How To Analyze A Proxy Statement (Form DEF 14A) Effectively

Table of Contents

A proxy statement, also known as a Form DEF 14A, is a document that publicly traded companies must file with the Securities and Exchange Commission (SEC) before shareholder meetings. It provides shareholders with information needed to make informed decisions on matters such as electing directors, approving executive compensation, and voting on other corporate proposals. This guide will equip you with the skills to navigate this document and extract meaningful insights.

Understanding the Structure of a Proxy Statement (Form DEF 14A)

A proxy statement is a comprehensive document, often lengthy and detailed. However, understanding its basic structure is key to efficient analysis. A typical proxy statement includes several key sections:

- Notice of Meeting: Details about the date, time, and location (physical or virtual) of the shareholder meeting.

- Shareholder Proposals: Proposals submitted by shareholders for consideration at the meeting.

- Election of Directors: Information about the nominees for the board of directors, including their backgrounds and qualifications.

- Executive Compensation: Compensation Discussion & Analysis (CD&A), detailing executive pay packages and rationale.

- Corporate Governance: Overview of the company's governance structure, including board committees and related-party transactions.

- Financial Statements: Abbreviated financial statements, often referencing the company's annual report (10-K) for more detail.

The following sections are particularly critical for investor analysis:

Key Sections for Investor Analysis:

-

Executive Summary: This section provides a concise overview of the key proposals and information contained within the proxy statement. Pay close attention to any significant changes or noteworthy items highlighted here.

-

Corporate Governance: Scrutinize the board's composition, the independence of its members, and the existence and effectiveness of key committees (audit, compensation, nominating). Look for any related-party transactions, which can signal potential conflicts of interest.

-

Compensation Discussion & Analysis (CD&A): This section is crucial for understanding executive compensation. Analyze whether pay is aligned with performance and whether there are any excessive or questionable compensation arrangements. Look for metrics used to justify pay and compare them to company performance.

-

Shareholder Proposals: Carefully review shareholder proposals. These can provide insights into concerns held by other investors and offer a glimpse into potential corporate governance issues.

-

Election of Directors: Examine the backgrounds and experience of director nominees. Assess their independence and expertise relevant to the company's business.

You can access proxy statements (Form DEF 14A) through the SEC's EDGAR database (Electronic Data Gathering, Analysis, and Retrieval system). This free online database is a valuable resource for accessing company filings.

Key Metrics and Data Points to Analyze in a Proxy Statement

While qualitative information is important, analyzing key quantitative data within the proxy statement is essential. This data should be considered in conjunction with information found in the company's 10-K report and other financial statements.

-

Executive Compensation: Analyze salary, bonuses, stock options, and other compensation elements. Compare this to the company's performance (e.g., revenue growth, profitability) to assess the alignment of pay with results. Look for excessive payouts relative to company performance.

-

Financial Performance: While the proxy statement might not contain full financial statements, it often references key financial metrics. Relate these metrics to the company's overall financial health and performance trends.

-

Related-Party Transactions: Identify and scrutinize any transactions between the company and its executives, directors, or other related parties. Large or unusual transactions warrant further investigation.

-

Shareholder Return: Examine the return on equity (ROE) and other indicators of shareholder value creation. Assess how executive compensation is tied to shareholder returns.

Identifying Potential Red Flags:

- High executive compensation without corresponding performance: This can be a warning sign of poor governance or excessive executive self-dealing.

- Significant related-party transactions: These may indicate potential conflicts of interest and unfair allocation of resources.

- Controversial shareholder proposals: The presence of numerous shareholder proposals often suggests underlying concerns about the company's management or strategy.

- Changes in corporate governance structure: Sudden or significant changes in governance can signal instability or a response to past issues.

Tools and Resources for Effective Proxy Statement Analysis

Effective proxy statement analysis goes beyond simply reading the document. Leveraging additional resources can significantly enhance your understanding:

-

SEC EDGAR Database: As previously mentioned, this is the primary source for accessing proxy statements.

-

Company Website: The company's investor relations section often provides supplementary information that complements the proxy statement.

-

Financial News Sources: Stay informed about the company through reputable financial news outlets. News articles can provide context and insights not explicitly stated in the proxy statement.

-

Financial Analysis Tools: Software packages and online tools can aid in analyzing financial data presented (or referenced) within the proxy statement, allowing for more detailed comparisons and trend analysis.

Comparing the data within the proxy statement with other financial statements (10-K, 10-Q) is crucial for a comprehensive understanding. This comparative analysis allows you to verify information and identify inconsistencies or potential red flags.

Interpreting the Information and Making Informed Decisions

Synthesizing information from the various sections of the proxy statement is critical. Don't treat each section in isolation; look for connections and patterns.

-

Risk Assessment: Use the information gathered to assess potential investment risks. Consider factors such as executive compensation, related-party transactions, and shareholder proposals.

-

Opportunity Identification: Conversely, identify potential opportunities based on your analysis. For example, a company with strong governance and a shareholder-friendly approach might represent a more attractive investment.

-

Voting Decisions: Use your analysis to inform your voting decisions as a shareholder. This is a direct way to influence corporate governance and promote shareholder value.

Remember to consider the information you've gleaned from the proxy statement in the context of broader market factors and your overall investment strategy. Don't base your decisions solely on the proxy statement; use it as one piece of the puzzle.

Conclusion: Mastering Proxy Statement Analysis for Informed Investments

Effectively analyzing a proxy statement (Form DEF 14A) involves understanding its structure, identifying key metrics and data points, utilizing available resources, and interpreting the information to make informed decisions. This process enables improved investment outcomes, empowers you to exercise your shareholder rights, and promotes better corporate governance. By mastering the art of analyzing a proxy statement, you significantly enhance your ability to assess risk, identify opportunities, and make more confident investment choices. Start analyzing proxy statements today and take control of your investments! Mastering the art of analyzing a proxy statement (Form DEF 14A) is a crucial step towards becoming a more savvy investor.

Featured Posts

-

Page Not Found On Reddit Us Specific Outage Reported By Users

May 17, 2025

Page Not Found On Reddit Us Specific Outage Reported By Users

May 17, 2025 -

La Liga Hyper Motion Almeria Eldense Online

May 17, 2025

La Liga Hyper Motion Almeria Eldense Online

May 17, 2025 -

Ai Digest Transforming Repetitive Scatological Documents Into Informative Podcasts

May 17, 2025

Ai Digest Transforming Repetitive Scatological Documents Into Informative Podcasts

May 17, 2025 -

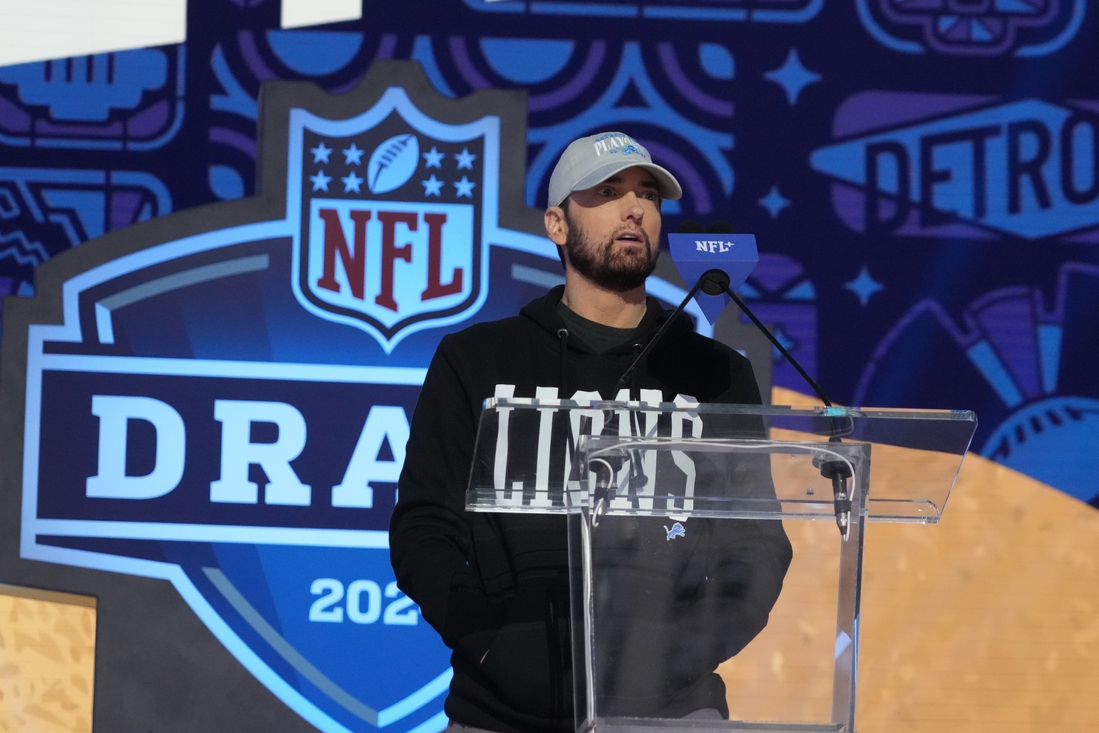

The Impact Of Eminem On A Potential Detroit Wnba Franchise

May 17, 2025

The Impact Of Eminem On A Potential Detroit Wnba Franchise

May 17, 2025 -

Ferrexpo I Zhevago Ugroza Prekrascheniya Investitsiy V Ukraine

May 17, 2025

Ferrexpo I Zhevago Ugroza Prekrascheniya Investitsiy V Ukraine

May 17, 2025