How The Ultra Wealthy Are Weathering The Storm In Luxury Real Estate

Table of Contents

H2: Diversification Strategies of the Ultra-High-Net-Worth (UHNW) Individuals

The ultra-wealthy understand the importance of diversification, a cornerstone of any robust investment portfolio. This principle extends far beyond simply owning multiple properties; it encompasses both geographic and asset class diversification.

H3: Geographic Diversification

UHNW individuals mitigate risk by spreading their luxury real estate investments across various international markets. This reduces reliance on any single economy and its associated fluctuations.

- Popular Locations: Miami, London, Dubai, Singapore, and other global hubs are favored for their political stability, strong economies, and potential for appreciation.

- Tax Implications & Political Stability: Careful consideration is given to the tax implications and political landscapes of each location. Stability and favorable tax regulations are critical factors in the decision-making process.

- Second Homes vs. Investment Properties: The purpose of each acquisition is carefully considered. A second home might serve primarily as a personal residence, while an investment property prioritizes capital appreciation and rental income. The strategic balance between these two types of properties is crucial.

H3: Asset Class Diversification

Beyond residential properties, UHNW individuals often diversify into other luxury asset classes, broadening their portfolio and reducing overall risk.

- Alternative Assets: Luxury hotels, vineyards, private islands, and even high-end commercial real estate provide alternative investment opportunities with distinct risk profiles.

- Risk Management: Diversification across various asset classes minimizes the impact of any single market downturn. This strategy protects the overall portfolio value, even if one sector underperforms. This holistic approach to wealth management is paramount for the ultra-wealthy.

H2: Navigating Market Volatility

Successfully navigating market volatility requires proactive strategies and access to specialized resources.

H3: Utilizing Private Financing and Off-Market Transactions

The ultra-wealthy often bypass traditional lending channels, utilizing private financing sources for increased flexibility and speed.

- Benefits of Private Financing: Private financing offers faster closing times, more flexible terms, and greater discretion compared to traditional bank loans.

- Off-Market Transactions: These discreet, private sales offer advantages in terms of confidentiality and competitive pricing, often bypassing public market pressures.

H3: Employing Expert Advisors

A team of experts is crucial for navigating the complexities of luxury real estate investment.

- Essential Professionals: This team typically includes specialized luxury real estate agents, experienced wealth managers, and tax attorneys.

- Strategic Planning: Expert advice is critical for developing a comprehensive investment strategy tailored to individual circumstances and market conditions.

H2: Capitalizing on Market Opportunities

The ultra-wealthy are not merely defensive; they actively seek opportunities.

H3: Identifying Undervalued Properties

Market corrections can present unique opportunities to acquire undervalued luxury properties.

- Finding Undervalued Assets: Strategies include meticulous market research, data analytics, and leveraging strong professional networks to uncover hidden gems and distressed sales.

- Leveraging Resources: The ultra-wealthy have the resources to conduct extensive due diligence and negotiate favorable terms, capitalizing on opportunities that might be missed by less well-resourced investors.

H3: Long-Term Investment Strategies

The ultra-wealthy often adopt a long-term perspective, focusing on properties with enduring value and potential for long-term appreciation.

- Key Considerations: Location, property condition, and long-term market trends are crucial factors in their investment decisions.

- Long-Term Horizon: This approach allows for weathering short-term market fluctuations and benefiting from sustained appreciation over time.

3. Conclusion:

The ultra-wealthy navigate the luxury real estate market successfully through a combination of diversification, expert advice, and a long-term investment perspective. They leverage private financing, seek undervalued properties, and strategically diversify their holdings across geographies and asset classes. By employing these strategies, they not only protect their investments but also capitalize on opportunities that arise during market fluctuations.

Invest wisely in luxury real estate. Navigate the luxury real estate market with confidence by consulting with experienced luxury real estate professionals. Secure your future with strategic luxury real estate investments. Don't wait—the opportunities in luxury real estate are waiting for those with the vision and resources to seize them.

Featured Posts

-

Actors And Writers Strike The Impact On Hollywood

May 17, 2025

Actors And Writers Strike The Impact On Hollywood

May 17, 2025 -

Cumhurbaskani Erdogan In Birlesik Arap Emirlikleri Devlet Baskani Ile Telefon Goeruesmesi

May 17, 2025

Cumhurbaskani Erdogan In Birlesik Arap Emirlikleri Devlet Baskani Ile Telefon Goeruesmesi

May 17, 2025 -

Fiesta Del Cine 2025 Guia Completa Para Comprar Entradas A 3000

May 17, 2025

Fiesta Del Cine 2025 Guia Completa Para Comprar Entradas A 3000

May 17, 2025 -

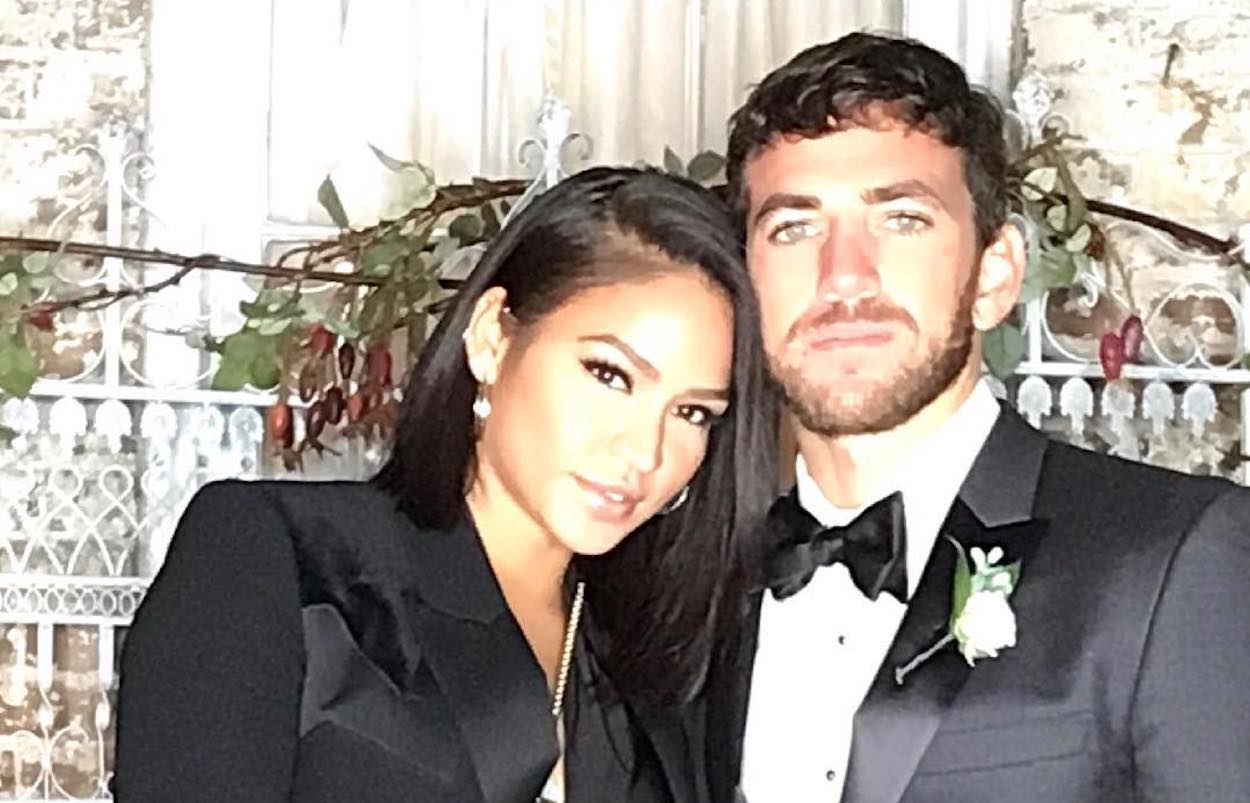

Cassie Announces Gender Of Third Baby With Alex Fine

May 17, 2025

Cassie Announces Gender Of Third Baby With Alex Fine

May 17, 2025 -

Knicks Post Brunson Performance A Long Road To Recovery

May 17, 2025

Knicks Post Brunson Performance A Long Road To Recovery

May 17, 2025