Indian Stock Market Update: Sensex, Nifty Performance & Key Movers

Table of Contents

Sensex and Nifty 50 Performance Analysis

Daily/Weekly/Monthly Performance

The Sensex and Nifty 50 indices have displayed mixed performance in the last month. Let's examine the recent trends:

- Daily Performance (as of October 26, 2023): (Insert actual data here – e.g., Sensex closed at 66,000, up 0.5%; Nifty 50 closed at 19,700, up 0.3%)

- Weekly Performance: (Insert actual data here – e.g., Sensex up 1.2%; Nifty 50 up 0.8%)

- Monthly Performance: (Insert actual data here – e.g., Sensex up 2.5%; Nifty 50 up 2%)

The indices reached a significant high of (Insert actual data) on (Insert date), before a slight correction. This fluctuation reflects the dynamic nature of the Indian stock market. A visual representation of this performance is provided below: (Insert chart here showing Sensex and Nifty 50 performance over the specified period)

Factors Influencing Performance

Several factors contributed to the recent performance of the market indices:

- Global Economic Slowdown: Concerns regarding a global recession and rising interest rates in the US impacted investor sentiment.

- Domestic Inflation: Persistent inflationary pressures in India continue to affect consumer spending and corporate profits.

- Geopolitical Uncertainty: Global geopolitical tensions added to market volatility.

- Strong Rupee: A relatively strong Indian Rupee against the US dollar provided some support to the market.

- Positive Sectoral Trends: Strong performance in specific sectors like IT and pharmaceuticals partially offset the negative impact of other factors.

Key Movers in the Indian Stock Market

Top Gainers and Losers

The following table highlights the top-performing and underperforming stocks across different market capitalizations:

| Stock | Sector | Change (%) | Market Cap |

|---|---|---|---|

| RELIANCE.NS | Energy | +3.0 | Large-cap |

| TCS.NS | IT | +2.5 | Large-cap |

| (Add more data) | |||

| (Add more data) |

Note: Percentage changes and market capitalization are illustrative examples and should be replaced with actual data. The strong performance of Reliance Industries reflects positive investor sentiment towards the energy sector. Conversely, the underperformance in certain sectors might be attributed to specific company-related news or broader market trends.

Sectoral Performance

A sectoral analysis reveals a mixed bag:

(Insert bar chart here showing the performance of various sectors like banking, IT, pharma, auto, etc.)

The IT sector continues to be a strong performer, driven by robust global demand. The banking sector showed moderate growth, while the auto sector faced some headwinds due to rising input costs. The pharmaceutical sector displayed a mixed performance, reflecting the varying fortunes of individual companies within the sector.

Investor Sentiment and Outlook

Analyst Predictions

Financial analysts offer mixed predictions for the near future. Some believe that the market has factored in much of the negative news and is poised for further growth, while others remain cautious, citing ongoing global uncertainties.

- "We expect the Indian market to remain volatile in the short term, but the long-term outlook remains positive," says (Name of analyst and source).

- "Inflationary pressures and global economic slowdown pose risks, but the strong domestic fundamentals offer support," notes (Name of analyst and source).

Trading Volume and Volatility

Trading volume has been relatively high recently, suggesting increased investor activity. However, market volatility remains elevated, reflecting the uncertainty in the global and domestic economic environment. (Insert data on trading volume and volatility indices here.) This high volatility underscores the need for careful risk management for investors.

Conclusion

The Indian stock market, as represented by the Sensex and Nifty 50 indices, has shown mixed performance recently. Global economic concerns, domestic inflation, and geopolitical uncertainties have impacted investor sentiment. However, strong sectoral performances and a positive long-term outlook offer some support. Key movers across various sectors displayed varying degrees of success. Staying informed about these market fluctuations and analyst predictions is crucial for all investors.

To stay updated on the latest developments in the Indian stock market, including regular analysis of Sensex and Nifty 50 performance and key movers, regularly check our website/platform for insightful Indian stock market news and analysis. Subscribe to our newsletter or follow us on social media for timely updates on the Indian stock market.

Featured Posts

-

Sharing Your Story How Trumps Executive Orders Affected Transgender Lives

May 10, 2025

Sharing Your Story How Trumps Executive Orders Affected Transgender Lives

May 10, 2025 -

Jogsertes Transznemu No Letartoztatasa Floridaban Noi Mosdo Miatt

May 10, 2025

Jogsertes Transznemu No Letartoztatasa Floridaban Noi Mosdo Miatt

May 10, 2025 -

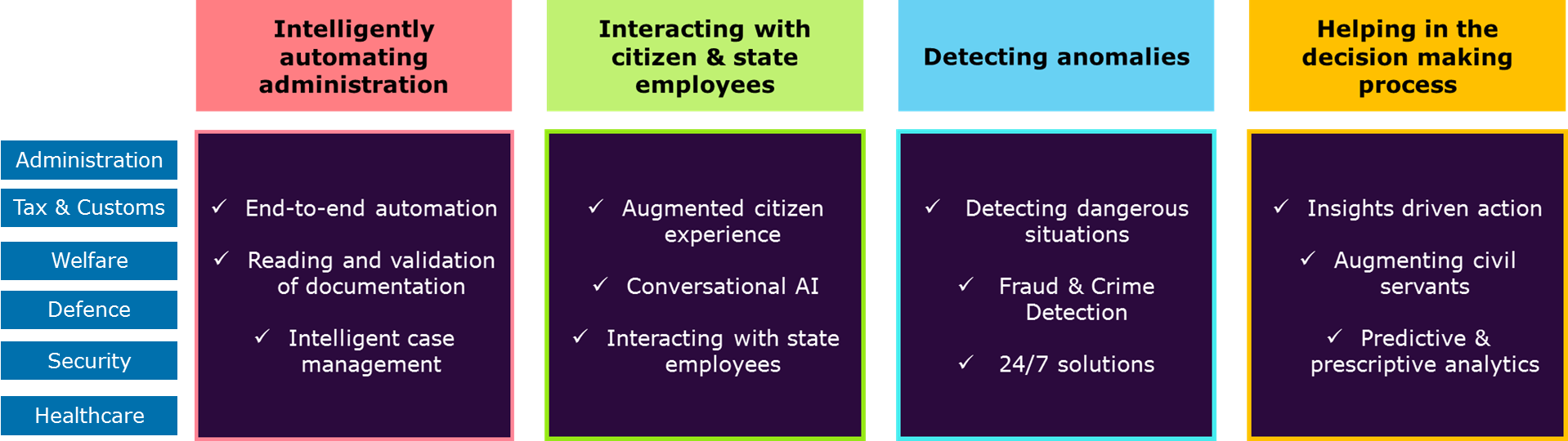

Public Sector Ai Revolution Understanding Palantirs Nato Deal

May 10, 2025

Public Sector Ai Revolution Understanding Palantirs Nato Deal

May 10, 2025 -

Chto Izmenitsya Dlya Ukrainy Posle Podpisaniya Soglasheniya Makrona I Tuska

May 10, 2025

Chto Izmenitsya Dlya Ukrainy Posle Podpisaniya Soglasheniya Makrona I Tuska

May 10, 2025 -

Discover The Elizabeth Stewart And Lilysilk Spring Capsule Collection

May 10, 2025

Discover The Elizabeth Stewart And Lilysilk Spring Capsule Collection

May 10, 2025