Ignoring High Stock Market Valuations: BofA's Argument For Investors

Table of Contents

BofA's Core Argument Against Immediate Market Correction

BofA's central thesis rests on several key pillars supporting their belief that high market valuations shouldn't trigger immediate selling. They suggest that the current high stock prices are justifiable, given the broader economic context. This isn't simply a bullish prediction; it's an analysis supported by several factors.

-

Low Interest Rates: Historically low interest rates significantly impact market valuations. These low rates make borrowing cheaper for companies, supporting investment and growth, and simultaneously make bonds less attractive, pushing investors towards higher-yielding equities. This contributes to elevated stock prices. The low-cost of capital fuels expansion and boosts corporate earnings.

-

Strong Corporate Earnings and Positive Growth Projections: BofA points to robust corporate earnings and positive future growth projections as key justifications for the current valuations. Many companies are demonstrating strong performance, leading to increased investor confidence and higher stock prices. Their analysis considers both current earnings and projections for future revenue streams.

-

Historical Context: BofA's analysis compares the current market environment with past periods of high valuations. They highlight instances where similar valuations were followed by continued market growth, rather than immediate corrections. This historical perspective provides context and mitigates concerns about an impending crash. They analyze various market cycles to support their assessment.

-

BofA's Research: BofA's investment strategists have published several reports and analyses supporting this argument. These reports delve into specific metrics and models, providing detailed justifications for their bullish outlook. Consulting these reports offers a deeper understanding of their rationale.

Addressing the Risks of High Stock Market Valuations

While BofA presents a bullish case, they acknowledge the inherent risks associated with high valuations. Ignoring these risks would be irresponsible.

-

Vulnerability to Negative News: High valuations inherently increase the market's sensitivity to negative economic news or unexpected interest rate hikes. A sudden shift in investor sentiment could trigger a sell-off. This sensitivity is a key factor in their investment strategy.

-

Market Volatility: High valuations often correlate with increased market volatility. While the long-term outlook might be positive, investors should be prepared for potential short-term corrections and fluctuations. This means having a robust risk management strategy in place.

-

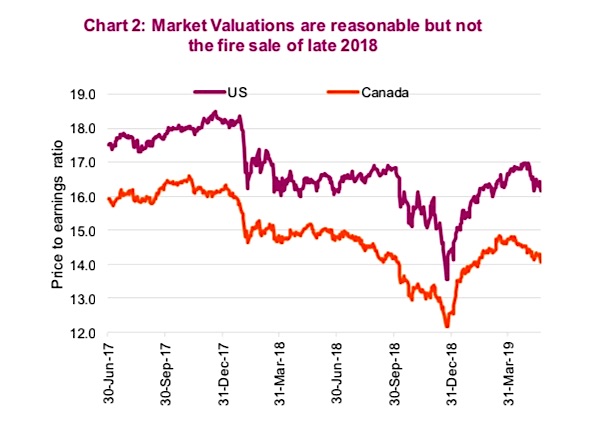

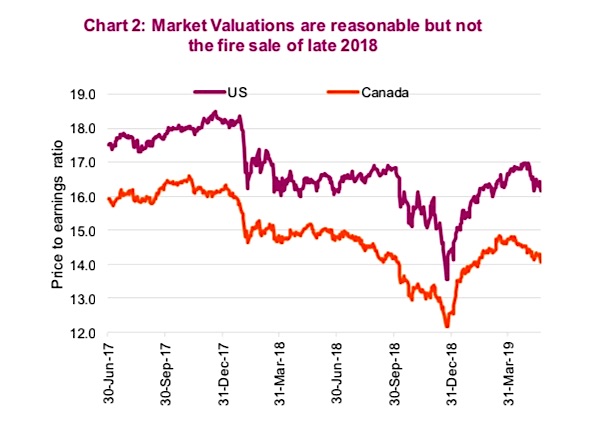

Valuation Metrics: BofA utilizes various valuation metrics, such as Price-to-Earnings (P/E) ratios and the Cyclically Adjusted Price-to-Earnings (Shiller P/E) ratio, to assess the market's overall valuation. While these metrics indicate high valuations, they aren’t the sole determinant of future performance. The careful use and interpretation of these metrics is crucial.

-

Risk Mitigation: BofA's strategy accounts for these risks through diversification and a focus on fundamentally sound companies. They don't advocate ignoring the potential for market downturns; rather, they suggest strategies for mitigating those risks.

BofA's Suggested Investment Strategy in a High-Valuation Environment

BofA suggests a proactive, risk-managed approach for investors navigating these high valuations.

-

Quality Companies: Their strategy emphasizes investing in high-quality companies with strong fundamentals, sustainable growth prospects, and robust balance sheets. These companies are more likely to weather market volatility.

-

Diversification: Diversifying across different sectors and asset classes is crucial to reduce risk. This helps mitigate potential losses in any single sector.

-

Sector Opportunities: Despite overall high valuations, BofA identifies specific sectors with potentially attractive opportunities for growth. Their analysis highlights sectors showing relative undervaluation or strong growth potential.

-

Long-Term Horizon: BofA stresses the importance of maintaining a long-term investment horizon. Short-term market fluctuations should not dictate long-term investment strategies. Patience is crucial in this environment.

-

Preferred Asset Classes: While specific recommendations may change, BofA frequently highlights sectors they believe are well-positioned for growth, even in a high-valuation environment. Their research should be consulted for the latest sector suggestions.

Counterarguments and Rebuttals

Concerns regarding market bubbles and potential economic shocks are valid counterarguments to BofA's perspective.

-

Market Bubbles: The risk of a market bubble forming and subsequently bursting is a legitimate concern. BofA acknowledges this but argues that current economic fundamentals and growth projections partially justify current valuations.

-

Economic Shocks: Unexpected economic shocks can significantly impact market performance, regardless of valuation levels. BofA's strategy incorporates risk mitigation measures to address these potential unforeseen events.

-

Alternative Investments: Comparing stocks to alternative investments like bonds and real estate is crucial. BofA's analysis considers these alternatives and argues that the potential for equity growth may still outweigh the risks, particularly given the low-interest-rate environment.

-

BofA's Response: BofA addresses these counterarguments by emphasizing the importance of a well-diversified portfolio, a long-term investment horizon, and a focus on fundamentally strong companies.

Conclusion

Bank of America's argument suggests that while high stock market valuations are a concern, they don't automatically signal an impending market crash. Their analysis highlights low interest rates, strong corporate earnings, and historical precedent as factors supporting their belief that continued market growth is possible. However, they also acknowledge the inherent risks and suggest a strategy of investing in high-quality companies, diversifying portfolios, and maintaining a long-term perspective. To effectively manage high stock market valuations, carefully consider BofA's perspective and further research their reports and analysis on this topic. Understanding how to navigate high stock market valuations is key to successful investing. Learn more by exploring BofA's investment research [link to BofA resources if available].

Featured Posts

-

Detroit Pistons Vs New York Knicks Season Matchup Analysis

May 17, 2025

Detroit Pistons Vs New York Knicks Season Matchup Analysis

May 17, 2025 -

New Deal In The Works Greenko Founders Aim To Buy Orix Stake In India

May 17, 2025

New Deal In The Works Greenko Founders Aim To Buy Orix Stake In India

May 17, 2025 -

Temuera Morrison In End Of The Valley Your Complete The Listener March Viewing Guide

May 17, 2025

Temuera Morrison In End Of The Valley Your Complete The Listener March Viewing Guide

May 17, 2025 -

Ujedinjeni Arapski Emirati Kultura Tradicija I Moderni Zivot

May 17, 2025

Ujedinjeni Arapski Emirati Kultura Tradicija I Moderni Zivot

May 17, 2025 -

Knicks Vs Pistons Series Bet365 Bonus Code Nypbet And Betting Predictions

May 17, 2025

Knicks Vs Pistons Series Bet365 Bonus Code Nypbet And Betting Predictions

May 17, 2025