Increased Taxes On Ivy League Endowments: The Harvard And Yale Case

Table of Contents

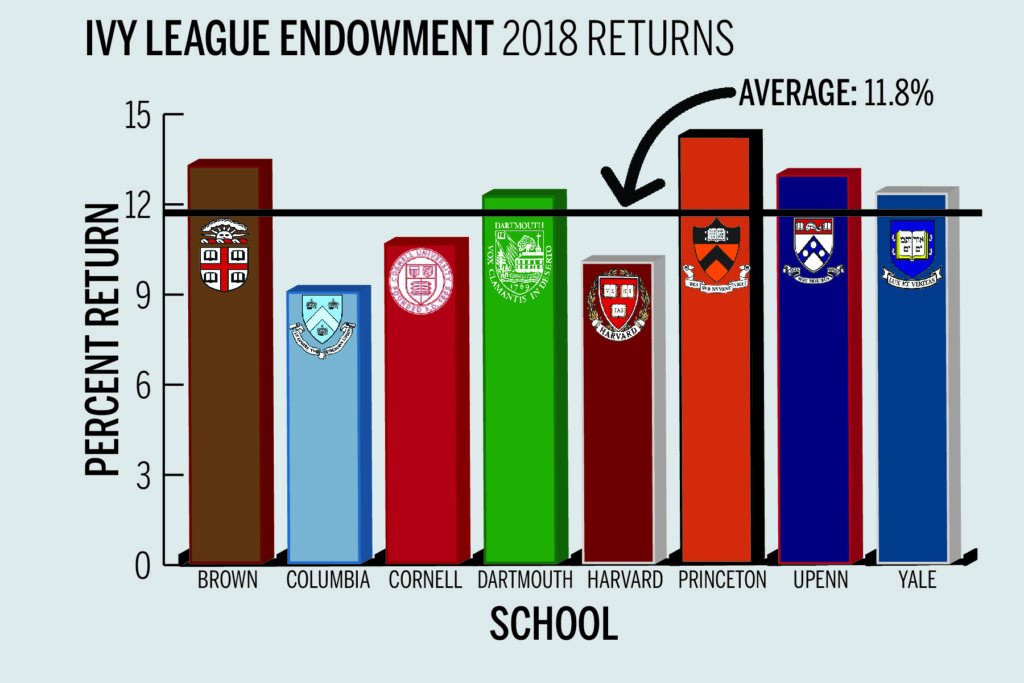

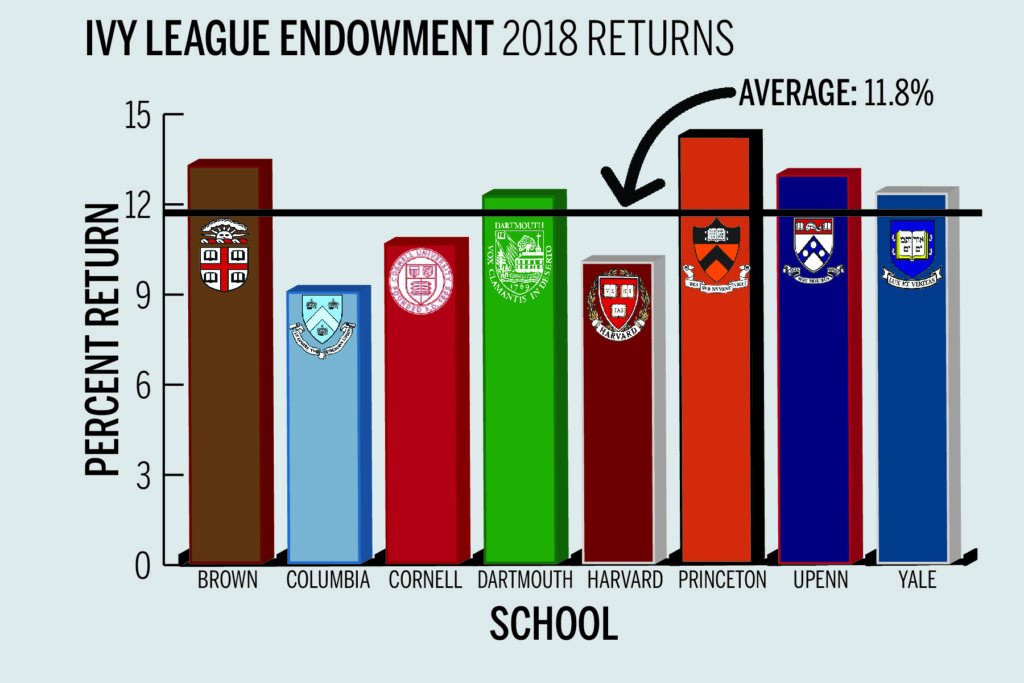

The Scale of Ivy League Endowments

The sheer size of Harvard and Yale's endowments is staggering. These endowments represent billions of dollars accumulated over centuries, fueled by donations, investments, and the universities' own success. Understanding the scale of these resources is crucial to evaluating the arguments for and against increased taxation.

How do these endowments compare to other universities? The disparity is significant. While many state universities struggle with funding, Ivy League institutions enjoy financial reserves that dwarf those of their peers. This wealth disparity fuels the debate about equitable distribution of resources.

- Harvard Endowment (2023): Approximately $53.2 billion (Source: Harvard University)

- Yale Endowment (2023): Approximately $42.3 billion (Source: Yale University)

- Comparison: These figures dwarf the endowments of most public universities, highlighting the significant financial advantage enjoyed by Ivy League institutions. Many state universities operate with significantly smaller budgets, relying heavily on public funding and tuition revenue.

Arguments for Increased Taxes on Ivy League Endowments

Proponents of increased taxes on Ivy League endowments argue that these institutions have a social responsibility to utilize their vast wealth to address critical societal problems. The argument centers on the idea that such substantial financial resources could be better used to alleviate student debt, reduce income inequality, and improve access to higher education for students from disadvantaged backgrounds.

Furthermore, the progressive taxation principle suggests that institutions with substantial wealth should contribute proportionally more to the public good. This argument is particularly compelling in light of the rising cost of higher education and the growing burden of student loan debt on many Americans.

- Potential Uses for Increased Tax Revenue:

- Increased financial aid for low-income students.

- Investment in affordable housing initiatives.

- Funding for research focused on societal challenges like climate change and healthcare.

- Statistics: The student loan debt crisis in the US is well-documented, with millions of Americans burdened by significant debt. Simultaneously, income inequality continues to widen, creating a significant barrier to higher education access for many.

Counterarguments and Rebuttals: Some argue that endowments are crucial for ongoing university operations and research. However, counterarguments emphasize that taxing a portion of these massive endowments wouldn’t necessarily cripple the institutions; instead, it could provide substantial funding for critical social programs while still leaving significant resources for university functions.

Arguments Against Increased Taxes on Ivy League Endowments

Opponents of increased taxes on Ivy League endowments emphasize the vital role these funds play in supporting critical university functions. Endowments are crucial for funding research initiatives, providing financial aid to students, and maintaining university infrastructure. Taxing these endowments, they argue, could severely hamper these essential functions.

Furthermore, there are concerns about setting a precedent for taxing non-profit organizations. If Ivy League endowments are taxed, it could open the door to similar taxes on other non-profits, potentially impacting charitable giving and the overall philanthropic landscape.

- Endowment-Funded Initiatives: Ivy League endowments support groundbreaking research in various fields, from medicine and engineering to the humanities and social sciences. Financial aid programs, which are often heavily reliant on endowment income, are another key area of concern.

- Negative Consequences: Reduced endowment funding could lead to cuts in financial aid, reduced research opportunities, and deferred maintenance on university facilities.

Legal and Political Challenges of Implementing Increased Taxes

Taxing non-profit endowments presents significant legal complexities. The legal framework governing non-profit organizations and their tax-exempt status would need careful consideration. The universities themselves might challenge any such legislation through legal means.

Politically, passing legislation regarding increased taxes on Ivy League endowments would face strong opposition. Universities are powerful lobbying forces, and they would likely mobilize significant resources to fight any such initiative.

- Legal Precedents: There’s limited legal precedent for taxing non-profit endowments on this scale. Any legislation would need to navigate existing legal frameworks and potentially establish new precedents.

- Political Considerations: The political landscape is likely to be contentious, with debates focusing on fairness, economic impact, and the role of government in regulating higher education.

The Harvard and Yale Case Studies

Increased taxes on Ivy League endowments would significantly affect Harvard and Yale. Specific programs funded by endowments, such as research grants, scholarships, and infrastructure improvements, would be directly impacted. The unique circumstances of each institution would influence the precise effects of such a tax.

For example, Harvard's extensive research enterprise relies heavily on endowment funds, while Yale's robust financial aid program is also significantly reliant on endowment income. Analyzing these specific dependencies is crucial in assessing the potential ramifications of taxation.

- Harvard Specifics: Harvard’s endowment funds numerous research labs, professorships, and student support programs. A tax could curtail these activities.

- Yale Specifics: Yale's large financial aid program directly benefits thousands of students. Funding cuts would disproportionately impact low-income students.

Conclusion

The debate surrounding increased taxes on Ivy League endowments is multifaceted and complex. While the vast wealth held by institutions like Harvard and Yale presents a compelling case for increased contribution to societal needs, significant legal and practical challenges exist. The potential impact on research, financial aid, and university operations is substantial, requiring careful consideration of both the potential benefits and drawbacks. The Harvard and Yale case studies highlight the complexities involved in balancing societal concerns with the financial needs of these institutions. Further research and public discourse are essential to find a balanced solution. The conversation about increased taxes on Ivy League endowments must continue, leading to the exploration of alternative and innovative policy solutions that address both wealth inequality and access to education.

Featured Posts

-

Izleze Prvata Kniga So Zbirka Romski Ba Ki

May 13, 2025

Izleze Prvata Kniga So Zbirka Romski Ba Ki

May 13, 2025 -

Syn Tatyany Kadyshevoy I Skandal S Lisheniem Roditelskikh Prav Chto Proizoshlo

May 13, 2025

Syn Tatyany Kadyshevoy I Skandal S Lisheniem Roditelskikh Prav Chto Proizoshlo

May 13, 2025 -

Guilty Plea Lab Owner Faked Covid Test Results During Pandemic

May 13, 2025

Guilty Plea Lab Owner Faked Covid Test Results During Pandemic

May 13, 2025 -

Kemenangan Telak Persipura Jayapura Atas Rans Fc Di Playoff Liga 2 8 0

May 13, 2025

Kemenangan Telak Persipura Jayapura Atas Rans Fc Di Playoff Liga 2 8 0

May 13, 2025 -

Record Heat Sweeps Through La And Orange Counties Impacts And Responses To Extreme Temperatures

May 13, 2025

Record Heat Sweeps Through La And Orange Counties Impacts And Responses To Extreme Temperatures

May 13, 2025

Latest Posts

-

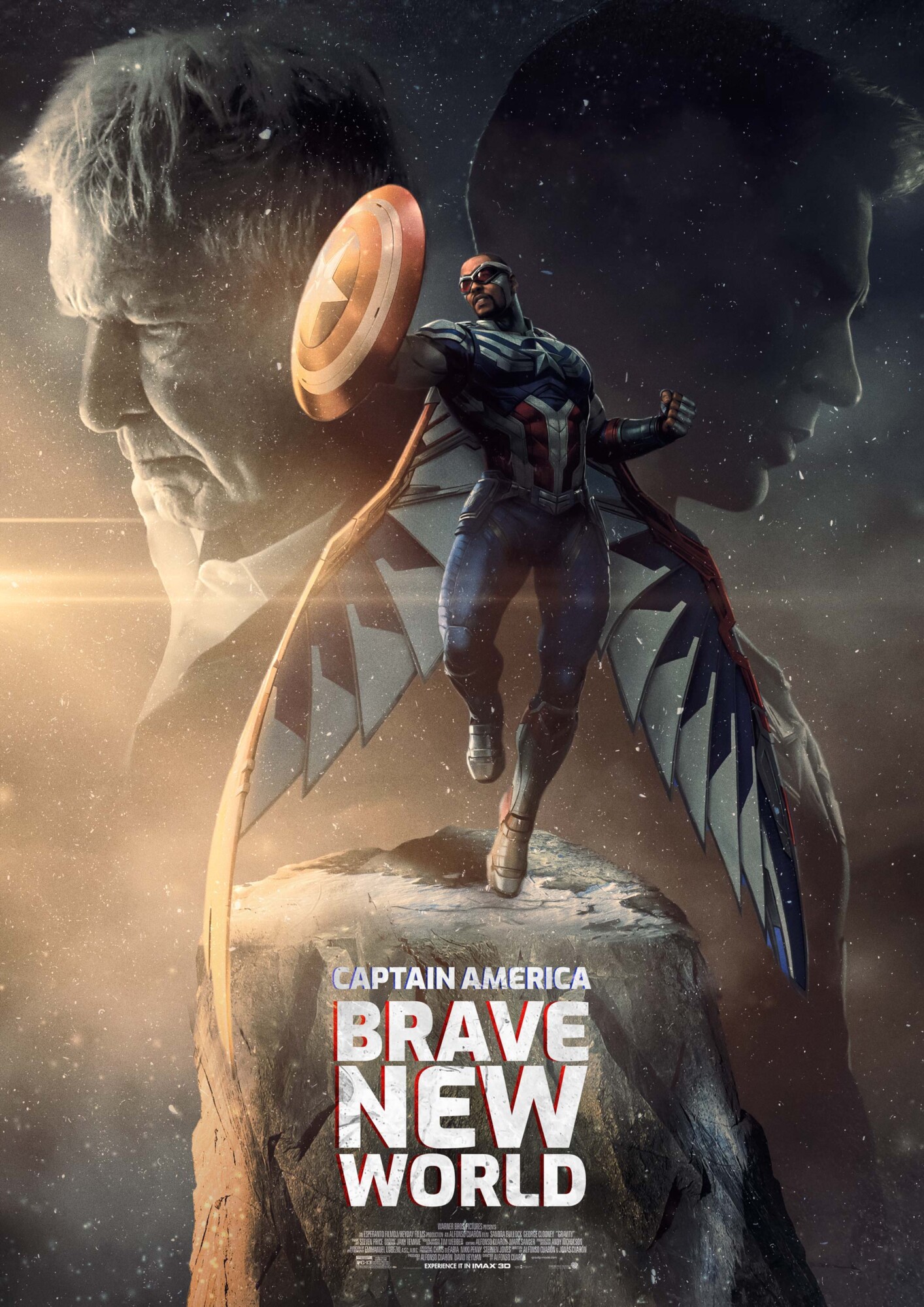

Captain America Brave New World Pvod Streaming Options A Guide

May 14, 2025

Captain America Brave New World Pvod Streaming Options A Guide

May 14, 2025 -

Where And When To Watch Captain America Brave New World On Disney

May 14, 2025

Where And When To Watch Captain America Brave New World On Disney

May 14, 2025 -

Adorable Video Scotty Mc Creerys Son Pays Homage To George Strait

May 14, 2025

Adorable Video Scotty Mc Creerys Son Pays Homage To George Strait

May 14, 2025 -

Captain America Brave New World Disney Streaming Premiere Date

May 14, 2025

Captain America Brave New World Disney Streaming Premiere Date

May 14, 2025 -

Captain America Brave New World Digital Release And Disney Streaming Details

May 14, 2025

Captain America Brave New World Digital Release And Disney Streaming Details

May 14, 2025