Interest Rate Cuts: Why The Federal Reserve Is Lagging Behind

Table of Contents

Persistent Inflation as a Primary Constraint

High inflation remains a significant concern, forcing the Fed to prioritize its fight against rising prices over immediate economic stimulus through interest rate cuts. Aggressive rate cuts risk further fueling inflation, a scenario the Fed is keen to avoid.

- Core inflation remains stubbornly high. Despite headline inflation showing some moderation, core inflation (excluding volatile food and energy prices) remains elevated, indicating underlying inflationary pressures.

- Wage growth is exceeding expectations, contributing to inflationary pressure. Strong wage growth, while positive for workers, can contribute to a wage-price spiral, further exacerbating inflation. The Fed is carefully monitoring wage data to assess its impact on price stability.

- The Fed's mandate is price stability—a primary reason for caution. The Federal Reserve's dual mandate includes price stability and maximum employment. Currently, the emphasis is heavily on price stability, making aggressive interest rate cuts less likely.

- Analyzing CPI and PCE data is crucial to understanding the Fed's perspective. The Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) price index are key inflation metrics the Fed closely monitors to guide its monetary policy decisions. These data points provide insights into the pervasiveness and stickiness of inflation.

Further detail: The Fed is scrutinizing the various components of CPI and PCE data to identify underlying inflationary drivers. The persistence of inflation in services sectors, for example, is a particular concern. Accurately predicting future inflation remains a challenge, adding to the complexity of the Fed's decision-making process. A miscalculation could lead to either runaway inflation or unnecessary economic hardship.

Concerns About a Potential Recessionary Spiral

The Fed walks a tightrope, balancing the need to combat inflation with the risk of triggering a recession through overly aggressive rate hikes or overly delayed cuts. The current economic climate is delicate and sensitive to monetary policy changes.

- A sudden and sharp interest rate cut might lead to uncontrolled inflation. A rapid easing of monetary policy could reignite inflationary pressures, undoing the progress made in combating inflation.

- The current economic climate is delicate and sensitive to monetary policy changes. Many sectors are already feeling the pinch from higher interest rates, and a poorly timed interest rate cut could destabilize the economy further.

- Delayed cuts may exacerbate economic hardship for consumers and businesses. Prolonged high interest rates can lead to reduced consumer spending, business investment, and overall economic slowdown.

- The impact of previous rate hikes is still unfolding, and the Fed is evaluating their effects. The full effects of past interest rate increases are not yet fully realized, requiring the Fed to carefully observe the economy's response before making any significant changes to its monetary policy.

Further detail: The yield curve inversion, a historically reliable recessionary predictor, is a key indicator the Fed is watching closely. Other leading economic indicators, such as consumer confidence, manufacturing PMI, and housing starts, provide additional insights into the economy's health and the potential for a recession. The Fed aims to achieve a "soft landing," slowing economic growth without triggering a recession – a notoriously difficult feat.

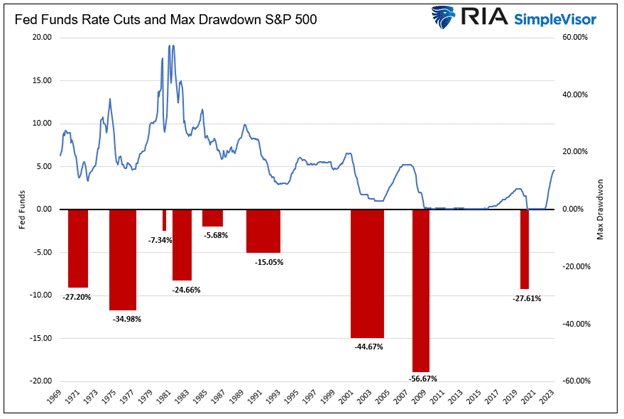

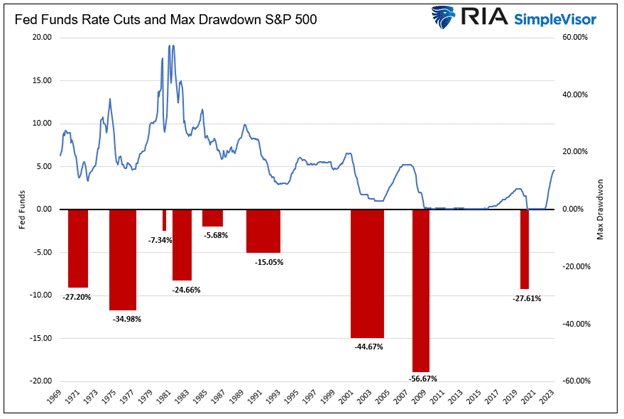

The Lag Effect of Monetary Policy

The impact of interest rate changes is not immediate; there's a time lag before the effects are fully felt. The Fed is likely considering this lag before making further cuts.

- It takes time for changes in interest rates to influence consumer spending and investment. Changes in borrowing costs don't instantly translate into changed behavior. There's a delay as consumers and businesses adjust their spending and investment plans.

- The Fed carefully considers historical data to understand the lag effect. The Fed's economists analyze past monetary policy decisions and their delayed effects to better predict the timing and magnitude of the current policy changes.

- Accurate forecasting of the lag effect is a challenge. The lag effect can vary depending on numerous economic factors, making it difficult to predict with precision.

Further detail: The lag effect operates through various channels, including consumer and business confidence, investment decisions, and asset prices. For example, a rate cut might not immediately boost investment if businesses are already hesitant due to other economic uncertainties. Understanding the complexities of this lag is crucial for effective monetary policy.

Geopolitical and Global Economic Uncertainty

Global factors, such as the war in Ukraine and ongoing supply chain disruptions, contribute to the Fed's cautious approach. These external factors impact the US economy and add complexity to their decision-making.

- Global economic instability necessitates a more conservative monetary policy. The interconnected nature of the global economy means that domestic monetary policy must take into account international economic conditions.

- Geopolitical events create uncertainty and unpredictability in the market. The war in Ukraine, for instance, has created significant energy price shocks and supply chain disruptions, adding to inflationary pressures and overall economic uncertainty.

- The Fed is monitoring global economic indicators alongside domestic data. The Fed considers global economic growth, inflation rates, and financial market conditions in its decision-making process.

Further detail: The ongoing impact of the war in Ukraine on energy prices and commodity markets is a major concern. Supply chain bottlenecks continue to affect various sectors, contributing to inflationary pressures and hindering economic growth. The Fed closely monitors global financial markets for signs of contagion or instability that could impact the US economy.

Conclusion

The Federal Reserve's measured approach to interest rate cuts is a complex issue influenced by persistent inflation, recessionary risks, the lag effect of monetary policy, and global uncertainties. While some argue they are lagging behind the need for immediate economic stimulus, the Fed's cautious strategy reflects a careful consideration of multiple intertwined factors. Understanding these factors is crucial for investors and consumers alike. Stay informed about the latest developments in monetary policy and the Fed's ongoing assessment of interest rate cuts and their potential impact on your financial well-being. Continuously monitoring the news regarding interest rate changes is key to navigating the current economic climate.

Featured Posts

-

Snls Harry Styles Impression The Singers Disappointed Response

May 09, 2025

Snls Harry Styles Impression The Singers Disappointed Response

May 09, 2025 -

Jeanine Pirro Insights Into Her Background And Net Worth

May 09, 2025

Jeanine Pirro Insights Into Her Background And Net Worth

May 09, 2025 -

Save On Elizabeth Arden Skincare Walmart Alternatives

May 09, 2025

Save On Elizabeth Arden Skincare Walmart Alternatives

May 09, 2025 -

The Great Decoupling Economic Implications And Future Trends

May 09, 2025

The Great Decoupling Economic Implications And Future Trends

May 09, 2025 -

Elizabeth Hurley Shows Off Her Figure In Maldives Bikini Photos

May 09, 2025

Elizabeth Hurley Shows Off Her Figure In Maldives Bikini Photos

May 09, 2025