Infineon (IFX): Lower Sales Projections Due To Tariff Uncertainty

Table of Contents

H2: Infineon's Revised Sales Outlook

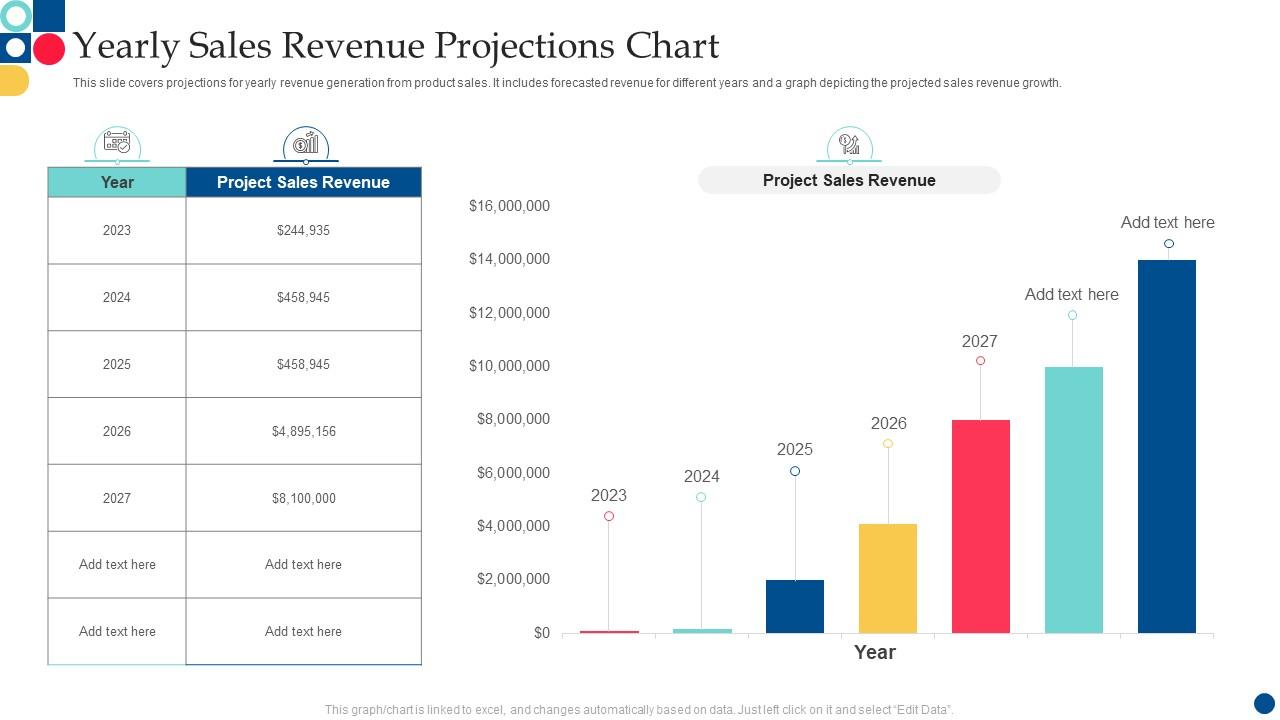

Infineon's revised sales forecast represents a considerable downturn in their previously anticipated revenue. The company announced a [Insert Percentage]% reduction in its sales projections for [Specify Time Period – e.g., the current quarter, fiscal year 2024]. This downward revision is a significant development, impacting investor confidence and prompting a closer examination of the company's financial performance.

- Source: [Insert link to official press release or financial report].

- Impacted Segments: The reduced projections primarily affect the [List affected segments, e.g., automotive, industrial power control, and communications segments]. The automotive sector, a key market for Infineon, appears to be particularly vulnerable to the current economic slowdown and supply chain disruptions.

- Reasons Cited: Infineon attributed the lower projections to a combination of factors, including weaker-than-expected demand in key markets, ongoing supply chain constraints stemming from geopolitical instability, and increased uncertainty relating to global trade policies.

H2: The Impact of Tariff Uncertainty on Infineon

The ongoing US-China trade war and the resulting tariff uncertainty are major contributors to Infineon's reduced sales outlook. The imposition of tariffs on semiconductors significantly increases the cost of Infineon's products, reducing their competitiveness in the global market. This directly impacts profitability and ultimately, sales projections.

- Specific Tariffs: [Specify the specific tariffs affecting Infineon's products and operations – e.g., tariffs on specific semiconductor components imported from China].

- Increased Costs & Reduced Competitiveness: These tariffs increase production costs, forcing Infineon to either absorb these higher costs, impacting profit margins, or pass them on to customers, potentially affecting demand. The increased costs significantly impact their ability to compete effectively with manufacturers in regions with lower tariff burdens.

- Supply Chain Disruption: Infineon's extensive global supply chain is particularly vulnerable to trade disputes. Tariffs and trade restrictions disrupt the seamless flow of components and materials, leading to production delays and impacting the company's ability to meet customer demand.

H2: Analysis of the Risk to Investors

The lower sales projections and the persistent uncertainty surrounding global trade have significant implications for investors holding IFX stock. The reduced revenue forecast is likely to negatively impact the company’s stock price in the short term. The overall market volatility further exacerbates the situation.

- Short-Term Effects: Expect potential short-term volatility in IFX's stock price as investors react to the revised sales outlook. The immediate impact could lead to price declines.

- Long-Term Effects: The long-term impact depends on several factors including the resolution of trade disputes, the company’s ability to adapt to changing market conditions, and overall global economic growth.

- Risk Assessment: Infineon's risk profile has increased due to the dependence on global trade and its exposure to tariff-related uncertainties. Investors should carefully assess this risk in the context of their overall portfolio. Consider whether your risk tolerance is appropriate for holding IFX given this new information.

H3: Alternative Investment Strategies

Given the heightened risk associated with tariff uncertainty in the semiconductor sector, investors may consider alternative strategies to mitigate potential losses.

- Diversification: Diversifying investments across different sectors reduces reliance on any single industry, mitigating risk exposure to tariff-related impacts on the semiconductor industry.

- Alternative Semiconductor Companies: Explore semiconductor companies with less exposure to the US-China trade war and lower dependence on global trade.

- Hedging Strategies: Consult with a financial advisor to explore hedging strategies to potentially offset losses related to IFX stock price fluctuations.

3. Conclusion:

Infineon's lowered sales projections underscore the significant impact of tariff uncertainty on the semiconductor industry. This uncertainty poses substantial risks for investors holding IFX stock. The combination of weaker demand, supply chain disruptions, and increased costs directly attributed to tariffs creates a challenging environment. Before making any investment decisions regarding Infineon (IFX), conduct thorough research, carefully assess your risk tolerance, and stay informed about developments in the ongoing trade disputes and their effects on the semiconductor industry. Refer to reputable financial news sources and Infineon's investor relations page for the latest updates. Remember to consult a financial advisor before making any significant investment decisions.

Featured Posts

-

Trump And Britain On The Brink Of A New Trade Agreement

May 09, 2025

Trump And Britain On The Brink Of A New Trade Agreement

May 09, 2025 -

Policia Prende Mulher Que Afirma Ser Madeleine Mc Cann No Reino Unido

May 09, 2025

Policia Prende Mulher Que Afirma Ser Madeleine Mc Cann No Reino Unido

May 09, 2025 -

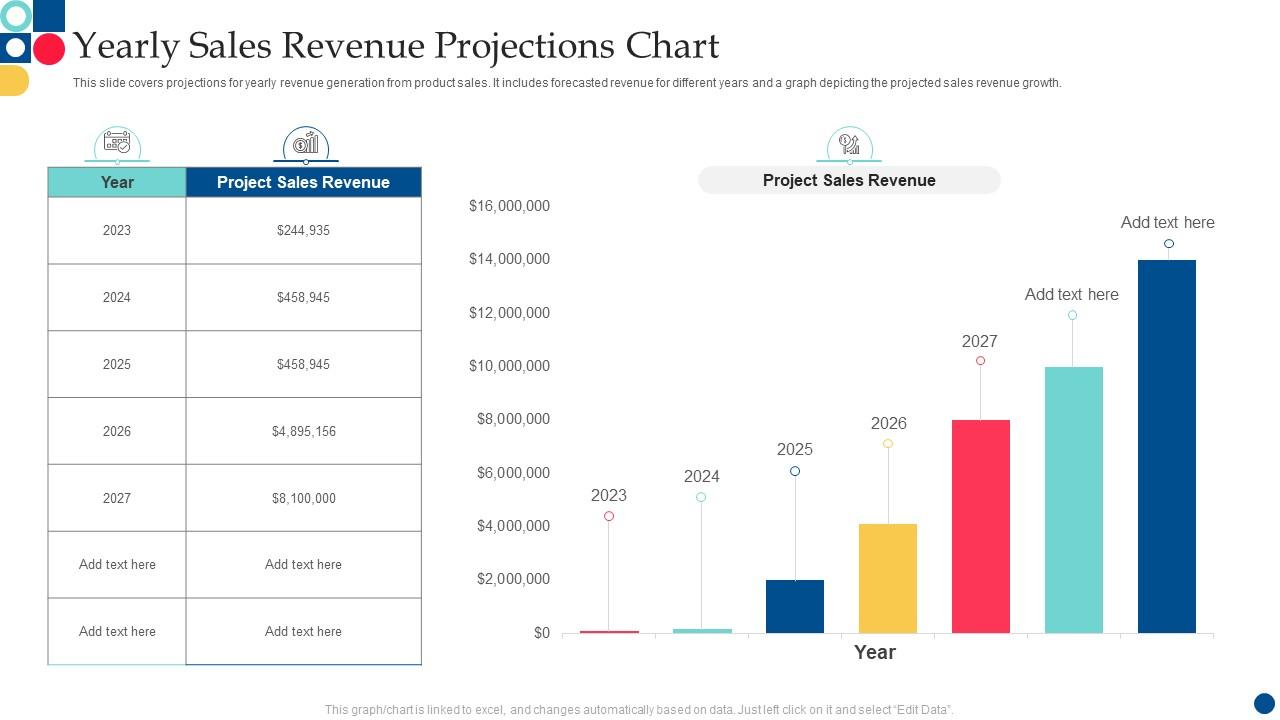

Leon Draisaitl Injury Update Oilers Star Expected Back For Playoffs

May 09, 2025

Leon Draisaitl Injury Update Oilers Star Expected Back For Playoffs

May 09, 2025 -

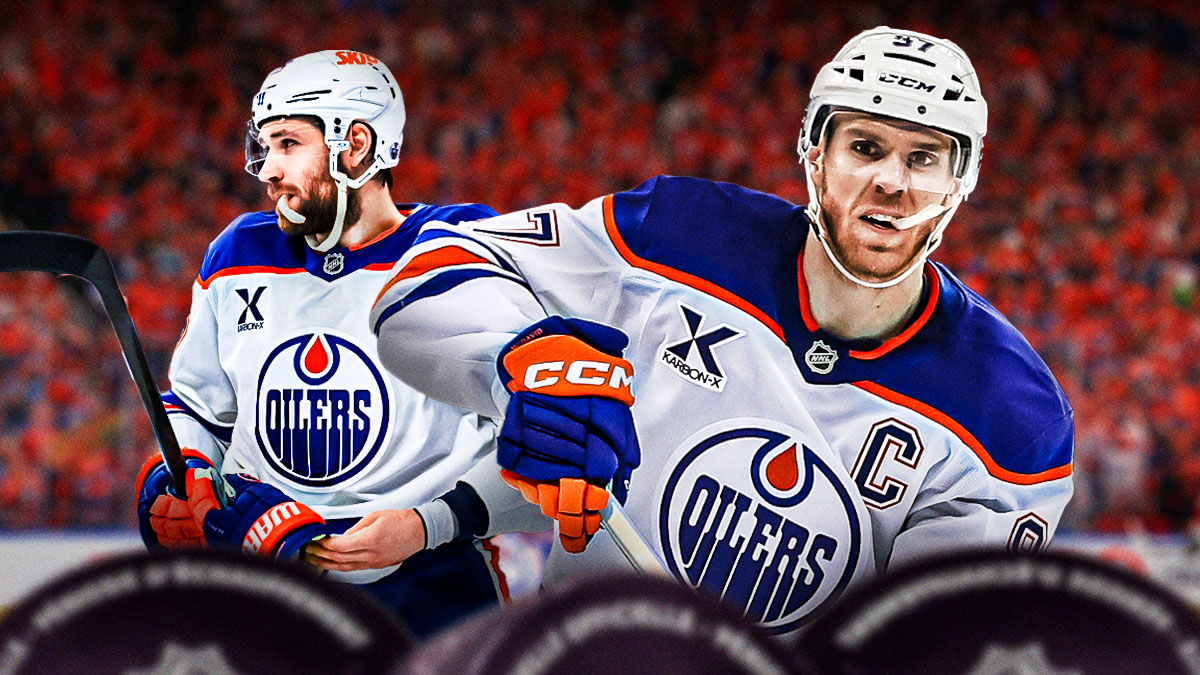

Updated Uk Visa Application Process Nationality Based Restrictions

May 09, 2025

Updated Uk Visa Application Process Nationality Based Restrictions

May 09, 2025 -

Whats App Spyware Case Metas Financial Hit And Ongoing Legal Battles

May 09, 2025

Whats App Spyware Case Metas Financial Hit And Ongoing Legal Battles

May 09, 2025