Investing In BigBear.ai (BBAI): Analyzing The Potential Of This AI Penny Stock

Table of Contents

Understanding BigBear.ai (BBAI) and its Business Model

BigBear.ai (BBAI) is a technology company that provides advanced AI-powered solutions and services to both government and commercial clients. Their core business revolves around leveraging cutting-edge artificial intelligence technologies to solve complex problems across various sectors.

- Specific Offerings: BigBear.ai offers a suite of AI solutions including advanced analytics, data visualization, predictive modeling, and AI-driven decision support systems. They cater to diverse needs, from national security applications to optimizing supply chain logistics for commercial enterprises.

- Target Markets: The company's primary target markets are the government sector (particularly defense and intelligence agencies) and large commercial clients seeking to enhance their operational efficiency and decision-making processes through AI. Government contracts represent a significant portion of their revenue stream.

- Competitive Advantages & Disadvantages: BigBear.ai's competitive advantages include its strong expertise in AI, a robust portfolio of solutions, and a proven track record of successful government contracts. However, dependence on government contracts can be a double-edged sword, exposing them to budget fluctuations and potential delays. Competition in the AI market is fierce, with larger, more established companies vying for similar contracts.

Analyzing BBAI's Financial Performance and Growth Prospects

Analyzing BBAI stock requires a close look at its financial statements. Recent financial reports should be reviewed to assess revenue generation, profitability (or lack thereof), and debt levels. Key financial ratios like the Price-to-Earnings (P/E) ratio and debt-to-equity ratio are crucial indicators of the company's financial health.

- Revenue & Earnings: Investors should carefully examine the trends in BBAI's revenue and earnings to gauge the company's growth trajectory. Consistent revenue growth is a positive sign, while declining earnings raise concerns.

- Debt Levels: High levels of debt can severely hinder a company's growth potential and increase its financial risk. Analyzing the debt-to-equity ratio is essential in assessing this risk.

- Growth Prospects: BigBear.ai's growth prospects depend heavily on its ability to secure new contracts, expand into new markets, and successfully develop and deploy innovative AI solutions. The overall growth of the AI market is a positive factor, but BBAI's ability to capture market share is crucial.

- Partnerships & Acquisitions: Keep an eye out for any significant partnerships or acquisitions that could significantly impact BBAI's financial performance and growth trajectory. Strategic alliances can open new market opportunities, while acquisitions can bolster the company's capabilities.

Evaluating the Risks Associated with Investing in BBAI

Investing in BBAI, as with any penny stock, comes with inherent risks. Penny stocks are known for their volatility, meaning the price can fluctuate wildly in short periods.

- Penny Stock Risk: The inherent volatility of penny stocks exposes investors to significant losses. BBAI is no exception. Price fluctuations can be dramatic, making it crucial to have a well-defined risk management strategy.

- Specific Risks for BBAI: BBAI faces risks related to its dependence on government contracts, intense competition from larger AI companies, and potential financial instability if it fails to secure sufficient contracts or manage its finances effectively.

- Volatility and Loss Potential: The price of BBAI stock can be highly volatile, meaning investors could experience substantial losses if the stock price declines. This risk is amplified by its status as a penny stock.

Comparing BBAI to Competitors in the AI Sector

BigBear.ai competes with numerous companies in the rapidly expanding AI market. A thorough competitive analysis is essential to assess BBAI's position within the industry.

- Key Competitors: Identify major players in the AI sector, focusing on those offering similar products and services to BBAI. Consider both large established corporations and smaller, more specialized companies.

- Strengths and Weaknesses: Compare BBAI's strengths (e.g., specific AI expertise, government relationships) and weaknesses (e.g., financial stability, market share) against its key competitors.

- Market Share & Potential: Analyzing BBAI's current market share and its potential for future market share gains is crucial. Factors influencing market share include innovation, pricing strategy, and marketing efforts.

Developing an Investment Strategy for BBAI

Investing in BBAI requires a well-defined strategy that incorporates risk management techniques.

- Investment Approaches: Consider a long-term hold strategy if you believe in the company's long-term growth potential. Short-term trading may be appealing to more risk-tolerant investors but requires precise timing and market analysis.

- Diversification: Diversification is crucial to mitigate risk. Don’t put all your investment eggs in one basket. Spread your investments across different asset classes to reduce the impact of losses in a single holding.

- Profit Targets and Stop-Loss Orders: Set realistic profit targets to determine when to sell your BBAI shares. Equally important are stop-loss orders to automatically sell your shares if the price falls below a predetermined level, limiting potential losses.

- Due Diligence: Thorough due diligence is paramount before investing in any stock, particularly a penny stock like BBAI. This includes reviewing financial reports, understanding the company's business model and competitive landscape, and assessing the inherent risks.

Conclusion: Final Thoughts on Investing in BigBear.ai (BBAI)

Investing in BigBear.ai (BBAI) presents both significant potential rewards and substantial risks. Its position in the growing AI sector is promising, but its status as a penny stock, dependence on government contracts, and intense competition should not be overlooked. Thorough research and a clear understanding of the associated risks are crucial before considering an investment. A well-defined investment strategy, including diversification and risk management techniques, is essential for navigating the volatility of this type of investment. Consider investing in BBAI only after conducting comprehensive due diligence and assessing whether it aligns with your individual risk tolerance and financial goals. Learn more about BBAI, analyze the BBAI investment opportunity carefully, and make informed decisions.

Featured Posts

-

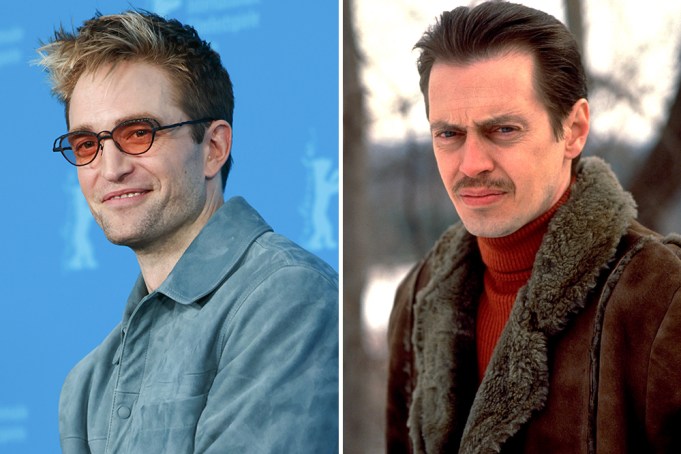

Robert Pattinsons Accent A Key To His Mickey 17 Performance

May 20, 2025

Robert Pattinsons Accent A Key To His Mickey 17 Performance

May 20, 2025 -

Eurovision 2025 Final Predictions And Top 5 Analysis

May 20, 2025

Eurovision 2025 Final Predictions And Top 5 Analysis

May 20, 2025 -

David Walliams Cancelled Joke Leaves Lorraine Kelly Uncomfortable

May 20, 2025

David Walliams Cancelled Joke Leaves Lorraine Kelly Uncomfortable

May 20, 2025 -

The D Wave Quantum Qbts Stock Slump Of 2025 Causes And Implications

May 20, 2025

The D Wave Quantum Qbts Stock Slump Of 2025 Causes And Implications

May 20, 2025 -

Nyt Mini Crossword Answers Today March 20 2025 Hints And Clues

May 20, 2025

Nyt Mini Crossword Answers Today March 20 2025 Hints And Clues

May 20, 2025

Latest Posts

-

Gangsta Granny A Review Of David Walliams Hilarious Book

May 20, 2025

Gangsta Granny A Review Of David Walliams Hilarious Book

May 20, 2025 -

David Walliams Cancelled Joke Leaves Lorraine Kelly Uncomfortable

May 20, 2025

David Walliams Cancelled Joke Leaves Lorraine Kelly Uncomfortable

May 20, 2025 -

Lorraine Kellys Awkward Tv Moment David Walliams Cancelled Comment

May 20, 2025

Lorraine Kellys Awkward Tv Moment David Walliams Cancelled Comment

May 20, 2025 -

New Cliff Richard Musical A Collaboration A Challenge

May 20, 2025

New Cliff Richard Musical A Collaboration A Challenge

May 20, 2025 -

Sandylands U Tv Schedule Where And When To Watch

May 20, 2025

Sandylands U Tv Schedule Where And When To Watch

May 20, 2025