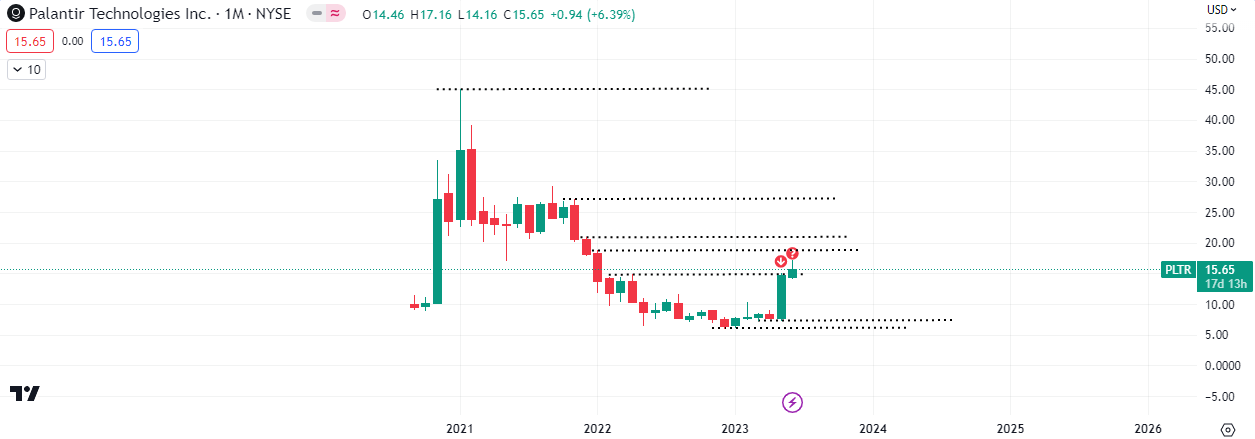

Investing In Palantir (PLTR) Before May 5th: A Comprehensive Guide

Table of Contents

Palantir Technologies (PLTR) stock has captivated investors with its potential for significant growth. With a potentially market-moving event on May 5th, now is a crucial time to consider investing in Palantir (PLTR). This comprehensive guide will equip you with the knowledge needed to make an informed decision about investing in Palantir (PLTR) before this important date. We'll delve into Palantir's business model, financial performance, and the potential implications of the May 5th event, helping you assess the risks and rewards of PLTR stock.

Understanding Palantir's Business Model and Growth Potential:

Palantir's core business revolves around providing cutting-edge data analytics solutions to both government and commercial clients. This dual-pronged approach offers significant diversification and growth opportunities.

Data Analytics and Government Contracts:

Palantir's expertise lies in its ability to process and analyze vast amounts of complex data. Its government contracts are a significant revenue driver, fueled by the increasing need for advanced data analytics in national security and intelligence.

- Successful deployments include assisting in counter-terrorism efforts and improving operational efficiency within various government agencies.

- The commercial sector presents a massive growth opportunity, with companies across various industries seeking to leverage Palantir's technology for better decision-making.

- The long-term growth potential is substantial, driven by the ever-expanding demand for advanced data analytics and artificial intelligence (AI) solutions.

Palantir's Foundry Platform:

Palantir Foundry is a central component of Palantir's growth strategy. This platform integrates data from various sources, enabling clients to gain valuable insights through AI-powered tools and machine learning capabilities.

- Key features include data integration, visualization, and predictive modeling, providing actionable insights for complex operational challenges.

- Foundry’s ability to streamline data processes and improve operational efficiencies has attracted numerous commercial clients, demonstrating the platform's widespread applicability.

- The scalability of Foundry presents a significant opportunity for future revenue growth, potentially driving substantial returns for PLTR investors.

Analyzing Palantir's Financial Performance and Valuation:

Assessing Palantir's financial health is crucial before investing in PLTR stock. A thorough analysis of key financial metrics and valuation is essential for understanding the company's potential and inherent risks.

Key Financial Metrics:

Investors should closely examine Palantir's recent financial reports, paying attention to:

- Revenue growth: Analyzing the trend in revenue growth helps assess the company's ability to expand its market share and capture new business opportunities.

- Profitability: Monitoring key profitability metrics like gross margin and operating margin reveals the efficiency of Palantir's operations and its ability to translate revenue into profits.

- Cash flow: Strong cash flow demonstrates the financial health and stability of the company.

- Regularly review Palantir's earnings per share (EPS) and price-to-sales ratio (P/S) to gauge its performance against competitors.

- Compare Palantir's key financial metrics to its competitors in the data analytics and AI space to evaluate its relative performance and competitive positioning.

Valuation and Investment Risks:

Palantir's current valuation needs careful consideration. While the company demonstrates significant growth potential, several risk factors must be assessed:

- Market volatility: The stock market's inherent volatility can significantly impact Palantir's stock price, regardless of the company’s fundamental performance.

- Competition: The data analytics market is competitive, posing a potential threat to Palantir's market share.

- Dependence on government contracts: A significant portion of Palantir's revenue comes from government contracts, creating a degree of dependence on government spending and policy. Understanding the potential risks associated with relying on these contracts is crucial.

- Analyze the price-to-sales ratio (P/S) to compare Palantir's valuation against industry peers and gauge its relative attractiveness.

Preparing for Investing in Palantir (PLTR) Before May 5th:

Making informed investment decisions requires thorough preparation and a well-defined strategy.

Due Diligence and Research:

Before investing in PLTR, conduct comprehensive due diligence:

- Carefully review Palantir's SEC filings (10-K, 10-Q) for detailed financial information and risk disclosures.

- Consult reputable financial news websites and analyst reports for insights into Palantir's performance and future outlook.

- Analyze industry trends and competitive landscape to assess Palantir’s competitive positioning.

Developing an Investment Strategy:

Choose an investment strategy aligned with your risk tolerance and financial goals:

- Long-term investors might view any pre-May 5th dips as buying opportunities, recognizing Palantir's long-term growth potential.

- Short-term traders might focus on exploiting short-term price fluctuations around the May 5th event. However, this strategy carries higher risk.

- Always diversify your portfolio to mitigate risk.

Understanding the May 5th Significance:

The May 5th event (e.g., earnings report) could significantly impact Palantir's stock price.

- Analyze analyst predictions and market sentiment to gauge potential price movements.

- Develop contingency plans for different scenarios (e.g., positive earnings surprise, negative earnings surprise). Prepare to adjust your investment strategy based on the actual results.

Conclusion:

Investing in Palantir (PLTR) requires a thorough understanding of its business model, financial performance, and the inherent risks involved. Conducting thorough due diligence and developing a sound investment strategy are crucial before making any investment decision. The potential impact of the May 5th event necessitates careful consideration and a flexible approach. Remember to always assess your risk tolerance and align your investment strategy with your financial goals. Start your Palantir (PLTR) investment research today! Learn more about investing in Palantir (PLTR) and its potential. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

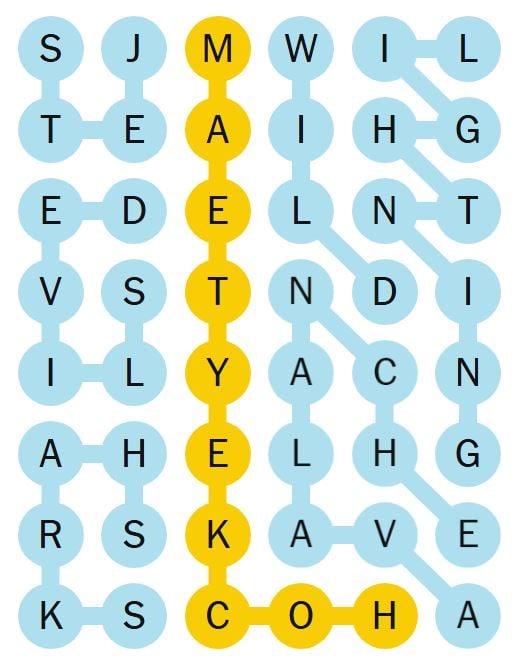

Nyt Strands Game 349 Hints And Solutions For February 15th

May 10, 2025

Nyt Strands Game 349 Hints And Solutions For February 15th

May 10, 2025 -

Joint Effort Pakistan Sri Lanka And Bangladesh Cooperate On Capital Market Development

May 10, 2025

Joint Effort Pakistan Sri Lanka And Bangladesh Cooperate On Capital Market Development

May 10, 2025 -

Fake Fentanyl Exhibit Attorney Generals Press Conference Analyzed

May 10, 2025

Fake Fentanyl Exhibit Attorney Generals Press Conference Analyzed

May 10, 2025 -

Revealed The Actor Playing David In High Potential Episode 13 And The Casting Choice

May 10, 2025

Revealed The Actor Playing David In High Potential Episode 13 And The Casting Choice

May 10, 2025 -

Hundreds In Caravans Is This Uk City Becoming A Ghetto

May 10, 2025

Hundreds In Caravans Is This Uk City Becoming A Ghetto

May 10, 2025