How To Track The Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc

Table of Contents

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc and its NAV

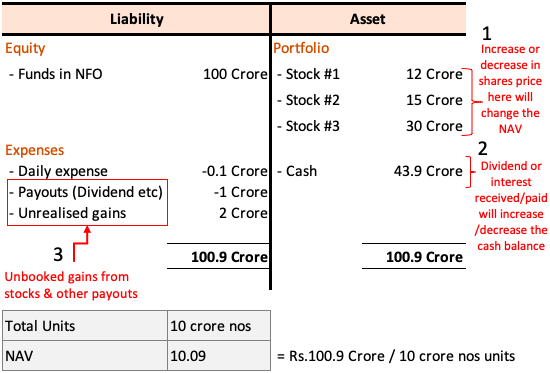

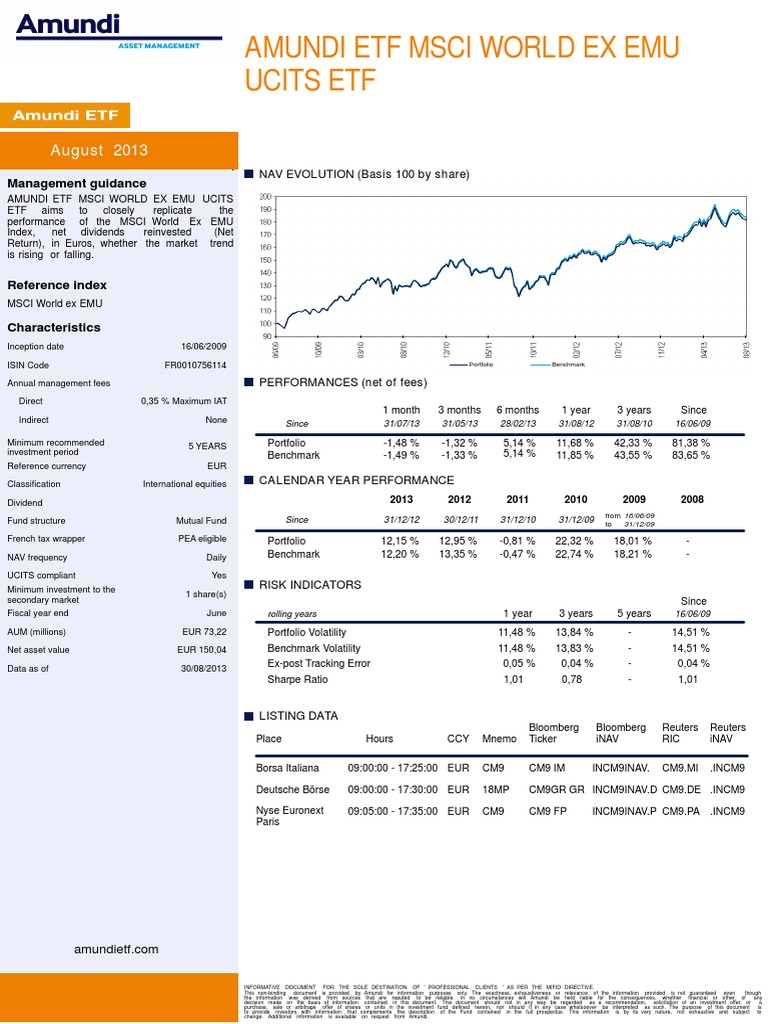

The Amundi MSCI All Country World UCITS ETF USD Acc is an exchange-traded fund (ETF) that aims to track the performance of the MSCI All Country World Index. This index represents a broad range of global equities, offering investors diversified exposure to the international stock market. The fund's investment objective is to provide investors with a cost-effective way to gain access to a wide variety of global companies.

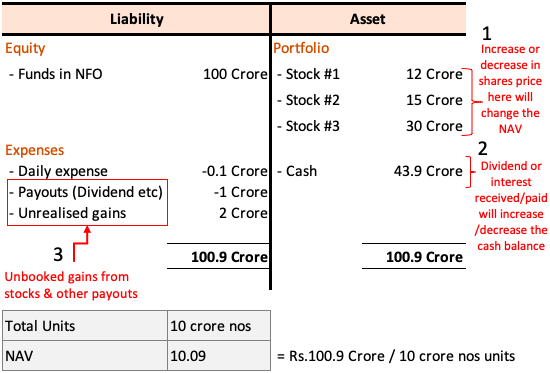

The Net Asset Value (NAV) is the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. For ETF investors, the NAV represents the intrinsic value of each share. It's a crucial metric for understanding the underlying value of your investment.

Several factors influence the ETF's NAV. These include:

-

Market Fluctuations: Changes in the prices of the underlying securities held by the ETF directly impact its NAV. A rising market generally leads to a higher NAV, while a falling market results in a lower NAV.

-

Currency Exchange Rates: Because the Amundi MSCI All Country World UCITS ETF USD Acc is denominated in US Dollars (USD Acc), fluctuations in exchange rates between the USD and other currencies can affect the NAV, particularly if a significant portion of the holdings are in non-USD currencies.

-

Explain the difference between NAV and market price: The NAV is the theoretical value of the ETF's assets, while the market price is the actual price at which the ETF is being traded on the exchange. These prices can differ slightly due to supply and demand.

-

Highlight the importance of understanding the fund's holdings for NAV interpretation: Knowing the ETF's composition helps you understand why its NAV is changing. For example, if the ETF has a large allocation to technology stocks and the tech sector declines, the NAV will likely reflect that.

-

Briefly explain the calculation of NAV: The NAV is calculated daily by taking the total market value of the ETF's holdings, subtracting any liabilities (such as management fees), and dividing by the number of outstanding shares.

Methods for Tracking the Amundi MSCI All Country World UCITS ETF USD Acc NAV

There are several reliable methods for tracking the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc:

Using the Amundi Website

The most direct way to find the NAV is through the official Amundi website. Look for a section dedicated to fund factsheets or performance data. This usually provides the daily NAV, often updated at the end of each trading day. The frequency of updates is typically daily.

Utilizing Financial News Websites and Brokerage Platforms

Many reputable financial websites, such as Bloomberg, Yahoo Finance, and Google Finance, provide real-time or delayed ETF price and NAV data. You can find this information by searching using the ETF's ticker symbol. Your brokerage platform will also typically display the NAV alongside your other investments, often providing historical charts for tracking performance. Many platforms even offer tools for automatic portfolio performance tracking, including NAV updates.

Employing Dedicated Financial Data Providers

For professional investors, dedicated financial data providers like Refinitiv and FactSet offer comprehensive data, including detailed NAV information, historical data, and analytical tools. However, these services often come with significant subscription costs.

Interpreting NAV Changes and Making Informed Investment Decisions

NAV fluctuations are influenced by various factors, including market trends, economic news (e.g., interest rate announcements, inflation data), geopolitical events, and currency exchange rate shifts. Comparing the NAV changes to the benchmark index (MSCI All Country World Index) helps gauge the ETF's tracking performance. A closely tracking ETF's NAV should move in line with the index.

It's crucial to consider long-term performance rather than focusing solely on daily NAV variations. Short-term fluctuations are normal in the market.

- Explain how to use NAV data to assess investment performance: By comparing the historical NAV data with your purchase price, you can calculate your return on investment.

- Emphasize the importance of not basing decisions solely on daily NAV changes: Daily changes are often noisy and can lead to poor investment decisions. Consider longer-term trends.

- Briefly touch on rebalancing and its impact on NAV: Rebalancing (adjusting asset allocations) can temporarily impact the NAV, but it's usually a strategic move to maintain the desired risk profile.

Conclusion

Successfully tracking the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is vital for informed investment management. By utilizing the resources and methods outlined above – from the Amundi website to reputable financial platforms – you can effectively monitor your investment's performance. Remember to consider long-term trends and avoid making impulsive decisions based solely on short-term NAV fluctuations. Stay informed and continue to monitor the Amundi MSCI All Country World UCITS ETF USD Acc's NAV to optimize your investment strategy. Understanding and tracking your ETF's NAV is key to effective investment tracking and making sound investment decisions.

Featured Posts

-

Jymypaukku Muhii Tuukka Taponen F1 Autoon Jo Taenae Vuonna

May 24, 2025

Jymypaukku Muhii Tuukka Taponen F1 Autoon Jo Taenae Vuonna

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc Daily Nav Updates And Reporting

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Daily Nav Updates And Reporting

May 24, 2025 -

Porsche 911 80 Millio Forintos Extrak

May 24, 2025

Porsche 911 80 Millio Forintos Extrak

May 24, 2025 -

Accessing Bbc Radio 1 Big Weekend 2025 Tickets At Sefton Park

May 24, 2025

Accessing Bbc Radio 1 Big Weekend 2025 Tickets At Sefton Park

May 24, 2025 -

Porsche 956 Nin Tavan Sergilemesinin Teknik Sebepleri

May 24, 2025

Porsche 956 Nin Tavan Sergilemesinin Teknik Sebepleri

May 24, 2025

Latest Posts

-

Kyle Walker And Serbian Models Partying In Milan After Wifes Flight

May 24, 2025

Kyle Walker And Serbian Models Partying In Milan After Wifes Flight

May 24, 2025 -

Footballer Kyle Walker Seen With Models In Milan After Wifes Trip Home

May 24, 2025

Footballer Kyle Walker Seen With Models In Milan After Wifes Trip Home

May 24, 2025 -

Kyle Walker Night Out In Milan Following Wifes Uk Departure

May 24, 2025

Kyle Walker Night Out In Milan Following Wifes Uk Departure

May 24, 2025 -

Kyle Walkers Milan Party Details Emerge After Wifes Return

May 24, 2025

Kyle Walkers Milan Party Details Emerge After Wifes Return

May 24, 2025 -

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 24, 2025

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 24, 2025