Impact Of Trump Media And Crypto.com's ETF Partnership On $CRO Price

Table of Contents

The recent partnership between Donald Trump's media company, Trump Media & Technology Group (TMTG), and the cryptocurrency exchange Crypto.com has sparked significant interest and speculation within the financial world. This article delves into the potential impact of this collaboration on the price of the CRO token, Crypto.com's native cryptocurrency. We will examine the factors influencing this relationship, exploring the long-term implications for both companies and the broader cryptocurrency market, analyzing market sentiment, trading volume, and potential regulatory hurdles.

Trump Media's Influence on Crypto Adoption

The partnership between Trump Media and Crypto.com has the potential to significantly influence crypto adoption, particularly within a demographic less traditionally engaged with cryptocurrencies.

Increased Visibility and Brand Recognition

This high-profile partnership exposes Crypto.com and its CRO token to a vast new audience through TMTG's substantial media reach.

- Increased brand awareness: TMTG's extensive network provides unparalleled exposure for Crypto.com, potentially boosting brand recognition among millions.

- Potential for new user acquisition: The association with a prominent figure like Donald Trump could attract a new wave of users to the Crypto.com platform.

- Positive media coverage: The partnership itself generates considerable media attention, leading to more positive news coverage for Crypto.com and potentially driving up interest in CRO.

- Association with a high-profile figure: The connection with Donald Trump, regardless of individual opinions, undoubtedly increases the visibility and memorability of Crypto.com.

Potential for Increased Transaction Volume

TMTG's substantial user base could translate into increased trading activity on Crypto.com's platform.

- Impact on trading volume: A surge in new users could lead to a significant increase in trading volume, impacting the price of CRO.

- Potential for price appreciation: Increased demand for CRO, driven by higher trading volumes, could contribute to price appreciation.

- Correlation between user growth and CRO price: A positive correlation is expected between user growth on Crypto.com and the price of the CRO token.

Risk Factors Associated with Political Partnerships

The association with a controversial figure like Donald Trump introduces significant risk.

- Reputational risk: Negative press surrounding Trump could negatively impact Crypto.com's reputation and, consequently, the price of CRO.

- Potential for negative press: Any controversies associated with Trump could spill over onto Crypto.com, potentially affecting investor confidence.

- Regulatory uncertainty: The partnership might attract increased regulatory scrutiny, potentially leading to uncertainty and impacting the price of CRO.

- Impact on investor confidence: Some investors might be hesitant to invest in CRO due to the political nature of the partnership.

Crypto.com's Strategic Objectives

Crypto.com's partnership with Trump Media serves several key strategic objectives.

Expanding Market Reach

The partnership directly targets a new demographic less engaged with cryptocurrencies.

- Targeting a broader audience: TMTG's audience significantly expands Crypto.com's reach beyond the traditional cryptocurrency investor base.

- Potential for mainstream adoption: This partnership could accelerate the mainstream adoption of cryptocurrencies, benefiting Crypto.com and the CRO token.

- Long-term growth strategy: This partnership is likely a crucial component of Crypto.com's long-term strategy for growth and market dominance.

Strengthening Brand Positioning

Aligning with a powerful media brand strengthens Crypto.com's market standing.

- Brand building: The association with a high-profile media brand enhances Crypto.com's credibility and brand image.

- Enhanced reputation: This partnership could boost Crypto.com's reputation among both traditional and crypto investors.

- Investor appeal: The partnership may attract new investors who are drawn to the association with TMTG.

- Positioning as a leading crypto exchange: This move positions Crypto.com more strongly as a leader in the competitive cryptocurrency exchange landscape.

Utility and Functionality of CRO within the Partnership

The partnership could see CRO integrated into TMTG's operations or offered as a payment method.

- Potential use cases for CRO: Opportunities exist for CRO to be integrated into TMTG's services, enhancing its utility.

- Integration with TMTG services: CRO could become a payment method within TMTG's ecosystem, increasing its demand.

- Increased utility and demand for CRO: Enhanced utility and increased demand could drive the price of CRO upward.

Market Analysis and Price Predictions

Analyzing the impact of this partnership requires considering both short-term volatility and long-term prospects.

Short-Term Price Volatility

The announcement of the partnership immediately impacted the CRO price and trading volume.

- Market reaction to news: The initial market reaction to the news likely involved price fluctuations reflecting investor sentiment.

- Short-term price fluctuations: Expect volatility in the short term as the market digests the implications of the partnership.

- Analysis of trading charts: Careful analysis of trading charts is necessary to understand the short-term price movements.

- Investor sentiment: Investor sentiment plays a crucial role in determining the short-term price fluctuations.

Long-Term Price Outlook

The long-term price of CRO depends on various factors.

- Factors influencing long-term price: These include the partnership's success, broader market trends, regulatory developments, and the overall adoption of cryptocurrencies.

- Market capitalization: The market capitalization of CRO will be a key indicator of long-term price movements.

- Adoption rate: Widespread adoption of CRO as a payment method or utility token will influence its long-term price.

- Regulatory landscape: Regulatory changes will impact the value of CRO.

- Competition: Competition from other cryptocurrencies will influence CRO's market share and price.

Comparative Analysis with Other Cryptocurrencies

Comparing CRO's performance with other cryptocurrencies provides valuable context.

- Market comparisons: Analyzing CRO's performance against other cryptocurrencies in similar market conditions is crucial.

- Correlation with other assets: Understanding the correlation between CRO's price and other assets in the crypto market is essential.

- Performance benchmarks: Establishing performance benchmarks against similar cryptocurrencies helps gauge CRO's progress.

Conclusion

The Trump Media and Crypto.com partnership presents both significant opportunities and considerable challenges for the CRO token price. The increased brand visibility and potential for user acquisition offer considerable upside potential. However, the inherent risks associated with political partnerships and regulatory uncertainty must be carefully considered. Ultimately, the long-term impact on the $CRO price will depend on the success of this collaboration, prevailing cryptocurrency market conditions, and overall investor sentiment. Therefore, monitoring the $CRO price, staying informed about the latest developments regarding this high-profile partnership, and conducting thorough research are essential for managing your investment in CRO and other cryptocurrencies effectively. Continuously monitor the $CRO price and make informed decisions based on your own due diligence.

Featured Posts

-

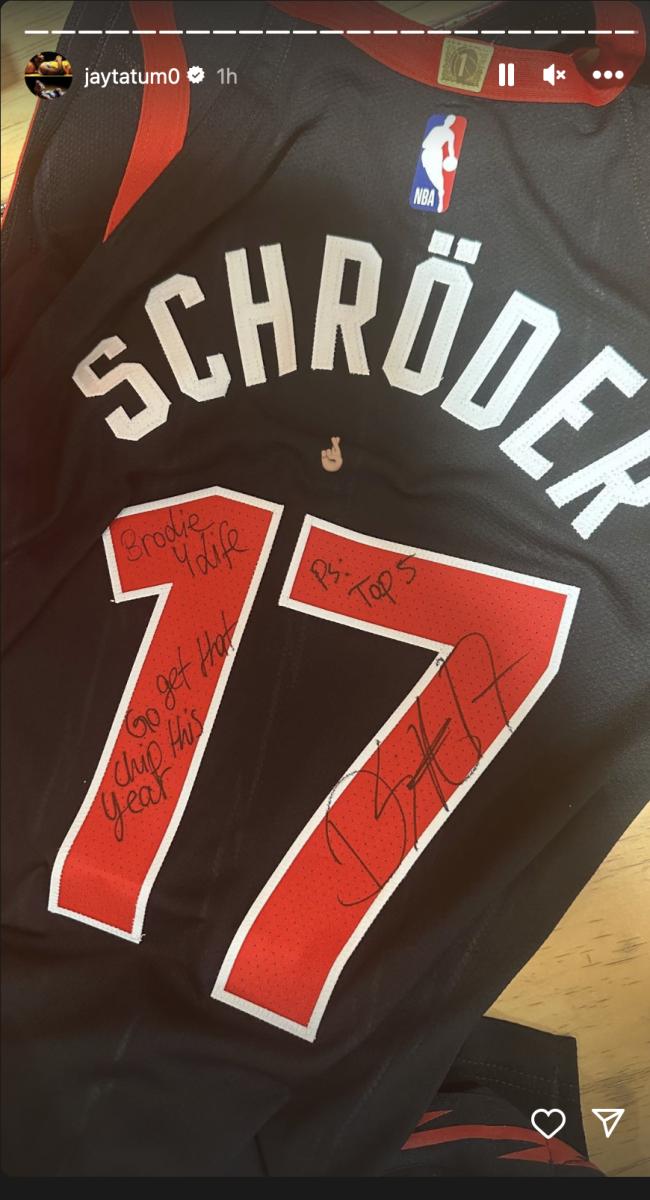

Kyle Kuzmas Reaction To Jayson Tatums Viral Instagram Post

May 08, 2025

Kyle Kuzmas Reaction To Jayson Tatums Viral Instagram Post

May 08, 2025 -

Boston Celtics Coach Provides Jayson Tatum Wrist Injury Update

May 08, 2025

Boston Celtics Coach Provides Jayson Tatum Wrist Injury Update

May 08, 2025 -

Ethereum Price Bullish Signals And Investment Strategies

May 08, 2025

Ethereum Price Bullish Signals And Investment Strategies

May 08, 2025 -

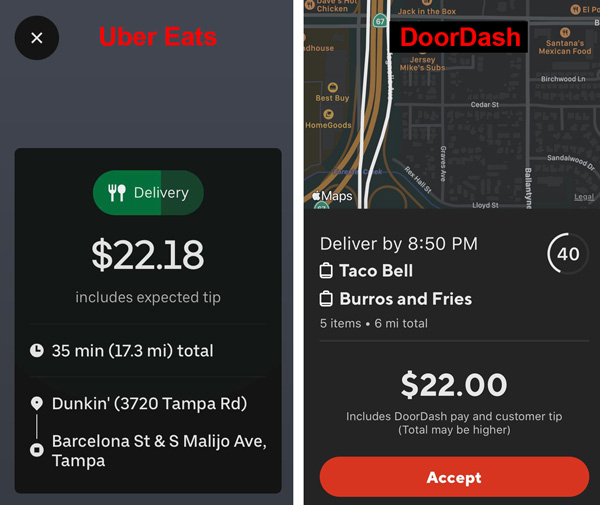

Uber Vs Door Dash A Legal Battle Over Food Delivery Dominance

May 08, 2025

Uber Vs Door Dash A Legal Battle Over Food Delivery Dominance

May 08, 2025 -

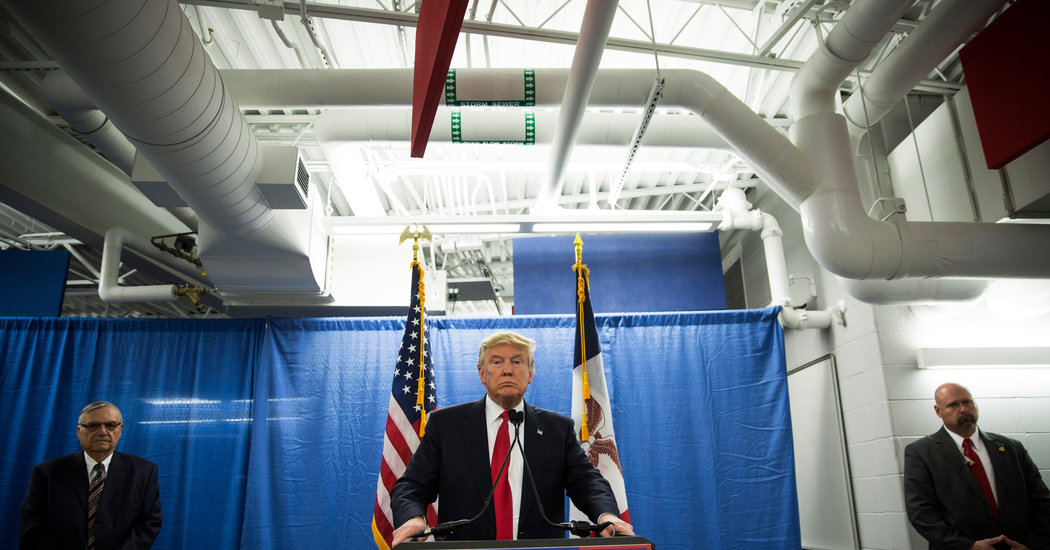

Carney Calls Trump Transformational In D C Meeting

May 08, 2025

Carney Calls Trump Transformational In D C Meeting

May 08, 2025