How To Track The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Understanding the Amundi Dow Jones Industrial Average UCITS ETF and its NAV

The Amundi Dow Jones Industrial Average UCITS ETF is designed to replicate the performance of the Dow Jones Industrial Average, offering investors diversified exposure to 30 leading US companies. Tracking its Net Asset Value (NAV) is crucial because it represents the true underlying value of the ETF's holdings per share.

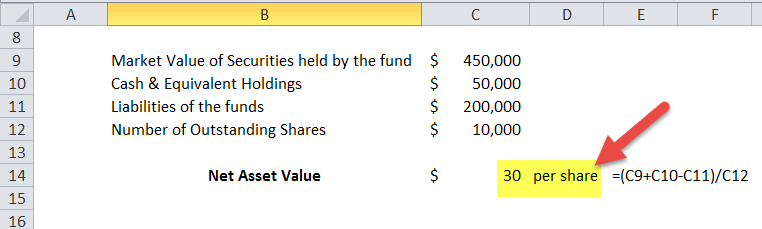

The Net Asset Value (NAV) is calculated daily by taking the total value of all the assets held by the ETF (shares of the 30 Dow Jones companies, minus any liabilities) and dividing it by the total number of outstanding shares. This figure represents the intrinsic value of one share.

It's important to distinguish between the NAV and the market price. The market price is the price at which the ETF is currently trading on the exchange, which can fluctuate throughout the day based on supply and demand. This means the market price can be higher or lower than the NAV. Understanding this difference is vital for making informed investment decisions.

- The ETF tracks the Dow Jones Industrial Average (DJIA), providing exposure to blue-chip US companies.

- NAV represents the underlying asset value per share, reflecting the true worth of the ETF's holdings.

- Market price can fluctuate based on supply and demand, deviating from the NAV.

- Understanding the difference between NAV and market price helps in making informed investment decisions.

Official Sources for Amundi Dow Jones Industrial Average UCITS ETF NAV

To accurately track the daily Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF, you should rely on official sources. These sources provide the most reliable and up-to-date information.

The primary source is Amundi's official website. While the specific page location may vary, you should be able to find the daily NAV data within their ETF fact sheets or dedicated fund information sections. [Insert link to Amundi's relevant page here if available].

Major financial data providers, such as Bloomberg and Refinitiv, also publish the daily NAV for various ETFs, including the Amundi Dow Jones Industrial Average UCITS ETF. [Insert links to relevant Bloomberg/Refinitiv pages if available]. Access to these platforms usually requires a subscription.

Finally, if you hold the ETF through a brokerage account (Interactive Brokers, Fidelity, Schwab, etc.), your account statement or online platform will typically display the daily NAV.

- Amundi's official website (link to the relevant page - replace with actual link if available)

- Major financial data providers (e.g., Bloomberg, Refinitiv - replace with actual links if available)

- Your brokerage account (e.g., Interactive Brokers, Fidelity, Schwab)

Using Financial Data Providers and Brokerage Platforms to Track NAV

Accessing the NAV through financial data providers like Bloomberg or Refinitiv usually involves searching for the ETF's ticker symbol (e.g., insert ticker symbol here if available). The platform will then display detailed information, including the daily NAV.

On most brokerage platforms, the process is similar. After logging in, search for the ETF using its ticker symbol. Look for a column labeled "NAV," "Net Asset Value," or something similar. The platform should provide the NAV alongside other key data points. Consider including screenshots here if possible, showing the location of the NAV information on popular platforms.

It's important to note that the timing of NAV updates may vary slightly across different platforms. Always check the date and time stamp associated with the displayed NAV to ensure you're using the most current data.

- Search for the ETF ticker symbol (e.g., insert ticker symbol here if available).

- Look for the "NAV" or "Net Asset Value" column.

- Note the date and time of the NAV update.

Interpreting the NAV Data

Understanding the NAV data involves more than just looking at a single number. To assess the ETF's performance, compare the NAV over different time periods (daily, weekly, monthly). Calculate percentage changes using the formula: [(New NAV - Old NAV) / Old NAV] * 100. This will give you a clear picture of the ETF's growth or decline.

When analyzing NAV changes, always consider the broader market context. For example, a decrease in NAV might reflect a general downturn in the market rather than specific issues with the ETF itself. Comparing the ETF's performance against relevant benchmarks like the Dow Jones Industrial Average itself can provide additional perspective.

- Compare NAV changes over different time periods (daily, weekly, monthly).

- Calculate percentage change using the formula:

[(New NAV - Old NAV) / Old NAV] * 100. - Consider the broader market context when analyzing NAV changes.

Conclusion

Tracking the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for monitoring its performance and making sound investment decisions. By utilizing official sources like the Amundi website, reputable financial data providers, and your brokerage platform, you can effectively track the daily NAV and gain valuable insights into your investment. Remember to regularly check the NAV and understand its significance in relation to the ETF's market price for optimal investment management. Start tracking the Net Asset Value (NAV) of your Amundi Dow Jones Industrial Average UCITS ETF today!

Featured Posts

-

Kyle Walker Spotted With Models In Milan Following Wifes Uk Trip

May 25, 2025

Kyle Walker Spotted With Models In Milan Following Wifes Uk Trip

May 25, 2025 -

Philips 2025 Annual General Meeting Of Shareholders Agenda Update

May 25, 2025

Philips 2025 Annual General Meeting Of Shareholders Agenda Update

May 25, 2025 -

Kapitaalmarkt Rentestijging En De Sterke Euro

May 25, 2025

Kapitaalmarkt Rentestijging En De Sterke Euro

May 25, 2025 -

M56 Accident Real Time Traffic Updates And Congestion

May 25, 2025

M56 Accident Real Time Traffic Updates And Congestion

May 25, 2025 -

France Considers Tougher Sentences For Young Offenders

May 25, 2025

France Considers Tougher Sentences For Young Offenders

May 25, 2025

Latest Posts

-

Mia Farrow Trump Must Be Held Accountable For Venezuelan Gang Deportations

May 25, 2025

Mia Farrow Trump Must Be Held Accountable For Venezuelan Gang Deportations

May 25, 2025 -

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 25, 2025

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025 -

Mia Farrow Demands Trumps Imprisonment For Venezuelan Gang Member Deportations

May 25, 2025

Mia Farrow Demands Trumps Imprisonment For Venezuelan Gang Member Deportations

May 25, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 25, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 25, 2025