Investing In The Future Of Transportation: Uber's Autonomous Vehicle Push And ETF Potential

Table of Contents

Uber's Autonomous Vehicle Strategy

Uber's journey into autonomous driving began with significant investments and strategic partnerships aimed at developing and deploying self-driving cars. Their approach is multifaceted, incorporating acquisitions of autonomous driving companies, in-house technological development, and extensive pilot programs in various cities.

- Acquisitions: Uber has acquired several promising autonomous driving startups, bolstering its technological capabilities and talent pool. These acquisitions have provided access to crucial technologies and accelerated its development timeline.

- In-house Development: Simultaneously, Uber has invested heavily in building its own autonomous driving technology, focusing on enhancing safety features, improving mapping accuracy, and refining the algorithms that govern its self-driving vehicles.

- Pilot Programs & Test Deployments: Uber has launched several pilot programs and test deployments of its robotaxis in selected cities, gathering real-world data to refine its technology and assess public acceptance. These programs provide valuable feedback for improving the overall system.

- Challenges: The path to widespread autonomous vehicle adoption is not without hurdles. Regulations surrounding autonomous driving vary significantly across different jurisdictions, posing a challenge for consistent deployment. Safety concerns and achieving public acceptance are also crucial obstacles that need to be overcome before widespread adoption is possible.

Uber’s long-term vision is to integrate autonomous vehicles seamlessly into its ride-hailing platform, reducing costs and improving efficiency. Their market share goals are ambitious, reflecting their belief in the transformative potential of this technology.

The Rise of Autonomous Vehicle Technology

The global autonomous vehicle market is experiencing exponential growth, driven by technological breakthroughs and increasing investor interest. Key players, including Waymo, Tesla, and Cruise (General Motors), are fiercely competing to develop and deploy the most advanced self-driving systems.

- Technological Advancements: Significant progress in sensor technology (LiDAR, radar, cameras), artificial intelligence (AI), and machine learning (ML) are fueling the rapid advancements in autonomous driving capabilities.

- Government Regulations: Government regulations and policies play a crucial role in shaping the development and deployment of AVs. The varying levels of regulatory oversight across different countries present both opportunities and challenges for companies in this sector.

- Market Projections: Market research firms predict substantial growth in the autonomous vehicle sector over the next decade, projecting billions of dollars in revenue and widespread adoption across various industries.

- Societal Impacts: The widespread adoption of autonomous vehicles is expected to have profound societal impacts, including improvements in road safety, increased accessibility for people with disabilities, and potential changes to urban planning and infrastructure.

Investing in the Autonomous Vehicle Revolution through ETFs

Exchange Traded Funds (ETFs) offer a diversified and convenient way to gain exposure to the autonomous vehicle industry. Unlike investing in individual stocks, ETFs allow investors to spread their risk across a basket of companies involved in various aspects of the autonomous vehicle ecosystem.

- Advantages of ETFs: ETFs provide diversification, lower fees compared to actively managed funds, and easy trading on major stock exchanges.

- Types of ETFs: There are various ETFs that offer exposure to the autonomous vehicle industry, including those focused on technology companies developing autonomous driving technology, automotive manufacturers, and related infrastructure companies.

- Examples of ETFs: While specific ETF tickers are subject to change and depend on your market, research ETFs that specifically track technology, automotive, or robotics indexes. Look for those with substantial holdings in companies involved in autonomous driving technology.

- Risk Factors: Investing in autonomous vehicle ETFs carries risks, including technological hurdles, regulatory uncertainty, and intense competition among industry players. Consider the expense ratios and management styles of different ETFs to find the best fit for your investment strategy.

Assessing the Risks and Rewards of Investing in Uber's AV Push

Investing in Uber's autonomous vehicle initiatives presents both significant opportunities and potential risks.

- Potential Risks: Technological challenges, fierce competition from established players and startups, and evolving regulatory landscapes all pose risks to Uber's success in the autonomous vehicle market.

- Potential Rewards: Successful implementation of Uber's AV strategy could lead to substantial cost reductions, increased efficiency, and a significant expansion of its market share in the transportation sector. This translates to high growth potential and potentially substantial long-term returns for investors.

- Return vs. Risk: The potential returns from investing in Uber's AV push must be carefully weighed against the inherent risks. A comprehensive risk assessment is essential before committing capital to this sector.

- Financial Analysis: A thorough analysis of Uber's financial performance, the performance of its autonomous driving division, and its overall financial health is crucial before making any investment decisions. Pay attention to their financial reports and analyst opinions.

Conclusion: Investing in the Future of Transportation

Uber's significant investment in autonomous vehicle technology reflects the immense potential of this disruptive sector. While challenges remain, the long-term prospects for growth are substantial. ETFs offer investors a diversified and accessible way to participate in this exciting revolution. Remember to research thoroughly and consider the risks involved. Explore various transportation ETFs and carefully analyze their holdings and expense ratios before investing. Research and invest in the future of transportation by exploring the opportunities presented by autonomous vehicle technology and related ETFs. Don't miss the chance to be a part of this transformative industry.

Featured Posts

-

Analysi Tis Omilias Toy Kasselaki Gia Ti Naytilia

May 18, 2025

Analysi Tis Omilias Toy Kasselaki Gia Ti Naytilia

May 18, 2025 -

Sondaz Prezydencki Onetu Co Mowia Najnowsze Dane

May 18, 2025

Sondaz Prezydencki Onetu Co Mowia Najnowsze Dane

May 18, 2025 -

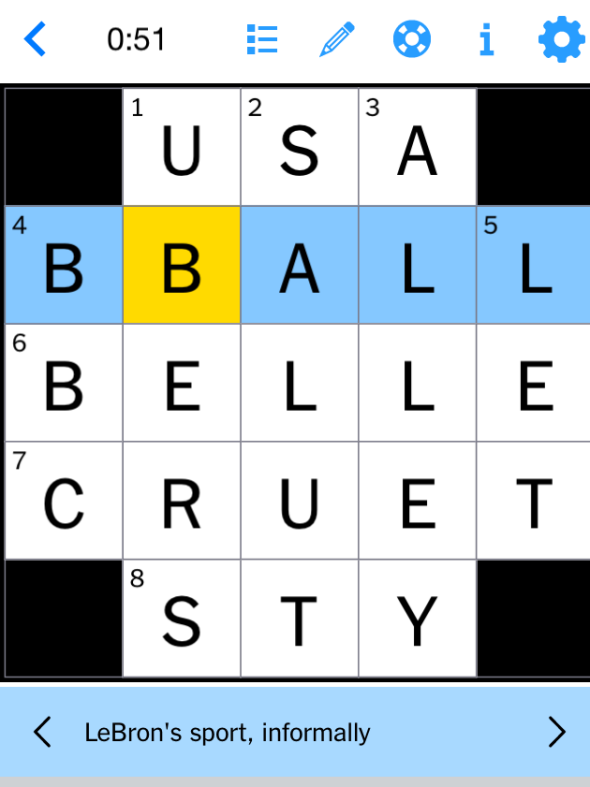

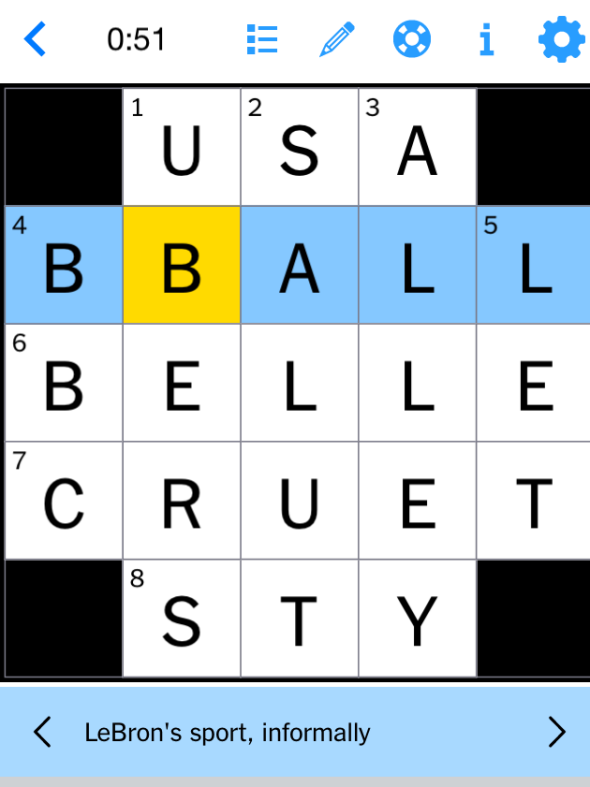

Nyt Mini Crossword Answers For March 16 2025

May 18, 2025

Nyt Mini Crossword Answers For March 16 2025

May 18, 2025 -

Understanding The Surge In Las Vegas Casino Layoffs

May 18, 2025

Understanding The Surge In Las Vegas Casino Layoffs

May 18, 2025 -

Survei Terbaru Mayoritas Warga Indonesia Dukung Negara Merdeka Palestina

May 18, 2025

Survei Terbaru Mayoritas Warga Indonesia Dukung Negara Merdeka Palestina

May 18, 2025

Latest Posts

-

Understanding The Marvel The Avengers Crossword Clue A Complete Guide

May 18, 2025

Understanding The Marvel The Avengers Crossword Clue A Complete Guide

May 18, 2025 -

Nyt Mini Crossword Solutions March 16 2025

May 18, 2025

Nyt Mini Crossword Solutions March 16 2025

May 18, 2025 -

Complete Guide To The Nyt Mini Crossword March 26 2025

May 18, 2025

Complete Guide To The Nyt Mini Crossword March 26 2025

May 18, 2025 -

March 12 2025 Nyt Mini Crossword Complete Solutions

May 18, 2025

March 12 2025 Nyt Mini Crossword Complete Solutions

May 18, 2025 -

Nyt Mini Crossword Answers For March 16 2025

May 18, 2025

Nyt Mini Crossword Answers For March 16 2025

May 18, 2025