Investigating The Impact: Trump's Tariffs And The Small Business Sector

Table of Contents

Increased Input Costs and Reduced Profit Margins

Trump's tariffs led to a substantial increase in input costs for many small businesses, directly impacting their profitability. This was primarily due to rising prices of raw materials and goods, and significant disruptions to global supply chains.

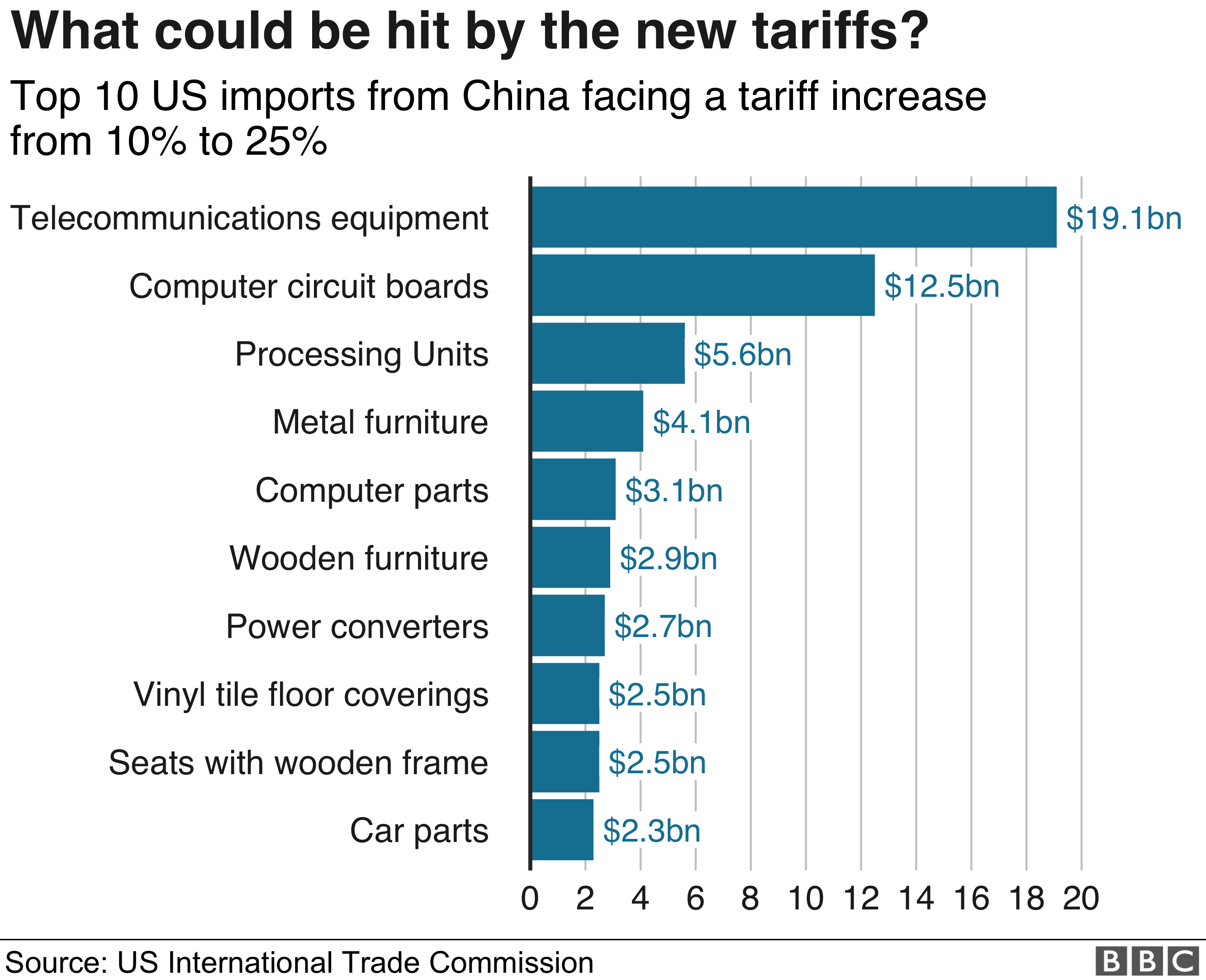

Rising Prices of Raw Materials and Goods

Tariffs increased the cost of imported raw materials and goods, squeezing profit margins for small businesses heavily reliant on global supply chains. This impact varied across sectors, but many felt the strain.

- Manufacturing: Businesses relying on imported steel, aluminum, and components experienced significant price hikes.

- Agriculture: Farmers importing fertilizers or exporting agricultural products faced increased costs and reduced market access.

- Retail: Businesses importing goods for resale saw increased costs passed on to consumers, impacting sales.

Data from the Bureau of Economic Analysis (BEA) showed a [insert percentage]% increase in import prices for certain key materials post-tariff implementation. This directly translated into reduced profit margins for many small businesses. Businesses adapted by employing various strategies:

- Implementing price increases to offset higher input costs.

- Reducing production volumes to manage expenses.

- Actively seeking domestic alternatives for imported goods, though often at a higher cost.

Impact on Supply Chains and Logistics

Tariffs caused significant disruptions to supply chains, leading to delays, increased transportation costs, and inventory challenges. The complexities of international trade became even more pronounced for small businesses lacking the resources of larger corporations.

- Increased shipping times: Delays at ports and border crossings led to longer lead times for raw materials and finished goods.

- Higher transportation costs: Businesses faced increased freight costs, adding to their already strained budgets.

- Inventory management challenges: Uncertainties in supply made it difficult for businesses to maintain optimal inventory levels.

Finding alternative suppliers presented another hurdle for small businesses. The established relationships and economies of scale enjoyed by larger corporations were often unavailable to smaller enterprises, leaving them more vulnerable to supply chain disruptions. Logistics became a critical concern, requiring businesses to invest time and resources in restructuring their supply chains to minimize the impact of tariffs.

Reduced Consumer Demand and Sales

The impact of Trump's tariffs extended beyond input costs; they also contributed to reduced consumer demand and, consequently, lower sales for small businesses. This was a result of higher prices and increased competition.

Impact of Higher Prices on Consumer Spending

Tariffs contributed to higher consumer prices, leading to decreased consumer spending and negatively impacting small business sales. Consumers, facing higher prices on various goods, adjusted their spending habits.

- Statistics from [insert source] showed a [insert percentage]% decrease in consumer spending on [insert specific product category] following tariff implementation.

- Businesses responded by implementing sales promotions, offering discounts, and unfortunately, in some cases, implementing layoffs.

- The reduced consumer spending created a ripple effect throughout the economy, impacting not only small businesses but also larger corporations and the overall economic growth.

Competition from Foreign and Domestic Businesses

Tariffs altered the competitive landscape for small businesses. Some foreign businesses found ways to navigate the tariffs, while larger domestic businesses, often with more resources, were better equipped to absorb the increased costs.

- Some smaller businesses lost market share to larger domestic competitors who could better manage the increased costs.

- Businesses in certain sectors faced increased competition from foreign businesses that were able to adapt to the new trade environment.

- The impact varied based on business size and structure. Larger businesses with diversified supply chains and greater financial reserves were better positioned to withstand the challenges.

This increased competition put immense pressure on small businesses, threatening their market share and long-term viability.

Government Support and Relief Measures (or Lack Thereof)

The availability and effectiveness of government assistance programs designed to help small businesses cope with the economic impact of Trump's tariffs were uneven. While some programs were implemented, their effectiveness and accessibility were debated.

Availability of Government Assistance Programs

Several government programs were designed to help small businesses affected by tariffs, but their effectiveness varied.

- [List specific government programs, e.g., SBA loans, disaster relief funds] and their eligibility criteria were often complex and difficult to navigate for many small business owners.

- Some programs faced criticism for slow disbursement of funds or limited accessibility for certain types of businesses.

- The success or failure of these programs depended on factors such as the speed of application processing, the clarity of eligibility requirements, and the overall amount of funding provided.

Advocacy Efforts by Small Business Organizations

Small business organizations played a crucial role in raising awareness of the challenges faced and advocating for government support.

- Organizations like the [Name specific organizations] actively lobbied for policy changes and increased government assistance.

- The effectiveness of their advocacy efforts varied depending on political circumstances and the responsiveness of policymakers.

- Their work highlighted the disproportionate impact of tariffs on small businesses and pushed for policies that would better support them.

Conclusion

Trump's tariffs had a significant and multifaceted impact on the small business sector. Increased input costs, reduced consumer demand, and limited government support created immense challenges for many small businesses. Understanding the complexities of these impacts, particularly the long-term effects on supply chains and competitiveness, is crucial for future economic planning. The experiences of small businesses during this period offer valuable lessons regarding the potential consequences of trade policy decisions.

To continue your research into the long-term consequences of these trade policies and better prepare your small business for future economic challenges, explore resources provided by organizations such as the Small Business Administration (SBA) and your local Chamber of Commerce. Understanding the impact of tariffs and other economic shifts is essential for business resilience.

Featured Posts

-

Bradley Wiggins From Cycling Champion To Drug Addiction And Bankruptcy

May 12, 2025

Bradley Wiggins From Cycling Champion To Drug Addiction And Bankruptcy

May 12, 2025 -

Tales From The Track Win Tickets Presented By Relay

May 12, 2025

Tales From The Track Win Tickets Presented By Relay

May 12, 2025 -

Us Ambassadors Remarks On Canada Tariffs Spark Debate

May 12, 2025

Us Ambassadors Remarks On Canada Tariffs Spark Debate

May 12, 2025 -

Viral Video A Fake Henry Cavill Captain Britain Trailer

May 12, 2025

Viral Video A Fake Henry Cavill Captain Britain Trailer

May 12, 2025 -

Could Henry Cavills Wolverine Appear In Marvels World War Hulk Movie

May 12, 2025

Could Henry Cavills Wolverine Appear In Marvels World War Hulk Movie

May 12, 2025