Impact Of SSE's £3 Billion Spending Reduction On Energy Sector And Consumers

Table of Contents

Impact on SSE's Energy Generation and Infrastructure Investments

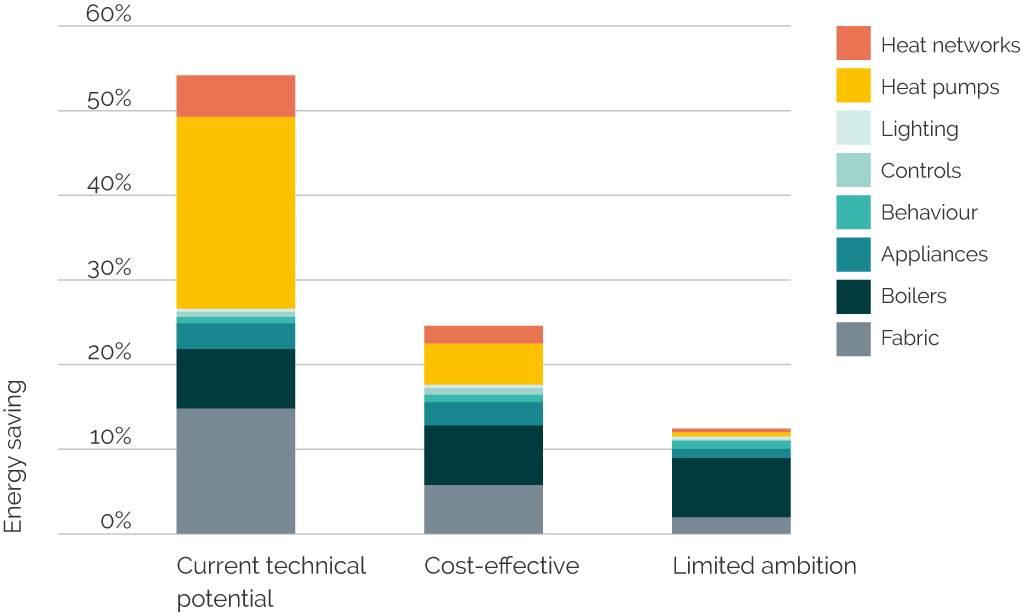

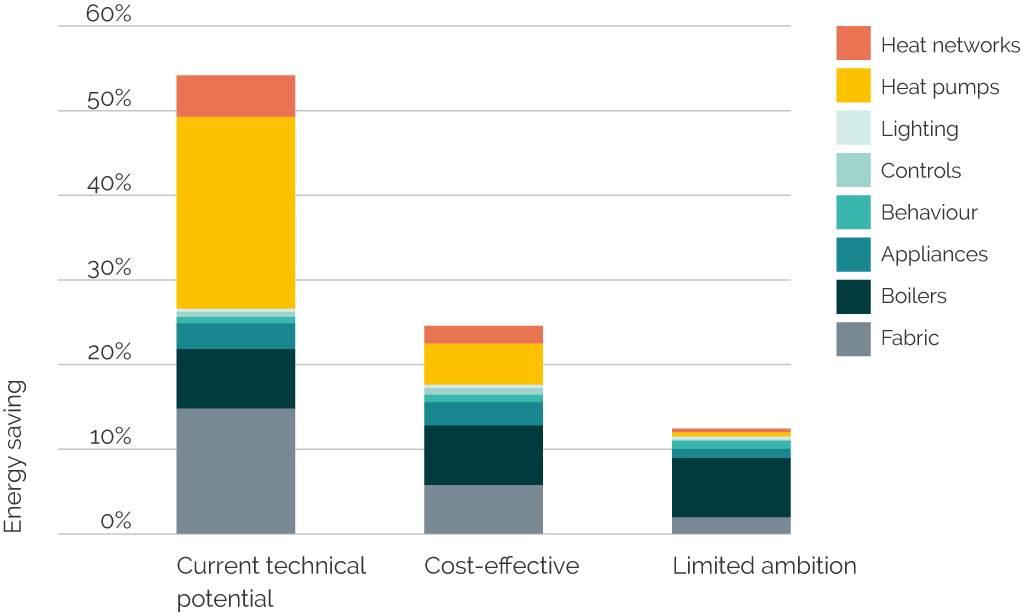

SSE's £3 billion spending reduction will undoubtedly affect its investment strategy across various energy generation and infrastructure projects. The company has indicated that this cut will primarily impact capital expenditure on new projects and upgrades to existing infrastructure. This means several key areas will feel the pinch.

-

Reduced investment in new wind farms: Plans for new offshore and onshore wind farms are likely to be delayed or scaled back, potentially hindering the UK's progress towards its renewable energy targets. This directly impacts the expansion of sustainable energy sources and could lead to a slower transition away from fossil fuels.

-

Delayed upgrades to existing power plants: Essential upgrades to existing power plants, crucial for maintaining reliability and efficiency, may be postponed. This could lead to increased operational costs and potentially lower output in the future. This also impacts the lifespan and overall sustainability of these existing assets.

-

Potential impact on job creation in the energy sector: The reduced investment will inevitably affect job creation opportunities within SSE and across its supply chain. Construction jobs related to new renewable energy projects, as well as engineering and maintenance roles, could be at risk. This has significant implications for employment in the already volatile energy sector.

-

Changes to the company's renewable energy targets: SSE’s ambitious renewable energy targets might be revised downwards, potentially impacting the UK's overall commitment to a greener future. This shift could impact investor confidence and the overall attractiveness of the UK energy market for green investments.

Wider Implications for the UK Energy Sector

The ripple effects of SSE's spending cut extend far beyond the company itself. Its decision will likely influence other energy companies, impacting the entire UK energy landscape.

-

Reduced competition in specific energy markets: Reduced investment from SSE could lead to less competition in specific energy markets, potentially leading to higher prices for consumers and a less dynamic market overall. This lack of competition could stifle innovation and efficiency within the sector.

-

Impact on the overall progress of the UK’s energy transition: A reduced pace of investment in renewable energy infrastructure hinders the UK's progress towards its net-zero targets. This slower transition could increase reliance on fossil fuels, potentially worsening the UK's carbon footprint.

-

Potential implications for achieving net-zero targets: The UK's ambitious net-zero targets are significantly challenged by this reduction in investment, requiring reassessment of existing strategies and potentially leading to a need for revised policy adjustments.

-

Increased reliance on fossil fuels in the short term: In the absence of sufficient investment in renewable energy, the UK might see an increased reliance on fossil fuels in the short term, undermining the country's climate change commitments.

Consequences for Energy Consumers

The consequences of SSE's £3 billion spending reduction will ultimately be felt by energy consumers across the UK.

-

Potential rise in energy bills: Reduced investment in renewable energy and potential instability in the energy market could lead to higher energy prices for both households and businesses. This increased cost of living pressure could disproportionately affect vulnerable consumers.

-

Reduced access to affordable and reliable energy: Delayed upgrades to existing infrastructure and a potential slowing of renewable energy development may lead to less reliable energy supplies. This could particularly affect rural areas, reducing access to affordable and dependable energy.

-

Increased vulnerability for low-income households: Rising energy prices and potentially less reliable supply will disproportionately impact low-income households, leading to increased energy poverty. This could have severe socio-economic consequences for vulnerable communities.

-

Impact on businesses and their operational costs: Higher energy prices will undoubtedly increase operational costs for businesses, affecting their competitiveness and potentially leading to job losses and reduced economic activity.

Government Response and Regulatory Implications

The government's response to SSE's spending reduction will be crucial in mitigating its negative consequences. Potential regulatory interventions could influence the direction of the energy sector and its ability to meet the UK's climate commitments.

-

Government statements and actions: The government's response will be closely scrutinized, with expectations for clear policy statements and potential financial interventions to stimulate investment in the energy sector.

-

Potential review of energy subsidies: The government may consider adjustments to energy subsidies to incentivize investment in renewable energy and ensure the energy market remains competitive.

-

Impact on government targets for renewable energy generation: The government may need to review and potentially revise its renewable energy generation targets in light of this reduced investment.

-

Changes to energy regulations: Changes to existing energy regulations might be necessary to encourage investment, ensure grid stability, and support the energy transition.

Conclusion: Understanding the Long-Term Effects of SSE's £3 Billion Spending Reduction

SSE's £3 billion spending reduction has significant implications for the UK energy sector and its consumers. The potential impact spans from rising energy bills and reduced investment in renewable energy to a slower energy transition and increased reliance on fossil fuels. The government's response and regulatory interventions will be critical in mitigating these risks. The long-term consequences will depend on a combination of factors, including policy decisions, market dynamics, and technological advancements. It is vital to monitor these developments closely. Stay informed about the ongoing impact of SSE's £3 billion spending reduction and how it may affect your energy costs by regularly checking reputable news sources and engaging in the public conversation around UK energy policy.

Featured Posts

-

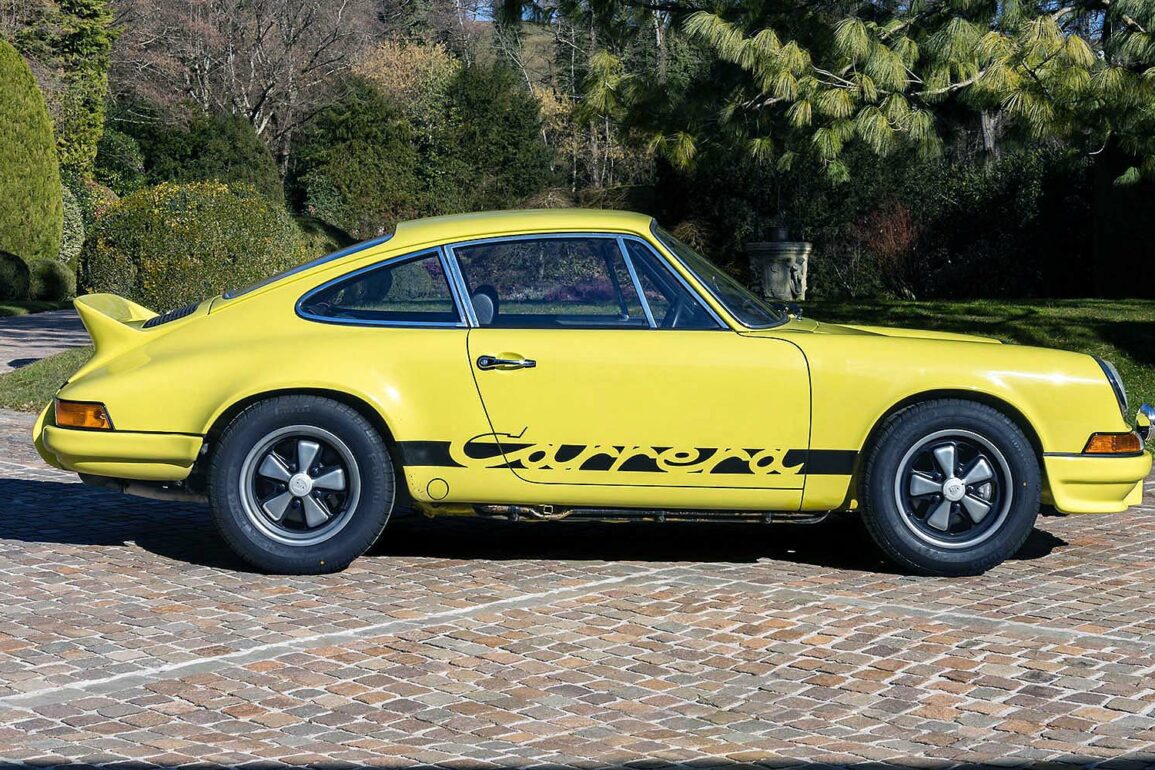

Neden Porsche 956 Arabalari Havada Sergileniyor

May 24, 2025

Neden Porsche 956 Arabalari Havada Sergileniyor

May 24, 2025 -

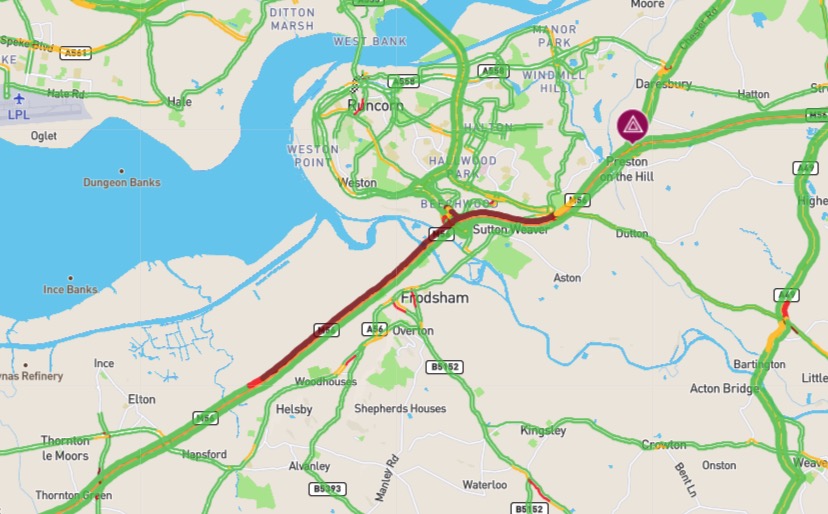

M56 Collision Cheshire Deeside Border Delays

May 24, 2025

M56 Collision Cheshire Deeside Border Delays

May 24, 2025 -

Unlocking Potential The Value Of Middle Managers In Todays Workplace

May 24, 2025

Unlocking Potential The Value Of Middle Managers In Todays Workplace

May 24, 2025 -

Kyle Walkers Wife Annie Kilner Seen After Husbands Night Out With Mystery Women

May 24, 2025

Kyle Walkers Wife Annie Kilner Seen After Husbands Night Out With Mystery Women

May 24, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025

Latest Posts

-

The Today Show Dylan Dreyers Unexpected Hosting Challenge

May 24, 2025

The Today Show Dylan Dreyers Unexpected Hosting Challenge

May 24, 2025 -

Dylan Dreyers Health And Fitness Journey A Today Show Success Story

May 24, 2025

Dylan Dreyers Health And Fitness Journey A Today Show Success Story

May 24, 2025 -

Social Media Reaction To Dylan Dreyers Latest Photo With Brian Fichera

May 24, 2025

Social Media Reaction To Dylan Dreyers Latest Photo With Brian Fichera

May 24, 2025 -

Nbcs Dylan Dreyer Transformation Story And Career Impact

May 24, 2025

Nbcs Dylan Dreyer Transformation Story And Career Impact

May 24, 2025 -

Brian Fichera And Dylan Dreyers Joint Post Public Reaction Explored

May 24, 2025

Brian Fichera And Dylan Dreyers Joint Post Public Reaction Explored

May 24, 2025