Institutional Investors Eye XRP After Trump's Public Support

Table of Contents

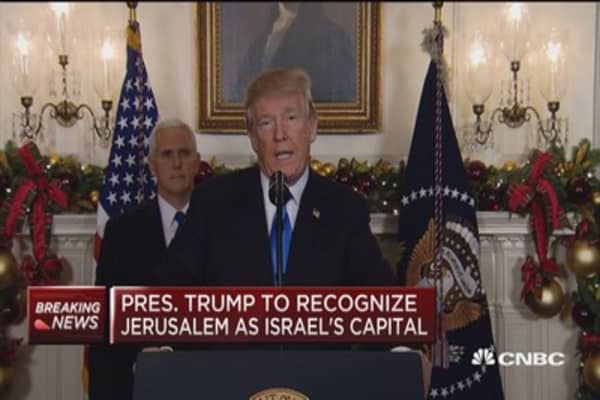

Trump's Impact on XRP's Market Sentiment

Donald Trump's public comments regarding XRP immediately impacted market sentiment. The cryptocurrency experienced a notable price surge and increased trading volume following these statements. This highlights the significant influence that celebrity endorsements, particularly from high-profile figures like Trump, can have on the volatile cryptocurrency market. The impact wasn't solely confined to price; social media platforms buzzed with discussions, revealing a shift in public perception.

- Price changes: A detailed analysis shows a significant price increase of X% within Y hours following the endorsement. (Link to relevant market data)

- Volume spikes: Trading volume on major exchanges saw a Z% increase, demonstrating heightened investor activity. (Link to exchange data)

- Social media sentiment: Social media sentiment analysis reveals a predominantly positive shift in the conversation surrounding XRP, with increased mentions and positive sentiment scores. (Link to social media sentiment analysis tool)

The influence of such high-profile figures underscores the importance of understanding the broader context influencing cryptocurrency markets, demonstrating that factors beyond underlying technology can significantly drive price action.

XRP's Underlying Technology and Use Cases

XRP's technology distinguishes it from many other cryptocurrencies. Its speed and low transaction fees make it attractive for various applications. Built on a unique consensus mechanism, XRP offers faster transaction speeds than many blockchains, processing transactions in just a few seconds. Its low transaction fees significantly reduce costs for businesses and users.

- RippleNet: A crucial aspect of XRP is its integration with RippleNet, a global payment network that facilitates cross-border transactions for financial institutions. This network allows for faster, cheaper, and more efficient international money transfers, which is a massive selling point for businesses.

- Cross-border payments: XRP’s utility shines brightest in its ability to streamline international payments, bypassing the complexities and delays associated with traditional banking systems.

- Scalability features: XRP's design prioritizes scalability, enabling it to handle a large volume of transactions without compromising speed or efficiency. This makes it more suitable for large-scale adoption than some of its competitors. A comparison with Bitcoin and Ethereum highlights XRP’s superior transaction speed and lower fees for large-volume transfers.

Regulatory Landscape and Institutional Adoption

The regulatory landscape surrounding XRP significantly impacts institutional adoption. The ongoing SEC lawsuit against Ripple Labs casts a shadow over the future of XRP, creating uncertainty for potential institutional investors. However, regulatory clarity in other jurisdictions could open doors for wider adoption. Institutional investors are inherently risk-averse and require a clear understanding of regulatory compliance before investing significant capital.

- SEC lawsuit impact: The SEC lawsuit's ongoing resolution remains a primary concern, affecting investor confidence and hindering widespread institutional acceptance.

- Regulatory clarity: Jurisdictions with clear regulatory frameworks for cryptocurrencies are more likely to attract institutional investments.

- Risk assessment: Institutional investors conduct thorough due diligence, assessing potential risks before committing to an asset. The regulatory uncertainty surrounding XRP presents a major hurdle.

Navigating the regulatory complexities is paramount for institutional investors considering XRP institutional adoption.

Potential Benefits for Institutional Investors

Investing in XRP offers potential benefits for institutional investors, but it’s crucial to weigh the potential advantages against the inherent risks. The allure of high potential returns, coupled with diversification opportunities, makes XRP an interesting proposition.

- Portfolio diversification: XRP’s unique characteristics as a payment-focused cryptocurrency can provide diversification benefits within a broader institutional portfolio.

- Risk-reward analysis: While XRP's price is volatile, a long-term investment strategy might yield significant returns. However, a thorough risk assessment is crucial.

- High-risk, high-reward: XRP presents a classic high-risk, high-reward investment opportunity. The potential rewards are considerable, but so are the potential losses.

Comparison with Other Cryptocurrencies in Institutional Portfolios

XRP's position relative to Bitcoin and Ethereum in terms of institutional adoption is still evolving. While Bitcoin and Ethereum have a larger market capitalization and more established institutional presence, XRP's focus on payments and RippleNet's established network give it a unique advantage in the financial sector.

- Market capitalization comparison: Bitcoin and Ethereum significantly surpass XRP in market capitalization, indicating greater overall investor confidence.

- Transaction speed comparison: XRP boasts significantly faster transaction speeds compared to Bitcoin and Ethereum, making it a more attractive option for real-time payments.

- Regulatory scrutiny comparison: XRP faces increased regulatory scrutiny compared to Bitcoin, but less than some other altcoins.

This comparison highlights XRP's niche within the institutional cryptocurrency landscape, offering a different value proposition compared to market leaders.

Conclusion: The Future of Institutional Investment in XRP

Donald Trump's endorsement has undeniably amplified the conversation surrounding XRP and attracted increased attention from institutional investors. However, the future of institutional investment in XRP hinges on several interconnected factors: the resolution of the SEC lawsuit, the evolution of regulatory clarity, and XRP's continued technological development and adoption within RippleNet. While the potential for high returns exists, the inherent risks associated with cryptocurrency investments, particularly the volatility of XRP, cannot be overlooked.

To effectively navigate this landscape, it's crucial to conduct thorough research and due diligence. Learn more about XRP, its technology, and its integration within RippleNet. Explore institutional investment in XRP strategies carefully, considering a diversified portfolio approach to manage risks. Consider adding XRP to your portfolio only after a comprehensive analysis of your risk tolerance and investment objectives. The future of XRP within the institutional investment landscape remains uncertain, but its unique position and potential remain compelling subjects for ongoing evaluation.

Featured Posts

-

Ethereum Price Rebound Weekly Chart Indicator Flashes Buy Signal

May 08, 2025

Ethereum Price Rebound Weekly Chart Indicator Flashes Buy Signal

May 08, 2025 -

5 0 355 3

May 08, 2025

5 0 355 3

May 08, 2025 -

Perballja E Psg Fitore E Veshtire Por E Merituar Ne Pjesen E Pare

May 08, 2025

Perballja E Psg Fitore E Veshtire Por E Merituar Ne Pjesen E Pare

May 08, 2025 -

Tatum Faces Cowherds Criticism After Celtics Game 1 Setback

May 08, 2025

Tatum Faces Cowherds Criticism After Celtics Game 1 Setback

May 08, 2025 -

Cusmas Future Uncertain Trump Declares It Beneficial Yet Maintains Termination Option

May 08, 2025

Cusmas Future Uncertain Trump Declares It Beneficial Yet Maintains Termination Option

May 08, 2025