Investing In China's Auto Industry: Opportunities And Risks

Table of Contents

The Alluring Opportunities in China's Automotive Market

China's automotive market is a powerhouse, driven by several key factors that create attractive opportunities for investors.

Booming Domestic Demand and Growing Middle Class

The expansion of China's middle class is a primary engine driving the surge in vehicle demand. This burgeoning consumer base has an increasing appetite for personal transportation, fueling substantial growth across various market segments. Electric vehicles (EVs) and SUVs are particularly prominent examples, exhibiting exceptionally robust sales figures.

- Market Size: China is already the world's largest automotive market, with annual sales exceeding [Insert current data on annual sales].

- Car Ownership Growth: Car ownership rates are steadily rising, indicating significant untapped potential for future growth. [Insert statistic on car ownership growth].

- EV Market China: The electric vehicle sector is booming, spurred by government initiatives and growing consumer awareness of environmental concerns. Sales of EVs in China are projected to [Insert projection data on EV sales].

- Strong Growth Segments: SUVs and luxury vehicles are experiencing disproportionately high growth rates within the Chinese auto market.

Government Support and Favorable Policies

The Chinese government is actively promoting the development of its domestic auto industry, particularly in the electric vehicle sector. This support manifests in several ways:

- China EV Subsidies: Generous subsidies and tax breaks incentivize consumers to purchase EVs, stimulating demand and supporting domestic manufacturers.

- Government Incentives Auto Industry China: Infrastructure development, including charging stations and battery recycling facilities, further accelerates the adoption of EVs.

- China Automotive Policy: Favorable policies aimed at fostering technological innovation and encouraging the use of domestically produced components also contribute to the growth. These policies aim to make China a global leader in automotive technology.

Technological Innovation and Supply Chain Integration

China's auto industry is at the forefront of technological innovation, presenting significant investment opportunities:

- China Auto Technology: Many Chinese companies are developing cutting-edge technologies in areas like battery technology, autonomous driving, and connected car solutions.

- Autonomous Driving China: Investments in autonomous driving technology are significant, with numerous companies vying for market share.

- Electric Vehicle Battery China: China is a leading producer of EV batteries, with companies making significant advancements in battery technology and efficiency.

- Sophisticated Supply Chain: The Chinese automotive supply chain is becoming increasingly sophisticated, offering opportunities for investors seeking integration into this robust network.

Understanding the Risks Associated with Investing in China's Auto Sector

Despite the significant opportunities, investing in China's auto industry involves considerable risks:

Intense Competition and Market Saturation

The Chinese automotive market is fiercely competitive, with both established international players and rapidly growing domestic brands vying for market share. This intense competition can lead to:

- China Auto Market Competition: Price wars and reduced profit margins are potential outcomes of this competitive landscape.

- Market Saturation China Auto: Certain segments, particularly in the lower-end of the market, could experience market saturation in the coming years.

Regulatory Uncertainty and Policy Changes

The regulatory environment in China is known for its complexity and potential for sudden changes. Investors need to be aware of:

- China Regulatory Risk: Unexpected policy shifts can significantly impact investment returns.

- Automotive Policy Changes China: Staying abreast of regulatory changes and adapting investment strategies accordingly is crucial.

Geopolitical Risks and Trade Tensions

Global trade relations and geopolitical factors can significantly influence the Chinese auto industry.

- China US Trade War Auto: Trade disputes and tariffs can disrupt supply chains and impact profitability.

- Geopolitical Risks China Investment: Political instability or shifts in international relations can create significant uncertainty for investors.

Intellectual Property Concerns

Protecting intellectual property rights in China remains a challenge for many international companies. Investors need to carefully consider:

- IP Protection: The risk of intellectual property theft needs to be carefully assessed and mitigated.

Conclusion: Weighing Opportunities and Risks in China's Auto Industry Investment

Investing in China's auto industry offers substantial potential for high returns, driven by strong domestic demand, government support, and technological innovation. However, the intense competition, regulatory uncertainty, geopolitical risks, and intellectual property concerns present significant challenges. Thorough due diligence, a deep understanding of the market dynamics, and a robust risk management strategy are essential for success. Before making any investment decisions, conduct further research, seek professional financial advice, and carefully weigh the opportunities against the potential risks associated with investing in China's auto industry. Remember to stay informed on the latest developments in the Chinese automotive market and adapt your strategies as needed.

Featured Posts

-

Colgate Shares Suffer As Tariffs Add 200 Million To Costs

Apr 26, 2025

Colgate Shares Suffer As Tariffs Add 200 Million To Costs

Apr 26, 2025 -

The Hollywood Strike What It Means For The Entertainment Industry

Apr 26, 2025

The Hollywood Strike What It Means For The Entertainment Industry

Apr 26, 2025 -

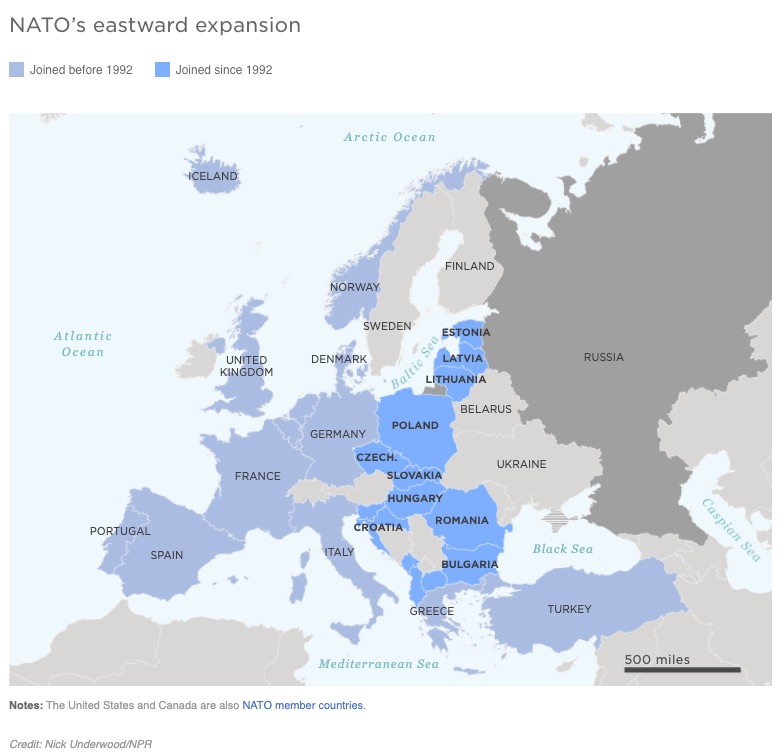

Ukraines Nato Aspiration Trumps Perspective And Implications

Apr 26, 2025

Ukraines Nato Aspiration Trumps Perspective And Implications

Apr 26, 2025 -

Over The Counter Birth Control A New Era Of Reproductive Freedom

Apr 26, 2025

Over The Counter Birth Control A New Era Of Reproductive Freedom

Apr 26, 2025 -

A Timeline Of Karen Reads Murder Cases And Legal Proceedings

Apr 26, 2025

A Timeline Of Karen Reads Murder Cases And Legal Proceedings

Apr 26, 2025