How Late Student Loan Payments Impact Your Credit

Table of Contents

Understanding How Student Loans Affect Your Credit

Student loans, like other installment loans, are reported to the three major credit bureaus: Experian, Equifax, and TransUnion. Your credit score, a crucial three-digit number, reflects your creditworthiness and significantly impacts your ability to secure loans (mortgages, auto loans), rent an apartment, or even land certain jobs. A high credit score unlocks better interest rates and financial opportunities. It's crucial to understand the difference between a missed payment (a payment not made at all) and a late payment (a payment made after the due date). Both negatively affect your credit, but the severity differs.

- Student loans are installment loans: Unlike credit cards, which report balances and transactions monthly, student loans report payment history on a monthly or even bi-monthly basis. A single late payment can significantly impact your credit.

- Late payments are reported: Any late payment is duly noted and reported to the credit bureaus, negatively affecting your credit history.

- Severity varies: The impact depends on the frequency and severity of late payments. A single late payment is less damaging than consistent late payments.

The Severity of Late Student Loan Payments

A late student loan payment results in a negative mark on your credit report, specifically impacting your payment history. This negative mark can significantly lower your credit score, potentially affecting your financial life for years to come.

- 7-year impact: Negative marks typically remain on your credit report for seven years from the date of delinquency.

- Repeated late payments: Multiple late payments drastically reduce your credit score, making it challenging to secure favorable interest rates on future loans (including mortgages and auto loans).

- Financial repercussions: Beyond loan applications, late payments can impact your ability to rent an apartment, secure a job (some employers check credit), or even obtain insurance at competitive rates.

- Higher interest rates: A lower credit score, resulting from late payments, translates to significantly higher interest rates on future loans, increasing your overall borrowing costs.

Preventing Late Student Loan Payments

Proactive management is key to avoiding the damaging effects of late student loan payments. Employing effective strategies can safeguard your credit score and financial future.

- Budgeting and Prioritization: Create a realistic monthly budget, prioritizing student loan payments alongside essential expenses.

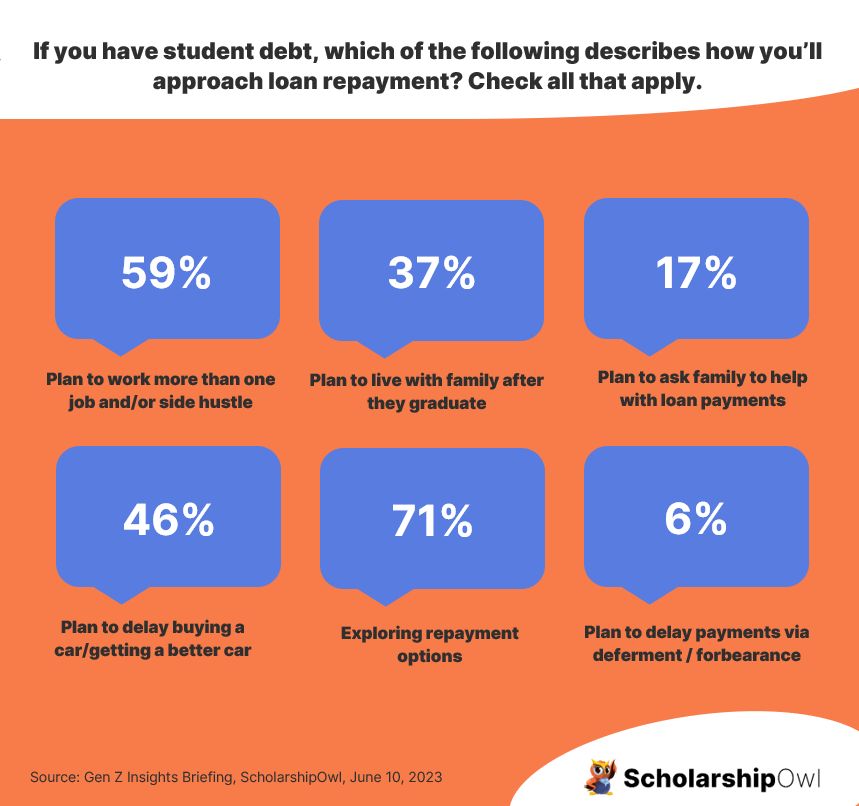

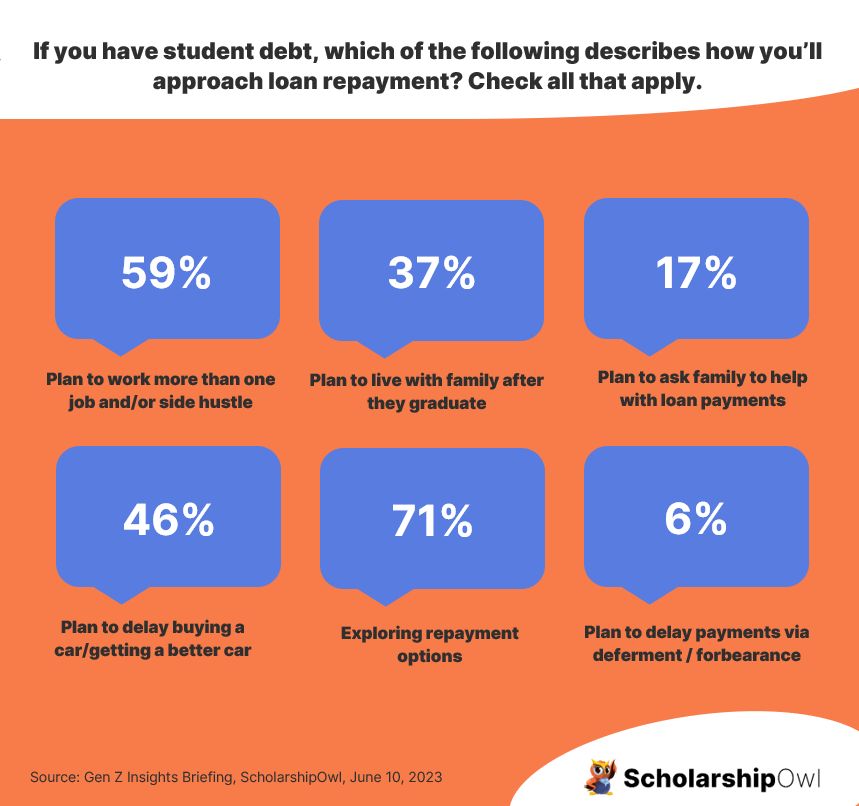

- Repayment Plan Selection: Explore different repayment plans offered by your loan servicer. Income-driven repayment plans may align better with your current financial situation.

- Automatic Payments: Set up automatic payments from your bank account to ensure on-time payments every month. This eliminates the risk of missed deadlines due to oversight.

- Payment Reminder Tools: Utilize mobile apps or online tools to receive reminders for your upcoming payments.

- Communication with Servicer: If you face unexpected financial hardship, contact your loan servicer immediately to discuss options like deferment or forbearance.

Repairing Your Credit After Late Student Loan Payments

While the impact of late student loan payments can be significant, it's not insurmountable. Repairing your credit requires consistent effort and responsible financial practices.

- Consistent On-Time Payments: The most critical step is to make all future payments on time. This demonstrates to lenders that you're committed to responsible repayment.

- Debt Reduction: Aggressively pay down any outstanding debts, including credit card balances. Lowering your debt-to-income ratio improves your credit score.

- Credit Utilization: Keep your credit utilization (the amount of credit you use relative to your total available credit) low. Aim to keep it under 30%.

- Credit Monitoring: Regularly monitor your credit report for errors or inaccuracies. Dispute any errors with the credit bureaus promptly.

- Credit Counseling (Optional): If you're struggling to manage your debt effectively, consider seeking professional credit counseling.

Conclusion:

Late student loan payments inflict significant damage on your credit score, potentially impacting your financial future for years. Understanding the severity of the consequences and proactively managing your payments is crucial. By diligently budgeting, exploring different repayment options, setting up automatic payments, and promptly addressing any financial hardship, you can protect your credit score. If you've already experienced late payments, focus on consistent on-time payments moving forward and actively work on repairing your credit. Protect your credit score by managing your student loan payments responsibly and avoid the damaging effects of late student loan payments. Take control of your financial future by understanding how late student loan payments impact your credit.

Featured Posts

-

Improved Fortnite Item Shop Navigation A New Feature Breakdown

May 17, 2025

Improved Fortnite Item Shop Navigation A New Feature Breakdown

May 17, 2025 -

Fortnite Cowboy Bebop Crossover How To Get The Freebies

May 17, 2025

Fortnite Cowboy Bebop Crossover How To Get The Freebies

May 17, 2025 -

Analisis Del Partido Belgica 0 1 Portugal

May 17, 2025

Analisis Del Partido Belgica 0 1 Portugal

May 17, 2025 -

Elaekeyhtioeiden Osakesijoitusten Tappiot Alkuvuonna 2024

May 17, 2025

Elaekeyhtioeiden Osakesijoitusten Tappiot Alkuvuonna 2024

May 17, 2025 -

Nba Playoffs Thibodeau Calls Out Refs After Knicks Game 2 Loss

May 17, 2025

Nba Playoffs Thibodeau Calls Out Refs After Knicks Game 2 Loss

May 17, 2025