Investing In Palantir Technologies: Is It The Right Time To Buy?

Table of Contents

Palantir's Business Model and Growth Potential

Palantir's core offerings revolve around two platforms: Gotham and Foundry. Gotham caters primarily to government agencies, providing sophisticated data integration and analysis capabilities for national security and intelligence applications. Foundry, on the other hand, targets the commercial sector, offering similar functionalities for a broader range of industries. This dual approach allows Palantir to tap into two significant markets with substantial growth potential.

The growth prospects for Palantir are promising. Increasing government spending on defense and intelligence, coupled with the growing adoption of big data analytics across commercial sectors like healthcare and finance, present considerable opportunities. Palantir's ability to leverage its powerful platforms in these evolving landscapes is key to its future success.

- Expansion into new markets: Palantir is actively expanding its reach into healthcare, finance, and other data-rich sectors, broadening its revenue streams.

- Development of new products and services: Continuous innovation and the development of new products and services are vital for staying ahead in the competitive big data analytics market.

- Potential for strategic partnerships and acquisitions: Strategic collaborations and acquisitions can accelerate growth and expand Palantir's market presence.

Palantir's Financial Performance and Valuation

Analyzing Palantir's financial performance requires a careful look at its revenue, profitability, and cash flow. While Palantir has demonstrated revenue growth, profitability remains a key area of focus for investors. Examining the Palantir revenue trajectory against its operational expenses is crucial for assessing its long-term sustainability. Further, comparing Palantir's valuation metrics, such as its P/E ratio and market capitalization, to industry peers provides valuable context for determining whether its current stock price is fairly valued.

- Key financial ratios and their trends: Analyzing key ratios like gross margin, operating margin, and net income margin reveals insights into Palantir's financial health and efficiency.

- Comparison to competitors in the data analytics market: Benchmarking Palantir against its competitors like Tableau, Qlik, and SAS helps determine its relative position and competitive advantages.

- Analysis of debt levels and cash reserves: A healthy balance sheet with manageable debt and sufficient cash reserves strengthens Palantir's financial resilience.

Risks and Challenges Facing Palantir

Investing in Palantir, like any other stock, carries inherent risks. The competitive landscape is intensifying, with established players and new entrants vying for market share. Furthermore, Palantir's reliance on government contracts presents a degree of risk associated with contract renewals and potential budget cuts. Macroeconomic factors, such as economic downturns, can also significantly impact demand for its services.

- Potential for increased competition from established players: The competitive pressure from larger, more established companies in the data analytics space is a persistent challenge.

- Risk associated with government contract renewals: The renewal of government contracts is crucial for Palantir's revenue stream, making this a key area of risk.

- Impact of economic downturns on demand for its services: During economic downturns, businesses often reduce spending on non-essential services, potentially affecting Palantir's revenue.

Analyst Ratings and Market Sentiment

Understanding analyst ratings and market sentiment is critical for assessing the overall outlook for Palantir stock. Tracking the consensus opinion of leading financial analysts, paying attention to buy, sell, and hold recommendations, provides valuable insights. Analyzing recent news and events impacting Palantir's stock price, and observing the overall market sentiment toward the company, is equally important. These factors combine to create a more comprehensive picture of the investment landscape.

- Summary of buy, sell, and hold recommendations: A summary of analyst ratings provides a general indication of the market's perception of Palantir's stock.

- Analysis of recent price movements and trading volume: Examining recent stock price movements and trading volume can reveal shifts in investor sentiment and potential buying or selling pressure.

- Impact of news events on investor confidence: Major news events, such as product launches, contract wins, or regulatory changes, can significantly impact investor confidence and stock price.

Conclusion: Should You Buy Palantir Stock?

This analysis has explored several key aspects of investing in Palantir Technologies, weighing the potential benefits and risks. Palantir’s strong growth potential in the expanding big data analytics market is undeniable. However, the company faces significant competition and the volatility of its stock price necessitates a cautious approach. Based on the current market conditions and Palantir's performance, a thorough due diligence process, including understanding its financial performance and assessing its competitive landscape, is essential before making any investment decisions.

While this analysis offers insights into investing in Palantir Technologies, it is crucial to conduct your own thorough research and consult with a financial advisor before making any investment decisions related to Palantir stock. Remember, this information is for educational purposes only and is not financial advice. Consider your own risk tolerance and investment goals before deciding whether to buy Palantir stock.

Featured Posts

-

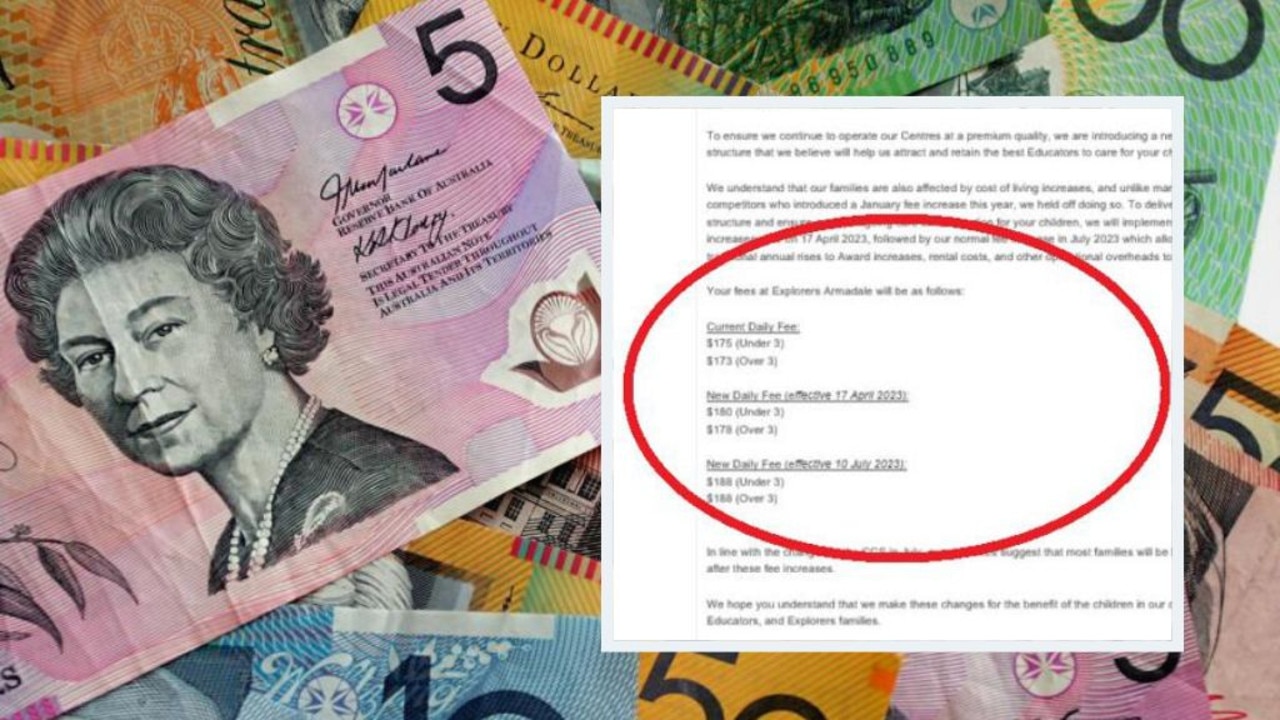

Daycare Costs Explode After Initial 3 000 Babysitter Payment

May 09, 2025

Daycare Costs Explode After Initial 3 000 Babysitter Payment

May 09, 2025 -

From 3 K Babysitting To 3 6 K Daycare A Fathers Financial Nightmare

May 09, 2025

From 3 K Babysitting To 3 6 K Daycare A Fathers Financial Nightmare

May 09, 2025 -

Luis Enriques Psg Transformation How They Secured The Ligue 1 Win

May 09, 2025

Luis Enriques Psg Transformation How They Secured The Ligue 1 Win

May 09, 2025 -

Oilers Even Series With Kings After Overtime Win

May 09, 2025

Oilers Even Series With Kings After Overtime Win

May 09, 2025 -

Changes To Uk Visa Policy Affecting Nigeria And Pakistan

May 09, 2025

Changes To Uk Visa Policy Affecting Nigeria And Pakistan

May 09, 2025