Increased Share Value: Berkshire's Long-Term Hold In Japanese Trading Companies

Table of Contents

Understanding Berkshire Hathaway's Investment Strategy

Berkshire Hathaway's success stems from a deeply ingrained philosophy of value investing, a strategy famously championed by Warren Buffett.

The Principles of Value Investing

Warren Buffett's value investing approach focuses on identifying undervalued assets with strong fundamentals and holding them for the long term, rather than engaging in short-term speculation. This patient strategy prioritizes:

- Long-term growth potential: Value investors seek companies with a clear path to sustained revenue and earnings growth, demonstrating resilience across economic cycles.

- Strong management teams: Identifying capable and ethical management is crucial. A competent leadership team is essential for navigating challenges and executing long-term strategies.

- Understanding company financials: Thorough due diligence, including a comprehensive analysis of financial statements, is paramount to identifying undervalued companies with healthy balance sheets and robust cash flow.

- Contrarian thinking: Value investors often invest in companies that are temporarily out of favor in the market, recognizing that their intrinsic value may be significantly higher than their current market price. This contrasts sharply with the short-term, often speculative trading strategies that dominate some segments of the stock market.

Why Japanese Trading Companies?

Berkshire Hathaway's selection of these specific Japanese trading companies wasn't arbitrary. Several factors contributed to this strategic decision:

- Established market positions: These companies hold dominant positions in their respective markets, giving them significant competitive advantages and providing a stable foundation for long-term growth.

- Diversified businesses: Their broad business portfolios, spanning various industries and geographies, mitigate risk and offer multiple avenues for growth. This diversification is highly attractive to a value investor.

- Resilience: These companies have proven remarkably resilient over time, demonstrating the ability to navigate economic downturns and adapt to changing market conditions.

- Undervalued assets: At the time of investment, Berkshire Hathaway identified these companies as undervalued relative to their intrinsic value and future growth potential, a cornerstone of value investing.

- Portfolio diversification: For Berkshire Hathaway, the investment in Japanese trading companies also provided significant geographical diversification to their existing portfolio.

The Impact of Berkshire's Long-Term Hold

Berkshire Hathaway's long-term investment has yielded significant positive outcomes, both for the companies themselves and the broader market.

Increased Share Value and Market Confidence

Since Berkshire's investment, the share value of these Japanese trading companies has experienced a considerable increase. This demonstrates the tangible impact of a long-term, value-driven approach:

- Specific examples: (Insert specific examples of share price increases for each company, citing reliable sources). This demonstrates a clear return on investment for Berkshire and reinforces the strategy’s validity.

- Increased investor confidence: Berkshire Hathaway's investment acted as a powerful endorsement, boosting investor confidence and attracting significant capital inflows into these companies.

- Improved market perception: The investment enhanced the market's perception of these Japanese trading companies, solidifying their reputations as stable, reliable, and profitable enterprises.

Strategic Partnerships and Synergies

The investment also opens doors for potential strategic partnerships and synergies between Berkshire Hathaway and the Japanese trading companies. These collaborations could involve:

- Supply chain optimization: Leveraging Berkshire's vast network and expertise to optimize supply chains for the Japanese trading companies.

- Global expansion: Facilitating the global expansion of these companies into new markets, leveraging Berkshire's international reach and resources.

- Access to new markets: Opening doors to new business opportunities and partnerships for both parties, fostering mutual growth and expansion.

Lessons Learned for Investors

Berkshire Hathaway's Japanese investment offers several crucial lessons for investors of all levels.

The Power of Patience and Long-Term Vision

This investment underscores the critical importance of patience and a long-term perspective in investing:

- Resisting market volatility: The strategy highlights the need to resist the temptation to react emotionally to short-term market fluctuations.

- Focus on fundamental analysis: The success rests on thorough due diligence and a focus on understanding the underlying fundamentals of the companies being invested in.

- Importance of due diligence: This investment strategy emphasizes the critical need for rigorous research, understanding the company's business model, and assessing its financial health.

Diversification and Risk Management

Berkshire Hathaway's investment strategy showcases the benefits of diversification and its crucial role in risk management:

- Reducing portfolio risk: Investing in established, diversified companies like these Japanese trading giants helps mitigate overall portfolio risk.

- Geographical diversification: The investment provided Berkshire with valuable geographical diversification, reducing reliance on any single market.

Conclusion

Berkshire Hathaway's investment in Japanese trading companies serves as a compelling example of the power of long-term value investing. The significant increase in share value since the investment underscores the benefits of a patient, research-driven approach, focusing on fundamental analysis and diversification. This strategy demonstrates that sustained success in investing often requires a long-term perspective, resisting the allure of short-term gains in favor of building wealth through carefully chosen, high-quality assets.

Explore the potential for increased share value in your own portfolio by adopting a long-term investment strategy. Further research into value investing principles and the global market landscape, including the Japanese market, can significantly enhance your investment decisions.

Featured Posts

-

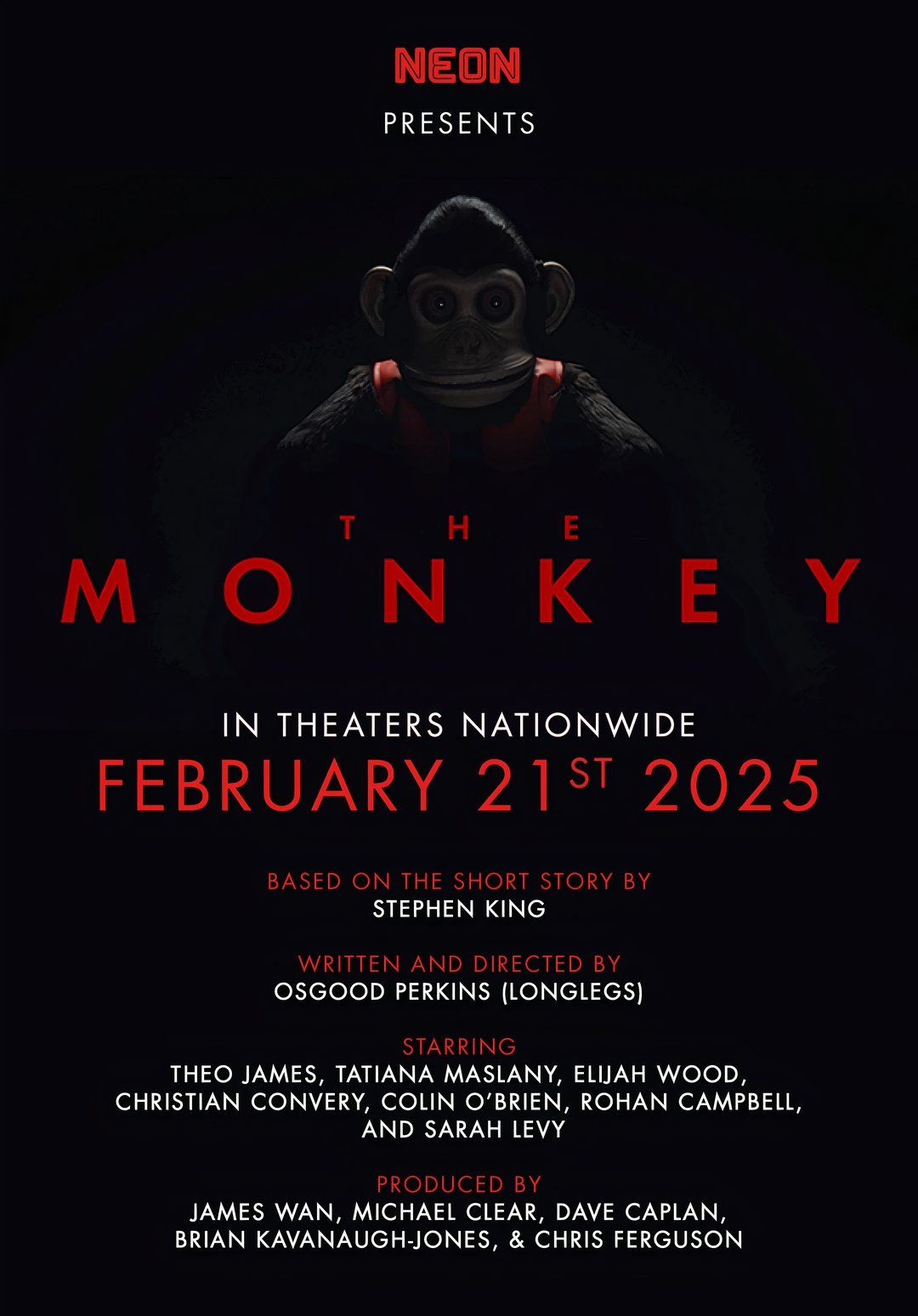

2025 Will The Monkey Be Stephen Kings Worst Movie Adaptation

May 08, 2025

2025 Will The Monkey Be Stephen Kings Worst Movie Adaptation

May 08, 2025 -

Neymar Te Psg Ceku Ishte Ne Arabisht Thote Agjenti

May 08, 2025

Neymar Te Psg Ceku Ishte Ne Arabisht Thote Agjenti

May 08, 2025 -

The Importance Of Trustworthy Crypto News Sources In A Volatile Market

May 08, 2025

The Importance Of Trustworthy Crypto News Sources In A Volatile Market

May 08, 2025 -

Fia Nets Four Additional Human Smugglers In Latest Operation

May 08, 2025

Fia Nets Four Additional Human Smugglers In Latest Operation

May 08, 2025 -

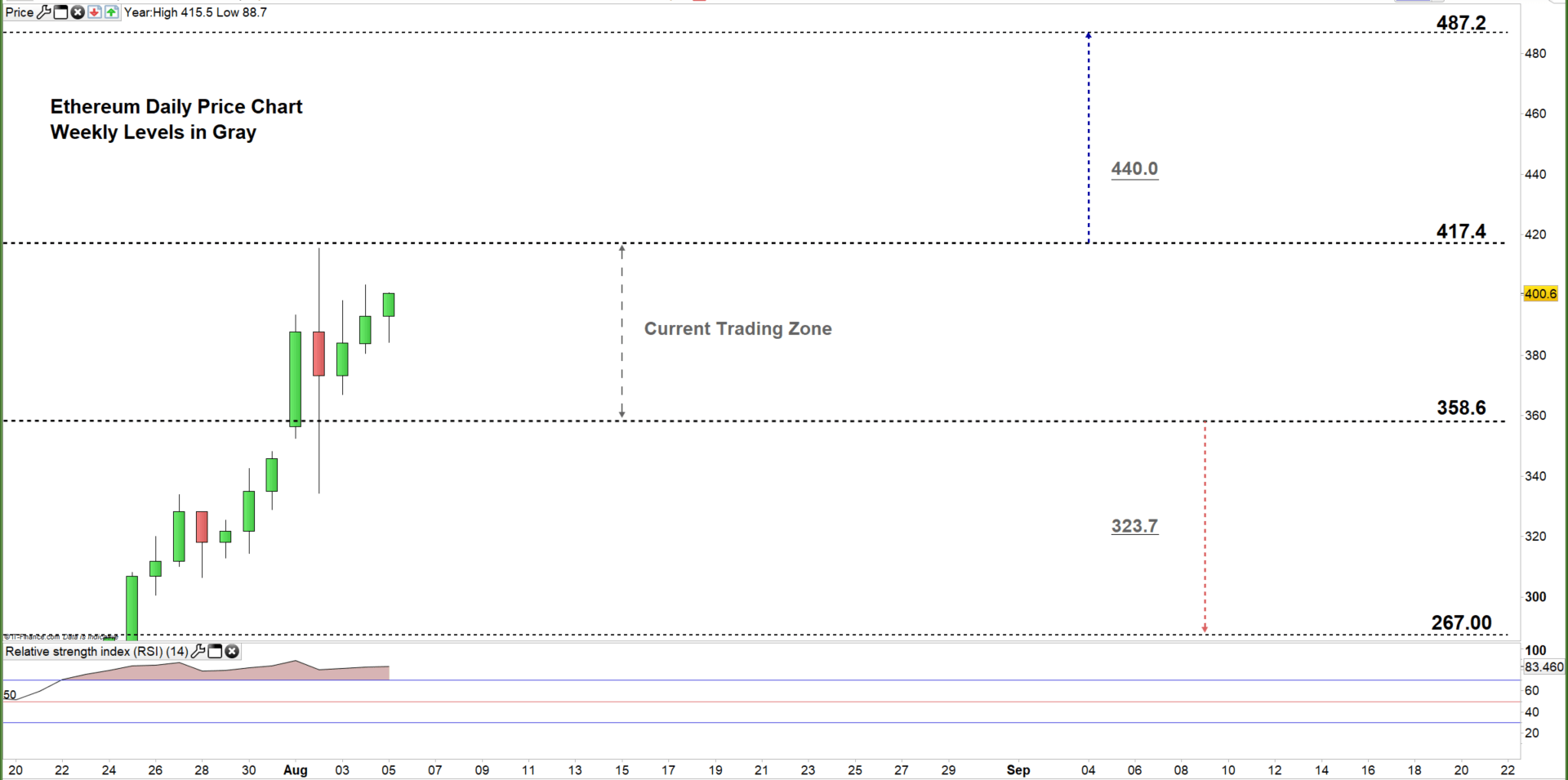

Ethereum Price Forecast Conquering Resistance Towards 2 000

May 08, 2025

Ethereum Price Forecast Conquering Resistance Towards 2 000

May 08, 2025