Investing In Uber: A Detailed Look At UBER Stock

Table of Contents

Understanding Uber's Business Model and Revenue Streams

Uber's success hinges on a diversified business model encompassing several key revenue streams. Let's delve into each component:

Ride-Sharing Services

Uber's core business, ride-sharing, remains a significant revenue generator. Its global reach and substantial market share make it a dominant player in the ride-sharing market.

- Market Dominance: Uber boasts a vast network of drivers and riders across numerous countries, establishing a strong competitive advantage.

- Competition Analysis: While facing competition from Lyft and other regional players, Uber's brand recognition and scale provide a significant buffer.

- International Expansion: Uber's continuous expansion into new markets fuels growth and diversifies its revenue streams.

- Pricing Strategies: Dynamic pricing models, while sometimes controversial, allow Uber to optimize pricing based on demand, influencing Uber's revenue. Analyzing these strategies is crucial when assessing UBER stock.

This core segment contributes significantly to Uber's revenue, making "Uber rides" a key driver of the company's overall financial performance. Understanding the dynamics of the "ride-sharing market" is crucial for evaluating UBER stock.

Uber Eats and Food Delivery

Uber Eats has quickly become a major player in the rapidly expanding food delivery market. Its growth potential is considerable.

- Market Share: Uber Eats competes aggressively with DoorDash and other food delivery services, vying for market share.

- Delivery Fees: The pricing model for delivery fees, along with commission structures with restaurants, significantly impacts profitability.

- Restaurant Partnerships: Strategic partnerships with restaurants are vital for securing a wide selection of options and maintaining competitive advantage.

- Technological Advancements: Investments in technology for order optimization and delivery efficiency are key to maintaining a competitive edge in the "food delivery market."

The success of Uber Eats is a critical factor when considering the long-term prospects of UBER stock and Uber's growth trajectory.

Uber Freight and Logistics

Uber Freight targets the business-to-business (B2B) sector, offering a digital freight marketplace.

- Target Market: This segment focuses on connecting shippers with carriers, capitalizing on the growing need for efficient logistics solutions.

- Technological Integration: Uber's technological infrastructure optimizes routes and facilitates seamless transactions, enhancing efficiency.

- Future Expansion Plans: Further expansion into different logistics segments promises to diversify Uber's revenue streams and reduce reliance on ride-sharing alone.

Uber Freight's contribution to Uber's overall "revenue streams" is increasing, showcasing Uber's diversification strategy. This diversification is a key point to consider when analyzing UBER stock.

Other Revenue Streams

Beyond its core offerings, Uber explores other avenues for revenue generation.

- Advertising: Leveraging its vast user base for targeted advertising presents a significant untapped potential.

- Potential for Growth: These smaller revenue sources may not be significant currently, but their potential for growth should not be underestimated when assessing UBER stock.

- Diversification Strategies: Continued exploration of new revenue streams is a key element of Uber's long-term strategy.

Analyzing "Uber revenue streams" in their entirety provides a comprehensive understanding of the company’s financial health.

Analyzing UBER Stock Performance and Future Projections

Assessing UBER stock requires a thorough examination of its historical performance and future prospects.

Historical Stock Performance

UBER stock has experienced significant volatility since its IPO.

- Key Performance Indicators (KPIs): Examining KPIs like revenue growth, earnings per share (EPS), and user growth provides valuable insights.

- Historical Volatility: Understanding the historical price swings helps gauge the risk associated with investing in UBER stock.

- Major Price Fluctuations and Their Causes: Analyzing past price fluctuations and their underlying causes offers valuable lessons for potential investors.

Tracking "UBER stock price" fluctuations and understanding the drivers of these changes is vital for informed investment decisions. Analyzing "Uber's financial performance" provides additional context.

Financial Health and Key Metrics

A deep dive into Uber's financial statements reveals its financial health.

- Revenue Growth Rates: Sustained revenue growth is a positive indicator for UBER stock.

- Profit Margins: Analyzing profit margins helps assess Uber's operational efficiency and profitability.

- Debt-to-Equity Ratio: This metric highlights Uber's financial leverage and associated risks.

- Cash Flow Analysis: A strong cash flow is essential for long-term sustainability and growth.

"UBER financials" provide crucial data for determining the investment viability of UBER stock. Analyzing "Uber's profitability" is especially important.

Growth Potential and Future Outlook

Uber operates in rapidly growing markets.

- Market Expansion: Continued geographic expansion presents significant opportunities for revenue growth.

- Technological Innovation: Investments in technology are crucial for maintaining a competitive edge.

- Regulatory Hurdles: Navigating regulatory challenges in various markets poses a risk.

- Competitive Landscape: The competitive landscape remains intense, influencing "Uber's future growth."

Projecting "market projections" and understanding "Uber's competitive advantage" are key when assessing the potential of UBER stock.

Risks and Considerations for Investing in UBER Stock

Investing in UBER stock involves inherent risks.

Competition

The ride-sharing and food delivery markets are fiercely competitive.

- Uber Competitors: Lyft, DoorDash, and other players pose a constant threat to Uber's market share and profitability.

- Competitive Analysis: A thorough competitive analysis is crucial for understanding the challenges facing Uber.

- Technological Disruption: The potential for disruptive technologies to emerge and impact Uber’s dominance is significant.

Understanding "Uber competitors" and the dynamics of "market competition" is critical when considering UBER stock.

Regulatory Risks

Government regulations significantly impact Uber's operations.

- Uber Regulations: Varying labor laws, licensing requirements, and data privacy regulations across different jurisdictions pose challenges.

- Regulatory Environment: Understanding the regulatory environment in key markets is crucial for assessing the risk associated with UBER stock.

- Legal Risks: Potential legal challenges related to labor practices and data privacy add to the overall risk profile.

"Uber regulations" and the "regulatory environment" are critical factors to consider when assessing the potential of UBER stock.

Economic Factors

Macroeconomic factors influence Uber's performance.

- Economic Impact on Uber: Economic downturns can negatively impact consumer spending, affecting both ride-sharing and food delivery demand.

- Macroeconomic Factors: Inflation, fuel prices, and overall economic conditions all play a role.

- Market Conditions: Understanding prevailing market conditions is crucial for informed investment decisions.

Analyzing the "economic impact on Uber" and understanding "macroeconomic factors" provides a realistic perspective on the risks involved with investing in UBER stock.

Conclusion: Making Informed Decisions About UBER Stock

Investing in UBER stock presents a complex proposition. While the company operates in large, growing markets and boasts a diversified business model, significant risks remain. Competition, regulatory hurdles, and economic fluctuations could significantly impact its performance. This analysis highlights the importance of conducting thorough due diligence before investing. Remember to consider your own risk tolerance and investment goals before making any investment decisions. Ready to dive deeper into the world of UBER stock? Conduct thorough research and consider your risk tolerance before making any investment decisions.

Featured Posts

-

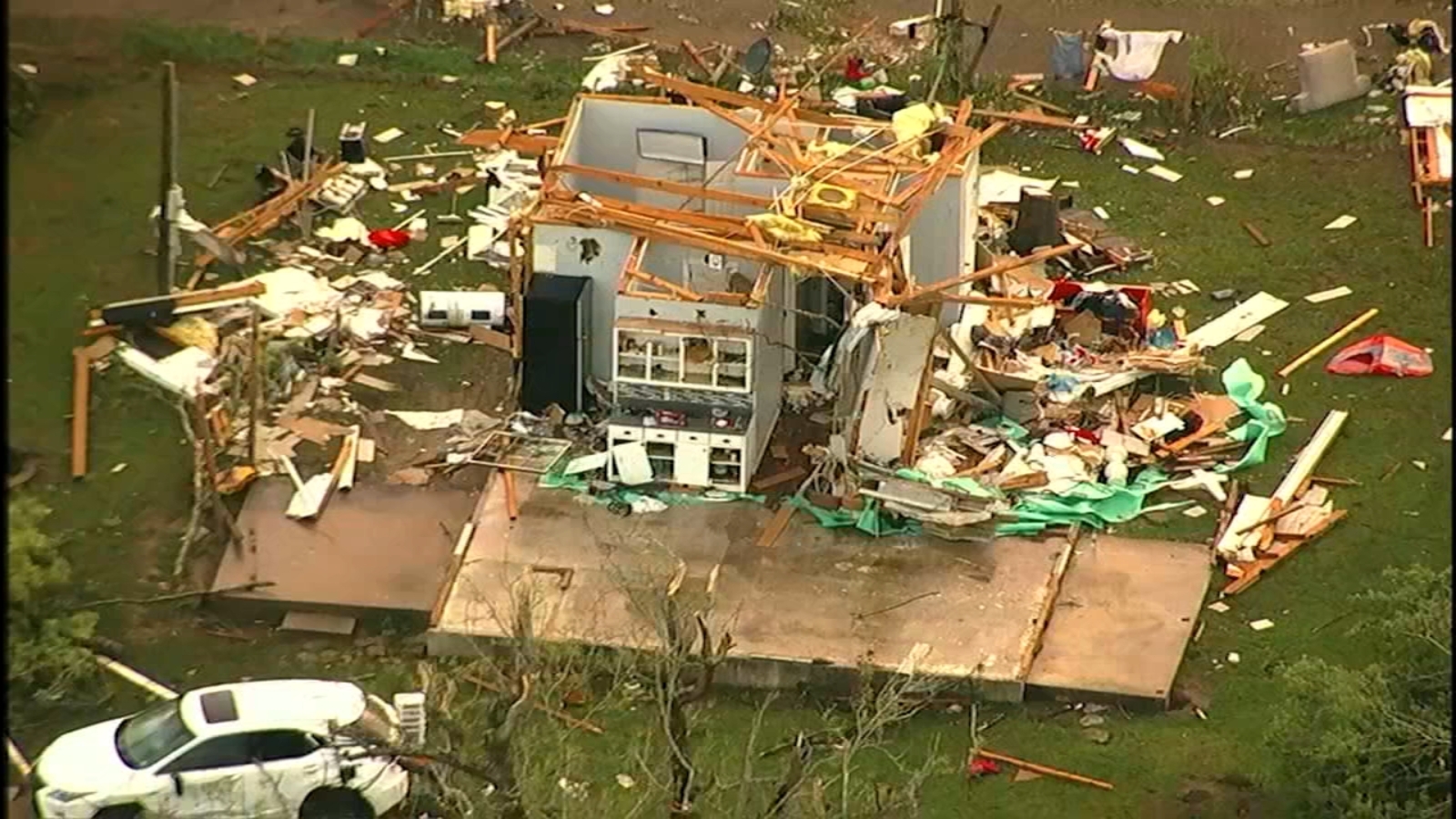

Exploring The Aftermath Cnns Coverage Of The Deadly Tornado

May 19, 2025

Exploring The Aftermath Cnns Coverage Of The Deadly Tornado

May 19, 2025 -

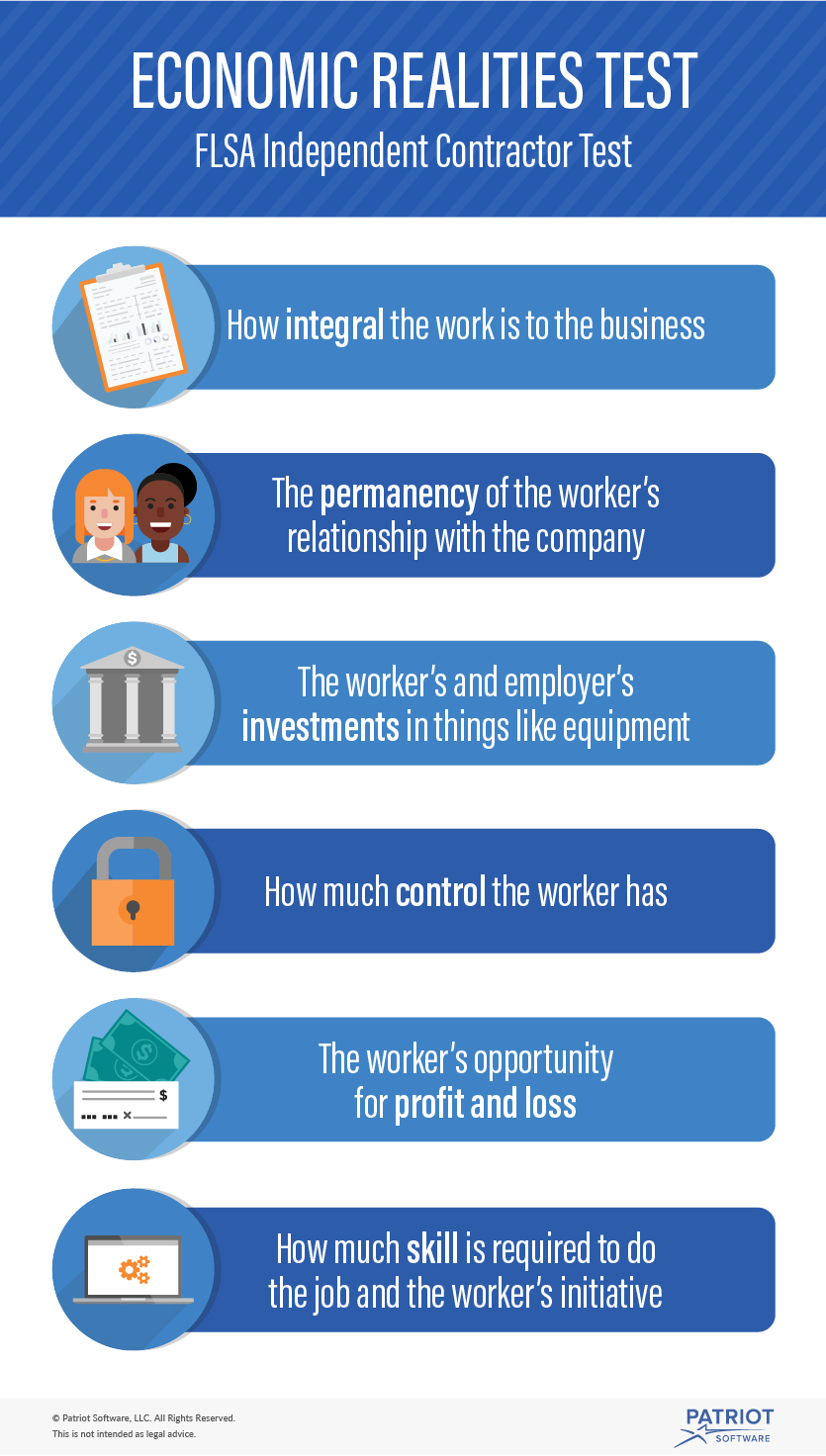

The Economic Realities Of Marriage When An A List Wife Out Earns Her Husband

May 19, 2025

The Economic Realities Of Marriage When An A List Wife Out Earns Her Husband

May 19, 2025 -

I A Stasi Ton Xairetismon Istoria T Heologia Kai Paradoseis Sta Ierosolyma

May 19, 2025

I A Stasi Ton Xairetismon Istoria T Heologia Kai Paradoseis Sta Ierosolyma

May 19, 2025 -

The Untapped Potential Of Middle Management How To Maximize Their Value

May 19, 2025

The Untapped Potential Of Middle Management How To Maximize Their Value

May 19, 2025 -

Brockwell Park Festivals The Impact Of Cancellation

May 19, 2025

Brockwell Park Festivals The Impact Of Cancellation

May 19, 2025