Increased Q1 Profit And Dividend Announcement From Telus

Table of Contents

Record Q1 Profit for Telus

Telus' Q1 2024 earnings report showcased exceptional financial performance, exceeding expectations and demonstrating significant year-over-year growth. The company reported a remarkable increase in both net income and revenue, solidifying its position as a leader in the telecommunications sector.

-

Specific Figures: Telus reported a net income of [Insert Actual Net Income Figure] for Q1 2024, representing a [Insert Percentage]% increase compared to the same period in 2023. Total revenue reached [Insert Actual Revenue Figure], a [Insert Percentage]% year-over-year jump.

-

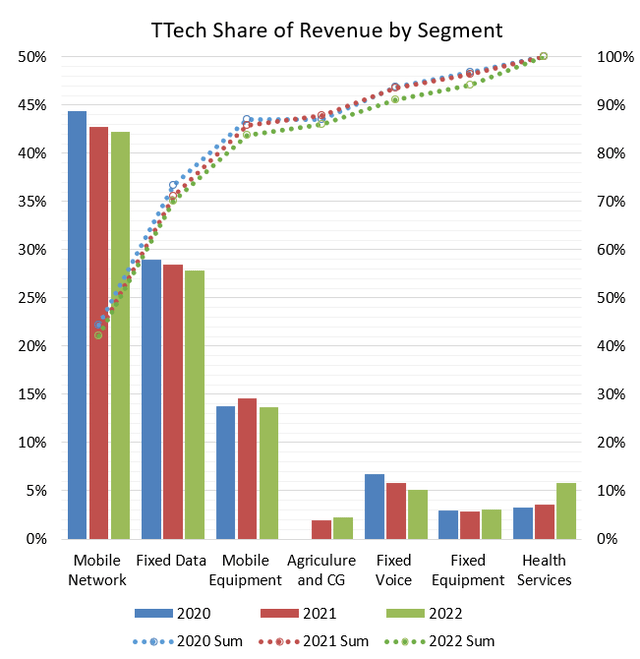

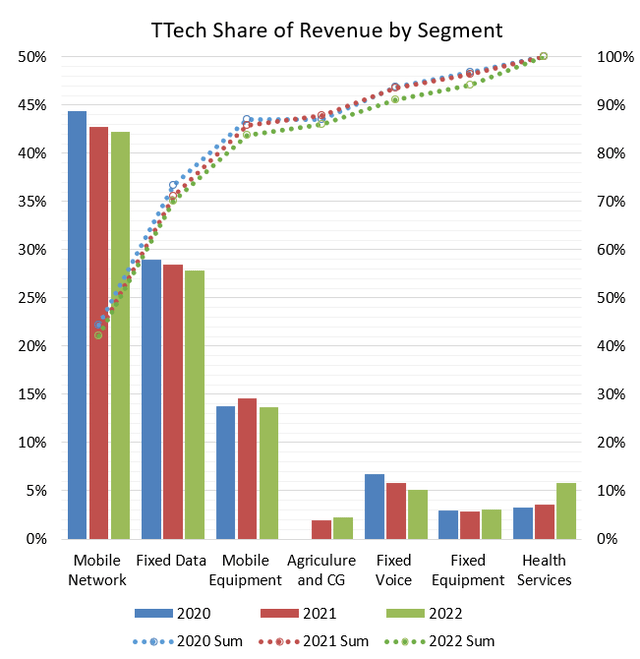

Revenue Breakdown: This impressive revenue growth was driven by strong performance across multiple segments. The wireless segment saw a notable increase in subscribers and average revenue per user (ARPU), while the wireline segment also contributed significantly to overall revenue. [Insert further details on specific revenue streams, if available].

-

Factors Contributing to Growth: Several factors contributed to this record-breaking Q1 performance. These include:

- A robust increase in the subscriber base across both wireless and wireline services.

- Successful implementation of cost-cutting measures, leading to improved operational efficiency.

- Strong demand for Telus' high-speed internet and 5G services.

-

Bullet Points:

- Record-breaking net income surpasses previous projections by [Insert Percentage]%.

- Strong growth in wireless and wireline subscribers exceeding [Insert Number] new additions.

- Improved operational efficiency resulting in a [Insert Percentage]% reduction in operating costs.

Increased Dividend for Telus Shareholders

The impressive Q1 2024 results have led Telus to announce a significant increase in its dividend payout, reflecting the company's confidence in its future prospects and its commitment to rewarding its shareholders.

-

Dividend Increase Details: The new dividend amount is [Insert Actual Dividend Amount] per share, representing a [Insert Percentage]% increase compared to the previous quarter. The ex-dividend date is [Insert Date], and the payment date is [Insert Date].

-

Impact on Shareholders: This increased dividend translates to a higher dividend yield, making Telus an even more attractive investment for income-seeking investors. The enhanced shareholder return underscores Telus' dedication to delivering long-term value.

-

Bullet Points:

- Significant increase in dividend payout reflects confidence in future performance and sustained growth.

- Attractive dividend yield of [Insert Percentage]% compared to industry competitors.

- Reinforces Telus’ commitment to returning value to shareholders and strengthening investor confidence.

Future Outlook for Telus Based on Q1 Results

The exceptional Q1 2024 performance sets a strong foundation for Telus' future growth. Management's commentary suggests a positive outlook for the remainder of the year, fueled by ongoing investments in network infrastructure and strategic initiatives.

-

Management Guidance: [Insert details on management's guidance for the year, including any projections for revenue, earnings, and subscriber growth. Include any quotes from management about their outlook].

-

Potential Challenges and Opportunities: While the outlook is positive, Telus faces potential challenges such as increased competition in the telecommunications market and the ongoing impact of inflation. However, opportunities exist in the expansion of 5G services, the growth of the Internet of Things (IoT), and further penetration into new markets.

-

Expert Opinions: Analysts have expressed positive sentiments regarding Telus' Q1 results, with many forecasting continued strong performance throughout 2024. [Insert details on any relevant analyst forecasts and ratings].

-

Bullet Points:

- Positive outlook suggests continued strong performance in upcoming quarters, driven by [mention key drivers].

- Potential for further stock price appreciation based on current market analysis.

- Strategic initiatives, such as [mention initiatives], are expected to drive future growth and innovation.

Conclusion

Telus’ Q1 2024 results demonstrate exceptional financial strength, marked by a substantial surge in profits and a generous dividend increase for shareholders. This robust performance positions Telus favorably for continued growth and solidifies its position as a leading telecommunications company. The increased dividend payout and positive outlook highlight the company's commitment to both its customers and its investors.

Call to Action: Stay informed about Telus’ performance and future announcements by regularly checking our website for updates on Telus' financial results and dividend information. Learn more about investing in Telus and understanding its financial statements. Consider Telus for your investment portfolio given its strong Q1 performance and increased dividend. Don't miss out on the opportunities presented by this telecommunications leader.

Featured Posts

-

Pregnancy Announcement Mackenzie Mc Kee And Khesanio Hall Expecting

May 11, 2025

Pregnancy Announcement Mackenzie Mc Kee And Khesanio Hall Expecting

May 11, 2025 -

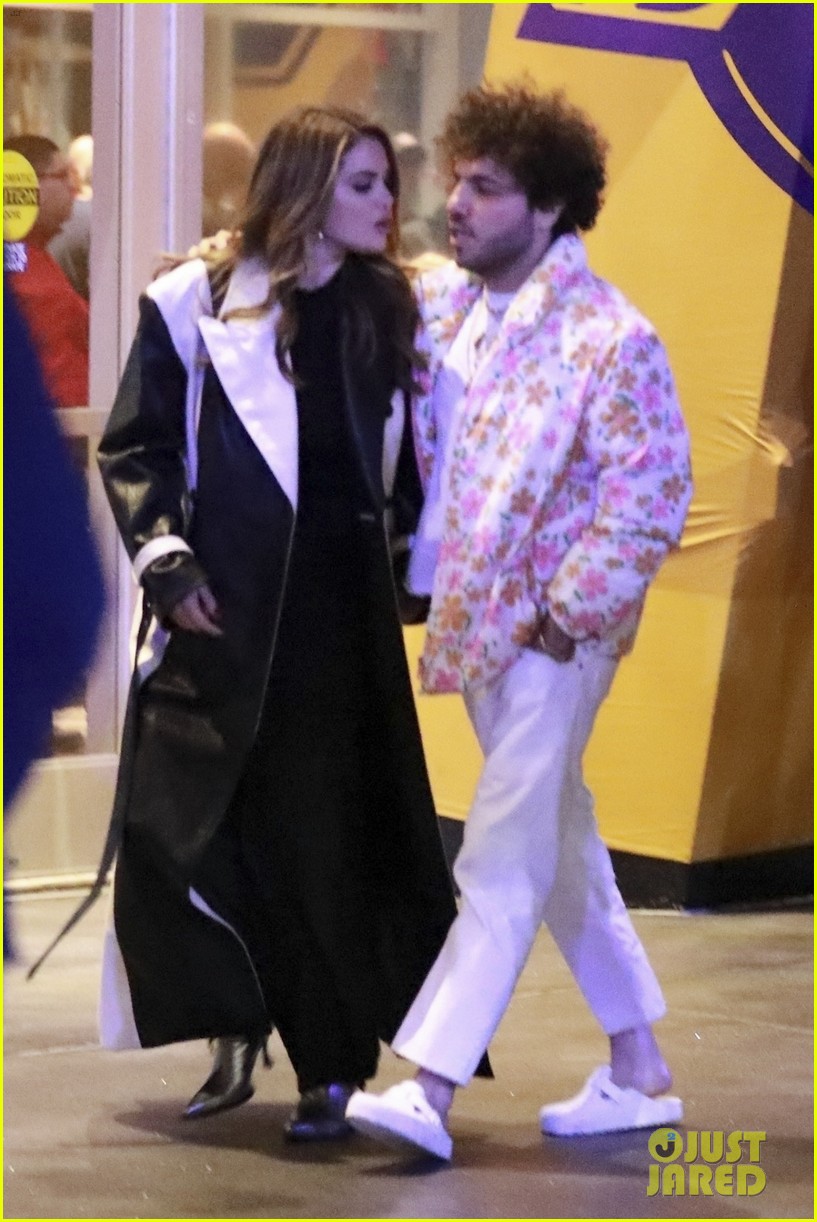

Benny Blanco And Selena Gomez Photos Fueling Cheating Rumors

May 11, 2025

Benny Blanco And Selena Gomez Photos Fueling Cheating Rumors

May 11, 2025 -

Is Happy Gilmore 2 Adam Sandlers Next Big Comedy Hit

May 11, 2025

Is Happy Gilmore 2 Adam Sandlers Next Big Comedy Hit

May 11, 2025 -

Bank Of Canada Rate Cuts Economists Predict Renewed Cuts Amidst Tariff Job Losses

May 11, 2025

Bank Of Canada Rate Cuts Economists Predict Renewed Cuts Amidst Tariff Job Losses

May 11, 2025 -

Jon M Chu Discusses The Future Of Crazy Rich Asians On Television

May 11, 2025

Jon M Chu Discusses The Future Of Crazy Rich Asians On Television

May 11, 2025