Investing In Palantir After A 30% Market Correction

Table of Contents

Understanding Palantir's Recent Market Correction

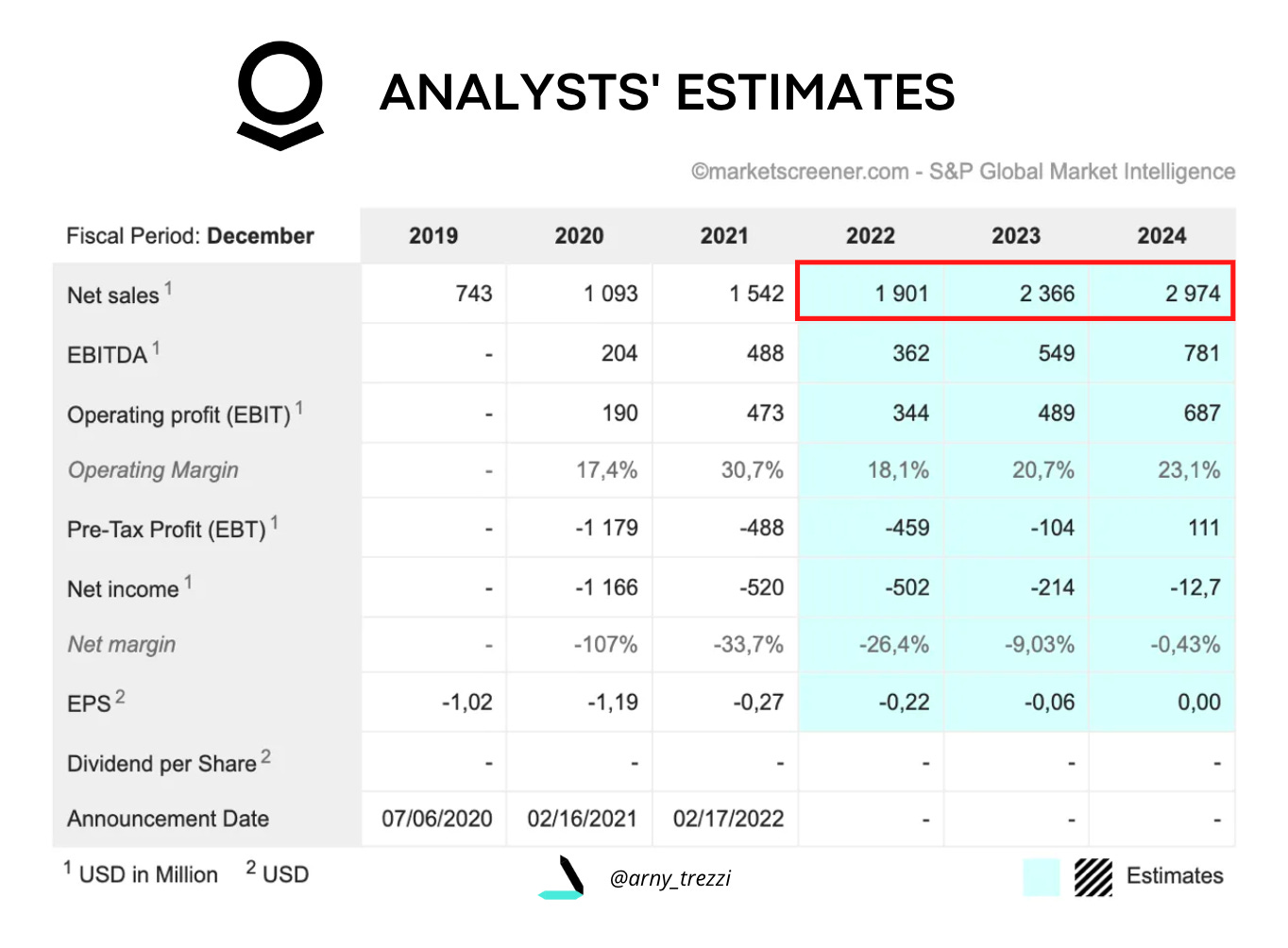

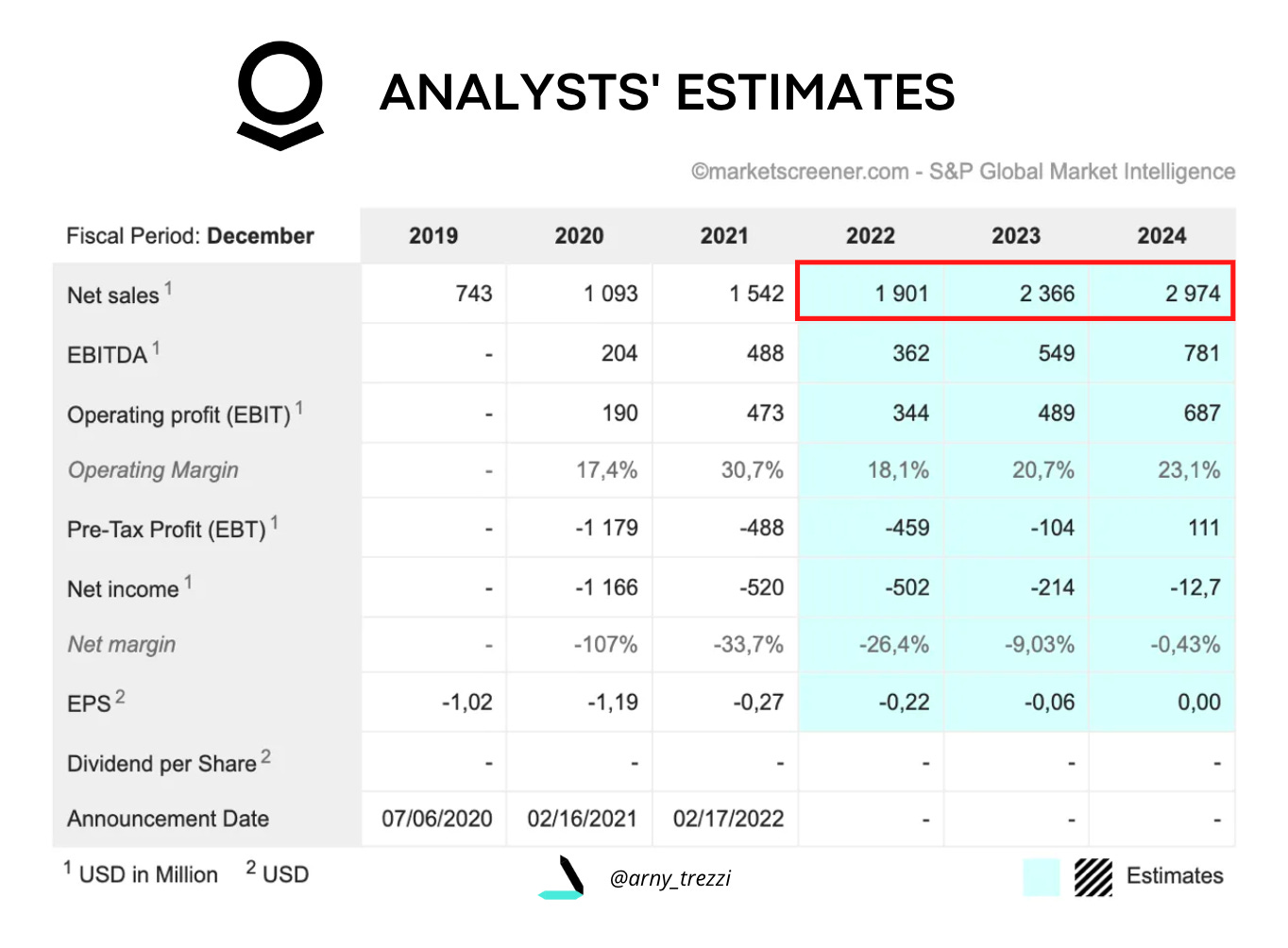

The 30% drop in Palantir stock price wasn't a singular event but rather a confluence of factors impacting both the broader market and the company specifically. The Palantir market correction reflects a combination of macroeconomic trends and company-specific news.

-

Overall Market Sentiment: The recent bear market and a widespread tech sell-off significantly impacted growth stocks like Palantir. Investor risk aversion led to a reassessment of valuations across the technology sector, pushing down even fundamentally strong companies. This broader Palantir stock price decline is a crucial context for understanding the recent drop.

-

Company-Specific News: While Palantir has shown consistent revenue growth, some quarters have seen slower-than-expected expansion, leading to concerns amongst investors. Missed earnings projections or cautious guidance can trigger significant sell-offs, as seen in the recent PLTR stock analysis by several financial institutions.

-

Investor Concerns: High Palantir valuation relative to earnings has always been a point of contention for some investors. Concerns about the sustainability of growth, particularly in the commercial sector, also played a role in the correction. Furthermore, the dependence on large government contracts creates volatility for some investors.

-

Key Negative News:

- Slower-than-expected revenue growth in certain quarters.

- Concerns about profitability and high operating expenses.

- Increased competition in the data analytics market.

-

Key Positive News:

- Continued strong growth in government contracts.

- Expanding presence in the commercial sector.

- Ongoing innovation and development of new products and services.

Evaluating Palantir's Long-Term Growth Potential

Despite the recent Palantir market correction, Palantir possesses significant long-term growth potential. Its core business revolves around providing advanced data analytics and operating platforms to both government and commercial clients. This dual approach positions it uniquely in the market.

-

Core Business Strengths:

- Data Analytics Capabilities: Palantir's proprietary platforms, Gotham and Foundry, offer unmatched data integration, analysis, and visualization capabilities.

- Government Contracts: Palantir holds substantial contracts with various government agencies, providing a stable revenue stream and a significant competitive advantage. These Palantir government contracts represent a substantial portion of its current revenue.

- Expanding Commercial Sector Presence: Palantir's expansion into the commercial sector, particularly with its Palantir Foundry platform, is a key driver for future growth. This Palantir commercial growth is expected to diversify its revenue streams and increase its overall market reach.

-

Future Growth Areas:

- Artificial Intelligence (AI) integration within its platforms – Palantir AIP is expected to be a significant factor in future growth.

- Expansion into new industries and markets.

- Strategic partnerships and acquisitions to enhance its capabilities.

Assessing the Risks of Investing in Palantir

While Palantir offers significant upside potential, investing in the company entails substantial risks. A comprehensive Palantir risk assessment is crucial before making any investment decisions.

-

High Valuation: Even after the recent correction, Palantir's Palantir valuation remains relatively high compared to its earnings. This makes it susceptible to further corrections if earnings don't meet expectations.

-

Government Contract Dependence: A significant portion of Palantir's revenue is derived from government contracts. Changes in government policy or budgetary constraints could negatively impact the company's performance.

-

Competition: The data analytics market is highly competitive, with established players and new entrants vying for market share. Palantir competition is fierce, requiring continuous innovation to maintain its leading position.

Comparing Palantir to Competitors

Direct comparisons between Palantir and competitors like other big data analytics companies need to consider Palantir’s unique offerings. While Palantir vs. competitors analyses vary, Palantir differentiates itself through its highly secure, specialized platforms and its long-standing relationships with key government clients. A key metric to watch is Palantir market share in both government and commercial sectors. The unique capabilities of its platforms remain a significant competitive advantage.

Developing an Investment Strategy for Palantir

Considering a Palantir investment requires a well-defined strategy.

-

Investment Approaches:

- Buy and Hold: A long-term Palantir long-term investment strategy leverages the company's growth potential.

- Dollar-Cost Averaging: This strategy mitigates risk by investing a fixed amount at regular intervals, regardless of price fluctuations. Palantir dollar-cost averaging can be an effective approach.

-

Diversification and Risk Management: It's crucial to diversify your portfolio to mitigate risk. Don't invest more than you can afford to lose.

Conclusion

Palantir's recent 30% market correction presents a complex investment scenario. While the company possesses significant long-term growth potential, fueled by its strong position in government and its expansion in the commercial sector, investors must carefully consider the inherent risks, including its high valuation and dependence on government contracts. This Palantir analysis highlights the need for a thorough understanding of the company's business model and the competitive landscape before making any investment decision. Considering investing in Palantir after its recent market correction? Carefully weigh the risks and rewards discussed in this article before making any investment decisions. Remember to conduct your own thorough due diligence before investing in Palantir or any other stock.

Featured Posts

-

Fatal Stabbing Highlights Rise In Racially Motivated Violence

May 10, 2025

Fatal Stabbing Highlights Rise In Racially Motivated Violence

May 10, 2025 -

Stiven King Vernulsya V X I Oskorbil Ilona Maska

May 10, 2025

Stiven King Vernulsya V X I Oskorbil Ilona Maska

May 10, 2025 -

Edmonton Receives Funding Boost For 14 School Projects

May 10, 2025

Edmonton Receives Funding Boost For 14 School Projects

May 10, 2025 -

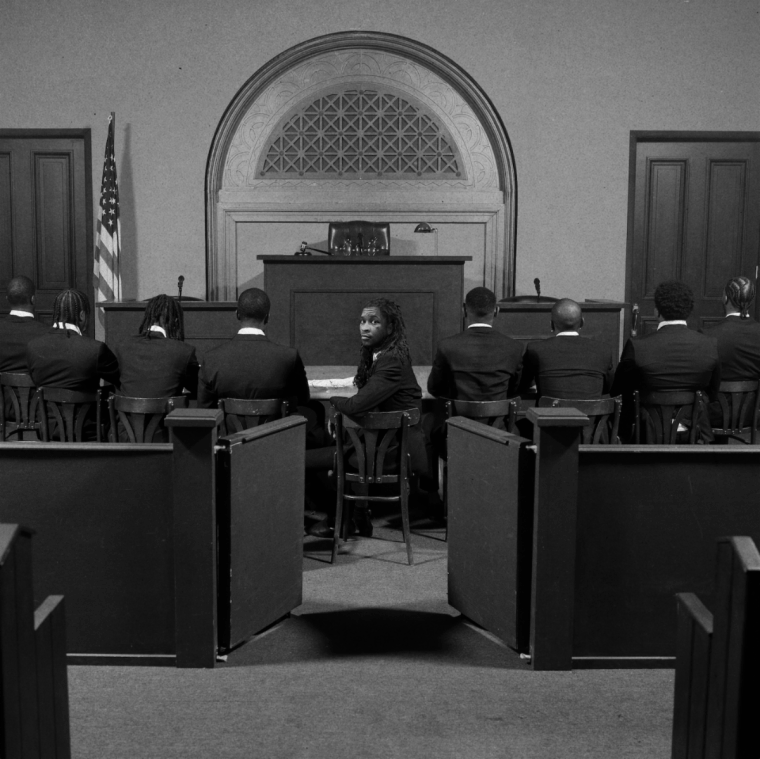

Mayor Ras Barakas Arrest Outside Ice Facility A Deeper Look

May 10, 2025

Mayor Ras Barakas Arrest Outside Ice Facility A Deeper Look

May 10, 2025 -

Young Thugs New Song A Promise To Stay Faithful

May 10, 2025

Young Thugs New Song A Promise To Stay Faithful

May 10, 2025