Investing In 2025: MicroStrategy Stock Vs. Bitcoin – A Detailed Analysis

Table of Contents

Understanding MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy's Core Business

MicroStrategy is a publicly traded company primarily focused on enterprise analytics software. Its core business involves providing business intelligence, mobile software, and cloud-based services to large organizations.

- Revenue Streams: Primarily derived from software licenses, maintenance contracts, and cloud subscriptions.

- Market Position: MicroStrategy holds a significant, albeit contested, position in the enterprise analytics market.

- Competition: Faces stiff competition from industry giants such as Tableau, Qlik, and SAP.

- Recent Performance: Financial performance has been influenced by both its core business and its significant Bitcoin holdings, leading to volatility.

Understanding MicroStrategy's core business performance is crucial for evaluating the overall investment potential of its stock. Fluctuations in the enterprise analytics software market directly impact MSTR stock price.

MicroStrategy's Bitcoin Strategy

MicroStrategy has garnered significant attention for its substantial Bitcoin holdings. The company has adopted a bold strategy of accumulating Bitcoin as a treasury reserve asset.

- Amount of BTC Owned: A substantial amount of Bitcoin, making it one of the largest corporate holders globally. (Note: Specific amounts will need to be updated to reflect current holdings).

- Average Purchase Price: The average cost basis of MicroStrategy's Bitcoin holdings will directly impact profitability.

- Stated Goals: The company has publicly stated its belief in Bitcoin as a long-term store of value and a hedge against inflation. This strategy presents both opportunity and risk.

MicroStrategy's Bitcoin investment strategy is a key factor differentiating it from purely traditional technology companies. The performance of Bitcoin directly impacts the valuation of MSTR.

Bitcoin's Market Position and Future Potential

Bitcoin's Technological Foundations

Bitcoin operates on a decentralized, public blockchain. This innovative technology underpins its key characteristics:

- Key Advantages: Decentralization, security (through cryptography), transparency, and limited supply.

- Key Disadvantages: Price volatility, regulatory uncertainty, scalability challenges, and environmental concerns related to energy consumption.

Bitcoin’s underlying technology is complex but understanding its core principles is essential for assessing its investment potential.

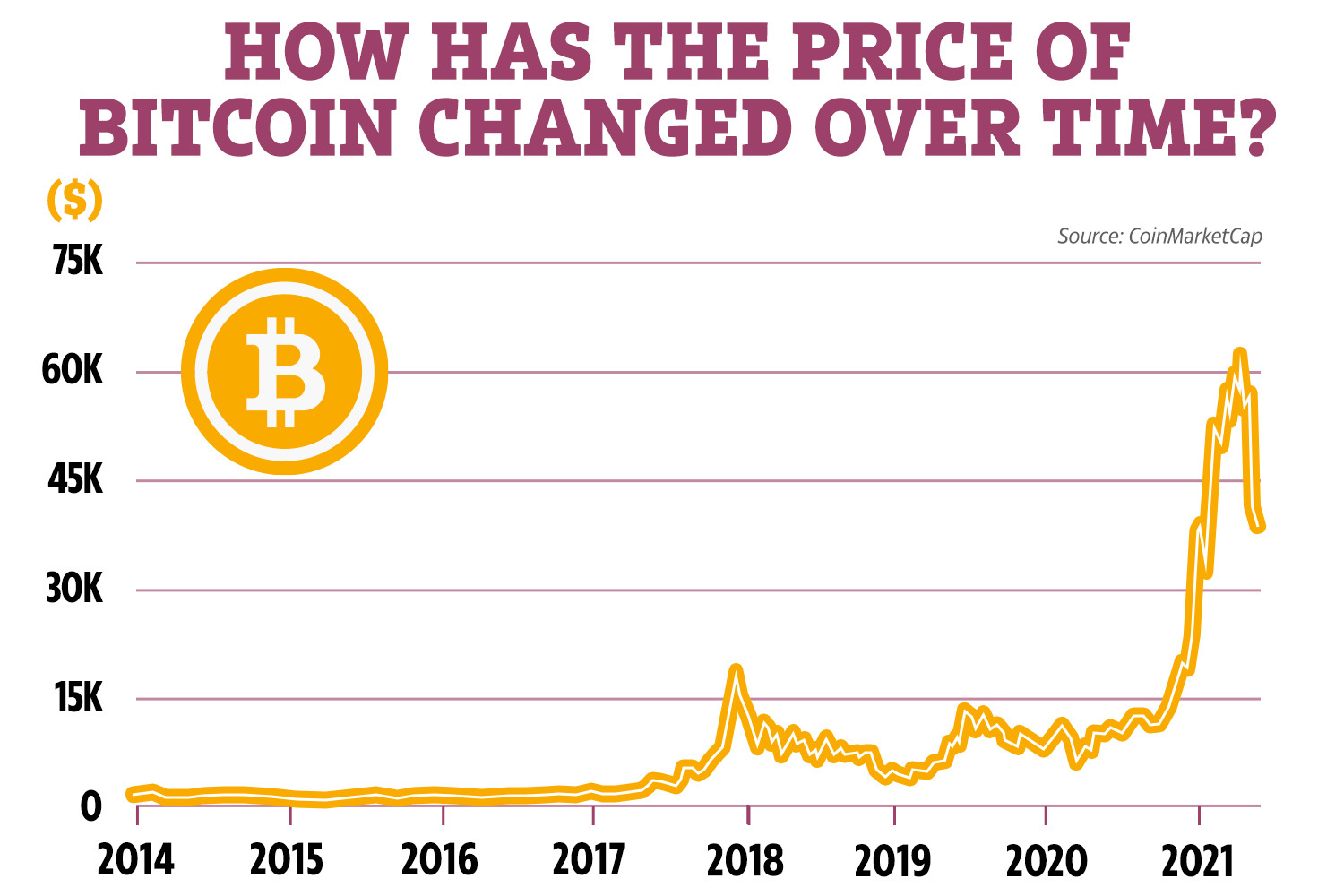

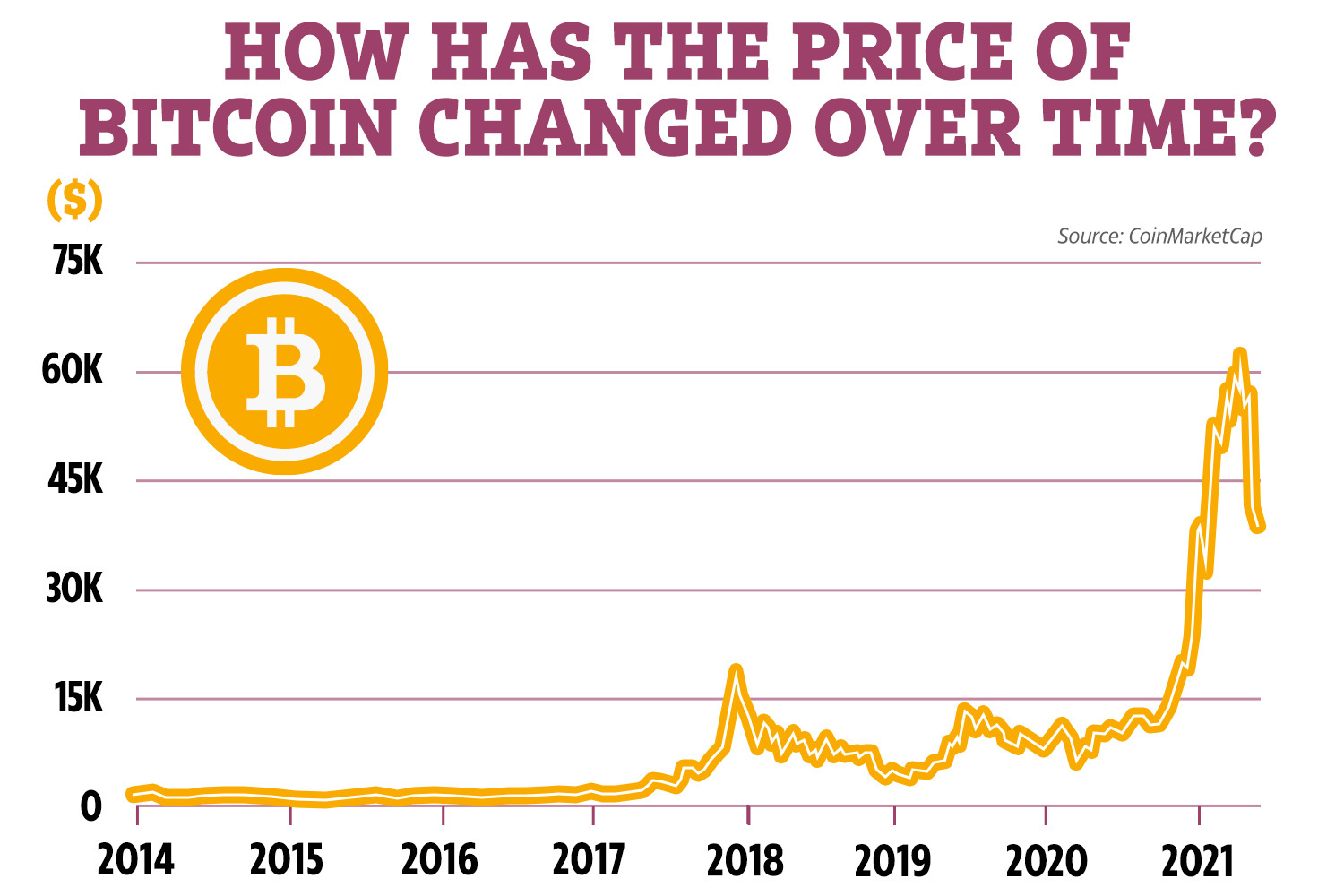

Bitcoin's Price Volatility and Risk Assessment

Bitcoin's price has historically demonstrated significant volatility. This presents both significant opportunities and considerable risk.

- Factors Influencing Price: Regulatory developments, adoption by institutional investors, macroeconomic factors, and market sentiment all play a crucial role.

- Potential Future Price Scenarios: Predicting Bitcoin's future price is highly speculative, with potential for substantial gains or losses.

- Risk Mitigation Strategies: Diversification and a long-term investment horizon are often recommended to mitigate some of the inherent risks.

Investors must carefully consider their risk tolerance before investing in Bitcoin due to its high price volatility.

Comparative Analysis: MicroStrategy Stock vs. Bitcoin in 2025

Investment Return Potential

Comparing the potential ROI for MicroStrategy stock and Bitcoin requires considering different investment horizons.

- Factors Affecting ROI (MSTR): Performance of the enterprise analytics software market, success of its Bitcoin strategy, and overall economic conditions.

- Factors Affecting ROI (BTC): Adoption rate, regulatory landscape, technological advancements, and macroeconomic factors.

- Potential Risks and Rewards: Both investments carry risk; however, the nature and magnitude of the risk differ significantly.

Long-term investors might see different ROI potentials for each asset class.

Risk Tolerance and Diversification

Choosing between MicroStrategy stock and Bitcoin depends heavily on your risk tolerance and portfolio diversification strategy.

- Suitable Investor Profiles: MSTR might suit investors seeking exposure to the enterprise analytics market with some Bitcoin-related exposure. Bitcoin is better suited for investors with a higher risk tolerance and a longer-term investment horizon.

- Diversification: Both assets can play a role in a diversified portfolio, but their inclusion depends on individual circumstances and risk preferences.

Effective risk management and portfolio diversification are crucial for mitigating potential losses in both investments.

Investing in 2025: MicroStrategy Stock vs. Bitcoin – A Final Verdict

Our analysis reveals that both MicroStrategy stock and Bitcoin present unique investment opportunities and challenges in 2025. MicroStrategy offers exposure to the enterprise analytics market and the potential upside of its Bitcoin holdings, but carries the risks associated with both sectors. Bitcoin presents higher risk and volatility but offers potentially significant rewards. The optimal choice depends heavily on individual risk tolerance, investment goals, and diversification strategies. Remember, this is not financial advice, and thorough due diligence is crucial before making any investment decisions. Start your research into MicroStrategy stock and Bitcoin investments today!

Featured Posts

-

20 Surprising Facts About The Making Of Saving Private Ryan

May 08, 2025

20 Surprising Facts About The Making Of Saving Private Ryan

May 08, 2025 -

El Psg Vence Al Lyon En Francia

May 08, 2025

El Psg Vence Al Lyon En Francia

May 08, 2025 -

Zherson I Zenit Podrobnosti Kontrakta Na E500 000

May 08, 2025

Zherson I Zenit Podrobnosti Kontrakta Na E500 000

May 08, 2025 -

Jayson Tatum Game Status Celtics Vs Nets Injury Report And Prediction

May 08, 2025

Jayson Tatum Game Status Celtics Vs Nets Injury Report And Prediction

May 08, 2025 -

Lahwr 5 Ahtsab Edaltyn Khtm Wfaqy Hkwmt Ka Aelan

May 08, 2025

Lahwr 5 Ahtsab Edaltyn Khtm Wfaqy Hkwmt Ka Aelan

May 08, 2025