ING Group's 2024 Form 20-F Filing: A Comprehensive Overview

Table of Contents

Key Highlights from ING Group's 2024 Form 20-F Filing

The 2024 Form 20-F filing from ING Group will reveal vital financial results, offering insights into the company's performance. While the exact figures are pending the official release, we anticipate key highlights such as net income, revenue growth, and key performance indicators (KPIs) to be closely scrutinized. These figures will be compared against the previous year's results to assess growth trajectories and identify any significant changes in ING's financial health. Analyzing these trends provides a crucial insight into ING's profitability and overall financial strength.

- Net income for the fiscal year: A key indicator of profitability, reflecting the overall success of ING's operations after accounting for all expenses.

- Revenue growth or decline: Showing the company's ability to generate sales and expand its market presence across its diverse banking, insurance and investment management divisions.

- Key performance indicators (KPIs) and their changes: KPIs like return on equity (ROE), return on assets (ROA), and cost-to-income ratio will provide further details into operational efficiency and profitability.

- Significant events affecting financial performance: Any mergers, acquisitions, divestitures, regulatory changes, or significant economic events will be reflected in the report and analyzed for their impact.

Analysis of ING's Financial Statements

The Form 20-F will contain detailed financial statements—the balance sheet, income statement, and cash flow statement—that provide a holistic view of ING Group's financial position. Analyzing these statements is crucial for understanding the company's financial health and future prospects.

Balance Sheet Analysis

The balance sheet details ING's assets, liabilities, and equity. Key areas of analysis include:

- Assets: Analyzing trends in liquid assets, loans and advances, and investments provides insights into the liquidity and risk profile of ING's balance sheet.

- Liabilities: Examining debt levels, customer deposits, and other liabilities is crucial for evaluating ING's financial leverage and solvency.

- Equity: Analyzing equity trends reveals insights into the company's shareholder value and financial strength.

Income Statement Analysis

The income statement shows ING's revenues and expenses. Key areas of analysis include:

- Revenue streams: Analyzing revenue generated from different business segments helps assess their relative contributions to overall profitability.

- Cost of revenue: Analyzing cost of revenue provides insight into operational efficiency and profitability margins.

- Operating expenses: Understanding the breakdown of operating expenses enables investors to gauge efficiency and cost management strategies.

- Profitability: Analyzing key metrics such as net income, operating income, and profit margins helps evaluate ING's profitability and growth potential.

Cash Flow Statement Analysis

The cash flow statement tracks the movement of cash in and out of ING. This reveals how the company generates and uses its cash. Key areas include:

- Cash flow from operating activities: This section shows cash generated from core business operations, indicating the efficiency of operations and cash generation capabilities.

- Cash flow from investing activities: This section highlights capital expenditures and investments, reflecting growth strategies and long-term prospects.

- Cash flow from financing activities: This section shows cash flows related to debt, equity, and dividends, providing insights into ING's financing structure and capital management.

- Free cash flow: A critical metric showing the cash available for reinvestment, debt repayment, or shareholder returns, offering insights into ING's future growth potential.

Risk Factors and Management's Discussion & Analysis (MD&A)

The 20-F will include a detailed discussion of risk factors and management’s analysis of ING’s financial condition and performance. This section provides valuable insights into the challenges and opportunities facing the company.

- Key risk factors: ING will likely identify risks such as interest rate risk, credit risk, market risk, operational risk, and regulatory risk. Understanding these risks is crucial for investors.

- Management's outlook for the future: Management’s perspective on future prospects, based on current market conditions and company performance, allows investors to gauge future growth expectations.

- Significant risks and uncertainties: This section will detail specific events or conditions that pose significant uncertainties to ING's future performance.

ING Group's Business Segments and Performance

ING operates across several business segments, each contributing uniquely to the overall financial results. The 20-F will provide a detailed performance analysis of each:

- Retail banking: Performance will be analyzed based on customer growth, loan portfolios, and profitability.

- Wholesale banking: This segment's performance will be evaluated based on its lending activities, trading results, and market share.

- Insurance: The insurance segment's performance will be assessed through metrics such as premium income, claims ratios, and policyholder growth.

- Investment management: This segment’s success will be based on asset under management, investment returns, and fee income.

Compliance and Regulatory Considerations

The 20-F will discuss ING's adherence to regulatory requirements and compliance matters, which is critical for investors assessing the risk profile of the company. Any significant regulatory changes and their impact on operations and financial performance will be outlined.

Conclusion

Analyzing ING Group's 2024 Form 20-F filing provides a crucial understanding of the company's financial health, operational efficiency, and future prospects. This comprehensive overview highlights key aspects including financial performance, risk factors, and business segment contributions. By understanding these factors, investors can make informed decisions. To gain a complete understanding of ING Group's 2024 financial performance, access the complete ING Group 2024 Form 20-F filing available on the SEC's EDGAR database and ING Group's investor relations website. Download the full ING Group 20-F report today and learn more about ING Group's 2024 financial performance through their 20-F filing.

Featured Posts

-

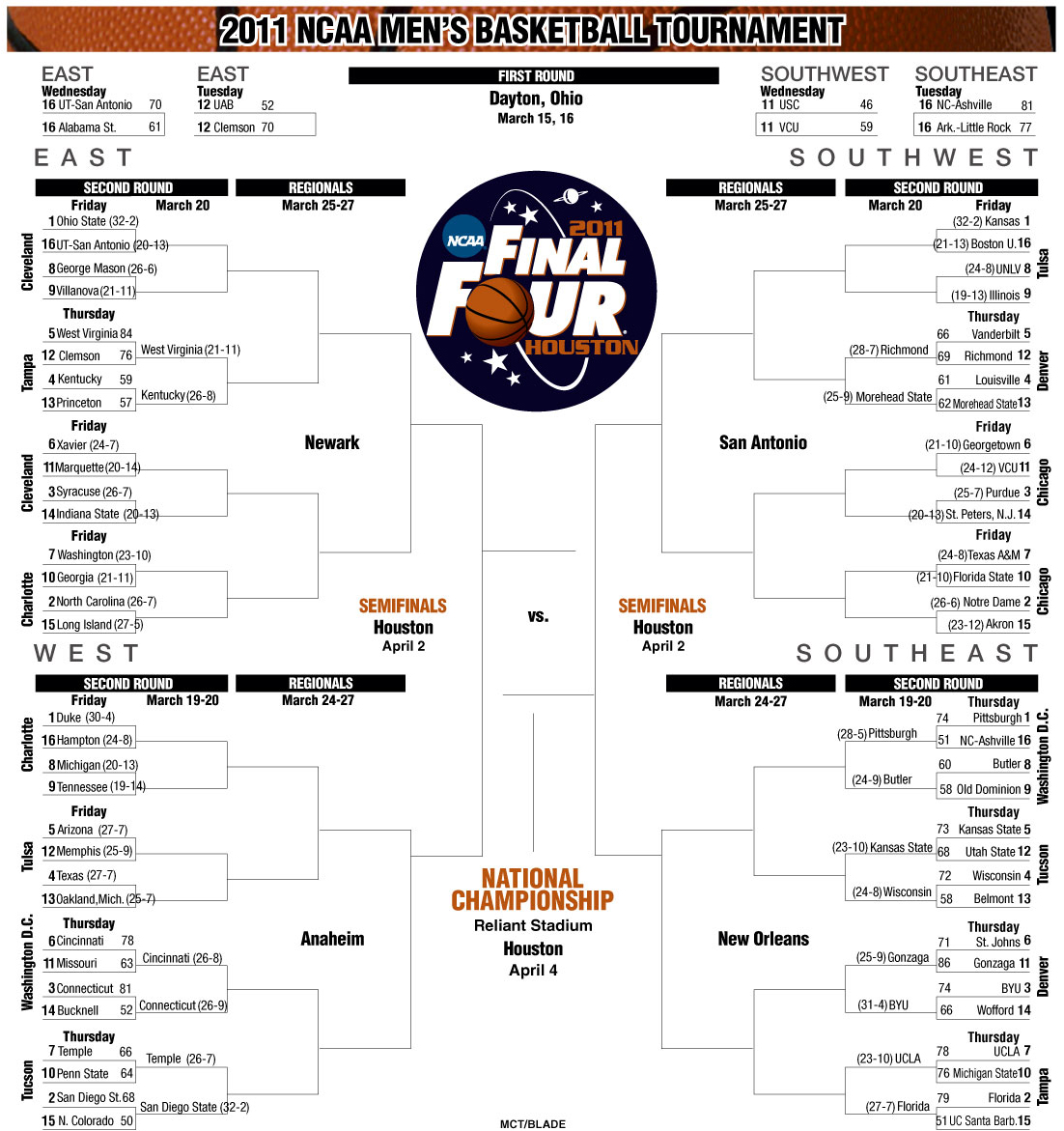

2025 Ncaa Tournament Bishop Englands Impact On Louisvilles Dance

May 23, 2025

2025 Ncaa Tournament Bishop Englands Impact On Louisvilles Dance

May 23, 2025 -

Bangladesh Ready For A Challenging Second Test Against Zimbabwe Currans Prediction

May 23, 2025

Bangladesh Ready For A Challenging Second Test Against Zimbabwe Currans Prediction

May 23, 2025 -

Ing Group 2024 Key Takeaways From The Form 20 F Annual Report

May 23, 2025

Ing Group 2024 Key Takeaways From The Form 20 F Annual Report

May 23, 2025 -

Big Rig Rock Report 3 12 97 1 Double Q In Depth Examination

May 23, 2025

Big Rig Rock Report 3 12 97 1 Double Q In Depth Examination

May 23, 2025 -

Emergency Livestock Evacuation In Swiss Alps Following Landslide Warning

May 23, 2025

Emergency Livestock Evacuation In Swiss Alps Following Landslide Warning

May 23, 2025

Latest Posts

-

Is A Best And Final Job Offer Really Final Negotiation Strategies

May 23, 2025

Is A Best And Final Job Offer Really Final Negotiation Strategies

May 23, 2025 -

Negotiating A Best And Final Job Offer Is It Possible

May 23, 2025

Negotiating A Best And Final Job Offer Is It Possible

May 23, 2025 -

Ramaphosas Calm Response Alternative Actions In The White House Ambush

May 23, 2025

Ramaphosas Calm Response Alternative Actions In The White House Ambush

May 23, 2025 -

Trumps Private Warning Putins Unreadiness For War End Say European Officials

May 23, 2025

Trumps Private Warning Putins Unreadiness For War End Say European Officials

May 23, 2025 -

Trumps Air Traffic Plan Newark Airports Recent Problems Explained

May 23, 2025

Trumps Air Traffic Plan Newark Airports Recent Problems Explained

May 23, 2025