Impact Of New US Solar Duties: Hanwha And OCI's Growth Strategy

Table of Contents

The Impact of US Solar Duties on the Solar Energy Market

The new US solar duties have created a complex and challenging environment for the entire solar energy sector. The increased costs and reduced competitiveness are impacting project viability and the overall growth of the US solar industry.

Increased Costs and Reduced Competitiveness

The direct impact of the duties is a significant increase in solar panel pricing. This leads to several detrimental effects:

- Increased manufacturing costs: Higher tariffs translate directly into increased production costs for solar panel manufacturers operating in or importing to the US.

- Potential project delays: Increased costs can make solar projects less financially viable, leading to delays or cancellations, impacting the timeline of renewable energy adoption.

- Impact on solar installation prices for consumers and businesses: Ultimately, consumers and businesses face higher prices for solar installations, dampening demand and slowing the transition to clean energy.

These factors collectively threaten the growth of the US solar energy sector, potentially hindering the country's progress towards its renewable energy goals. The increased costs associated with US solar duties make competing with solar energy sources from other countries significantly more difficult.

Shift in Supply Chains and Geopolitical Implications

The US solar duties are forcing a reconsideration of global solar panel supply chains, leading to several geopolitical implications:

- Increased reliance on alternative suppliers: Companies are actively seeking alternative suppliers outside the US, potentially leading to a shift in global manufacturing dominance.

- Potential trade disputes with other countries: The duties could trigger retaliatory tariffs from other nations, escalating trade tensions and further complicating the global solar market.

- Long-term implications for energy security: Over-reliance on specific regions or suppliers for critical solar components could create vulnerabilities in the long-term energy security of the US.

This necessitates a strategic re-evaluation for companies, pushing them to diversify their sourcing and manufacturing strategies to mitigate risks and ensure a stable supply of components.

Hanwha's Response and Growth Strategy

Hanwha, a major player in the solar industry, is actively adapting to the challenges posed by the US solar duties. Their response includes a dual focus on market diversification and technological innovation.

Diversification of Markets and Production

To mitigate the impact of the US duties, Hanwha is pursuing several diversification strategies:

- Investment in new production facilities outside the US: Expanding manufacturing capabilities beyond US borders reduces dependence on US-based production and mitigates tariff impacts.

- Exploration of new partnerships: Collaborating with companies in other regions provides access to new markets and resources, enhancing overall resilience.

- Focus on downstream segments like EPC and O&M: Expanding into Engineering, Procurement, and Construction (EPC) and Operations and Maintenance (O&M) services reduces reliance solely on panel manufacturing.

These actions demonstrate Hanwha's proactive approach to navigating the changing landscape and securing its long-term growth.

Technological Innovation and Efficiency Improvements

Hanwha is also investing heavily in R&D to maintain its competitiveness:

- Development of next-generation solar technologies: Investing in more efficient and cost-effective solar technologies helps offset increased material costs.

- Improving manufacturing processes: Optimizing manufacturing processes enhances efficiency and reduces production costs, thus improving profitability.

- Focus on sustainable energy solutions: Expanding into related sustainable energy sectors reduces dependence on a single product line.

This focus on innovation positions Hanwha to gain a competitive edge by offering advanced, cost-effective solutions in the evolving market.

OCI's Response and Growth Strategy

OCI, a significant polysilicon producer, is leveraging its position in the upstream sector to weather the storm created by the US solar duties.

Focus on Polysilicon Production and Supply Chain Management

OCI's strategy centers on securing and optimizing its polysilicon supply chain:

- Strategic partnerships: Collaborating with key players in the industry ensures stable access to raw materials and markets.

- Investment in polysilicon production capacity: Expanding polysilicon production capacity strengthens OCI's market position and reduces vulnerability to price fluctuations.

- Securing long-term supply contracts: Locking in long-term supply agreements minimizes the impact of short-term market volatility.

This vertical integration provides a buffer against the price fluctuations and tariff impacts experienced by downstream manufacturers.

Strategic Alliances and Joint Ventures

OCI is also pursuing strategic partnerships to broaden its market reach:

- Collaborations with other solar companies: Joint ventures and collaborations allow access to wider distribution networks and technological expertise.

- Exploration of new business models: Developing innovative business models helps navigate the complexities of the changing market environment.

- Expansion into complementary energy sectors: Diversifying into complementary sectors, such as energy storage, reduces reliance on solar panels alone.

These collaborations enhance OCI's resilience and adaptability in the face of the new US solar duties.

Conclusion

The new US solar duties have undeniably created significant challenges for the solar industry, impacting key players like Hanwha and OCI. Increased costs, supply chain disruptions, and geopolitical implications are forcing these companies to adapt and innovate. However, their responses demonstrate resilience and a commitment to long-term growth. Hanwha's diversification strategy and investment in technological innovation, along with OCI's focus on securing its polysilicon supply chain and forming strategic alliances, highlight the industry’s ability to navigate this complex situation. Understanding these strategies offers valuable insights for other players. The new US solar duties present a complex challenge, but companies like Hanwha and OCI are demonstrating resilience and adaptability. Understanding their strategies offers valuable insights for other players in the solar industry. Stay informed about the evolving impact of US Solar Duties on the global solar energy market and learn how to develop robust growth strategies to thrive in this dynamic environment. Further research into the long-term implications of these US solar duties is crucial for all stakeholders.

Featured Posts

-

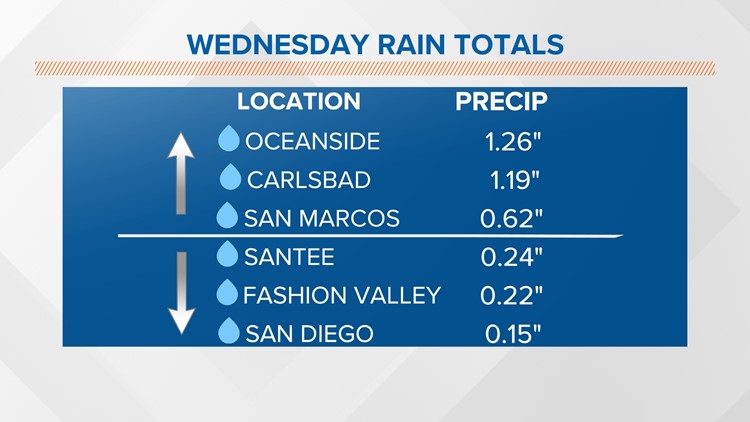

Latest San Diego Rain Totals And Weather Updates From Cbs 8 Com

May 30, 2025

Latest San Diego Rain Totals And Weather Updates From Cbs 8 Com

May 30, 2025 -

Harmful Algal Bloom Crisis The Toll On Californias Ocean Wildlife

May 30, 2025

Harmful Algal Bloom Crisis The Toll On Californias Ocean Wildlife

May 30, 2025 -

Gorillaz To Play First Three Albums Live In London One Off Shows Announced

May 30, 2025

Gorillaz To Play First Three Albums Live In London One Off Shows Announced

May 30, 2025 -

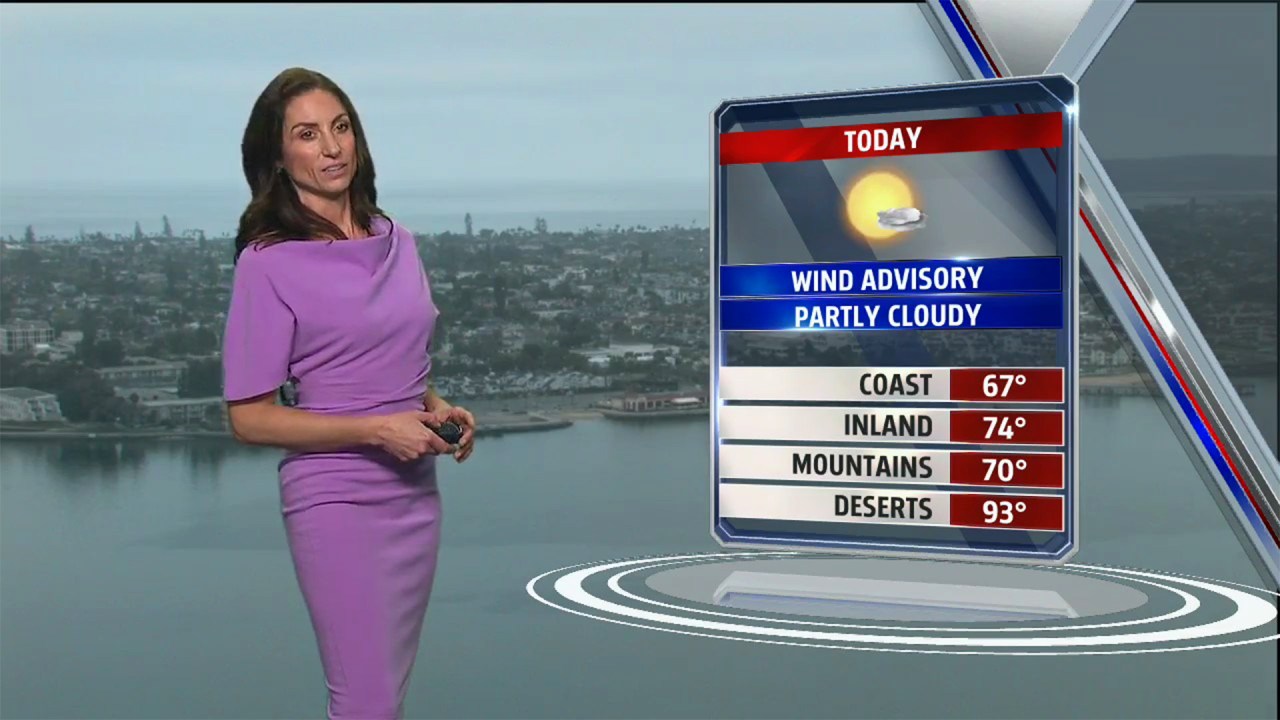

San Diego Weather Forecast Expect Fog Cool Temperatures And A Chance Of Showers

May 30, 2025

San Diego Weather Forecast Expect Fog Cool Temperatures And A Chance Of Showers

May 30, 2025 -

Norrie Upsets Medvedev Djokovic Advances At French Open

May 30, 2025

Norrie Upsets Medvedev Djokovic Advances At French Open

May 30, 2025