ING 2024 Annual Report (Form 20-F): Key Highlights And Financial Data

Table of Contents

The ING 2024 Annual Report (Form 20-F) provides a comprehensive overview of the company's financial performance for the year. This analysis will dissect the key highlights and financial data, providing investors and stakeholders with a clear understanding of ING's position and future trajectory. We'll examine key metrics, growth areas, and potential challenges highlighted in the report. This deep dive into the ING 2024 financials will offer valuable insights for anyone interested in the performance of this global financial institution.

ING's 2024 Financial Performance: A Deep Dive

ING Revenue and Net Income:

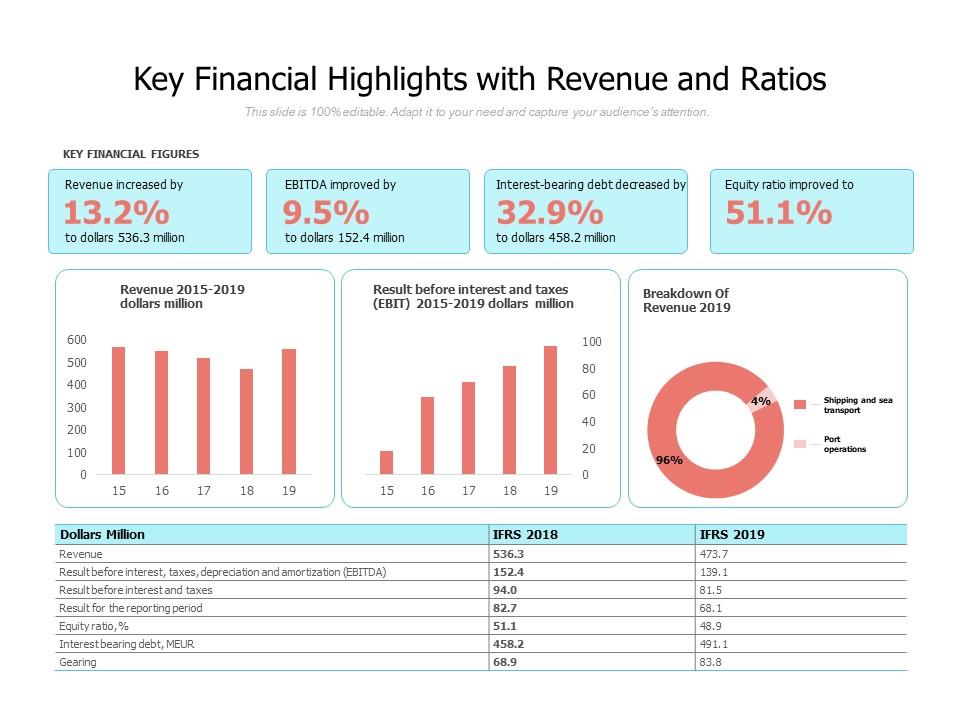

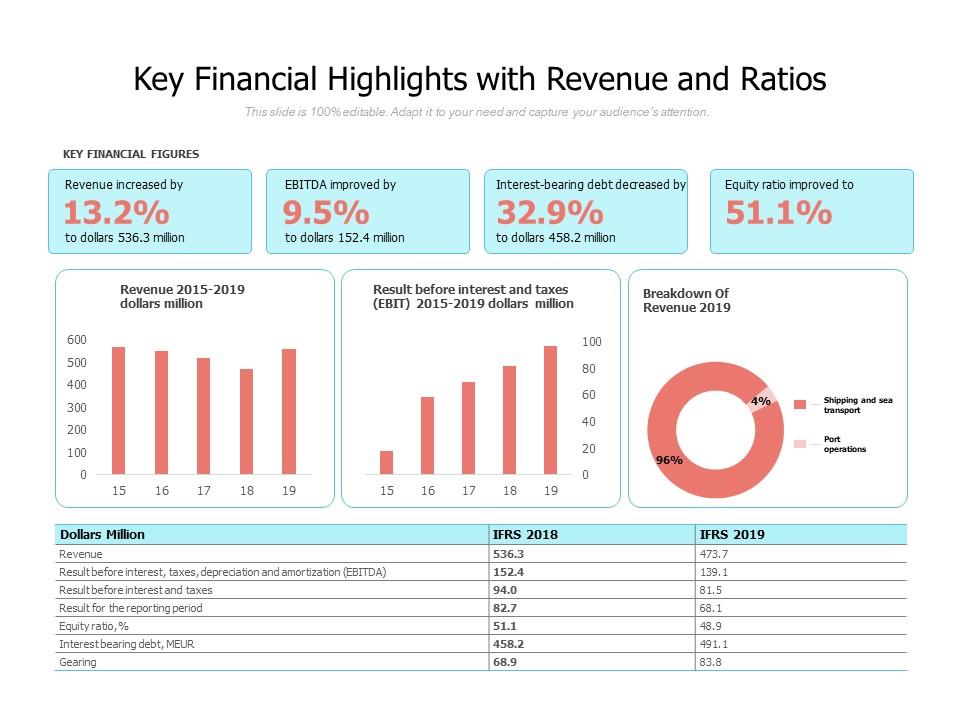

Analyzing ING's 2024 financial performance requires a close look at its revenue and net income. Understanding the year-over-year growth in these key metrics provides crucial insights into the overall health of the company. While specific numbers would need to be sourced from the actual 20-F filing, we can outline how this analysis would proceed.

- ING Revenue: The analysis would examine the total revenue generated by ING in 2024 and compare it to the revenue figures from 2023. This would reveal the percentage change in revenue, indicating growth or decline. Factors contributing to revenue growth or decline, such as changes in market conditions or specific business strategies, would be explored. Keywords like "ING revenue growth" and "ING revenue sources" would be relevant here.

- ING Net Income: Similarly, the net income (profit after all expenses) would be analyzed for year-over-year growth. A breakdown of the key factors impacting net income – for example, changes in operating expenses, interest rates, or loan losses – would be vital. The analysis would also compare ING's net income to industry benchmarks to assess its performance relative to its competitors. Keywords like "ING net income margin" and "ING profitability" are important here.

- Year-over-Year Comparison & Benchmarks: The analysis would include a detailed comparison of both ING revenue and net income against previous years' results, providing a clear picture of trends. Comparing these figures to industry averages or those of key competitors would further enrich the analysis and provide context. Example: "ING's net income increased by X% in 2024 compared to 2023, outperforming the industry average of Y%."

Example Bullet Points (using hypothetical data):

- ING Revenue 2024: €50 billion (10% increase YoY)

- ING Net Income 2024: €5 billion (15% increase YoY)

- ING Revenue Growth compared to competitors: +5% above average

Key Financial Ratios:

Understanding ING's financial health requires analyzing key financial ratios. These ratios provide a deeper insight into the company's profitability, efficiency, and financial risk.

- ING ROE (Return on Equity): This ratio reveals how effectively ING is using shareholder investments to generate profit. A higher ROE indicates better profitability and efficiency.

- ING ROA (Return on Assets): This ratio demonstrates how efficiently ING is using its assets to generate earnings. A higher ROA suggests better asset management.

- Other Relevant Ratios: The analysis would incorporate other essential ratios such as the debt-to-equity ratio (measuring financial leverage), the liquidity ratio (assessing short-term solvency), and the efficiency ratio (measuring operating efficiency). The choice of ratios would depend on the specific focus of the analysis.

Example Bullet Points (using hypothetical data):

- ING ROE 2024: 12%

- ING ROA 2024: 1.5%

- Debt-to-Equity Ratio 2024: 0.8

ING Capital Adequacy and Risk Management:

A crucial aspect of analyzing ING's financial performance is evaluating its capital adequacy and risk management practices.

- ING Capital Adequacy Ratios: The analysis would focus on ratios like the Common Equity Tier 1 (CET1) ratio, which measures a bank's high-quality capital relative to its risk-weighted assets. Compliance with regulatory requirements is critical. Keywords like "ING capital strength" and "ING regulatory compliance" are crucial here.

- Risk Management Strategies: The effectiveness of ING's risk management strategies in mitigating various risks (credit risk, market risk, operational risk) would be examined. The report would likely discuss strategies implemented to mitigate these risks.

Example Bullet Points (using hypothetical data):

- ING CET1 Ratio 2024: 15% (above regulatory minimum)

- Key Risk Management Initiatives: Enhanced stress testing, improved fraud detection systems

Segment Performance and Growth Areas:

ING operates across various segments, and understanding each segment's contribution to the overall performance is essential.

Retail Banking Performance:

This section would analyze the performance of ING's retail banking segment.

- Key Metrics: Loan growth, deposit growth, and customer acquisition are key metrics for evaluating retail banking success. The analysis would assess the trends in these areas and discuss the factors driving the performance. Keywords: "ING retail banking growth," "ING customer acquisition strategy."

- Successful Initiatives: The report would likely highlight successful initiatives within the retail banking segment, such as the introduction of new digital products or improvements in customer service.

- Areas for Improvement: Conversely, it should also address areas needing improvement, perhaps highlighting challenges related to competition or regulatory changes.

Example Bullet Points (using hypothetical data):

- Loan Growth in Retail Banking: 8%

- Deposit Growth in Retail Banking: 5%

- New Customer Acquisition: 10%

Wholesale Banking Performance:

This section would focus on ING's wholesale banking activities.

- Key Areas: Investment banking, corporate lending, and trading revenue are key areas to assess within wholesale banking. Analyzing trends in these areas provides insights into the health of this segment. Keywords: "ING corporate lending," "ING investment banking performance."

- Key Transactions and Partnerships: Any significant transactions or strategic partnerships undertaken during the year would be discussed.

- Segment-Specific Financial Data: This section would present specific financial data related to the wholesale banking segment.

Example Bullet Points (using hypothetical data):

- Corporate Lending Growth: 7%

- Investment Banking Revenue: €2 billion

- Trading Revenue: €1.5 billion

Investment Management Performance:

This section would examine ING's investment management division.

- AUM Growth and Investment Returns: Analyzing the assets under management (AUM) growth and investment returns provides a clear picture of the performance. Keywords: "ING AUM growth," "ING investment strategy."

- Key Investment Strategies: The report would likely detail the key investment strategies employed by the investment management division and how these strategies contributed to performance.

- Market Performance: The analysis would consider the impact of overall market performance on the investment management segment.

Example Bullet Points (using hypothetical data):

- AUM Growth: 12%

- Average Investment Return: 8%

- Key Strategy: Focus on sustainable investments

Future Outlook and Strategic Initiatives:

This section would analyze ING's outlook and plans for the future.

- Strategic Goals and Objectives: The report would detail ING's strategic goals and objectives for the coming year, possibly including targets for revenue growth, profitability, or market share. Keywords: "ING long-term strategy," "ING future plans."

- Growth Opportunities and Challenges: The analysis would assess potential growth opportunities and challenges facing ING, such as changes in market conditions, increased competition, or regulatory changes.

- Acquisitions, Mergers, or Divestitures: Any significant acquisitions, mergers, or divestitures undertaken or planned would be discussed.

Example Bullet Points (using hypothetical data):

- Key Strategic Initiative: Expansion into new markets

- Growth Opportunity: Leveraging digital technology

- Potential Challenge: Increasing regulatory scrutiny

Conclusion:

The ING 2024 Annual Report (Form 20-F) reveals [insert brief summary of overall performance – positive or negative, with reference to key data points from the hypothetical examples above]. This analysis has highlighted key financial metrics, segment performance, and the company's future outlook. The data suggests [positive or negative conclusion, summarizing the main findings].

Call to Action: For a more in-depth understanding of ING's financial performance and strategic direction, download the complete ING 2024 Annual Report (Form 20-F) and conduct your own thorough analysis of the ING financial data. Stay informed about ING's financial health and future developments by regularly reviewing their financial reports. Remember to always conduct your own due diligence before making any investment decisions based on this or any other financial analysis.

Featured Posts

-

The Thames Water Executive Bonus Debate A Critical Analysis

May 23, 2025

The Thames Water Executive Bonus Debate A Critical Analysis

May 23, 2025 -

Swiss Village Faces Landslide Risk Livestock Evacuated By Hoof And Helicopter

May 23, 2025

Swiss Village Faces Landslide Risk Livestock Evacuated By Hoof And Helicopter

May 23, 2025 -

Kiwi Rail Hillside 127 Million Investment Officially Opened By Peters And Jones

May 23, 2025

Kiwi Rail Hillside 127 Million Investment Officially Opened By Peters And Jones

May 23, 2025 -

A Real Pain Kieran Culkins Performance At Theater Het Kruispunt

May 23, 2025

A Real Pain Kieran Culkins Performance At Theater Het Kruispunt

May 23, 2025 -

Understanding Different Types Of Briefs A Comprehensive Overview

May 23, 2025

Understanding Different Types Of Briefs A Comprehensive Overview

May 23, 2025

Latest Posts

-

Trumps Exclusive Memecoin Dinner Guaranteed Anonymity For Attendees

May 23, 2025

Trumps Exclusive Memecoin Dinner Guaranteed Anonymity For Attendees

May 23, 2025 -

Italy Eases Citizenship Requirements Great Grandparent Lineage

May 23, 2025

Italy Eases Citizenship Requirements Great Grandparent Lineage

May 23, 2025 -

Tik Tok Fame Years After A Bishops Past Surfaces

May 23, 2025

Tik Tok Fame Years After A Bishops Past Surfaces

May 23, 2025 -

Significant Changes Lead To House Passage Of Trump Tax Bill

May 23, 2025

Significant Changes Lead To House Passage Of Trump Tax Bill

May 23, 2025 -

Newark Airports Struggles Attributing Recent Air Traffic Issues To A Past Policy Decision

May 23, 2025

Newark Airports Struggles Attributing Recent Air Traffic Issues To A Past Policy Decision

May 23, 2025