How To Monitor The Net Asset Value Of The Amundi MSCI World Catholic Principles UCITS ETF Acc

Table of Contents

Understanding the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV

The Net Asset Value (NAV) represents the total value of an ETF's underlying assets, divided by the number of outstanding shares. For the Amundi MSCI World Catholic Principles UCITS ETF Acc, the NAV reflects the collective value of the stocks included in its portfolio, which adheres to specific Catholic ethical principles. Daily fluctuations in the NAV are influenced by various factors:

- Underlying asset performance: The primary driver of NAV changes is the performance of the stocks within the ETF's portfolio. Positive market movements generally lead to NAV increases, while negative movements cause decreases.

- Currency exchange rate fluctuations: As the ETF invests globally, fluctuations in exchange rates between different currencies can impact the NAV, especially in the short term.

- Dividend distributions and reinvestments: Dividend payments from the underlying companies will affect the NAV, depending on whether the ETF distributes these dividends or reinvests them. Reinvestment increases the number of underlying assets and can positively affect the NAV.

- Management fees and expenses: The ETF's operating expenses, including management fees, are deducted from the NAV, slightly reducing its value over time.

The composition of the Amundi MSCI World Catholic Principles UCITS ETF Acc, which invests in companies adhering to Catholic social teaching, influences its NAV. Companies that align with these principles might have different performance characteristics compared to broader market indices, leading to unique NAV trends. Understanding these influences helps you interpret NAV movements effectively.

Methods for Monitoring the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV

Several methods allow you to track the NAV of your Amundi MSCI World Catholic Principles UCITS ETF Acc investment:

Using Online Brokerage Platforms

Most online brokerage accounts provide real-time or delayed NAV data for the ETFs held in your portfolio. Platforms like Interactive Brokers, Fidelity, Schwab, and TD Ameritrade typically display this information prominently. The advantage is easy access and integration with your investment portfolio; however, data might be slightly delayed depending on the platform and market conditions.

Checking the Amundi Website

Amundi, the ETF issuer, usually publishes NAV data on its official website. While this can be a reliable source, there might be a slight delay in updating the information compared to real-time brokerage data. Look for a dedicated section on their site that details ETF information, including daily NAVs. (Note: Insert a link to the Amundi website's relevant page if available.)

Utilizing Financial News and Data Providers

Reputable financial news websites and data providers, such as Bloomberg, Yahoo Finance, and Google Finance, often list ETF NAVs. These sources offer a broader perspective on market trends, but it's crucial to verify the accuracy and timeliness of the information, as data may not be updated in real-time.

Interpreting NAV Changes and Their Significance

Understanding NAV movements requires considering broader market trends and the ETF's composition. An upward NAV movement generally indicates positive performance of the underlying assets, reflecting strong market conditions or positive developments within the companies held by the ETF. Conversely, a downward movement might signal market corrections or negative news affecting the ETF's holdings.

However, daily fluctuations should be viewed within the context of the ETF's long-term performance. The Amundi MSCI World Catholic Principles UCITS ETF Acc, owing to its diversification, aims for long-term growth. Focusing solely on short-term NAV changes can be misleading.

- Diversification: The ETF's diverse holdings across various sectors and geographies mitigate the impact of individual company performance on the overall NAV.

- Global Economic Events: Major global events, such as economic recessions or geopolitical instability, can significantly impact the NAV, regardless of the ETF's underlying principles.

- Catholic Principles: While the application of Catholic principles might lead to slightly different performance characteristics compared to broader market indices, the long-term impact is a key factor to consider.

Conclusion: Stay Informed About Your Amundi MSCI World Catholic Principles UCITS ETF Acc Investment

Regularly monitoring the NAV of your Amundi MSCI World Catholic Principles UCITS ETF Acc investment is crucial for informed decision-making. By using online brokerage platforms, checking the Amundi website, or utilizing financial news sources, you can stay updated on your investment's performance. Remember to consider the long-term perspective and the influence of global economic factors and the ETF’s ethical investment strategy when interpreting NAV changes. By effectively tracking the Net Asset Value of your Amundi MSCI World Catholic Principles UCITS ETF Acc, you can make more informed decisions about your ethical investment strategy, ensuring your portfolio aligns with your values and long-term financial goals.

Featured Posts

-

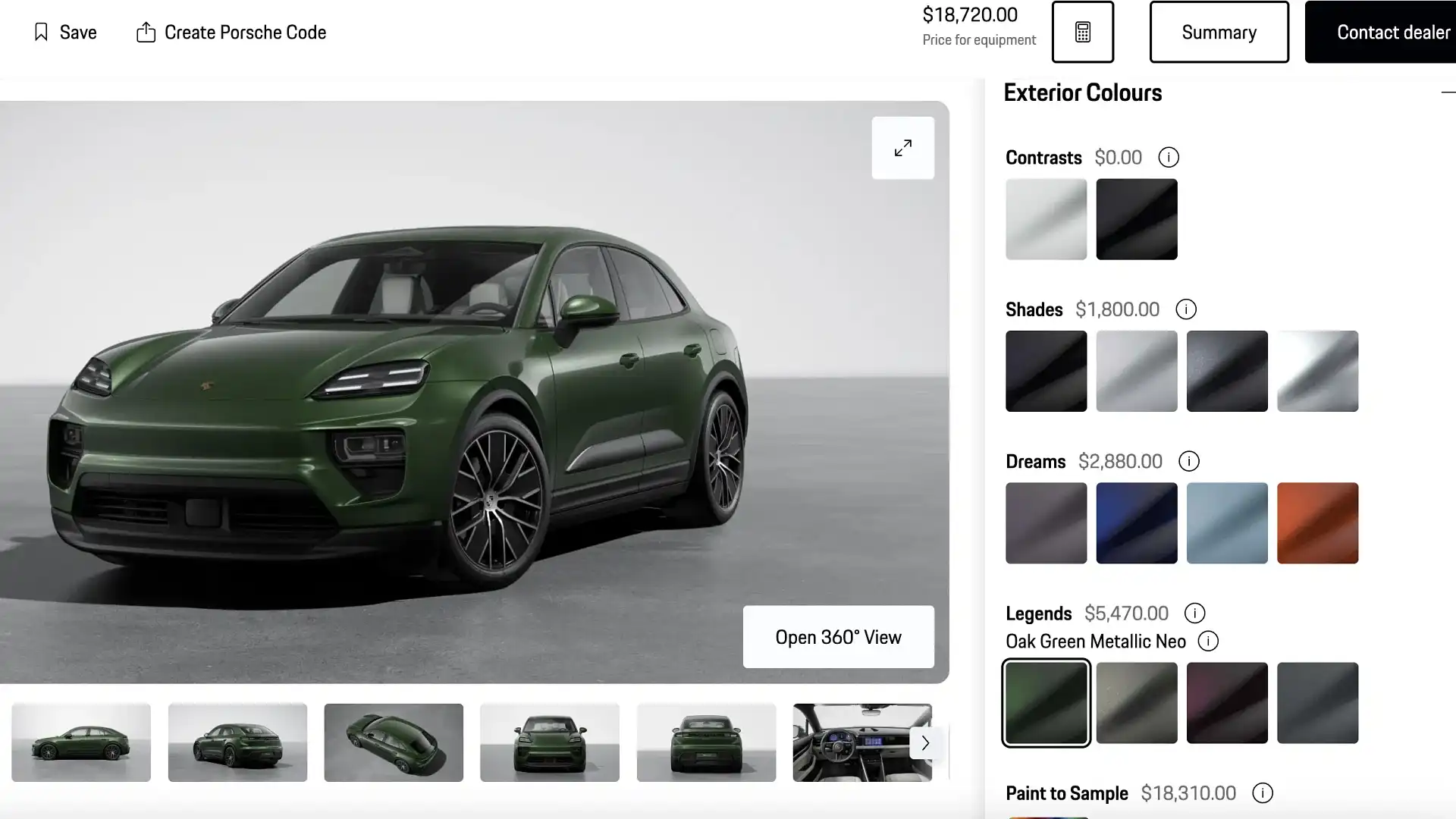

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025 -

The Kyle Walker Annie Kilner And Mystery Women Situation

May 24, 2025

The Kyle Walker Annie Kilner And Mystery Women Situation

May 24, 2025 -

Escape To The Country Securing Your Dream Home On A 1m Budget

May 24, 2025

Escape To The Country Securing Your Dream Home On A 1m Budget

May 24, 2025 -

Ferraris Inaugural Service Centre In Bengaluru What To Expect

May 24, 2025

Ferraris Inaugural Service Centre In Bengaluru What To Expect

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist Daily Nav And Its Implications

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist Daily Nav And Its Implications

May 24, 2025

Latest Posts

-

Kyle Walker And Serbian Models Partying In Milan After Wifes Flight

May 24, 2025

Kyle Walker And Serbian Models Partying In Milan After Wifes Flight

May 24, 2025 -

Footballer Kyle Walker Seen With Models In Milan After Wifes Trip Home

May 24, 2025

Footballer Kyle Walker Seen With Models In Milan After Wifes Trip Home

May 24, 2025 -

Kyle Walker Night Out In Milan Following Wifes Uk Departure

May 24, 2025

Kyle Walker Night Out In Milan Following Wifes Uk Departure

May 24, 2025 -

Kyle Walkers Milan Party Details Emerge After Wifes Return

May 24, 2025

Kyle Walkers Milan Party Details Emerge After Wifes Return

May 24, 2025 -

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 24, 2025

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 24, 2025