Investing In Palantir Stock Before May 5th: A Comprehensive Guide

Table of Contents

Palantir's Current Financial Performance and Future Projections

Understanding Palantir's financial standing is crucial before investing. Analyzing recent reports and analyst forecasts offers valuable insights into its potential for growth.

Recent Earnings Reports and Key Metrics

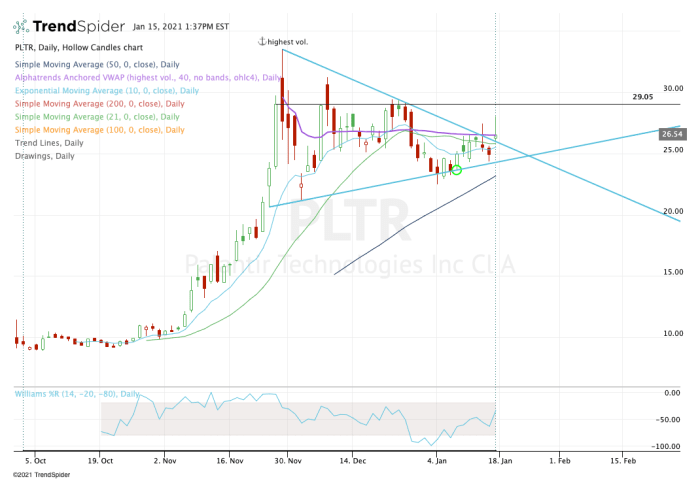

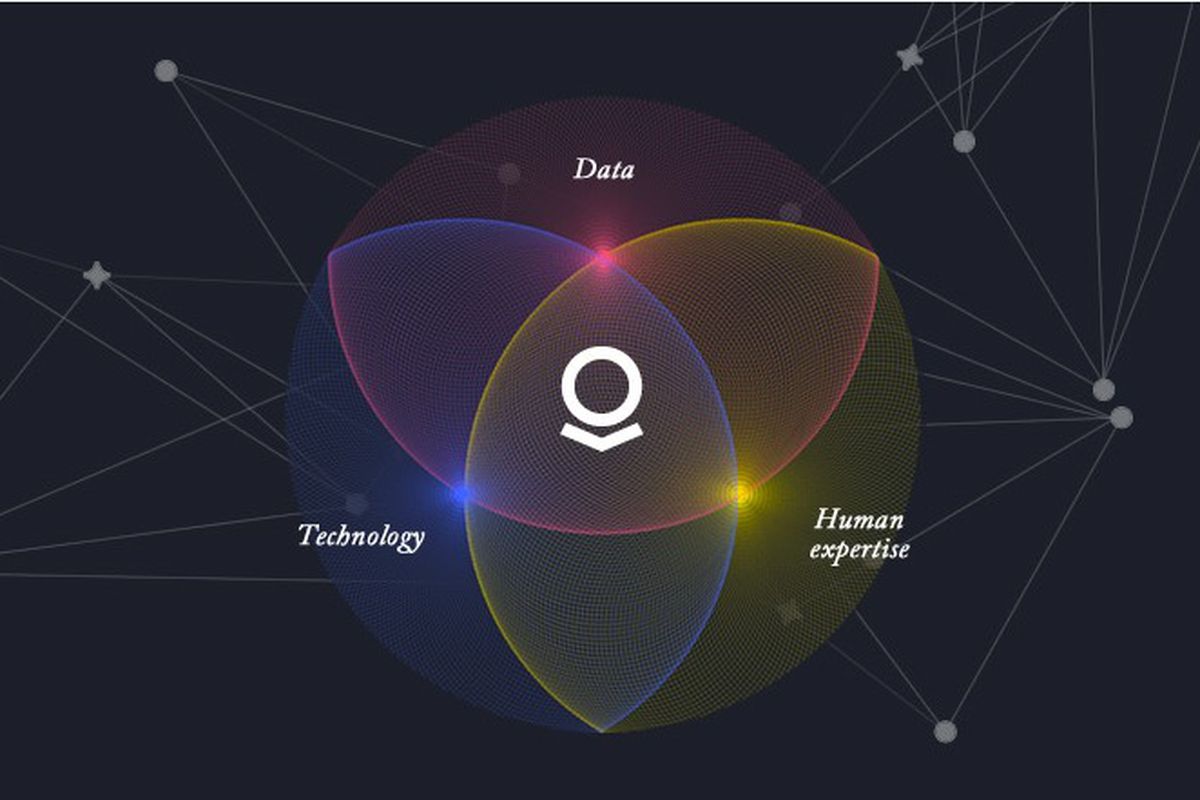

Palantir Technologies (PLTR) has demonstrated fluctuating growth. Examining recent quarterly and annual earnings reports reveals key trends. We need to look beyond headline numbers to understand the underlying drivers of performance.

- Revenue Growth Trends: While Palantir has shown consistent revenue growth, the rate of growth has varied. Analyzing the year-over-year and quarter-over-quarter changes provides a clearer picture of its trajectory. (Source: Palantir's SEC filings)

- Profit Margins and Profitability: Assess the company's profit margins – both gross and operating – to gauge its efficiency and profitability. Tracking changes in these metrics over time indicates the health of its business model. (Source: Palantir's SEC filings)

- Significant Contracts and Partnerships: Palantir's success is tied to securing large contracts, particularly within the government and commercial sectors. Identifying significant new contracts and partnerships can signal future growth potential. (Source: Palantir's press releases and investor relations materials)

- Relevant Financial Data: Consider metrics like operating cash flow, free cash flow, and customer churn rate to gain a comprehensive understanding of Palantir's financial health.

Analyst Forecasts and Price Targets

Financial analysts offer projections for Palantir's future performance and stock price. While these are not guarantees, they reflect the collective wisdom of market experts. It's essential to consider the range of price targets and any recent revisions.

- Range of Price Targets: Analyst price targets often vary widely. Understanding the high and low estimates helps assess the potential upside and downside risk. (Source: Bloomberg, Yahoo Finance, etc.)

- Upward or Downward Revisions: Note any significant upward or downward revisions in price targets as these often reflect changing market sentiment or new information regarding Palantir’s prospects. (Source: Bloomberg, Yahoo Finance, etc.)

- Reputable Sources for Analyst Predictions: Rely on reputable sources for analyst forecasts, considering the analyst's track record and potential conflicts of interest.

Understanding Palantir's Business Model and Competitive Landscape

Palantir operates in a complex and dynamic market. Understanding its business model and competitive positioning is critical to assessing its long-term prospects.

Core Business Operations and Target Markets

Palantir's core business revolves around its data analytics platforms: Gotham, focused on government clients, and Foundry, targeting commercial enterprises. These platforms help organizations analyze massive datasets to gain valuable insights.

- Key Differentiators: Palantir's technology is often lauded for its ability to handle highly sensitive data and its user-friendly interface. Understanding its unique selling propositions is crucial.

- Market Share and Competitive Advantages: While Palantir holds a significant position in certain niche markets, its market share varies across different sectors. Assessing its competitive advantages is essential.

- Growth Potential in Target Markets: The growth potential in both government and commercial data analytics markets is significant. Assessing Palantir's ability to capitalize on this growth is key.

Key Competitors and Market Dynamics

Palantir faces competition from established players and emerging startups. Understanding this competitive landscape is vital for evaluating its long-term viability.

- Key Competitors: Identify and analyze competitors such as AWS, Microsoft Azure, Google Cloud, and other data analytics companies.

- Market Share and Competitive Pressures: Assess the competitive pressures Palantir faces and its ability to maintain or grow its market share.

- Potential Threats and Opportunities: Identify potential threats, like increased competition or changes in government regulations, and opportunities, like expansion into new markets or technological advancements.

Risk Assessment and Investment Considerations Before May 5th

Investing in Palantir, like any stock, carries inherent risks. Understanding these risks is vital for informed decision-making before May 5th.

Potential Risks and Challenges

Several factors could negatively impact Palantir's stock price. A thorough risk assessment is crucial before committing capital.

- Market Risks: Overall market downturns can significantly impact even strong companies like Palantir.

- Company-Specific Risks: Contract losses, delays in product development, or operational challenges could negatively affect Palantir's performance.

- Geopolitical Risks: Political instability or changes in government policies could impact Palantir's government contracts.

Investment Strategies and Diversification

Diversification is a cornerstone of successful investing. Spreading your investments across various asset classes helps mitigate risk.

- Suitable Portfolio Allocation: Determine a suitable allocation for Palantir within your overall investment portfolio based on your risk tolerance and investment goals.

- Risk Management Strategies: Implement risk management strategies such as stop-loss orders to limit potential losses.

- Individual Investment Goals and Risk Tolerance: Investing in Palantir should align with your individual investment goals and risk tolerance. Don't invest more than you can afford to lose.

Practical Steps to Invest in Palantir Stock Before May 5th

Once you've conducted thorough research, you can proceed with investing. Here's a guide to the practical steps involved.

Choosing a Brokerage Account

Selecting the right brokerage account is crucial for a smooth investment process.

- Compare Brokerage Platforms: Compare various brokerage platforms based on fees, features, and user experience.

- Commission Fees and Account Minimums: Consider commission fees and any minimum account balances required.

- Security and Regulation: Ensure the brokerage is regulated and secure to protect your investment.

Placing Your Order and Monitoring Your Investment

Buying Palantir stock involves a straightforward process, but careful execution and monitoring are key.

- Executing a Buy Order: Use your brokerage account to execute a buy order for Palantir stock (PLTR).

- Setting Realistic Expectations: Understand that stock prices fluctuate, and setting realistic expectations is crucial.

- Tracking Investment Performance: Regularly monitor your investment's performance and adjust your strategy if needed.

Conclusion

Investing in Palantir stock before May 5th requires careful consideration of its financial performance, business model, competitive landscape, and inherent risks. By thoroughly analyzing these factors and employing sound investment strategies, you can make an informed decision. Remember to diversify your portfolio and only invest what you can afford to lose. Take control of your investment strategy and explore the potential of Palantir stock before May 5th, but always proceed with caution and seek professional financial advice if needed. This guide provides information for educational purposes only and does not constitute investment advice.

Featured Posts

-

3 Year Stock Prediction Identifying Two Potential Palantir Outperformers

May 09, 2025

3 Year Stock Prediction Identifying Two Potential Palantir Outperformers

May 09, 2025 -

Young Thugs Loyalty Vow To Mariah The Scientist A New Snippet Emerges

May 09, 2025

Young Thugs Loyalty Vow To Mariah The Scientist A New Snippet Emerges

May 09, 2025 -

Ftc Probes Open Ai Implications For Ai Development And Regulation

May 09, 2025

Ftc Probes Open Ai Implications For Ai Development And Regulation

May 09, 2025 -

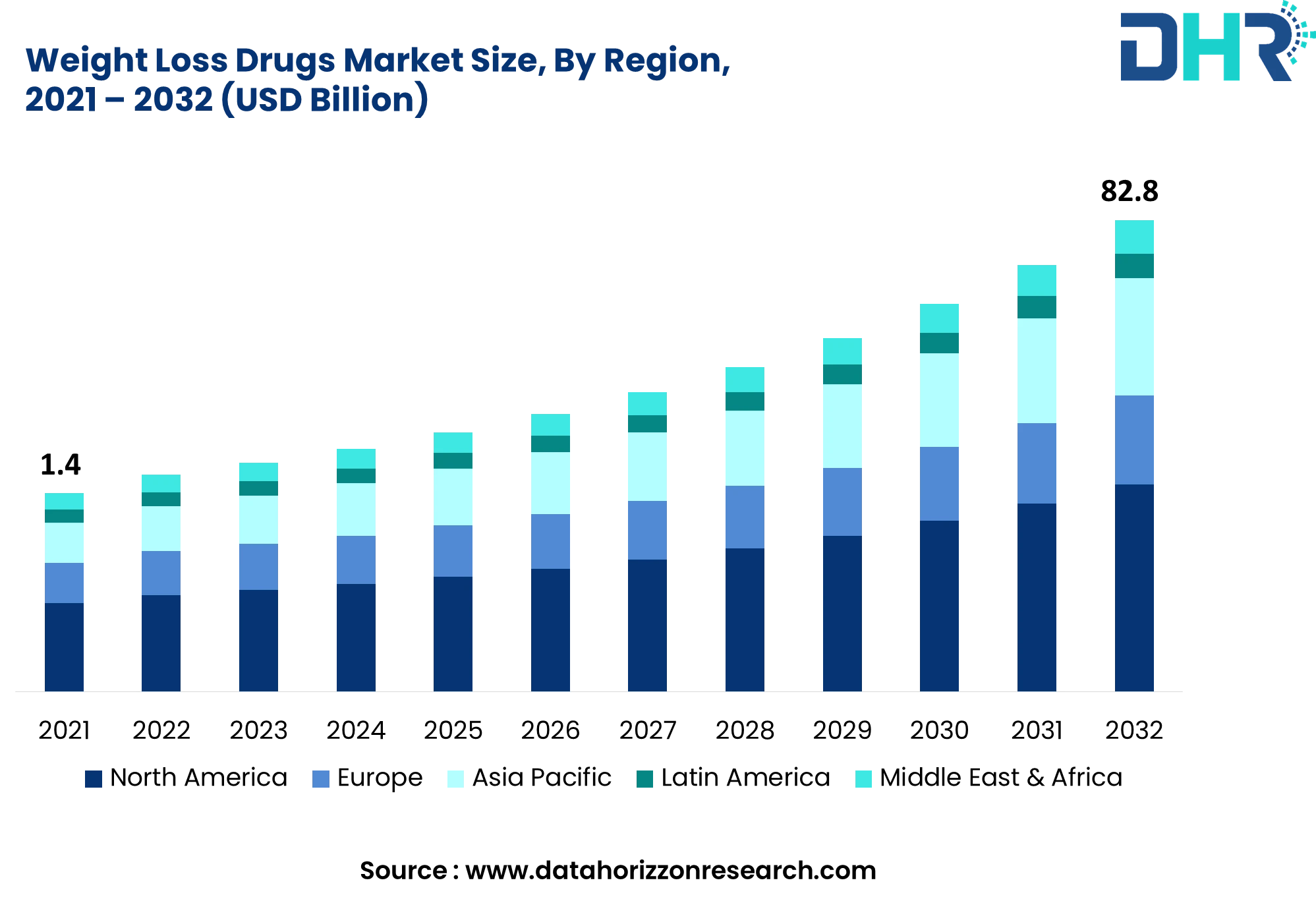

Weight Loss Drug Market Growth And Weight Watchers Financial Troubles

May 09, 2025

Weight Loss Drug Market Growth And Weight Watchers Financial Troubles

May 09, 2025 -

Prodolzhenie Snegopadov V Yaroslavskoy Oblasti Chto Nuzhno Znat

May 09, 2025

Prodolzhenie Snegopadov V Yaroslavskoy Oblasti Chto Nuzhno Znat

May 09, 2025