Impact Of US-China Trade War: Canadian Aluminum Trader's Bankruptcy

Table of Contents

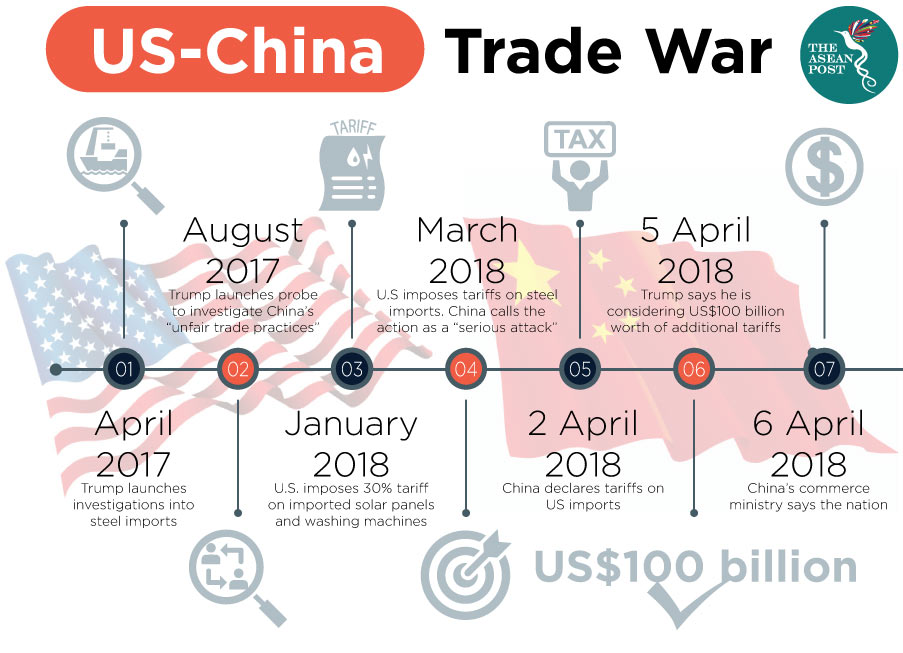

The US-China Trade War and its Impact on Aluminum Prices

The US-China trade war, characterized by escalating tariffs and trade restrictions, created significant volatility in global aluminum prices. The imposition of tariffs on aluminum imports, particularly from China, disrupted established supply chains and increased production costs for many companies. This led to significant price fluctuations throughout the trade war period. For Canadian aluminum traders like Alpha Metals, these fluctuations presented a double-edged sword. While some periods saw increased prices, creating short-term opportunities, the overall uncertainty severely hampered long-term planning and investment. The unpredictable nature of the market made it incredibly difficult to forecast demand and secure profitable contracts.

- Increased uncertainty in the market: The constant threat of new tariffs and retaliatory measures made it nearly impossible to predict future aluminum prices.

- Reduced demand for aluminum: As global trade slowed due to the trade war, demand for aluminum, a key component in many industries, declined significantly.

- Increased production costs: Tariffs and logistical challenges related to navigating trade restrictions pushed up production costs for many aluminum producers, affecting profitability and competitiveness.

- Difficulty in securing financing: Lenders became more hesitant to provide financing to companies operating in the volatile aluminum market, further exacerbating financial difficulties.

Alpha Metals' Business Model and its Vulnerability to Trade War Impacts

Alpha Metals' business model, heavily reliant on trading aluminum between the US and Chinese markets, proved particularly vulnerable to the disruptions caused by the trade war. The company's lack of diversification in both its sourcing and customer base amplified the negative impact of price volatility and trade disruptions. Alpha Metals lacked sufficient hedging strategies to protect itself against price fluctuations and did not possess adequate financial reserves to weather the storm.

- Heavy reliance on specific markets: The company's concentration on the US and Chinese markets left it extremely exposed to trade tensions between the two countries.

- Insufficient hedging strategies: A lack of proper hedging mechanisms to mitigate price risks contributed significantly to the company's financial instability.

- Poor risk management practices: Overall, Alpha Metals demonstrated poor risk management, failing to adequately assess and manage the substantial risks associated with its business model.

- Limited financial reserves: The company lacked sufficient financial reserves to absorb the losses incurred due to the trade war's impact.

The Role of Tariffs and Sanctions in Alpha Metals' Downfall

The Section 232 tariffs imposed by the US on aluminum imports, along with retaliatory measures from China, directly contributed to Alpha Metals' demise. These tariffs increased the cost of aluminum imports, reducing the company's profit margins and making it less competitive. Furthermore, the increased logistical challenges associated with navigating the complex web of tariffs and sanctions added further pressure to the company's already strained finances. Legal battles with suppliers and clients, stemming from contract disputes arising from the fluctuating market conditions, further compounded the company's problems.

- Section 232 tariffs on aluminum imports: These tariffs significantly increased the cost of aluminum, impacting Alpha Metal's profitability.

- Countermeasures from China: Retaliatory tariffs from China further restricted trade flows and reduced demand for Canadian aluminum.

- Increased logistical challenges: Navigating the complex web of tariffs and trade restrictions added significant costs and delays.

- Legal battles with suppliers and clients: Contract disputes related to price volatility and delivery issues further strained the company's resources.

Lessons Learned and Future Implications for Canadian Aluminum Traders

Alpha Metals' bankruptcy serves as a cautionary tale for Canadian aluminum traders. The key lesson is the paramount importance of diversification and robust risk management strategies. Simply put, over-reliance on specific markets or trading partners leaves businesses vulnerable to unforeseen global events. The future of the Canadian aluminum industry depends on adapting to a changing geopolitical landscape, focusing on diversification of both markets and supply chains, and implementing comprehensive risk management plans that include hedging strategies against price volatility.

- Importance of diversification of markets and supply chains: Canadian aluminum traders must diversify their client base and sourcing strategies to mitigate risk.

- Need for effective risk management strategies: Comprehensive risk assessments, including scenario planning and hedging, are crucial.

- Importance of hedging against price volatility: Implementing effective hedging strategies is essential to protect against price fluctuations in the aluminum market.

- Strengthening government support for the aluminum industry: Government policies should support diversification and innovation within the aluminum sector.

Conclusion: Navigating the Risks: Avoiding Another Canadian Aluminum Trader Bankruptcy

The US-China trade war provided a stark lesson for the Canadian aluminum industry, with Alpha Metals' bankruptcy serving as a prime example of the devastating consequences of insufficient risk management and lack of diversification in global markets. The company's downfall underscores the importance of implementing robust risk mitigation strategies, including hedging and diversification of both markets and supply chains. To thrive in the face of global economic uncertainty, Canadian aluminum traders must adopt a proactive approach to risk management, paying close attention to geopolitical developments and implementing strategies to protect their businesses from similar disruptions. Learn more about the implications of global trade wars and develop effective Canadian aluminum trade risk mitigation and global trade strategies to safeguard your business. The need for vigilance and adaptation in the face of ongoing global economic uncertainty cannot be overstated.

Featured Posts

-

Five Teens Charged In Violent Anti Gay Attack On Minor

May 29, 2025

Five Teens Charged In Violent Anti Gay Attack On Minor

May 29, 2025 -

Why Winning Riders Choose Honda Motorcycles

May 29, 2025

Why Winning Riders Choose Honda Motorcycles

May 29, 2025 -

Trump Administrations Plan To Sever Ties With Harvard University

May 29, 2025

Trump Administrations Plan To Sever Ties With Harvard University

May 29, 2025 -

China Sinograins Soybean Auction Addressing Supply Shortages

May 29, 2025

China Sinograins Soybean Auction Addressing Supply Shortages

May 29, 2025 -

Prakiraan Cuaca Hari Ini Dan Besok 23 4 Di Jawa Tengah

May 29, 2025

Prakiraan Cuaca Hari Ini Dan Besok 23 4 Di Jawa Tengah

May 29, 2025