Increased Ethereum Network Activity: What Does It Mean For Investors?

Table of Contents

Understanding Increased Ethereum Network Activity

"Increased Ethereum network activity" refers to a rise in various metrics indicating greater usage of the Ethereum blockchain. This isn't simply about more transactions; it's a multifaceted phenomenon reflecting the network's overall health and demand. Key metrics used to gauge this activity include:

-

Transaction Volume: This represents the sheer number of transactions processed on the network. A higher volume suggests increased user engagement and activity within the Ethereum ecosystem. Tracking this metric provides a clear picture of overall network usage.

-

Gas Fees: Gas fees are the transaction costs paid in Ether (ETH) to execute transactions on the Ethereum network. Increased demand often leads to higher gas fees, reflecting the competition for network resources. Monitoring gas fees offers insights into network congestion and user willingness to pay for transactions.

-

Active Addresses: This metric counts the number of unique Ethereum addresses actively interacting with the network. A rising number indicates growth in the user base and expanding adoption of Ethereum-based applications.

-

Decentralized Application (dApp) Usage: The increasing popularity and usage of decentralized applications (dApps) built on the Ethereum blockchain are significant drivers of network activity. Many dApps require frequent transactions, contributing substantially to overall network usage.

Factors Driving Increased Ethereum Network Activity

Several key factors contribute to the observed increase in Ethereum network activity:

DeFi Boom

Decentralized Finance (DeFi) has exploded in popularity, significantly impacting Ethereum's network. DeFi applications, offering services like lending, borrowing, trading, and yield farming, require numerous transactions to function.

-

Popularity of DeFi: DeFi protocols offer innovative financial services without intermediaries, attracting a large and growing user base. This popularity directly translates into increased transaction volume on the Ethereum network.

-

Specific DeFi Protocols: Platforms like Uniswap (a decentralized exchange), Aave (a lending protocol), and Compound (another lending protocol) have become enormously popular, driving substantial network activity. Each transaction on these platforms contributes to the overall increase.

-

Relationship between DeFi and Gas Fees: The high demand for DeFi services often leads to increased gas fees, reflecting the competition for limited network resources.

NFT Market Growth

The Non-Fungible Token (NFT) market boom has also fueled increased Ethereum network activity. NFTs, representing unique digital assets, are predominantly traded on the Ethereum blockchain.

-

NFT Market Rise: The surge in popularity of NFTs, particularly in digital art, collectibles, and gaming, has led to a significant increase in transaction volume on the Ethereum network.

-

High Transaction Volume: Buying, selling, and transferring NFTs requires numerous transactions, contributing heavily to network congestion and increased gas fees.

-

Prominent NFT Marketplaces: OpenSea, Rarible, and other prominent NFT marketplaces operate on the Ethereum blockchain, further solidifying its role in the NFT ecosystem.

Ethereum 2.0 Development and Anticipation

The ongoing development and anticipation of Ethereum 2.0, with its planned upgrades like sharding, are also contributing factors. These upgrades aim to significantly improve the network's scalability and efficiency.

-

Improved Network Capacity: Ethereum 2.0 is designed to substantially increase the network's transaction processing capacity, addressing current scalability limitations.

-

Impact on Gas Fees and Transaction Speeds: By improving scalability, Ethereum 2.0 is expected to reduce gas fees and increase transaction speeds, making the network more user-friendly and efficient.

-

Positive Investor Sentiment: The anticipation of Ethereum 2.0 creates positive investor sentiment, further boosting interest in the Ethereum ecosystem.

Investment Implications of Increased Ethereum Network Activity

The increased Ethereum network activity presents both opportunities and risks for investors:

Potential Benefits

-

Increased Demand: Higher network activity often correlates with increased demand for ETH, potentially leading to price appreciation.

-

Ecosystem Growth: The growth of the Ethereum ecosystem, driven by DeFi and NFTs, creates new investment opportunities and expands the potential for future returns.

-

Long-Term Potential: Sustained high network activity can be a strong indicator of the long-term potential and viability of the Ethereum blockchain.

Potential Risks

-

High Gas Fees: Increased gas fees can make transactions prohibitively expensive, impacting usability and potentially hindering the adoption of Ethereum-based applications.

-

Network Congestion: High network activity can lead to congestion, resulting in slower transaction processing times and potential delays.

-

Market Volatility: The cryptocurrency market is inherently volatile, and increased network activity doesn't guarantee sustained price increases.

Conclusion

Increased Ethereum network activity signals strong underlying growth within the DeFi and NFT sectors, fueled further by anticipation of Ethereum 2.0. While this surge presents significant potential for investors, understanding both the opportunities and risks associated with increased gas fees and market volatility is crucial. Before making any investment decisions based on increased Ethereum network activity, conduct thorough research and consider your risk tolerance. Stay informed about Ethereum 2.0 developments and the evolving landscape of decentralized applications to make well-informed decisions about your Ethereum investments. Remember to always do your own research before investing in any cryptocurrency. Understanding increased Ethereum network activity is key to navigating this exciting and dynamic market.

Featured Posts

-

James Gunns Superman A New Look At The Upcoming Dc Movie

May 08, 2025

James Gunns Superman A New Look At The Upcoming Dc Movie

May 08, 2025 -

How One Cryptocurrency Could Weather The Trade War Storm

May 08, 2025

How One Cryptocurrency Could Weather The Trade War Storm

May 08, 2025 -

Trump Medias Crypto Com Etf Partnership A Detailed Analysis

May 08, 2025

Trump Medias Crypto Com Etf Partnership A Detailed Analysis

May 08, 2025 -

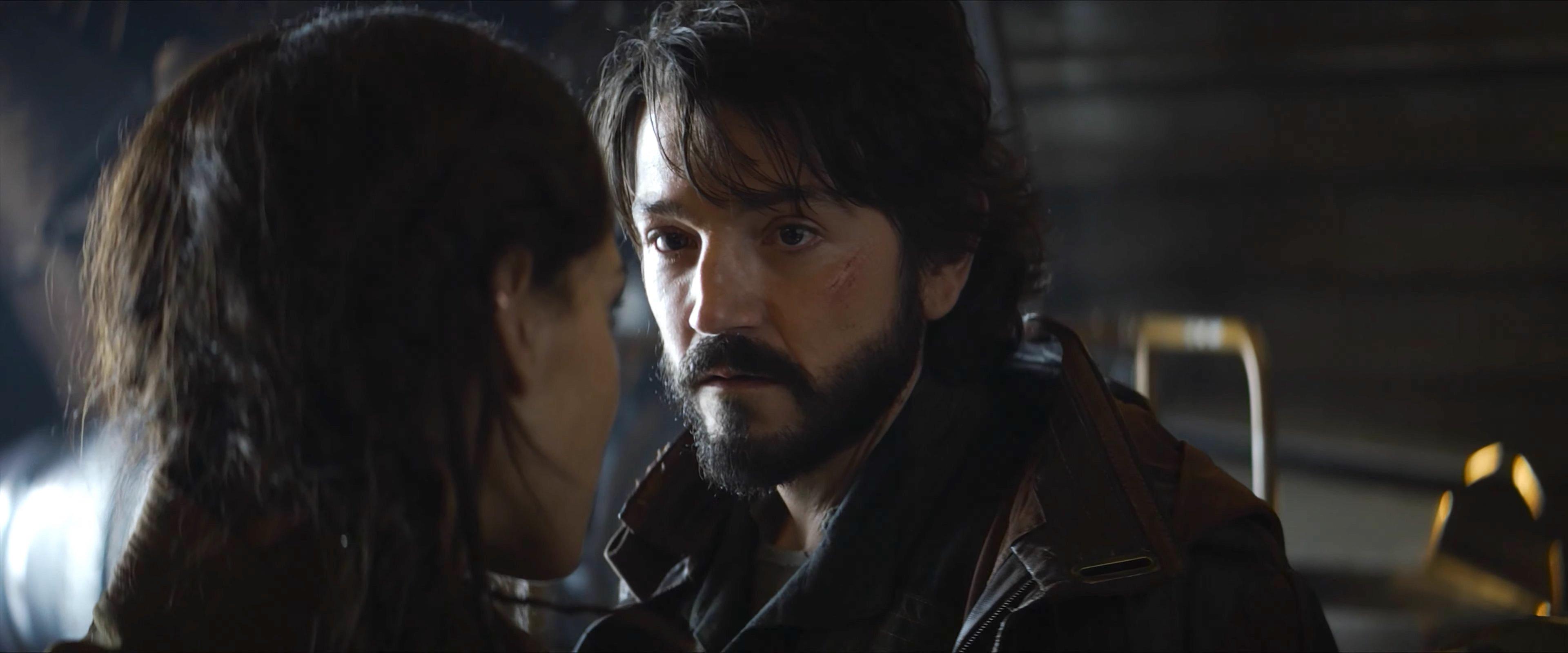

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025 -

Barcelona And Inter Milans Champions League Semi Final A Six Goal Epic

May 08, 2025

Barcelona And Inter Milans Champions League Semi Final A Six Goal Epic

May 08, 2025