Imported Soybeans Auctioned By Sinograin Amidst China's Supply Shortage

Table of Contents

Sinograin's Auction: Details and Significance

The recent Sinograin auction involved a substantial volume of imported soybeans, aiming to alleviate the immediate pressure of the current shortage. While precise figures aren't always publicly released immediately, reports suggest a significant quantity was offered, likely in the hundreds of thousands of tons. The auction’s timing is crucial; it coincides with peak demand and dwindling domestic supplies, highlighting the urgency of the situation.

The specific types of soybeans auctioned, their origin (likely Brazil and the US, China's main suppliers), and the precise bidding process remain partially opaque. However, the identity of the winning bidders – whether primarily state-owned enterprises or private companies – offers crucial insights into market dynamics and government intervention strategies. The auction price relative to the prevailing market price is also a key indicator of its impact. A price significantly below the market price could indicate government intervention to stabilize prices for consumers.

- Volume of soybeans auctioned: (Specific figures to be added once publicly available)

- Origin of imported soybeans: Primarily Brazil and the United States

- Winning bidders: A mix of state-owned and private companies is likely.

- Auction price compared to market price: (To be determined based on post-auction market analysis)

- Projected impact of the auction on soybean prices: Expected to temporarily ease price pressures.

Underlying Causes of China's Soybean Supply Shortage

China's current soybean supply shortage is a complex issue with multiple contributing factors. Poor domestic harvests, exacerbated by increasingly unpredictable weather patterns and climate change, play a significant role. Trade tensions and global supply chain disruptions have also impacted soybean imports. Furthermore, government policies, including import tariffs and quotas, influence both domestic production and the availability of imported soybeans.

- Impact of adverse weather conditions on domestic soybean yields: Reduced yields due to droughts and floods.

- Trade relations with major soybean exporting countries (e.g., Brazil, USA): Trade agreements and potential tariffs significantly affect import volumes.

- Government policies aimed at boosting domestic soybean production: Subsidies, land allocation policies, and research funding are crucial.

- Analysis of import tariffs and quotas: These measures can both protect domestic producers and limit the availability of imported soybeans.

Impact of the Auction on the Chinese Soybean Market and Related Industries

The Sinograin auction's short-term impact on soybean prices is anticipated to be a slight reduction in market prices due to increased supply. However, the long-term effects remain uncertain and depend on several factors, including future harvests and global market conditions. Animal feed manufacturers, a major consumer of soybeans, will see immediate relief in input costs. Food processing companies, reliant on soybeans for various products, will also benefit from potentially lower raw material prices. However, any long-term benefits are contingent upon the sustainability of supply and consistent government policies. Ripple effects are likely to be seen in related markets, such as vegetable oil and soybean meal.

- Price changes in the soybean market following the auction: A temporary price decrease is expected.

- Impact on livestock feed costs: Reduced costs for animal feed producers.

- Effect on the profitability of food processing companies: Improved profit margins due to lower input costs.

- Potential changes in soybean imports after the auction: Import levels may adjust based on market demand and government policies.

Future Outlook for China's Soybean Market

Addressing China's long-term soybean supply challenges requires a multi-pronged approach. Increased domestic production through improved yields and technological advancements is crucial. This includes investing heavily in agricultural research and development, promoting sustainable farming practices, and adopting advanced farming techniques. Simultaneously, maintaining stable and reliable import channels with major soybean-producing countries is essential. Government interventions, including strategic reserves management and well-defined import policies, will continue to play a vital role in stabilizing the market.

- Government investments in agricultural research and development: Funding for improved soybean varieties and cultivation techniques.

- Adoption of advanced farming techniques to improve soybean yields: Precision agriculture, GMOs, and other technological solutions.

- Potential for increased imports from other soybean producing countries: Diversification of import sources to reduce reliance on any single country.

Conclusion: Navigating the Challenges in China's Soybean Market

Sinograin's soybean auction represents a crucial, albeit temporary, measure to address the immediate impact of China's soybean supply shortage. The underlying causes, including poor domestic harvests, global supply chain issues, and trade dynamics, demand a comprehensive and long-term solution. While the auction offers short-term relief to various sectors, addressing these fundamental issues through technological advancements, sustainable agricultural practices, and strategic government policies will ultimately determine the future stability and resilience of China's soybean market. Stay updated on future Sinograin auctions and the evolving landscape of China's soybean market for insights into this crucial agricultural sector.

Featured Posts

-

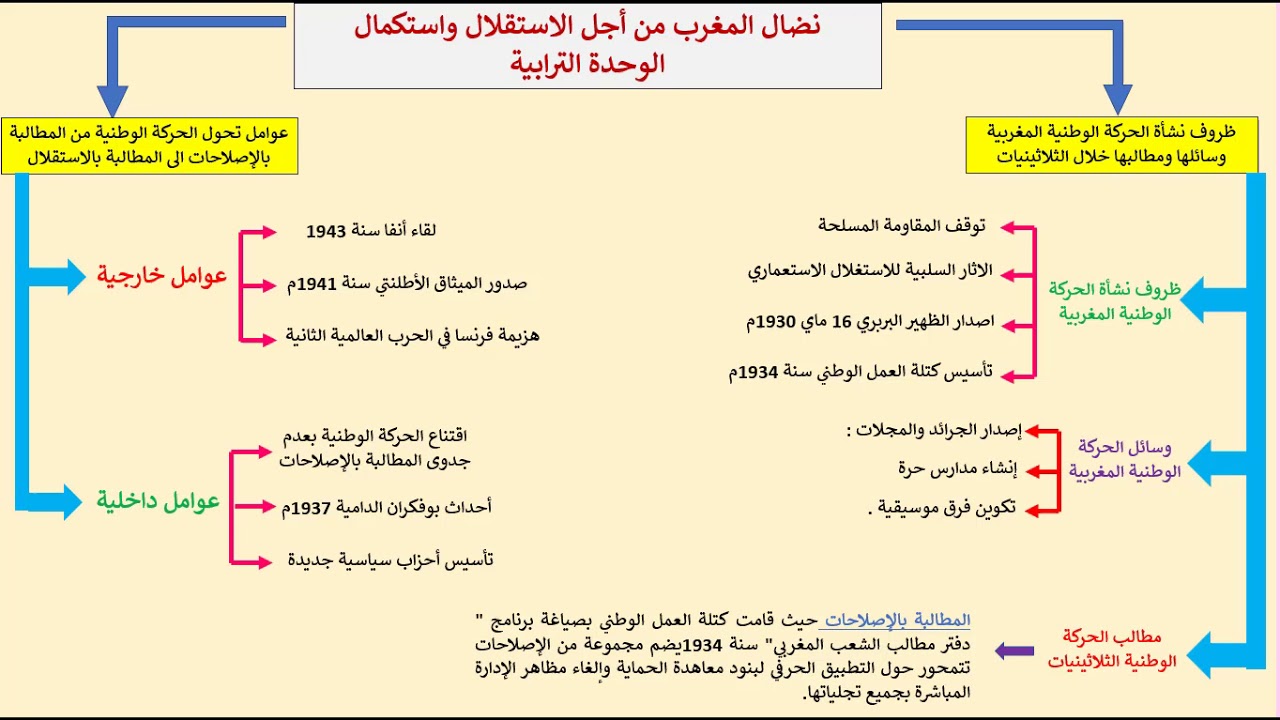

Tarykh Alastqlal Ndal Wtdhyat Mn Ajl Alhryt

May 29, 2025

Tarykh Alastqlal Ndal Wtdhyat Mn Ajl Alhryt

May 29, 2025 -

Frances Crackdown On Drug Trafficking Phone Seizure As Deterrent

May 29, 2025

Frances Crackdown On Drug Trafficking Phone Seizure As Deterrent

May 29, 2025 -

The Chinese Auto Market Opportunities And Obstacles For Luxury Brands Like Bmw And Porsche

May 29, 2025

The Chinese Auto Market Opportunities And Obstacles For Luxury Brands Like Bmw And Porsche

May 29, 2025 -

Heitinga En Ajax Besprekingen Over Potentiele Hoofdtrainersrol

May 29, 2025

Heitinga En Ajax Besprekingen Over Potentiele Hoofdtrainersrol

May 29, 2025 -

Pokemon Tcg Pocket Codes Your Guide To Free Cards And More

May 29, 2025

Pokemon Tcg Pocket Codes Your Guide To Free Cards And More

May 29, 2025