India Real Estate Investment: A 47% Quarter-on-Quarter Increase

Table of Contents

Factors Driving the Surge in India Real Estate Investment

Several converging factors have contributed to the explosive growth in India real estate investment. Understanding these drivers is crucial to assessing the long-term prospects of the market.

Economic Growth and Increased Disposable Income

India's robust economic growth directly correlates with a rise in disposable income. This increased purchasing power fuels demand, particularly within the middle class, which is expanding rapidly. A positive economic outlook further bolsters investor confidence, leading to increased investment in India real estate.

- Increased purchasing power: Higher salaries and improved economic conditions enable more individuals to afford homes and invest in property.

- Growing middle class: The expanding middle class represents a vast pool of potential homebuyers and investors, driving demand for various property types.

- Positive economic outlook: Positive forecasts for India's GDP growth inspire confidence, making real estate a desirable investment option.

The National Statistical Office's data on per capita income consistently demonstrates this upward trend, showcasing the significant increase in disposable income.

Government Initiatives and Policy Changes

The Indian government has implemented several supportive policies and initiatives to stimulate growth within the real estate sector. These measures have significantly improved ease of doing business and investor sentiment.

- Infrastructure development: Massive investments in infrastructure projects, such as improved roads, metro lines, and airports, enhance connectivity and boost property values in surrounding areas.

- Tax benefits: Various tax incentives and deductions related to home loans and property investment incentivize individuals to invest in real estate.

- Ease of doing business reforms: Streamlined regulatory processes and reduced bureaucratic hurdles make it easier for developers and investors to navigate the market.

The introduction of RERA (Real Estate (Regulation and Development) Act) has also played a significant role in increasing transparency and accountability within the sector, further boosting investor confidence.

Favorable Interest Rates and Lending Policies

Low interest rates and readily available credit have significantly fueled the surge in India real estate investment. Access to attractive home loan options makes property ownership more accessible.

- Attractive home loan options: Banks and financial institutions offer competitive interest rates and flexible repayment plans, making mortgages more affordable.

- Increased accessibility to mortgages: Relaxed lending norms and increased credit availability have made it easier for individuals to secure home loans.

The Reserve Bank of India's (RBI) monetary policy plays a crucial role in influencing interest rates and impacting the affordability of home loans, thereby directly affecting India real estate investment.

Growing Urbanization and Demand for Housing

Rapid urbanization and a burgeoning population are key drivers of the increased demand for residential and commercial properties across India.

- Migration from rural areas: People are migrating from rural areas to urban centers in search of better employment opportunities and lifestyle, driving housing demand.

- Expanding cities: Major Indian cities are experiencing rapid expansion, leading to an increased need for housing and commercial spaces.

- Increasing population density: The growing population puts pressure on existing infrastructure and necessitates the development of new residential and commercial projects.

Data from the UN's World Urbanization Prospects highlights India's rapid urbanization rate, clearly indicating the substantial increase in demand for housing and commercial spaces.

Investment Opportunities in the Indian Real Estate Market

The surge in India real estate investment presents a wide range of opportunities for investors with varying risk profiles and financial goals.

Residential Properties

Investing in residential properties offers attractive prospects, with potential for both high rental yields and significant capital appreciation. The market caters to diverse segments, offering options from affordable housing to luxury apartments.

- High rental yields: Strong rental demand across various cities ensures a steady stream of rental income.

- Capital appreciation potential: Property values are likely to appreciate over the long term, offering significant capital gains.

- Diverse locations: Opportunities exist across various cities and regions, offering diverse investment choices.

Commercial Real Estate

Commercial real estate, including office spaces and retail establishments, demonstrates strong growth potential, driven by the expanding business landscape.

- Strong demand from businesses: The growing number of businesses and corporations creates a high demand for office spaces and retail outlets.

- High rental income potential: Commercial properties often command higher rental rates compared to residential properties.

- Long-term stability: Commercial real estate investments tend to offer greater long-term stability compared to other asset classes.

Emerging Markets and Investment Hotspots

Beyond major metropolitan areas, Tier 2 and Tier 3 cities present promising emerging markets with significant growth potential, fueled by infrastructure development and rising disposable incomes.

- Tier 2 and Tier 3 cities: These cities offer relatively lower property prices and higher growth potential compared to major metropolitan areas.

- Rapidly developing regions: Regions witnessing rapid infrastructure development present attractive investment opportunities.

- Upcoming infrastructure projects: Investment near upcoming infrastructure projects often sees significant appreciation in property values.

Cities like Ahmedabad, Pune, and Hyderabad are examples of rapidly developing hubs attracting significant investment in India real estate.

Risks and Considerations for India Real Estate Investment

While the Indian real estate market offers significant opportunities, potential investors must be aware of certain risks and considerations.

Regulatory Landscape and Legal Due Diligence

Thorough due diligence and understanding the regulatory landscape are crucial to mitigating potential risks. Compliance with regulations such as RERA is essential.

- RERA compliance: Ensuring that the property complies with the Real Estate (Regulation and Development) Act is crucial to protect your investment.

- Legal documentation: Thorough scrutiny of all legal documents is vital to ensure the legitimacy of the property and the transaction.

- Property verification: Independent verification of property ownership and title is essential to avoid potential legal disputes.

Market Volatility and Potential Risks

Like any investment, the Indian real estate market is subject to certain risks, including market fluctuations and economic downturns.

- Economic downturns: Economic slowdowns can affect property prices and rental yields.

- Inflation: High inflation rates can erode the real value of your investment.

- Policy changes: Changes in government policies can impact the real estate market.

Choosing the Right Investment Strategy

Selecting the right investment strategy is crucial, considering factors like risk tolerance, financial goals, and investment horizon.

- Long-term vs. short-term investments: Long-term investments generally offer higher returns but require greater patience.

- Diversification: Diversifying investments across different property types and locations can mitigate risk.

- Professional advice: Seeking professional advice from real estate experts and financial advisors can help you make informed investment decisions.

Conclusion: Capitalize on the Booming India Real Estate Investment Market

The remarkable 47% quarter-on-quarter surge in India real estate investment underscores the market's dynamism and presents significant opportunities for investors. This growth is driven by robust economic growth, supportive government policies, favorable interest rates, and rapid urbanization. While certain risks exist, careful due diligence and a well-defined investment strategy can help you navigate the market effectively. Invest wisely in the thriving India real estate investment market and explore the potential of lucrative India real estate investment opportunities. Learn more about profitable India real estate investment opportunities today and start building your portfolio in this exciting and dynamic market.

Featured Posts

-

Cost Of Emirates Id For Newborn Babies In The Uae March 2025

May 17, 2025

Cost Of Emirates Id For Newborn Babies In The Uae March 2025

May 17, 2025 -

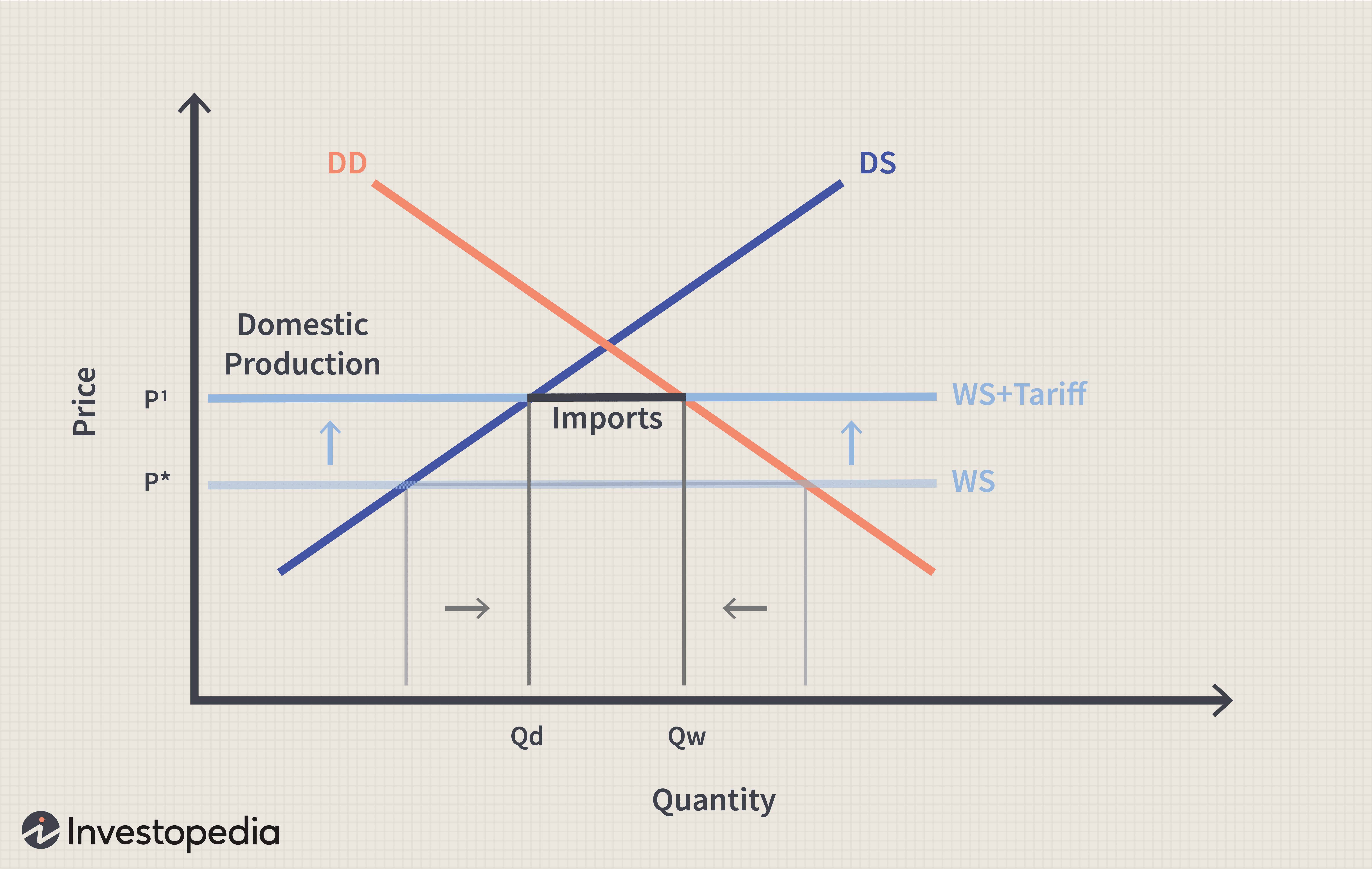

Near Zero Tariffs Canadas New Trade Policy With The Us

May 17, 2025

Near Zero Tariffs Canadas New Trade Policy With The Us

May 17, 2025 -

1 Pick

May 17, 2025

1 Pick

May 17, 2025 -

Ferrexpo I Zhevago Ugroza Prekrascheniya Investitsiy V Ukraine

May 17, 2025

Ferrexpo I Zhevago Ugroza Prekrascheniya Investitsiy V Ukraine

May 17, 2025 -

Did Lawrence O Donnell Expose Trumps Humiliation On Live Tv

May 17, 2025

Did Lawrence O Donnell Expose Trumps Humiliation On Live Tv

May 17, 2025