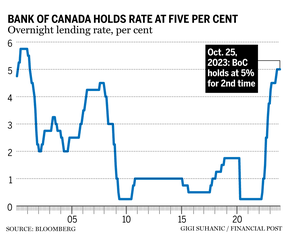

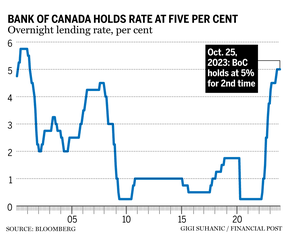

Increased Retail Sales: Will The Bank Of Canada Hold Rates?

Table of Contents

Analyzing the Recent Surge in Retail Sales

The recent increase in Canadian retail sales figures represents a significant development for the Canadian economy. Growth percentages, while varying by sector, point towards a robust upswing in consumer spending. Several factors are contributing to this surge:

- Increased Consumer Confidence: Rising employment rates and wage growth have boosted consumer confidence, leading to increased discretionary spending.

- Government Spending Initiatives: Government programs and initiatives designed to stimulate the economy have injected additional funds into the consumer market.

- Pent-up Demand: Following the pandemic restrictions, there's evidence of pent-up demand influencing purchasing decisions across various sectors.

Let's break down the sales figures further:

- Automotive Sales: This sector experienced a notable rebound, suggesting increased consumer confidence in larger purchases.

- Furniture and Home Furnishings: Sales in this area also showed significant growth, potentially linked to home renovation projects and increased housing activity.

- Clothing and Apparel: Growth in this sector reflects a return to pre-pandemic spending habits, suggesting a boost in discretionary spending.

Regional variations exist, with some provinces experiencing more robust growth than others. However, the overall picture points towards a nationwide increase in retail sales, adding pressure on the Bank of Canada. The impact of inflation on consumer spending habits remains a crucial factor. While prices are elevated, consumers are still spending, indicating a resilience in the face of rising costs. This resilience, however, needs to be analyzed within the broader context of inflation and its potential to erode purchasing power. Compared to previous periods of retail sales growth, this current surge is relatively strong, highlighting its significance for monetary policy decisions.

The Bank of Canada's Mandate and Current Economic Conditions

The Bank of Canada's primary mandate is to maintain price stability by controlling inflation. Its target inflation rate is typically around 2%, although current inflation significantly exceeds this target. This necessitates a careful evaluation of monetary policy tools, including interest rate adjustments. The Bank also considers other key economic indicators:

- Inflation Target: The Bank of Canada's current inflation target is consistently missed. This necessitates a response through monetary policy adjustments.

- Current Inflation Rate: The elevated inflation rate is a major concern, and the Bank must address it to maintain economic stability.

- Unemployment Rate: While the unemployment rate remains relatively low, it's important to evaluate its impact on wage growth and overall economic activity.

- GDP Growth: Recent GDP growth figures contribute to the overall economic picture, influencing the Bank of Canada's assessment of the situation.

The relationship between interest rates and inflation is crucial. Generally, raising interest rates cools down the economy by making borrowing more expensive, thereby reducing consumer spending and investment. However, the Bank needs to balance the need to combat inflation with the potential negative impacts of higher rates on economic growth. Other external factors, such as global economic conditions and geopolitical events, also influence the Bank's decisions.

Potential Impacts of Holding or Raising Interest Rates

The Bank of Canada faces a difficult choice. Holding interest rates could allow the economic expansion to continue, benefiting businesses and consumers. However, it risks exacerbating inflationary pressures. Raising interest rates could curb inflation, but it might also slow economic growth, potentially impacting consumer confidence and employment. Let’s examine the potential impacts:

- Impact on Borrowing Costs: Increased interest rates directly increase the cost of borrowing for consumers and businesses, affecting mortgage payments, personal loans, and business investments.

- Effect on Business Investment: Higher borrowing costs can discourage business investment, potentially slowing economic expansion.

- Potential Consequences for the Housing Market: Higher interest rates typically lead to a cooling effect on the housing market, impacting housing prices and affordability.

- Impact on Different Population Segments: The effects of interest rate changes disproportionately affect lower-income households, who are more sensitive to increases in borrowing costs.

Market Predictions and Expert Opinions

Forecasts from leading economists and financial analysts vary regarding the Bank of Canada's next move. Some predict a further rate hike to combat inflation aggressively, while others suggest holding rates to avoid stifling economic growth. The uncertainty reflects the complexity of the current economic situation:

- Expert Opinions: Prominent economists offer diverse perspectives, reflecting the uncertainty surrounding the optimal monetary policy response.

- Market Predictions: Market analysts have produced a range of predictions, reflecting the difficulty in forecasting the Bank's response to current economic data.

- Uncertainty: The substantial uncertainty surrounding the decision underscores the challenges policymakers face in navigating the current economic environment.

Conclusion

The recent surge in increased retail sales presents a significant challenge for the Bank of Canada as it weighs the risks of inflation against the risks of slowing economic growth. While the strong consumer spending suggests a robust economy, the elevated inflation rate demands a careful and considered response. Diverse expert opinions and market predictions highlight the complexity of the situation and the uncertainty surrounding the Bank's next decision regarding interest rates. Understanding the interplay between increased retail sales and the Bank of Canada's monetary policy is crucial for both businesses and consumers.

Call to Action: Stay informed about the Bank of Canada's announcements regarding interest rates and their implications for the Canadian economy. Conduct further research into the impact of increased retail sales and the Bank of Canada's monetary policy on your personal finances and investment strategies. Understanding this dynamic relationship is vital for navigating the evolving economic landscape.

Featured Posts

-

Onlayn Vestnik Struma Lagard Preduprezhdava Za Globalni Trgovski Konflikti I Zaplakhata Za Evropa

May 27, 2025

Onlayn Vestnik Struma Lagard Preduprezhdava Za Globalni Trgovski Konflikti I Zaplakhata Za Evropa

May 27, 2025 -

Coachella After Party Megan Thee Stallion And Justin Bieber Spotted Together

May 27, 2025

Coachella After Party Megan Thee Stallion And Justin Bieber Spotted Together

May 27, 2025 -

Addressing The Housing Crisis Gregor Robertsons Strategy For Affordability

May 27, 2025

Addressing The Housing Crisis Gregor Robertsons Strategy For Affordability

May 27, 2025 -

Koalitsiya Reb 11 Stran Obyedinilis Dlya Pomoschi Ukraine

May 27, 2025

Koalitsiya Reb 11 Stran Obyedinilis Dlya Pomoschi Ukraine

May 27, 2025 -

The Price Of Perfection How To Determine Your Watch Budget

May 27, 2025

The Price Of Perfection How To Determine Your Watch Budget

May 27, 2025

Latest Posts

-

Podcast Integrale Europe 1 Soir 19 Mars 2025

May 30, 2025

Podcast Integrale Europe 1 Soir 19 Mars 2025

May 30, 2025 -

L Integrale De L Emission Europe 1 Soir 19 03 2025

May 30, 2025

L Integrale De L Emission Europe 1 Soir 19 03 2025

May 30, 2025 -

Marine Le Pen Et La Presidentielle 2027 Un Possible Empechement Selon Jacobelli

May 30, 2025

Marine Le Pen Et La Presidentielle 2027 Un Possible Empechement Selon Jacobelli

May 30, 2025 -

Reecouter L Integrale D Europe 1 Soir Du 19 Mars 2025

May 30, 2025

Reecouter L Integrale D Europe 1 Soir Du 19 Mars 2025

May 30, 2025 -

Exclusion De Marine Le Pen En 2027 Jacobelli Repond A Hanouna

May 30, 2025

Exclusion De Marine Le Pen En 2027 Jacobelli Repond A Hanouna

May 30, 2025