Ignoring The Noise: BofA's Rationale For High Stock Market Valuations

Table of Contents

BofA's Bullish Stance: Why They Believe in Sustained Growth

BofA maintains a bullish stance on the stock market, predicting sustained growth despite current economic uncertainties. Their optimism isn't blind faith; it's rooted in a thorough analysis of several key factors influencing the stock market rationale.

-

Strong corporate earnings despite economic headwinds: Many companies have reported robust earnings, exceeding expectations even amidst inflation and geopolitical instability. This demonstrates resilience and adaptability within the corporate sector. BofA's analysis highlights that efficient cost management and strong pricing power are contributing factors.

-

Resilience of the consumer sector: Despite rising interest rates and inflation, consumer spending remains relatively strong in key areas. BofA's research indicates that this resilience, while potentially softening, is still supporting corporate revenue streams.

-

Innovation and technological advancements driving growth in specific sectors: Technological breakthroughs in areas like artificial intelligence, renewable energy, and biotechnology are fueling significant growth in specific sectors. BofA points to these sectors as key drivers of future market expansion, justifying some of the higher valuations.

-

Positive long-term economic projections: BofA's economists forecast continued, albeit slower, economic growth in the coming years. This long-term perspective underpins their belief that current stock market valuations are sustainable. While acknowledging potential short-term volatility, their projections support a positive outlook.

BofA's analysis acknowledges counterarguments, such as the potential for a recession. However, their research suggests that a "soft landing" is possible, mitigating the impact on corporate profitability.

Addressing Inflation Concerns and Interest Rate Hikes

Inflation and rising interest rates are significant concerns impacting stock market valuations. BofA addresses these headwinds directly.

-

Analysis of the effectiveness of Fed rate hikes in controlling inflation: BofA acknowledges the Federal Reserve's efforts to curb inflation through interest rate hikes but also analyzes the lag effects and potential for overcorrection. Their analysis suggests that while inflation remains a concern, the rate hikes are having a tangible, albeit gradual, effect.

-

Assessment of the impact on corporate profitability: BofA's research assesses the impact of higher interest rates on corporate borrowing costs and profitability. While acknowledging some negative impacts, they point out that many companies have strong balance sheets and can weather the storm.

-

Discussion of the potential for a "soft landing" scenario: BofA highlights the possibility of a "soft landing," where inflation is brought under control without triggering a significant recession. This scenario would be positive for stock market valuations.

-

Explanation of how certain sectors are better positioned to withstand higher rates: BofA identifies sectors like energy and financials, which can often benefit from higher interest rates, as being relatively well-positioned.

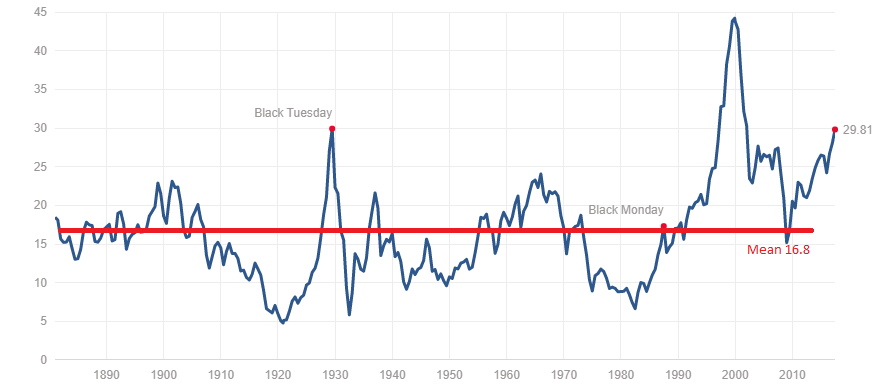

Charts illustrating the historical relationship between interest rates and market performance support BofA's cautiously optimistic outlook. They highlight periods where interest rate increases did not lead to immediate market crashes, underscoring the complexities of market dynamics.

The Importance of Long-Term Investing and Ignoring Short-Term Volatility

BofA strongly emphasizes the importance of long-term investing and ignoring short-term market noise – a crucial aspect of understanding BofA stock market valuation in the context of broader market trends.

-

Ignoring short-term market fluctuations (noise): BofA advises investors to focus on the long-term fundamentals of companies rather than reacting to daily market swings.

-

Focusing on fundamental company performance: Thorough due diligence and understanding a company's intrinsic value are crucial, rather than reacting to short-term market sentiment.

-

Importance of diversification: A diversified portfolio helps mitigate risk and reduces the impact of short-term market volatility.

-

The benefits of dollar-cost averaging: This strategy involves investing a fixed amount at regular intervals, regardless of market fluctuations, smoothing out the impact of volatility.

Short-term market noise, driven by factors like news headlines and speculation, can lead to impulsive and potentially detrimental investment decisions. BofA provides historical examples of how long-term investment strategies have consistently outperformed short-term trading approaches.

Analyzing Specific Sectors with High Valuations and BofA's Justification

Several sectors, such as technology and healthcare, currently have high valuations. BofA offers justifications for these valuations:

-

Future growth potential analysis for each sector: BofA provides detailed analysis of the future growth potential of these high-valuation sectors, considering factors like technological innovation and market expansion.

-

Innovation and technological breakthroughs in the respective sectors: Continuous innovation in these sectors justifies premium valuations, as the potential for future growth is significant.

-

Strong competitive advantages held by companies in these sectors: Many companies in these sectors hold strong competitive advantages, including strong brands, patents, and network effects, supporting their high valuations.

-

Addressing the risks associated with these valuations: BofA acknowledges the risks associated with high valuations but stresses the importance of careful due diligence and risk management. They provide insights into potential downside scenarios and suggest ways to mitigate risks.

Examples of specific companies and their valuations illustrate BofA's points. For instance, the strong growth potential of AI-related companies in the technology sector is highlighted, justifying premium valuations despite potential risks.

Conclusion

BofA's rationale for current high stock market valuations centers on a long-term perspective, emphasizing sustained growth fueled by corporate resilience, technological innovation, and a potential "soft landing" for the economy. They stress the importance of ignoring short-term market noise and focusing on fundamental company performance. Their positive outlook is supported by detailed analysis of macroeconomic indicators and sectoral trends. While acknowledging risks, their research provides a compelling argument for a cautiously optimistic investment strategy.

While the stock market can be volatile, understanding BofA's rationale for high stock market valuations can inform your investment strategy. By focusing on fundamental analysis and long-term growth, and by ignoring the noise, you can make informed decisions about your investments. Consider exploring BofA's research further to refine your understanding of the current market landscape and make well-informed choices. Learn more about managing your portfolio in the face of high valuations and explore ways to leverage BofA's insights to mitigate risk.

Featured Posts

-

Ankle Sprain Sidelined Jalen Brunson Return Expected Sunday

May 16, 2025

Ankle Sprain Sidelined Jalen Brunson Return Expected Sunday

May 16, 2025 -

Anthony Edwards And Ayesha Howard Custody Battle Resolved

May 16, 2025

Anthony Edwards And Ayesha Howard Custody Battle Resolved

May 16, 2025 -

Haly Wwd Astar Tam Krwz Pr Mdah Ka Hmlh Wydyw Wayrl

May 16, 2025

Haly Wwd Astar Tam Krwz Pr Mdah Ka Hmlh Wydyw Wayrl

May 16, 2025 -

Ayesha Howard Granted Custody After Paternity Dispute With Anthony Edwards

May 16, 2025

Ayesha Howard Granted Custody After Paternity Dispute With Anthony Edwards

May 16, 2025 -

La Ligas Piracy Blockade Vercel Highlights Concerns Over Internet Censorship

May 16, 2025

La Ligas Piracy Blockade Vercel Highlights Concerns Over Internet Censorship

May 16, 2025