Investing In Uber's Autonomous Driving Technology: An ETF Strategy

Table of Contents

Understanding the Autonomous Driving Market and Uber's Role

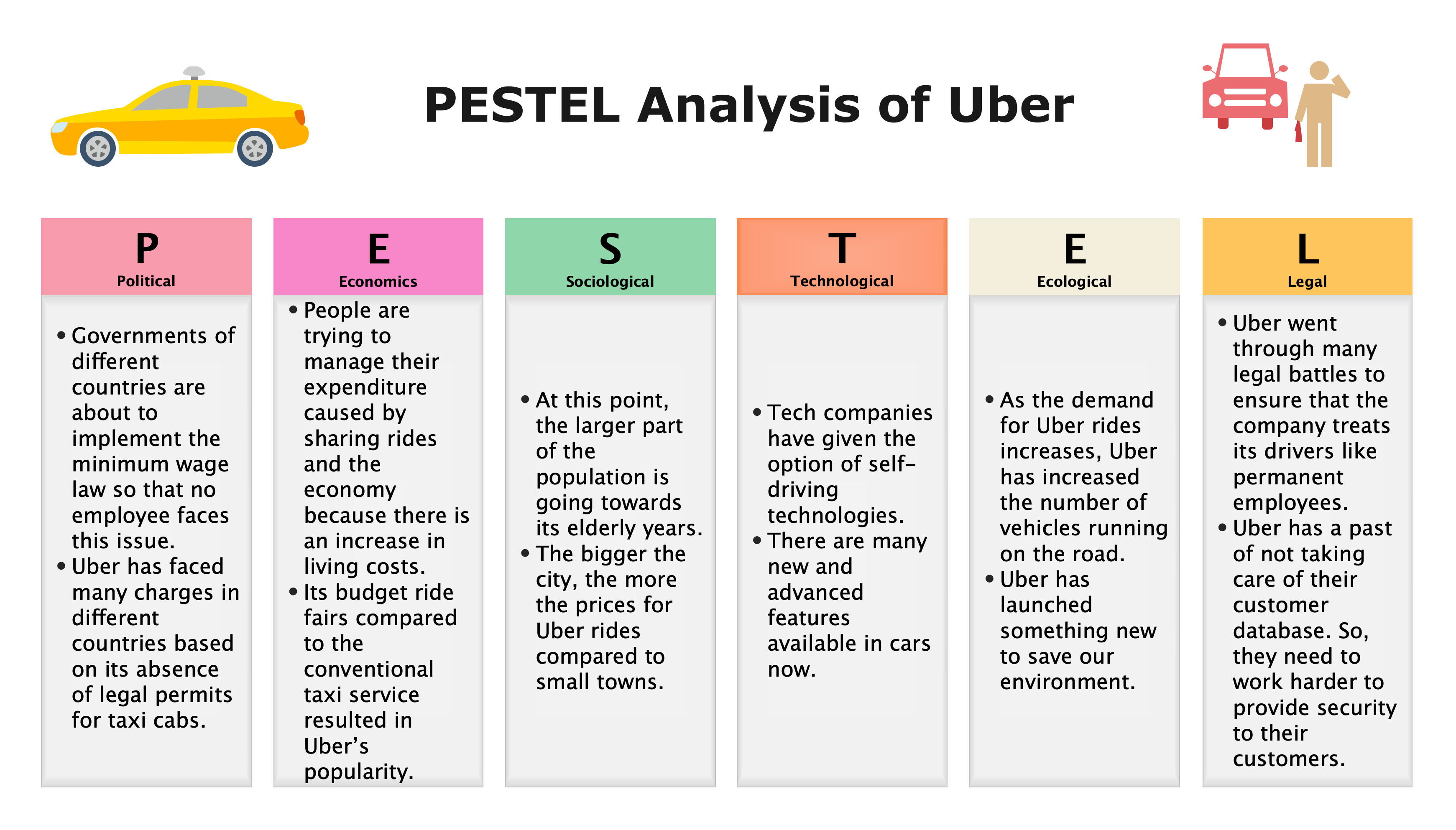

The autonomous vehicle market is poised for explosive growth. Predictions vary, but many analysts forecast a market valued in the trillions of dollars within the next decade. This growth is fueled by advancements in artificial intelligence (AI), sensor technology, and mapping capabilities. The competitive landscape is crowded, with major players including established automakers, tech giants, and innovative startups.

Uber, despite its challenges in the ride-sharing market, is a significant player in the autonomous driving space. Its substantial investment in research and development, coupled with strategic partnerships, positions it for a leading role in this transformative industry.

- Market size projections for the autonomous vehicle industry: Estimates range from $1 trillion to over $8 trillion by 2030, depending on the source and assumptions made.

- Uber's key players and partnerships in autonomous driving: Uber Advanced Technologies Group (ATG) is the driving force behind Uber's self-driving efforts. They have collaborated with various tech companies and suppliers for essential components and expertise.

- Recent milestones achieved by Uber in autonomous vehicle development: While Uber has faced setbacks, including accidents and restructuring within ATG, they continue to make progress in areas such as simulation technology and improved sensor integration.

- Discussion of the challenges faced by Uber in this field (regulation, competition, etc.): The regulatory landscape for autonomous vehicles is constantly evolving and differs across jurisdictions, posing a significant hurdle. Intense competition from well-funded rivals adds further complexity.

Identifying Relevant ETFs for Exposure to Autonomous Driving Technology

Gaining exposure to Uber's autonomous driving ambitions directly through its stock can be risky. A more diversified approach involves investing in ETFs that focus on the broader technological landscape supporting autonomous vehicles. This strategy mitigates risk by spreading investment across multiple companies contributing to the sector.

Several ETF categories offer indirect exposure to Uber and the autonomous driving revolution. Focus on ETFs that invest in companies involved in AI, robotics, sensor technology, lidar, and high-definition mapping – all crucial for self-driving car technology.

- Examples of technology ETFs with significant holdings in relevant companies: Consider ETFs like the Invesco QQQ Trust (QQQ), which holds significant positions in companies like NVIDIA (NVDA) known for its AI chips vital for autonomous vehicles, or the Technology Select Sector SPDR Fund (XLK), which provides broad exposure to the technology sector. Always check the latest holdings.

- Explanation of how these ETFs offer diversified exposure, reducing the risk associated with investing in a single company: By investing in an ETF, your risk is spread across many companies, reducing the impact of any single company's underperformance.

- Comparison of expense ratios and performance of selected ETFs: Compare expense ratios (the annual fee charged by the ETF) and past performance; however, past performance doesn't guarantee future results.

- Discussion of the potential benefits of using ETFs over direct stock investment in Uber: ETFs offer diversification, lower transaction costs, and greater ease of management compared to picking individual stocks in the autonomous driving sector.

Analyzing ETF Holdings for Uber-Related Exposure

Analyzing ETF holdings is crucial to determine the level of indirect exposure to Uber's autonomous driving efforts. While ETFs won't directly hold Uber ATG, they might hold companies supplying crucial technologies to Uber or its competitors.

- Step-by-step guide on analyzing ETF holdings: Most ETF providers offer detailed fact sheets and portfolio breakdowns on their websites. Check the holdings, weighting of each company, and sector breakdowns to identify companies related to AI, sensor technology, and mapping.

- Example of how to find Uber's related companies within an ETF: Look for companies like NVIDIA (AI chips), Mobileye (autonomous driving systems), or companies specializing in lidar or sensor technology. These firms contribute to the underlying technology driving the entire autonomous vehicle sector, including Uber's efforts.

- Importance of regularly reviewing ETF holdings and rebalancing the portfolio: Market conditions and ETF holdings change. Regular reviews (e.g., annually or semi-annually) ensure your portfolio remains aligned with your investment goals and risk tolerance.

Risk Management and Diversification Strategies

Investing in emerging technologies like autonomous driving carries inherent risks. Technological setbacks, regulatory hurdles, and intense competition can significantly impact the success of companies involved.

- Potential risks (regulatory hurdles, technological setbacks, competition): Autonomous vehicle technology is still developing, and unforeseen technical challenges can emerge. Regulatory uncertainty can also affect the deployment and adoption of autonomous vehicles. The competitive landscape is fierce, and the success of any one company isn't guaranteed.

- Strategies for diversifying across different asset classes: Don't put all your eggs in one basket. Diversify beyond technology ETFs into other asset classes like bonds, real estate, or other sectors to reduce overall portfolio volatility.

- Importance of considering personal risk tolerance and investment goals: Your investment strategy should align with your personal risk tolerance and long-term financial goals. If you're risk-averse, consider a more conservative approach with lower exposure to technology ETFs.

Conclusion

Investing in Uber's autonomous driving technology through ETFs presents a compelling opportunity to participate in a potentially transformative market. By carefully selecting ETFs that provide exposure to relevant technologies and companies, and by employing robust risk management strategies, investors can build a diversified portfolio aligned with their investment objectives. Remember to thoroughly research each ETF, paying close attention to its holdings, expense ratio, and historical performance. Start exploring the best ETFs for accessing the exciting world of autonomous vehicle technology today – begin your journey into investing in Uber's autonomous driving technology: an ETF strategy now!

Featured Posts

-

Las Vegas Strip Decline Growth Beyond The Boulevard

May 18, 2025

Las Vegas Strip Decline Growth Beyond The Boulevard

May 18, 2025 -

Autonomous Vehicles And Etfs A Look At Ubers Investment Potential

May 18, 2025

Autonomous Vehicles And Etfs A Look At Ubers Investment Potential

May 18, 2025 -

Where To Watch Shrek On Bbc Three Your Complete Guide

May 18, 2025

Where To Watch Shrek On Bbc Three Your Complete Guide

May 18, 2025 -

Top Rated Virginia Online Casinos 2025 Play At Legal Va Sites

May 18, 2025

Top Rated Virginia Online Casinos 2025 Play At Legal Va Sites

May 18, 2025 -

Taking Your Pet On An Uber In Mumbai A Step By Step Guide

May 18, 2025

Taking Your Pet On An Uber In Mumbai A Step By Step Guide

May 18, 2025

Latest Posts

-

Delhi And Mumbai Uber Launches Pet Friendly Rides With Heads Up For Tails Partnership

May 19, 2025

Delhi And Mumbai Uber Launches Pet Friendly Rides With Heads Up For Tails Partnership

May 19, 2025 -

Heads Up For Tails And Uber Team Up For Easier Pet Travel In Delhi And Mumbai

May 19, 2025

Heads Up For Tails And Uber Team Up For Easier Pet Travel In Delhi And Mumbai

May 19, 2025 -

Analyzing Ubers April Performance A Double Digit Rally

May 19, 2025

Analyzing Ubers April Performance A Double Digit Rally

May 19, 2025 -

Double Digit Growth For Uber In April A Detailed Analysis

May 19, 2025

Double Digit Growth For Uber In April A Detailed Analysis

May 19, 2025 -

Uber Stock Soars Understanding Aprils Double Digit Gains

May 19, 2025

Uber Stock Soars Understanding Aprils Double Digit Gains

May 19, 2025