resentment.

Delayed or Abandoned Goals

Without sufficient funds, achieving significant life goals becomes nearly impossible. This can lead to feelings of failure and disappointment. Many dreams are put on hold indefinitely:

- Postponed education: The cost of tuition, books, and living expenses can be a major barrier to further education.

- Inability to start a business: Securing start-up capital is crucial for launching a new business, and a lack of funds can be a deal-breaker.

- Deferred homeownership: Saving for a down payment and covering ongoing mortgage payments requires significant financial resources.

- Unmet travel aspirations: Travel plans often require substantial savings, and limited finances can prevent you from exploring the world.

Compromised Opportunities

Limited finances can restrict your ability to take advantage of lucrative opportunities, hindering your personal and professional growth. This can manifest in several ways:

- Missed investment opportunities: A lack of funds can prevent you from investing in stocks, bonds, or other assets that could generate wealth over time.

- Inability to pursue further education or training: Professional development opportunities often require financial investment, and a lack of funds can limit your career advancement potential.

- Limited career advancement options: Taking on new responsibilities or seeking promotions may require relocation or further training, which can be challenging without sufficient financial resources.

- Reduced social and networking opportunities: Conferences, workshops, and networking events can be expensive, limiting opportunities to connect with peers and potential employers.

Strategies to Overcome Financial Shortfalls and Achieve Your Goals

While a lack of funds can be daunting, it's not insurmountable. By implementing effective strategies, you can overcome financial challenges and work towards your goals.

Creating a Realistic Budget

The cornerstone of financial stability is a well-structured budget. This involves tracking your spending, identifying areas for savings, and creating a plan that aligns with your income:

- Utilize budgeting apps or spreadsheets: Tools like Mint, YNAB, or simple spreadsheets can help you track your income and expenses effectively.

- Categorize expenses (needs vs. wants): Differentiating between essential expenses and discretionary spending allows for better allocation of resources.

- Set realistic savings goals: Start with achievable goals and gradually increase your savings as your financial situation improves.

- Regularly review and adjust your budget: Your financial situation may change over time, so regular review and adjustments are crucial.

Exploring Funding Options

There are various avenues to supplement your income or secure funding for your goals:

- Seeking loans (personal, business, student): Loans can provide the necessary capital for various purposes, but it's essential to understand the terms and interest rates.

- Applying for grants and scholarships: Grants and scholarships can significantly reduce the financial burden of education or other projects.

- Crowdfunding platforms: Platforms like Kickstarter and GoFundMe allow you to raise funds from a wider audience.

- Side hustles and freelance work: Supplementing your income through part-time work or freelancing can help you accelerate your savings.

- Negotiating better payment terms with creditors: Contacting creditors to discuss payment plans or lower interest rates can alleviate financial pressure.

Prioritizing and Re-evaluating Goals

Sometimes, it's necessary to adjust your plans to align with your current financial situation:

- Prioritize essential goals over less urgent ones: Focus on goals that are critical for your well-being and long-term success.

- Break down large goals into smaller, more manageable steps: This makes the process less daunting and allows for incremental progress.

- Re-evaluate the feasibility of certain goals: Be honest about which goals are realistically achievable with your current resources.

- Seek professional financial advice if needed: A financial advisor can provide personalized guidance and strategies to manage your finances effectively.

Conclusion

Lack of funds presents a significant obstacle to achieving personal and professional goals. However, by understanding the impact of financial constraints, creating a realistic budget, exploring various funding options, and prioritizing goals strategically, you can overcome these challenges and work towards a more financially secure and fulfilling future. Don't let a lack of funds define your potential; take control of your finances and start achieving your dreams today. Learn more about managing your finances and overcoming a lack of funds by [link to relevant resource/page].

Featured Posts

-

Freepoint Eco Systems Announces Ing Project Finance Facility

May 21, 2025

Freepoint Eco Systems Announces Ing Project Finance Facility

May 21, 2025 -

Juergen Klopp Efsane Yoeneticinin Bueyuek Doenuesue

May 21, 2025

Juergen Klopp Efsane Yoeneticinin Bueyuek Doenuesue

May 21, 2025 -

Jellystone And Pinata Smashling Top Picks In Teletoon S Spring Streaming Slate

May 21, 2025

Jellystone And Pinata Smashling Top Picks In Teletoon S Spring Streaming Slate

May 21, 2025 -

Abn Amro Groeiend Autobezit Drijft Occasionverkoop Omhoog

May 21, 2025

Abn Amro Groeiend Autobezit Drijft Occasionverkoop Omhoog

May 21, 2025 -

Love Monster And Child Development A Parents Guide

May 21, 2025

Love Monster And Child Development A Parents Guide

May 21, 2025

Latest Posts

-

New Attempt To Break The Trans Australia Run World Record

May 21, 2025

New Attempt To Break The Trans Australia Run World Record

May 21, 2025 -

American Couple Arrested In Uk Bbc Antiques Roadshow Connection

May 21, 2025

American Couple Arrested In Uk Bbc Antiques Roadshow Connection

May 21, 2025 -

Is The Trans Australia Running Record About To Fall

May 21, 2025

Is The Trans Australia Running Record About To Fall

May 21, 2025 -

Antiques Roadshow American Couples Arrest Following Uk Episode

May 21, 2025

Antiques Roadshow American Couples Arrest Following Uk Episode

May 21, 2025 -

Trans Australia Run A Race Against Time And Distance

May 21, 2025

Trans Australia Run A Race Against Time And Distance

May 21, 2025