ING Group 2024 Annual Report (Form 20-F) Released

Table of Contents

ING Group's 2024 Financial Performance: A Deep Dive

The 2024 Annual Report reveals a robust financial performance for ING Group, showcasing growth across several key areas. Let's delve into the specifics.

Revenue and Profitability

ING Group demonstrated strong revenue growth in 2024, driven by a combination of factors including increased market activity and successful strategic initiatives. The report highlights:

- Significant Revenue Growth: A [Insert Percentage]% increase in total revenue compared to 2023, reaching [Insert Amount] Euros.

- Improved Net Income: Net income increased by [Insert Percentage]%, reaching [Insert Amount] Euros, exceeding analyst expectations.

- Enhanced Profitability Margins: Profitability margins saw a positive shift, improving by [Insert Percentage]% year-over-year, reflecting operational efficiency and strong cost management. Earnings per share (EPS) also increased significantly, demonstrating strong returns for shareholders. Return on Equity (ROE) further solidified ING's position as a leader in the financial sector.

Comparing ING Group's performance to industry benchmarks reveals a favorable position, outperforming many key competitors in revenue growth and profitability. Any variances from the previous year's performance are primarily attributed to [Insert Reasons for Variance, e.g., successful strategic initiatives, improved market conditions, etc.].

Key Financial Ratios and Indicators

Analyzing key financial ratios provides a comprehensive picture of ING Group's financial health and stability. The 20-F reveals:

- Strong Liquidity: High liquidity ratios demonstrate ING Group's ability to meet its short-term financial obligations.

- Solid Solvency: Favorable solvency ratios indicate the company's ability to meet its long-term financial obligations.

- Managed Leverage: The debt-to-equity ratio remains within acceptable parameters, suggesting a healthy balance between debt and equity financing.

These ratios, when compared to previous years and industry averages, paint a picture of financial strength and resilience. Further analysis reveals that ING's management of leverage and liquidity are key contributors to its stable financial position.

Strategic Initiatives and Outlook for 2025 and Beyond

ING Group's 2024 Annual Report outlines ambitious strategic initiatives aimed at driving future growth and strengthening its market position.

Growth Strategies and Market Positioning

ING Group continues to prioritize strategic growth through several key initiatives:

- Expansion into New Markets: The report details plans to expand into [Mention specific geographic markets or business segments].

- Digital Transformation: Continued investment in technology and digitalization is expected to improve efficiency and enhance customer experience.

- Sustainability Initiatives: ING Group is committed to sustainable business practices, which are expected to contribute to long-term value creation. This focus on ESG (environmental, social, and governance) factors is key to their competitive landscape and strategy.

These strategic initiatives are expected to contribute significantly to ING Group's financial performance in the coming years, enhancing its competitive advantage.

Risk Management and Compliance

The report dedicates a significant section to risk management and regulatory compliance. Key aspects highlighted include:

- Proactive Risk Management: ING Group employs robust risk management frameworks to mitigate financial, operational, and regulatory risks.

- Regulatory Compliance: The company maintains a strong focus on adhering to all relevant regulations and compliance standards.

- Mitigation Strategies: The report details specific strategies implemented to address identified risks, ensuring business continuity and stability.

Dividend Policy and Shareholder Returns

ING Group's commitment to shareholder returns is evident in its dividend policy. The 2024 Annual Report details:

- Dividend per Share: [Insert Amount] per share, reflecting a [Insert Percentage]% increase year-over-year.

- Dividend Yield: [Insert Percentage]%, attractive compared to industry peers.

- Share Buyback Programs: [Mention details of any share buyback programs implemented].

The company’s approach to capital allocation prioritizes both organic growth and returning value to shareholders through consistent dividend payouts and strategic share buyback programs.

Conclusion: Understanding the ING Group 2024 Annual Report (Form 20-F)

The ING Group 2024 Annual Report (Form 20-F) paints a positive picture of the company's financial health, strategic direction, and commitment to shareholder value. Key takeaways include strong revenue growth, improved profitability, robust financial ratios, and ambitious strategic initiatives focused on sustainable growth and digital transformation. Understanding this report is crucial for making informed investment decisions regarding ING Group. To gain a comprehensive understanding of ING Group's performance and outlook, download and review the complete ING Group 2024 Annual Report (Form 20-F) [Insert Link to Report Here]. This in-depth analysis of ING's 20-F filing provides crucial insights for informed decision-making regarding ING's future. Don't miss this key information on ING's annual report analysis and key insights from ING's Form 20-F.

Featured Posts

-

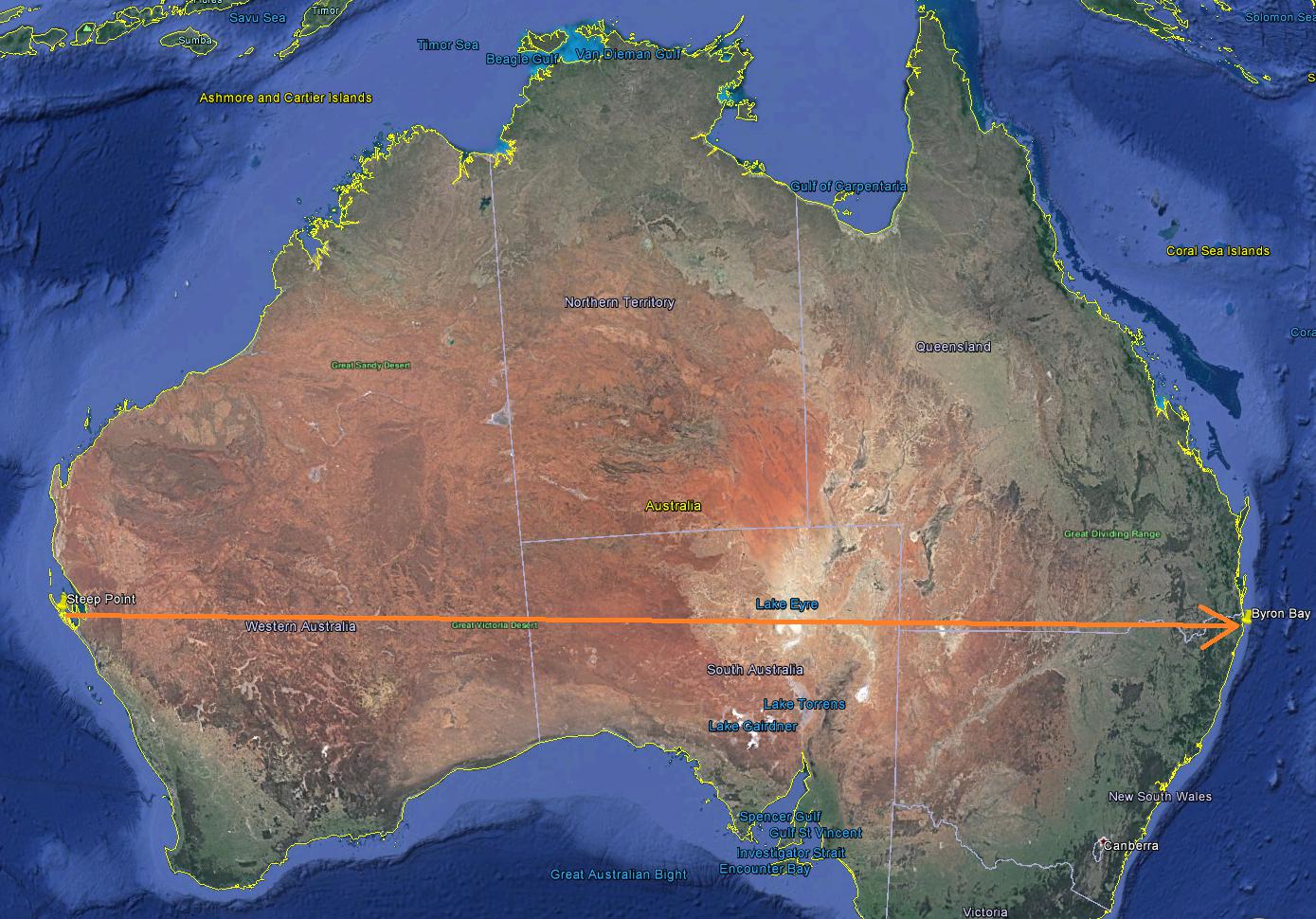

Trans Australia Run Is The World Record About To Fall

May 22, 2025

Trans Australia Run Is The World Record About To Fall

May 22, 2025 -

Dialogue On Tariffs A Switzerland China Proposal

May 22, 2025

Dialogue On Tariffs A Switzerland China Proposal

May 22, 2025 -

Betalen In Nederland Een Overzicht Van Bankrekeningen En Tikkie

May 22, 2025

Betalen In Nederland Een Overzicht Van Bankrekeningen En Tikkie

May 22, 2025 -

Funko Debuts First Ever Dexter Pop Vinyl Figures

May 22, 2025

Funko Debuts First Ever Dexter Pop Vinyl Figures

May 22, 2025 -

Freepoint Eco Systems Secures Project Finance Facility From Ing

May 22, 2025

Freepoint Eco Systems Secures Project Finance Facility From Ing

May 22, 2025

Latest Posts

-

Couple Arrested Following Antiques Roadshow Appearance National Treasure Case

May 22, 2025

Couple Arrested Following Antiques Roadshow Appearance National Treasure Case

May 22, 2025 -

Antiques Roadshow Appraisal Leads To Arrest For National Treasure Trafficking

May 22, 2025

Antiques Roadshow Appraisal Leads To Arrest For National Treasure Trafficking

May 22, 2025 -

Couple Arrested Following Antiques Roadshow Stolen Goods Discovery

May 22, 2025

Couple Arrested Following Antiques Roadshow Stolen Goods Discovery

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025 -

Antiques Roadshow Appraisal Exposes Theft Results In Arrest

May 22, 2025

Antiques Roadshow Appraisal Exposes Theft Results In Arrest

May 22, 2025