Investing In Apple: Considering Wedbush's Revised Price Target And Long-Term View

Table of Contents

Wedbush's Revised Price Target and its Implications

Wedbush Securities recently revised its price target for Apple stock to $230, representing a significant increase from its previous estimate. This bullish outlook stems from several key factors driving their analysis. Wedbush's analysts believe Apple's robust iPhone sales, coupled with expanding revenue streams from its services sector (including Apple Music, iCloud, and the App Store), justify this heightened price target. Furthermore, anticipation surrounding new product launches, such as potential advancements in augmented reality/virtual reality (AR/VR) technology and the continued success of the Apple Watch, significantly contribute to their positive outlook on the Apple stock price prediction.

The impact of this revised target on investor sentiment is already palpable. A higher price target generally boosts investor confidence, potentially leading to increased buying pressure and a rise in Apple's stock price. However, it's crucial to remember that analyst predictions are not guarantees. Market behavior is complex and influenced by numerous unpredictable factors.

- Key factors supporting Wedbush's bullish outlook: Strong iPhone sales, expanding services revenue, upcoming product launches, loyal customer base.

- Potential downside risks considered by Wedbush: Economic slowdown, increased competition, supply chain disruptions.

- Comparison to other analysts' price targets for Apple: While Wedbush's target is on the higher end, many other analysts also maintain positive outlooks for Apple, indicating a general sense of optimism surrounding the stock.

Apple's Long-Term Growth Potential

Apple's long-term growth potential rests on several pillars. Its diverse product portfolio, encompassing iPhones, iPads, Macs, wearables (Apple Watch, AirPods), and a rapidly expanding services ecosystem, provides multiple avenues for revenue generation and expansion. Apple consistently maintains a significant market share across several key product categories, demonstrating its enduring appeal to consumers. The company's commitment to research and development fuels continuous innovation, ensuring its ability to adapt to evolving technological landscapes and maintain a competitive edge.

- Growth potential in specific product segments: The services segment shows exceptional growth potential, with recurring revenue streams and opportunities for expansion into new services. Wearables are also a significant growth driver, experiencing substantial year-over-year increases in sales.

- Opportunities in emerging markets: Apple's brand recognition and premium positioning offer opportunities for substantial growth in emerging markets with expanding middle classes and increasing smartphone penetration.

- Risks associated with competition and technological disruptions: Intense competition from other tech giants, particularly in the smartphone and services markets, poses a significant risk. Technological disruptions could also impact Apple's dominance in specific areas.

Analyzing the Risks of Investing in Apple

Despite its undeniable strengths, investing in Apple stock carries inherent risks. Macroeconomic factors, such as inflation, recessionary pressures, or fluctuations in currency exchange rates, can significantly impact Apple's profitability and stock price. Geopolitical instability and supply chain disruptions can also affect production, distribution, and ultimately, financial performance. Furthermore, the possibility of overvaluation, where the stock price surpasses its intrinsic value, represents a risk for investors.

- Specific economic risks to Apple's profitability: A global recession could significantly reduce consumer spending on discretionary electronics, impacting iPhone and other product sales. Inflationary pressures can increase production costs, squeezing profit margins.

- Competitive threats from other tech giants: Companies like Samsung, Google, and other emerging tech players continuously challenge Apple’s market share and innovation.

- Risks related to regulatory scrutiny and antitrust concerns: Increasing regulatory scrutiny and antitrust investigations could lead to penalties or restrictions that could negatively impact Apple's business.

Diversification and Risk Management Strategies

Diversification is paramount when constructing an investment portfolio. Relying solely on Apple stock, regardless of its potential, exposes your investment to significant risk. To mitigate this, consider diversifying your portfolio across various asset classes and sectors. Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals, can help reduce the impact of market volatility. Stop-loss orders, which automatically sell a stock when it falls below a predetermined price, can limit potential losses.

- Examples of other tech stocks to diversify with: Consider including other established tech companies like Microsoft, Google (Alphabet), Amazon, or promising growth stocks in different sub-sectors of the tech industry.

- Strategies to manage risk through dollar-cost averaging or stop-loss orders: These strategies can help reduce the emotional aspect of investing and limit potential losses during market downturns.

Conclusion

Wedbush's revised price target for Apple reflects a positive outlook driven by strong sales, expanding services, and anticipated new product launches. Apple's long-term growth potential is undeniable, fueled by a diverse product portfolio, strong brand loyalty, and ongoing innovation. However, investors must acknowledge the significant risks associated with any stock investment, including macroeconomic factors, competition, and the potential for overvaluation. Remember, investing in Apple, or any stock, involves inherent risk.

Call to Action: While the prospect of investing in Apple based on Wedbush's prediction is alluring, thorough due diligence is non-negotiable. Carefully consider your personal investment goals, risk tolerance, and overall portfolio diversification before making any decisions regarding Apple stock. Conduct your own in-depth research and, if needed, seek advice from a qualified financial advisor to make informed investment choices. Remember that investing in Apple requires a thoughtful assessment of both potential rewards and inherent risks.

Featured Posts

-

Long Term Investing The Gut Wrenching Reality Of Buy And Hold

May 25, 2025

Long Term Investing The Gut Wrenching Reality Of Buy And Hold

May 25, 2025 -

Waiting By The Phone Her Story

May 25, 2025

Waiting By The Phone Her Story

May 25, 2025 -

Explore The 2025 Porsche Cayenne Interior And Exterior Pictures

May 25, 2025

Explore The 2025 Porsche Cayenne Interior And Exterior Pictures

May 25, 2025 -

Google Vs Open Ai A Deep Dive Into I O And Io Differences

May 25, 2025

Google Vs Open Ai A Deep Dive Into I O And Io Differences

May 25, 2025 -

Lady Gaga Spotted With Fiance Michael Polansky At Snl Afterparty

May 25, 2025

Lady Gaga Spotted With Fiance Michael Polansky At Snl Afterparty

May 25, 2025

Latest Posts

-

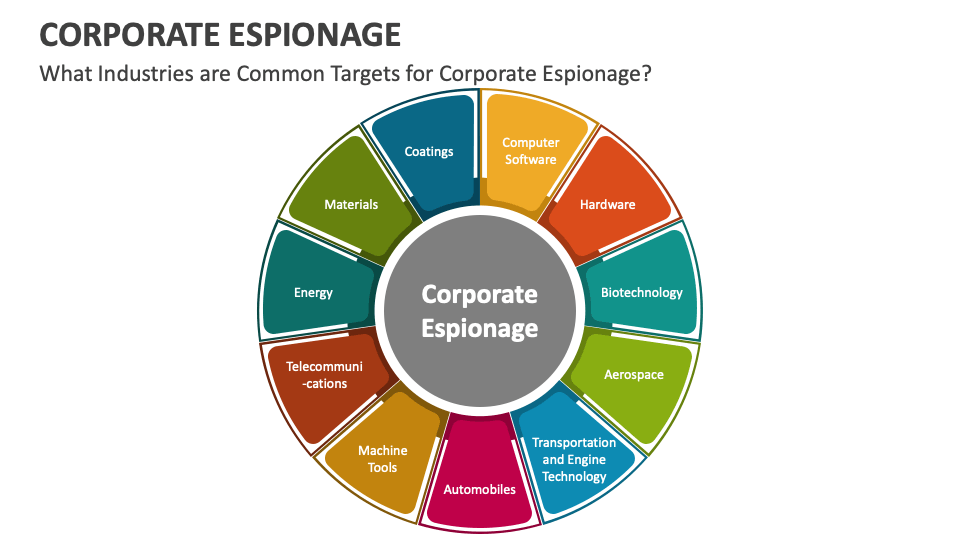

Corporate Espionage Office365 Breaches Net Millions For Hacker

May 25, 2025

Corporate Espionage Office365 Breaches Net Millions For Hacker

May 25, 2025 -

Federal Charges Millions Stolen Via Executive Office365 Hacks

May 25, 2025

Federal Charges Millions Stolen Via Executive Office365 Hacks

May 25, 2025 -

Open Ai 2024 Streamlined Voice Assistant Creation For Developers

May 25, 2025

Open Ai 2024 Streamlined Voice Assistant Creation For Developers

May 25, 2025 -

Office365 Hacker Made Millions Targeting Executives

May 25, 2025

Office365 Hacker Made Millions Targeting Executives

May 25, 2025 -

Ai Digest Transforming Repetitive Scatological Data Into Engaging Podcasts

May 25, 2025

Ai Digest Transforming Repetitive Scatological Data Into Engaging Podcasts

May 25, 2025