Investing In A Watch: A Guide To Smart Spending

Table of Contents

Understanding Your Investment Goals When Buying a Watch

Before diving into the exciting world of luxury watches, it's crucial to establish clear investment goals. This involves careful consideration of your financial resources and expectations.

Defining Your Budget:

Setting a realistic budget is paramount. Investing in a watch requires careful planning, balancing potential long-term returns with immediate gratification.

- Entry-Level (<$1,000): Focus on reliable, well-established brands offering good value. Consider quartz movements or entry-level mechanical watches.

- Mid-Range ($1,000 - $5,000): Explore established brands with a history of quality and potential for modest appreciation. Look for pre-owned watches for better value.

- Luxury (>$5,000): This segment opens doors to prestigious brands like Rolex, Patek Philippe, and Audemars Piguet, known for significant appreciation potential. However, requires substantial financial commitment.

Remember to save diligently and thoroughly research before committing to a purchase. Impulsive buying rarely yields strong investment returns.

Choosing the Right Watch Type for Investment:

Certain watch categories have a higher likelihood of appreciating in value.

- Vintage Watches: Well-maintained vintage timepieces from reputable brands often command premium prices due to their rarity and historical significance.

- Limited Editions: Limited-production runs enhance exclusivity and desirability, contributing to higher resale values.

- Luxury Sports Watches: Popular models from brands like Rolex (Submariner, Daytona) and Omega (Speedmaster) are highly sought after and often appreciate significantly.

Brands renowned for retaining or increasing their value include Rolex, Patek Philippe, Omega, Audemars Piguet, and Jaeger-LeCoultre. Factors influencing a watch's investment potential include brand reputation, rarity (limited editions, discontinued models), condition, and provenance (original documentation and service history).

Researching and Evaluating Watches Before Purchasing

Thorough research is critical to avoid costly mistakes when investing in a watch.

Authenticity Verification:

Ensuring authenticity is paramount to avoid fraud. Counterfeit watches are prevalent, and purchasing one can result in significant financial loss.

- Inspect Carefully: Examine the watch closely for inconsistencies in markings, materials, and movement.

- Reputable Dealers: Purchase only from authorized dealers or well-established, reputable sellers with proven track records.

- Professional Authentication: Consider using a professional watch authenticator for high-value pieces.

Buying from unauthorized sellers carries considerable risk. Always prioritize safety and authenticity.

Assessing Condition and Value:

Determining a watch's condition and market value is crucial for making sound investment decisions.

- Case and Bracelet: Check for scratches, dents, and wear.

- Movement: Assess the functionality and accuracy of the watch's internal mechanism.

- Service History: A documented service history increases value and demonstrates proper care.

- Online Resources: Utilize online forums, auction sites (eBay, Chrono24), and price indices to research market values.

- Professional Appraisers: For high-value pieces, consider consulting a professional watch appraiser.

Original documentation, such as the warranty card and box, significantly impact a watch's value.

Where to Buy and Sell Investment Watches

Choosing the right platform for buying and selling is vital for successful investing in a watch.

Reputable Dealers and Auction Houses:

- Authorized Dealers: Offer certified, new watches with warranties but often at higher prices.

- Reputable Online Marketplaces: Platforms like Chrono24 offer a wide selection of watches from various sellers, requiring due diligence.

- Auction Houses (Christie's, Sotheby's): Ideal for high-value, rare pieces, but involve significant fees and competition.

Consider the advantages and disadvantages of each channel, including buyer protection, seller fees, and authentication processes.

Understanding the Market:

Monitoring market trends is essential for informed decision-making.

- Online Watch Price Indices: Track price fluctuations and overall market trends.

- Collector Forums: Engage with experienced collectors to gain insights and perspectives.

Supply and demand significantly influence watch prices. Understanding market dynamics is crucial for maximizing returns on your investment.

Conclusion: Making Smart Choices When Investing in a Watch

Successfully investing in a watch involves careful planning, thorough research, and a keen eye for detail. Remember to define your budget, research potential purchases meticulously, and choose reputable sources for buying and selling. By following these guidelines, you can significantly increase your chances of building a profitable and enjoyable watch collection. Start your journey into investing in a watch today by exploring reputable dealers and understanding your financial goals. Further research into specific brands and models within your chosen budget will enhance your success in this rewarding field.

Featured Posts

-

Elsbeth Season 2 Finale Streaming Guide And Where To Watch Free

May 27, 2025

Elsbeth Season 2 Finale Streaming Guide And Where To Watch Free

May 27, 2025 -

The Implications Of Trumps Backing For The Nippon Steel Deal

May 27, 2025

The Implications Of Trumps Backing For The Nippon Steel Deal

May 27, 2025 -

Where To Stream 1923 Season 2 Episode 5 Tonight Free Options

May 27, 2025

Where To Stream 1923 Season 2 Episode 5 Tonight Free Options

May 27, 2025 -

How To Watch Mob Land Season 1 Pierce Brosnan Tom Hardy And Helen Mirren

May 27, 2025

How To Watch Mob Land Season 1 Pierce Brosnan Tom Hardy And Helen Mirren

May 27, 2025 -

Lizzos Britney Spears Janet Jackson Comparison Ignites Fan Debate

May 27, 2025

Lizzos Britney Spears Janet Jackson Comparison Ignites Fan Debate

May 27, 2025

Latest Posts

-

Revenirea Lui Andre Agassi Primul Meci De Pickleball

May 30, 2025

Revenirea Lui Andre Agassi Primul Meci De Pickleball

May 30, 2025 -

Andre Agassi O Noua Era In Cariera Sa Pickleball

May 30, 2025

Andre Agassi O Noua Era In Cariera Sa Pickleball

May 30, 2025 -

Legenda Tenisului Andre Agassi Joaca Pickleball

May 30, 2025

Legenda Tenisului Andre Agassi Joaca Pickleball

May 30, 2025 -

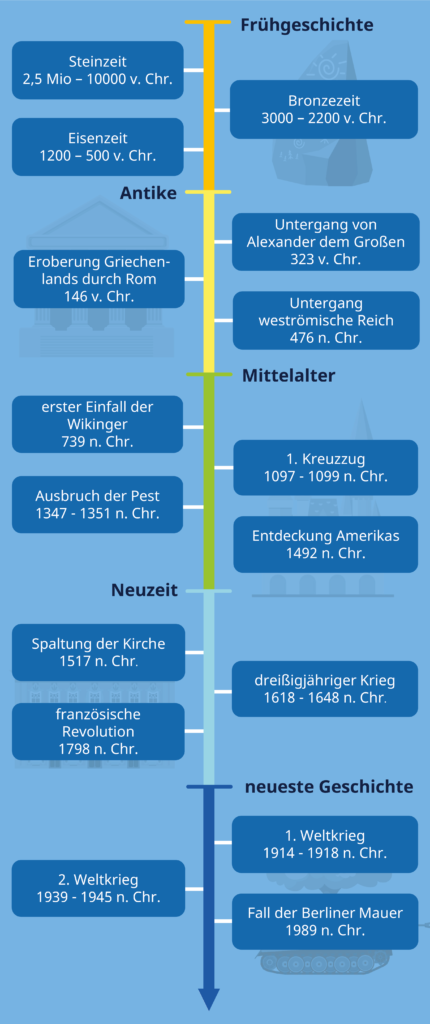

Der 10 April In Der Geschichte Daten Fakten Und Ereignisse

May 30, 2025

Der 10 April In Der Geschichte Daten Fakten Und Ereignisse

May 30, 2025 -

Andre Agassi Prima Partida Profesionala De Pickleball

May 30, 2025

Andre Agassi Prima Partida Profesionala De Pickleball

May 30, 2025