Investing In Palantir: Analyzing The Potential 40% Increase By 2025

Table of Contents

Palantir's Growth Drivers: Assessing the Path to a 40% Increase

Several key factors could contribute to Palantir achieving a 40% stock price increase by 2025. Let's examine them closely.

Government Contracts: A Cornerstone of Palantir's Revenue

Government contracts form a crucial pillar of Palantir's revenue. The company's sophisticated data analytics platforms are highly sought after by government agencies worldwide for intelligence gathering, cybersecurity, and operational efficiency. The current government contract landscape presents several opportunities:

- Specific examples of major government contracts: Palantir has secured substantial contracts with the US intelligence community, including the CIA and various branches of the military. International contracts are also growing, with significant deals signed with governments in Europe and elsewhere.

- Analysis of contract renewal rates and potential future contract wins: Palantir’s high contract renewal rates demonstrate the value provided to its clients. Continued success in bidding for new contracts, especially in expanding sectors like defense modernization and cybersecurity, is essential for sustained growth.

- Discussion of geopolitical factors affecting government spending on Palantir's technology: Global geopolitical tensions are likely to fuel increased government spending on national security and intelligence, bolstering demand for Palantir's solutions.

Commercial Market Expansion: Unlocking New Revenue Streams

While government contracts are vital, Palantir's commercial market expansion is key to its long-term growth and reaching that 40% increase. The company faces stiff competition, but its unique value proposition lies in its ability to handle complex, large-scale datasets and provide actionable insights.

- Examples of successful commercial partnerships and client acquisitions: Palantir has successfully partnered with major players in various sectors, including finance and healthcare. These partnerships demonstrate its ability to adapt its technology to diverse industries.

- Discussion of market penetration strategies and future target markets: Palantir’s strategic focus on high-value clients and specific verticals ensures efficiency and significant impact. This targeted approach, along with continued expansion into new sectors, will be crucial for commercial growth.

- Analysis of commercial revenue growth trends: The rate of commercial revenue growth will be a significant indicator of Palantir's overall success in achieving the 40% target. Strong and consistent growth in this area is crucial.

Technological Innovation and Future Products: Fueling Long-Term Growth

Palantir's commitment to research and development (R&D) fuels its long-term growth potential. Investments in artificial intelligence (AI), machine learning (ML), and other cutting-edge technologies are crucial for maintaining a competitive edge and developing innovative products and services.

- Specific examples of new product releases or technological advancements: Regular updates and new product releases demonstrate Palantir’s commitment to innovation. These advancements cement its position at the forefront of data analytics.

- Discussion of Palantir's competitive advantage in data analytics and AI: Palantir’s ability to analyze vast quantities of complex data is a key differentiator. Its expertise in AI and ML enhances its value proposition further.

- Analysis of the potential market size for these new technologies and services: The expanding market for AI and data analytics provides ample opportunity for growth and market share capture.

Financial Performance and Valuation: A Realistic Assessment

Analyzing Palantir's financial statements is crucial for assessing the feasibility of the 40% growth prediction. Key performance indicators (KPIs) such as revenue growth, profitability, and cash flow need thorough scrutiny.

- Review of revenue growth, profitability, and cash flow: Consistent and robust growth across these indicators are necessary for supporting the 40% stock price target.

- Comparison of Palantir's valuation to competitors: A comparative analysis with competitors in the data analytics sector helps determine whether Palantir's valuation is justified.

- Discussion of potential risks and challenges that could impact the 40% growth target: Factors like increased competition, economic downturns, and challenges in scaling operations could impact the projected growth.

Conclusion: Investing in Palantir: A Calculated Risk with Potential Rewards?

This analysis has explored the key factors driving Palantir's potential for a 40% stock price increase by 2025. While government contracts provide a solid foundation, the expansion into the commercial market and continued technological innovation are critical for achieving this ambitious goal. However, potential risks, including competition and economic uncertainty, must be considered. A balanced perspective is necessary: Palantir presents a compelling investment opportunity, but thorough due diligence is crucial before investing. While this analysis suggests significant potential for Palantir stock, thorough due diligence is crucial before investing. Learn more about Palantir investing strategies and make informed decisions.

Featured Posts

-

How Elon Musk Made His Billions A Deep Dive Into His Financial Success

May 09, 2025

How Elon Musk Made His Billions A Deep Dive Into His Financial Success

May 09, 2025 -

Iditarod Rookies 7 Sled Dog Teams Aiming For Nome

May 09, 2025

Iditarod Rookies 7 Sled Dog Teams Aiming For Nome

May 09, 2025 -

Netochniy Prognoz Snegopady V Mae I Problemy Meteorologii

May 09, 2025

Netochniy Prognoz Snegopady V Mae I Problemy Meteorologii

May 09, 2025 -

Harry Styles Devastated Reaction To A Poor Snl Impression

May 09, 2025

Harry Styles Devastated Reaction To A Poor Snl Impression

May 09, 2025 -

Hyatt Hotel Construction To Replace Historic Broad Street Diner

May 09, 2025

Hyatt Hotel Construction To Replace Historic Broad Street Diner

May 09, 2025

Latest Posts

-

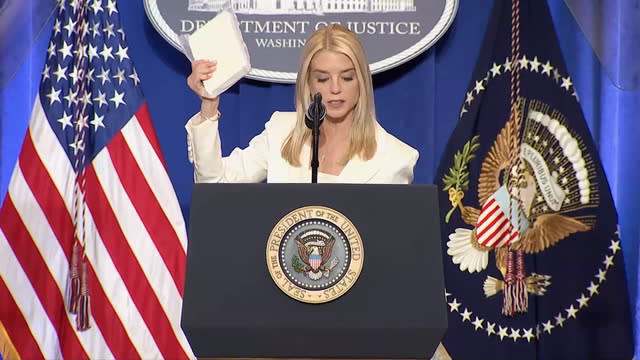

Attorney Generals Use Of Fake Fentanyl Public Reaction

May 10, 2025

Attorney Generals Use Of Fake Fentanyl Public Reaction

May 10, 2025 -

Press Conference Controversy Attorney General And The Fentanyl Block

May 10, 2025

Press Conference Controversy Attorney General And The Fentanyl Block

May 10, 2025 -

Presidential Politics Examining The Trump Administration On May 8th 2025

May 10, 2025

Presidential Politics Examining The Trump Administration On May 8th 2025

May 10, 2025 -

Update Pam Bondi To Publicly Release Documents Related To Epstein Diddy Jfk And Mlk

May 10, 2025

Update Pam Bondi To Publicly Release Documents Related To Epstein Diddy Jfk And Mlk

May 10, 2025 -

Analyzing The Trump Presidency Key Events Of Day 109 May 8th 2025

May 10, 2025

Analyzing The Trump Presidency Key Events Of Day 109 May 8th 2025

May 10, 2025