Inside AIMSCAP's World Trading Tournament (WTT) Strategy

Table of Contents

The AIMSCAP World Trading Tournament (WTT) team consistently delivers exceptional results, setting a benchmark for others to follow. This article delves into their winning strategy, providing valuable insights into their approach to trading, risk management, and overall tournament success. We’ll explore the key elements that contribute to their consistent victories in the highly competitive world of WTT.

Understanding AIMSCAP's WTT Approach

AIMSCAP's philosophy towards the WTT is best described as a balanced approach, combining elements of both aggressive and conservative strategies. They don’t chase quick, short-term gains at the expense of long-term stability. Instead, they prioritize sustainable growth and risk mitigation.

- Focus on long-term growth vs. short-term gains: AIMSCAP prioritizes building a strong portfolio over rapid, potentially risky profits. Their strategies are designed for sustained growth over multiple WTT events.

- Emphasis on fundamental analysis vs. technical analysis (a blend): While utilizing technical indicators, AIMSCAP places significant weight on fundamental analysis, thoroughly researching the underlying assets before making investment decisions. This provides a solid foundation for their trades.

- Importance of market research and due diligence: Before entering any trade, AIMSCAP undertakes meticulous market research and due diligence. This involves studying market trends, economic indicators, and news events that could impact asset prices.

- Team collaboration and expertise sharing: Success in the WTT isn't a solo endeavor. AIMSCAP fosters a collaborative environment where team members share expertise, insights, and strategies, leading to stronger decision-making.

Key Strategies Employed by AIMSCAP in the WTT

AIMSCAP employs a diverse range of trading strategies adapted to specific market conditions and opportunities. They aren't confined to a single approach; instead, they flexibly utilize strategies such as swing trading and day trading, choosing the most appropriate method for each situation. Arbitrage opportunities are also actively explored.

- Specific examples of successful trades and the reasoning behind them: For instance, their successful investment in Company X during the WTT was predicated on a thorough fundamental analysis revealing undervalued potential and positive upcoming news.

- Use of indicators and tools for analysis (mention specific tools if possible): AIMSCAP leverages tools like moving averages, RSI, and MACD to identify potential entry and exit points, supplementing their fundamental research. They also utilize advanced charting software for detailed market visualization.

- Adaptability to changing market conditions: A key strength is their ability to quickly adapt to unexpected market shifts. Their strategies are dynamic, allowing them to adjust their positions and approaches as needed.

- Risk mitigation strategies: AIMSCAP incorporates several risk mitigation techniques into their strategies, ensuring capital protection is paramount.

Risk Management: A Cornerstone of AIMSCAP's WTT Success

AIMSCAP's dedication to risk management is evident in their meticulous approach to capital protection. This commitment is integral to their long-term success in the WTT.

- Stop-loss orders and their implementation: Stop-loss orders are systematically used to limit potential losses on each trade, ensuring that even unfavorable market movements don't wipe out significant portions of their capital.

- Position sizing strategies: Careful position sizing, based on risk tolerance and market volatility, prevents overexposure to any single asset or trade.

- Diversification techniques across various asset classes: Diversification forms a crucial part of their strategy. Spreading investments across diverse asset classes, like stocks, bonds, and currencies, reduces overall portfolio risk.

- Regular portfolio review and adjustments: Continuous monitoring and adjustments are made to the portfolio based on performance, market trends, and risk assessments.

The Role of Technology in AIMSCAP's WTT Strategy

Technology plays a vital role in enhancing AIMSCAP's trading performance and efficiency.

- Algorithmic trading (if applicable): While not fully reliant on it, AIMSCAP explores the use of algorithmic trading for specific strategies, automating certain aspects of their trading process.

- Use of advanced charting software: They utilize advanced charting software with real-time data feeds to analyze market trends and identify trading opportunities promptly.

- Data analytics and predictive modelling (if applicable): Data analytics helps identify patterns and insights that inform their decision-making, supplementing their other research methods.

- Automation of trading processes: Automation streamlines various tasks, allowing the team to focus on strategy and analysis rather than manual processes.

Post-Tournament Analysis and Continuous Improvement

AIMSCAP's commitment to continuous improvement is demonstrated through their thorough post-tournament analysis.

- Thorough review of trades – wins and losses: Each trade, successful or not, is meticulously reviewed to identify contributing factors and potential areas for improvement.

- Identification of areas for improvement in strategy and execution: This analysis helps refine their existing strategies and identify weaknesses to address.

- Ongoing training and skill development for the team: Continuous learning and skill development are emphasized to maintain a high level of expertise.

- Adaptation based on market trends and competitor analysis: AIMSCAP actively monitors market trends and analyzes the strategies of competitors to constantly refine their approaches.

Conclusion

This article provided insight into AIMSCAP's winning World Trading Tournament (WTT) strategy, highlighting their balanced approach, robust risk management, and commitment to continuous improvement. Their success stems from a combination of well-defined strategies, technological expertise, and a dedicated team. Their commitment to a blend of fundamental and technical analysis, coupled with rigorous risk management and adaptability, forms the core of their winning formula.

Call to Action: Want to learn more about crafting your own winning World Trading Tournament (WTT) strategy? Explore our resources on [link to relevant resources] and unlock your trading potential. Master the art of the AIMSCAP WTT approach and discover your own path to success in the world of competitive trading.

Featured Posts

-

Peppa Pig Theme Park Texas Rides Attractions And Ticket Information

May 21, 2025

Peppa Pig Theme Park Texas Rides Attractions And Ticket Information

May 21, 2025 -

The Popularity Of Dexter Resurrections New Villain

May 21, 2025

The Popularity Of Dexter Resurrections New Villain

May 21, 2025 -

Wtt Star Contender Chennai Indias Unprecedented 19 Paddler Team

May 21, 2025

Wtt Star Contender Chennai Indias Unprecedented 19 Paddler Team

May 21, 2025 -

Le Festival Le Bouillon Engagement Et Spectacles A Clisson

May 21, 2025

Le Festival Le Bouillon Engagement Et Spectacles A Clisson

May 21, 2025 -

A New Frontier In Computing Chinas Space Based Supercomputer Project

May 21, 2025

A New Frontier In Computing Chinas Space Based Supercomputer Project

May 21, 2025

Latest Posts

-

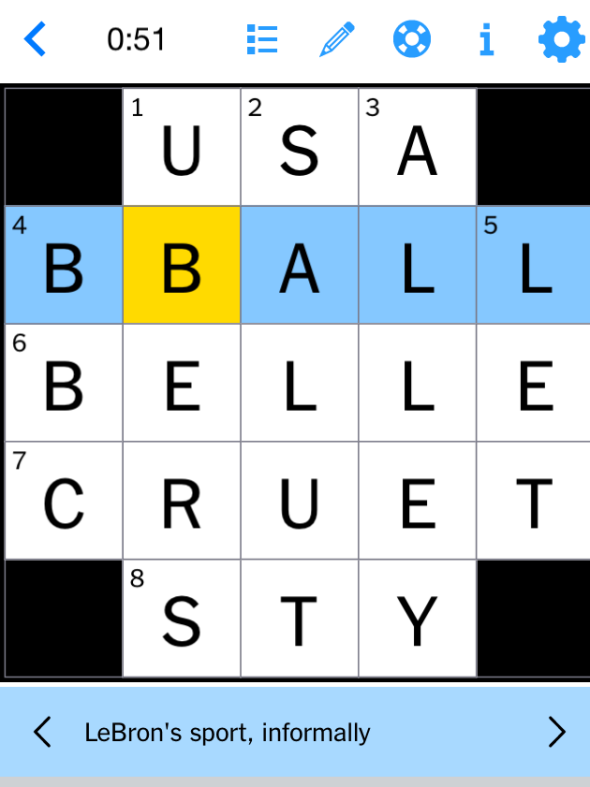

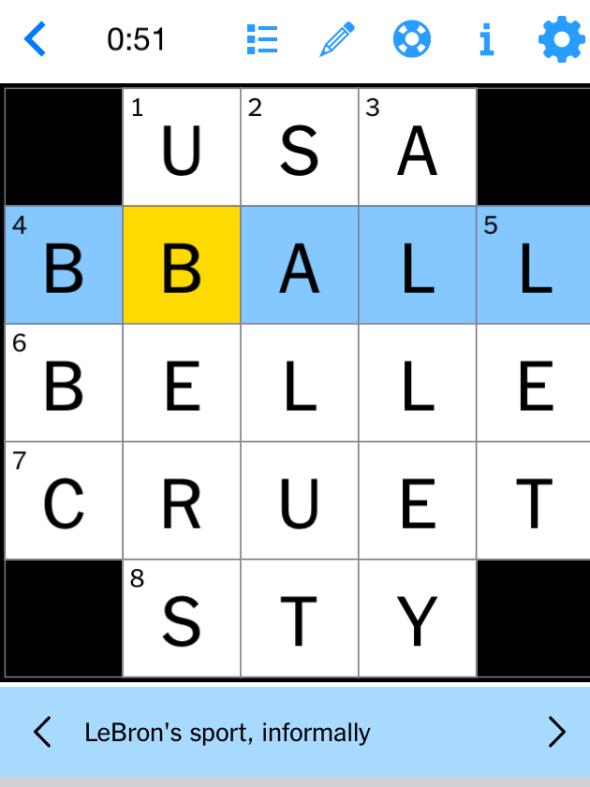

Solve The Nyt Mini Crossword March 5 2025 Hints And Solutions

May 21, 2025

Solve The Nyt Mini Crossword March 5 2025 Hints And Solutions

May 21, 2025 -

Unpacking The Numbers A Critical Review Of Trumps Aerospace Deals

May 21, 2025

Unpacking The Numbers A Critical Review Of Trumps Aerospace Deals

May 21, 2025 -

Trumps Aerospace Legacy Promises Performance And Particulars

May 21, 2025

Trumps Aerospace Legacy Promises Performance And Particulars

May 21, 2025 -

The Trump Years An Examination Of Aerospace Deal Transparency

May 21, 2025

The Trump Years An Examination Of Aerospace Deal Transparency

May 21, 2025 -

Complete Nyt Mini Crossword Answers March 13 Solutions And Hints

May 21, 2025

Complete Nyt Mini Crossword Answers March 13 Solutions And Hints

May 21, 2025